Dogecoin Price Prediction: DOGE Could Reach $5

Preface

Recently, crypto analyst Crypto Patel suggested Dogecoin could be on the verge of a historic rally, with prices potentially surging to $5. Currently, DOGE is working to retake the key psychological price level of $0.20. Despite current bearish sentiment, the analyst asserts that DOGE has already broken out and retested its structure as it prepares for a potential parabolic move.

Historical Patterns Signal Strong Upside Potential

Crypto Patel highlights that the present monthly chart pattern mirrors those seen during the 2017 and 2021 bull market cycles, both of which produced previous 9x or 324x gains for DOGE. While the current setup is unlikely to deliver those gains, a 10x to 30x increase remains possible. His analysis sets an initial target at $2, followed by $5, which would represent a new all-time high (ATH) for DOGE if achieved.

Short-Term Risks and Support Zones

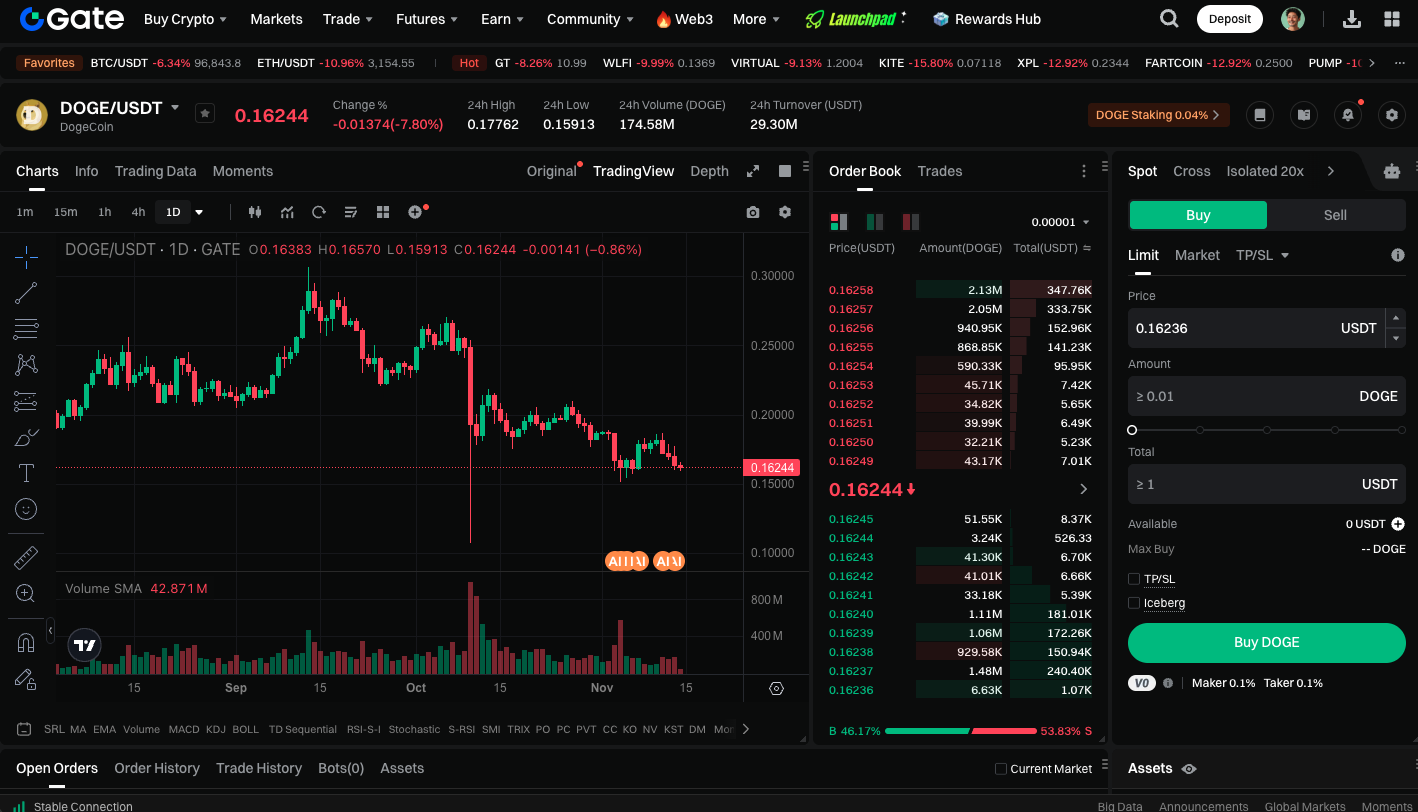

Although DOGE shows strong long-term potential, short-term risks persist. With Bitcoin unable to hold the $100,000 level, DOGE faces downside pressure and currently trades below the $0.20 psychological threshold. Its short-term support zone is around $0.16.

Analyst Trader Tardigrade anticipates DOGE could establish a bottom near $0.16. After completing the green triangle structure, a rebound to $0.32 is possible, approaching the projected highs for 2025.

ATH Targets and Potential Gains

Analyst Javon Marks notes that if DOGE continues to form higher lows (HLs), it could soon challenge the current all-time high (ATH) of $0.73. A successful breakout could lead to another record high.

Start trading DOGE spot now: https://www.gate.com/trade/DOGE_USDT

Conclusion

Based on various analyst perspectives, Dogecoin currently faces short-term support challenges. Its long-term technical structure and historical patterns suggest considerable upside. In the near term, DOGE may consolidate and establish a base within the $0.16 - $0.20 range. If DOGE completes its technical pattern, it may rally to $0.32 - $0.73, challenge its all-time high, and potentially reach the long-term target of $5. For investors, DOGE continues to offer significant upside potential provided risks are managed. Ongoing monitoring of support levels and momentum is essential for decision-making.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data