Cardano Price Prediction ADA Price Dips to 0.4 Amid 150M ADA Transfer

Large Transfers Drive Short-Term ADA Price Drop

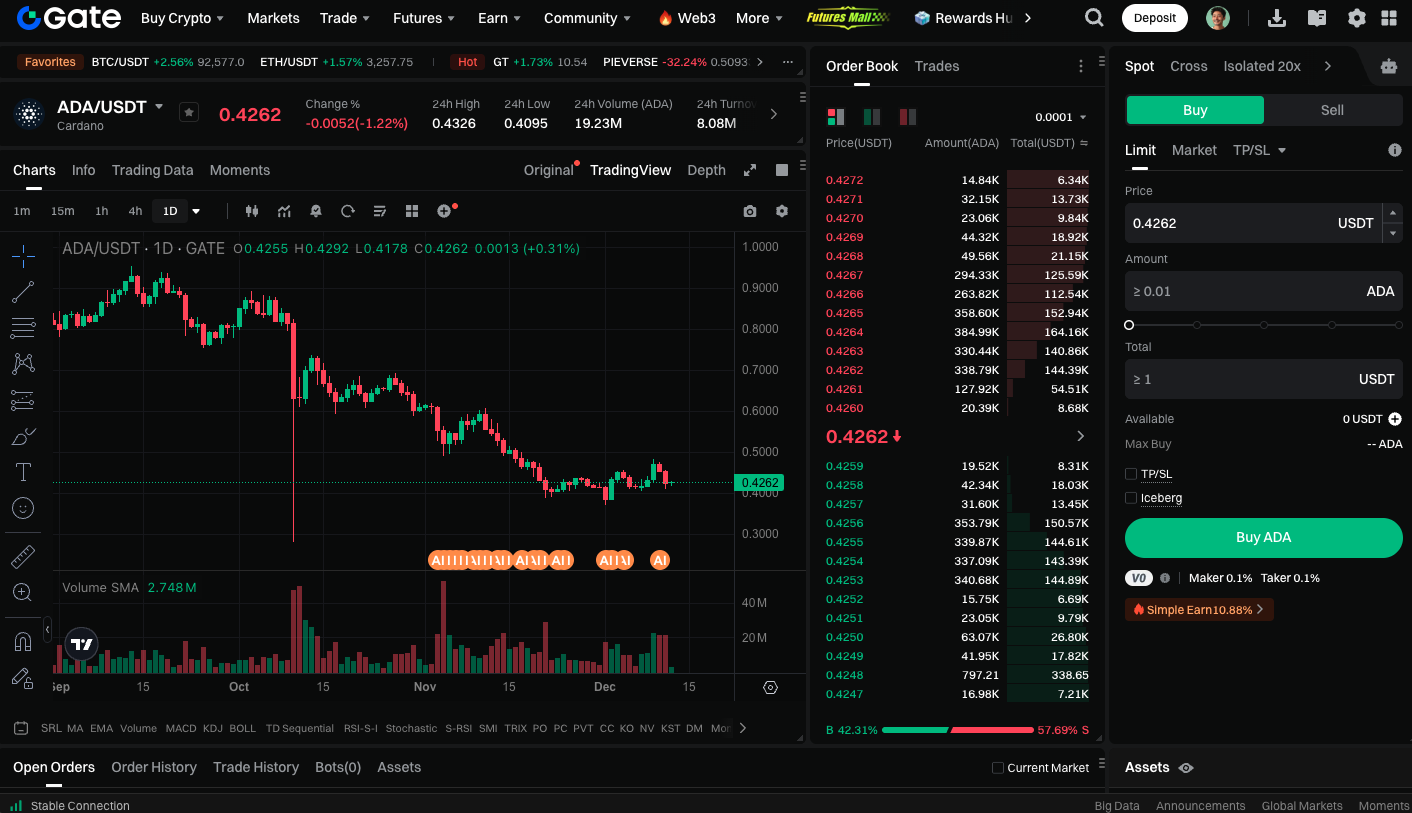

On Wednesday, Cardano (ADA) saw heightened volatility after a massive transfer of 150 million ADA (about $63.3 million) between two unidentified wallets. This transaction occurred during a period of low market activity, immediately drawing traders’ attention. Within just 15 minutes, ADA’s price slid from roughly $0.421 to $0.414 before rebounding slightly to close near $0.417–$0.418.

This situation underscores how large fund movements can impact short-term price action. The market often interprets such transfers as potential signals of selling pressure or portfolio rebalancing, even in the absence of definitive evidence.

Ongoing Multi-Month Downtrend

Daily charts show ADA has remained in a downward channel since early October, with prices steadily declining from highs near $0.95–$1.05 to November lows. This latest large transfer simply continues the prevailing downtrend. Each short-term bounce has failed to hold, leaving bulls unable to take control of the price.

Traders should recognize that ADA is still trading near multi-month lows, with further volatility likely in the near term—especially if additional large transactions occur.

December Performance History and Technical Support

Historically, Cardano’s December performance has usually been flat or weak, with only a handful of standout years. If the price falls below $0.41, technical analysis points to a possible move down to the $0.38–$0.40 support range. Holding the current price band may provide temporary stability, but traders should remain alert to the market psychology surrounding large fund movements.

Trade ADA spot now: https://www.gate.com/trade/ADA_USDT

Summary

ADA continues to trade at multi-month lows, with the potential for further short-term swings driven by large transfers or new developments. Investors should closely monitor key support and resistance levels, as well as significant fund movements, to inform their trading strategies as the market adjusts.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution