BlackRock Bitcoin ETF Inflow Surge: $223 Million in One Day as Institutions Renew Focus on BTC

Image: https://farside.co.uk/btc/

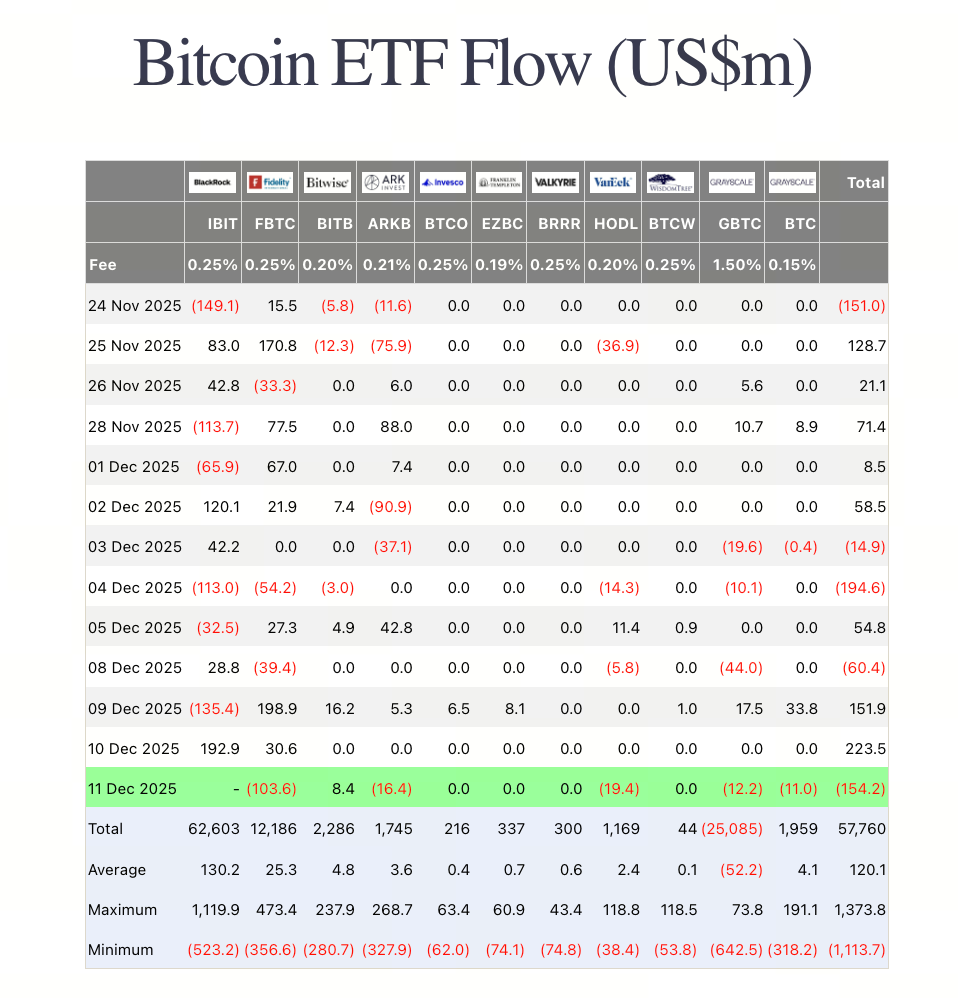

One of the most significant recent developments in the crypto asset market is the robust resurgence of net capital inflows into Bitcoin Spot ETFs. BlackRock’s iShares Bitcoin Trust (IBIT) stood out, posting a single-day net inflow of $223 million on December 10. IBIT served as the primary force driving the overall return of capital to ETFs.

Latest data shows that several Bitcoin Spot ETFs in the US market collectively attracted about $223.5 million in inflows that day—the strongest single-day performance in the past three weeks—highlighting a clear rebound in institutional sentiment.

Capital Inflows: The Strongest Day in Three Weeks

In recent weeks, Bitcoin Spot ETF capital flows have been volatile, affected by macroeconomic pressures and price swings in Bitcoin itself. Some days even saw net outflows. By mid-December, however, inflows picked up again, with IBIT resuming its lead. IBIT contributed the majority of inflows and maintained its position as the top ETF in the category.

This wave of capital inflows is widely seen as a clear signal that institutions are increasing their positions and strategic allocation to crypto assets.

Why Does IBIT Lead Capital Inflows?

BlackRock, one of the world’s largest asset managers, has established a formidable reputation and ETF issuance capability in traditional finance. IBIT’s dominance stems from several key factors:

- Significant scale advantage: IBIT’s assets under management have grown steadily since launch, ensuring high liquidity in the market.

- Strong brand trust: Large institutions favor issuers with a history of long-term performance and regulatory compliance.

- Mature trading experience: Convenience, transparency, and deep liquidity make IBIT the preferred entry point for institutional Bitcoin allocation.

This explains why, even as most ETFs saw modest results, capital concentrated heavily in IBIT.

Comparison with Other Bitcoin ETFs

While the market overall posted strong net inflows, the trend was far from evenly spread:

- Leading products—especially IBIT—drew the lion’s share of capital attention;

- Some smaller, less liquid ETFs saw little to no notable capital movement that day;

- Institutional investors are clearly pursuing concentrated allocations rather than spreading capital evenly.

This divergence shows the market’s approach to Bitcoin ETFs has shifted from trial allocations to more sophisticated strategies, with a premium on scale, liquidity, and brand strength.

Market Sentiment and BTC Price Performance

Fueled by renewed capital inflows, Bitcoin’s price found some support that day, helping stabilize earlier downward pressure. Multiple research firms noted:

- Persistent net inflows into spot ETFs are boosting market confidence;

- ETF capital inflows could help provide downside support for Bitcoin;

- However, short-term price action remains subject to macroeconomic conditions, investor risk appetite, and Federal Reserve policy, among other external factors.

In short, ETF inflows are a positive signal, but not a decisive driver of short-term price moves.

Investor Strategies: Long-Term Allocation vs. Short-Term Trading

Investors with different time horizons can consider the following approaches:

Long-Term Investors

- The surge in ETF capital inflows is a key indicator of strengthening institutional confidence.

- IBIT’s leadership shows a strong institutional preference for mature, compliant products, which supports conviction in long-term allocation.

Short-Term Traders

- Should be alert to heightened BTC price volatility;

- While ETF inflows are constructive, they do not guarantee immediate price appreciation;

- It’s advisable to maintain disciplined risk management at all times.

Risk Warning: Market Uncertainty Persists

Despite robust ETF net inflows, investors should remain mindful:

- Bitcoin remains highly volatile;

- There have been historical episodes of rapid ETF outflows and sharp price corrections;

- Macroeconomic policy shifts—especially Federal Reserve interest rate directions—continue to exert major influence on the crypto market.

Investors should only allocate capital after fully understanding the associated risks.

Conclusion

BlackRock’s IBIT recorded a strong $223 million inflow on December 10, signaling a renewed acceleration of institutional capital into the Bitcoin market. This trend highlights the appeal of leading ETFs and indicates that digital assets are attracting more mature, compliant capital.

If this inflow trend continues, the coming weeks could further impact market sentiment, capital structure, and Bitcoin’s price baseline—bringing increased attention and potential opportunities to the crypto market as year-end approaches.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution