Fluid: DeFi's New Dominator?

Money markets are at the core of DeFi, offering various strategies that users can leverage to gain exposure to specific assets. Over time, this vertical has grown in terms of value locked (TVL) and the features it offers. With the introduction of new protocols like @MorphoLabs">@ MorphoLabs, @0xFluid">@ 0xFluid, @eulerfinance">@ eulerfinance, and @Dolomite_io">@ Dolomite_io, the set of abilities lending protocols conceive has increased.

In this report, we are focusing on one such protocol, Fluid.

Fluid has launched multiple features, with the most interesting being Smart Debt and Smart Collateral. It cannot be considered a vanilla lending protocol as it also combines its DEX features to offer more to its users.

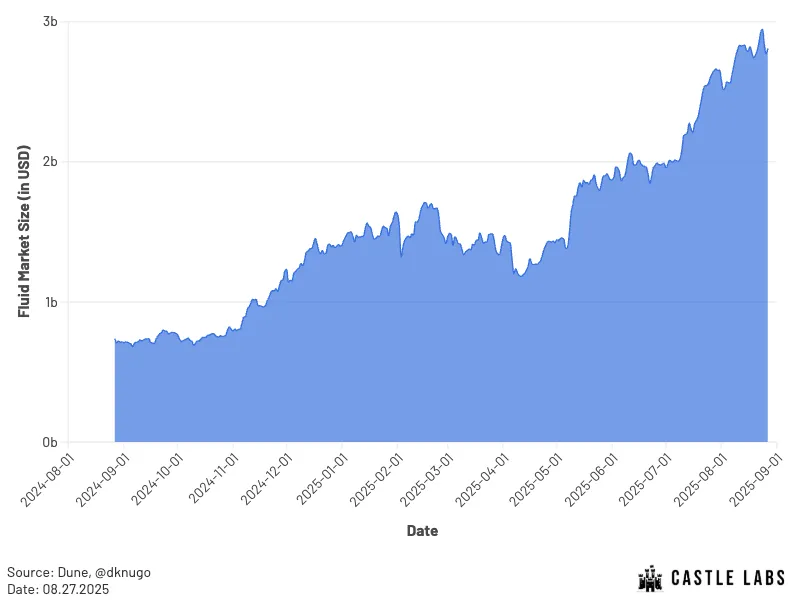

Fluid has been witnessing a significant growth trajectory in both DEX and Lending verticals, with a total market size (expressed in total deposits) of over $2.8 billion.

Fluid Market Size, Source: Dune, @ dknugo

Fluid Market Size represents the Total Deposits in the protocol. The reason for choosing this metric over TVL is that debt is a productive asset in the protocol and contributes to the exchange liquidity.

Understanding Fluid

This section provides a brief overview of the Fluid Protocol’s components and explains how it operates, highlighting what makes it a capital-efficient protocol.

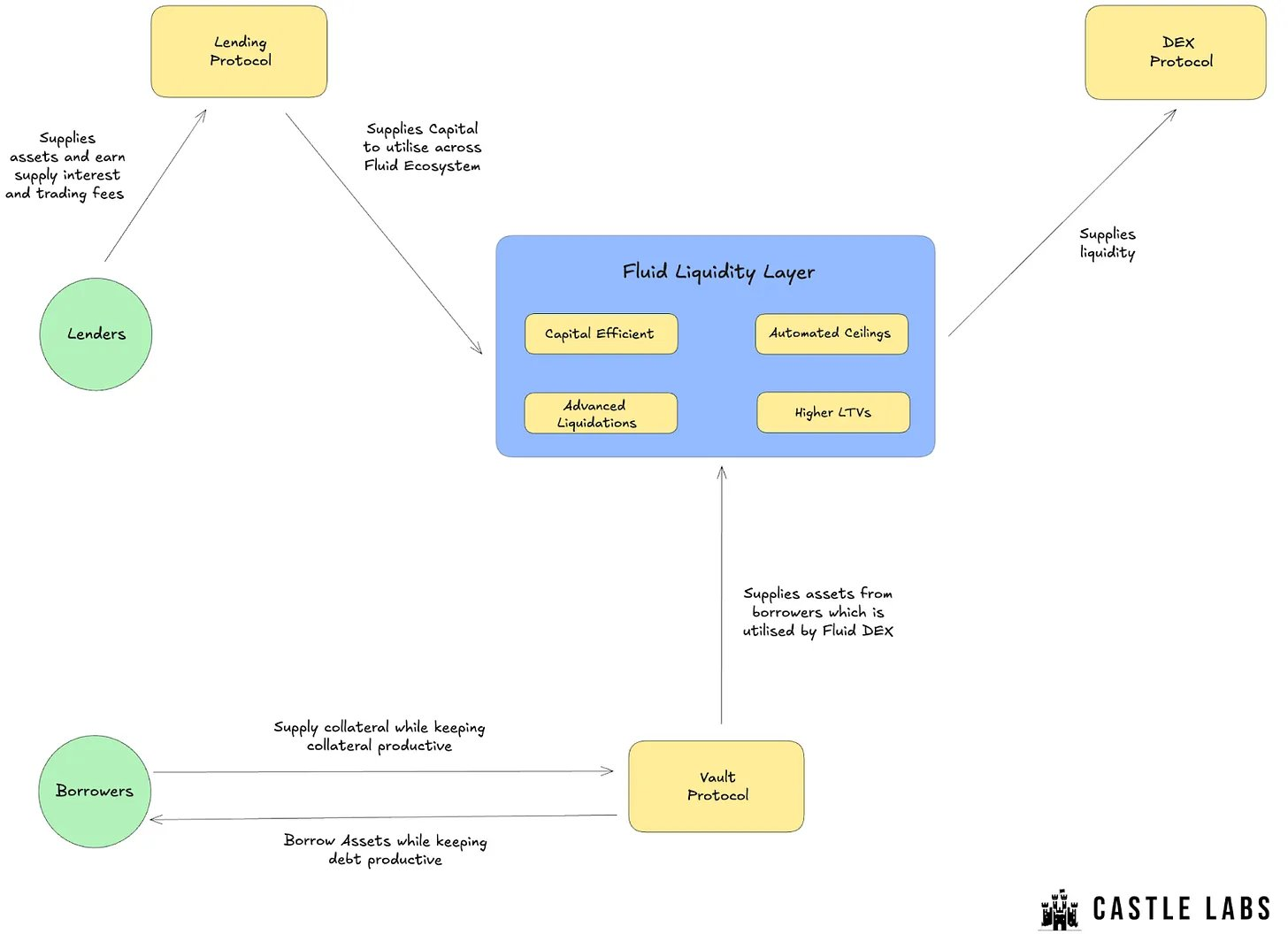

Fluid operates on a unified liquidity model, and beneath this liquidity, multiple protocols utilise it, including the Fluid Lending Protocol, Fluid Vaults, and DEX.

Fluid Lending allows users to supply assets and earn interest on top of them. The assets provided here are used across the Fluid Ecosystem, increasing their capital efficiency. It also opens up long-term yield opportunities as the protocol is designed to adapt to changes in the borrowing side of the market.

Fluid Vaults are single-asset, single-debt vaults. These vaults are extremely capital efficient, as they allow for high LTV (Loan-to-Value), up to 95% of the value of the collateral. This number decides the users’ borrowing capacity, in contrast to the collateral deposited.

Additionally, Fluid employs a unique liquidation mechanism, which reduces the liquidation penalties to as low as 0.1%. The protocol only liquidates the amount necessary to bring the position back to a healthy state. The liquidation process on Fluid is inspired by the Uniswap V3 design. It categorises positions in ticks or ranges of their LTVs and executes batch liquidations whenever the collateral value reaches the liquidation price. DEX aggregators then utilise these batches as liquidity: the liquidation penalty is translated into a discount for traders swapping.

Fluid DEX earns an extra layer of yield for the liquidity layer from trading fees earned through swaps, which further reduces the borrower’s position interest while increasing capital efficiency across the protocol. Different DEX aggregators, such as KyberSwap and Paraswap, utilise Fluid DEX as a liquidity source to access deeper liquidity and increase volume.

On Fluid, users can supply their collateral into the DEX and earn both lending fees and trading fees, making it a Smart Collateral.

If a user wishes to borrow against their collateral, they can either borrow assets or borrow a Smart Debt Position, making the debt productive. For example, a user could borrow from the ETH <> USDC/USDT pool, where they can deposit ETH as collateral and borrow USDC/USDT. In exchange, they would then get USDC and USDT in their wallet and use them as they wish, while the trading fees earned from the pool (USDC <> USDT) are utilised to reduce the outstanding debt.

Fluid’s Latest Advancements and Expansion

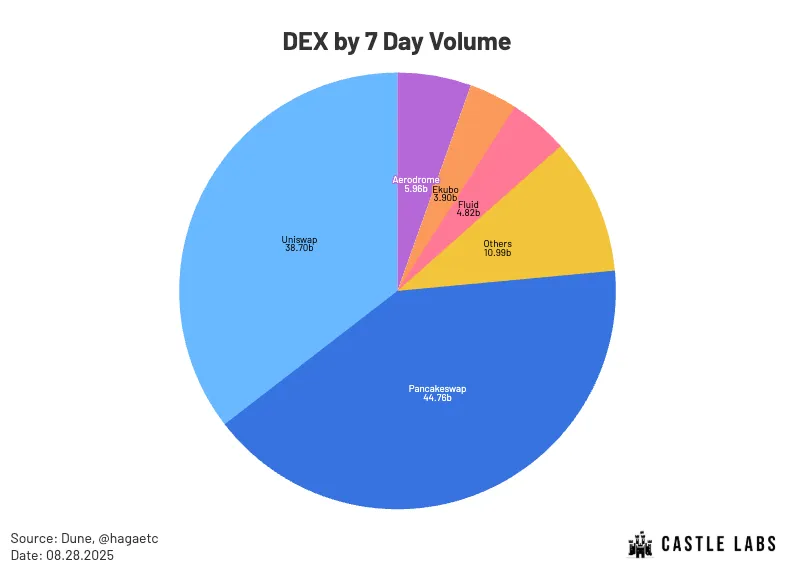

Based on the volume data from the last 7 days, Fluid DEX ranks 4th, behind @Uniswap">@ Uniswap, @Pancakeswap">@ Pancakeswap, and @AerodromeFi">@ AerodromeFi. Fluid has gone live with Jupiter Lend today, which was in Private Beta from the start of the month, and Fluid DEX Lite is already live.

Furthermore, Fluid DEX v2 is set to go into production soon.

DEX by 7 Day Volume, Source: Dune, @ hagaetc

In addition to this, the protocol is also expecting to run token buybacks, as the annualised revenue has crossed $10 million. Fluid also recently posted about this in their governance forum; the post opens up the discussion for buybacks and also lays down three approaches to it.

Check out different proposed approaches here:

https://x.com/0xnoveleader/status/1957867003194053114

Upon governance approval (following discussion), the buybacks would commence on October 1 with a 6-month evaluation period.

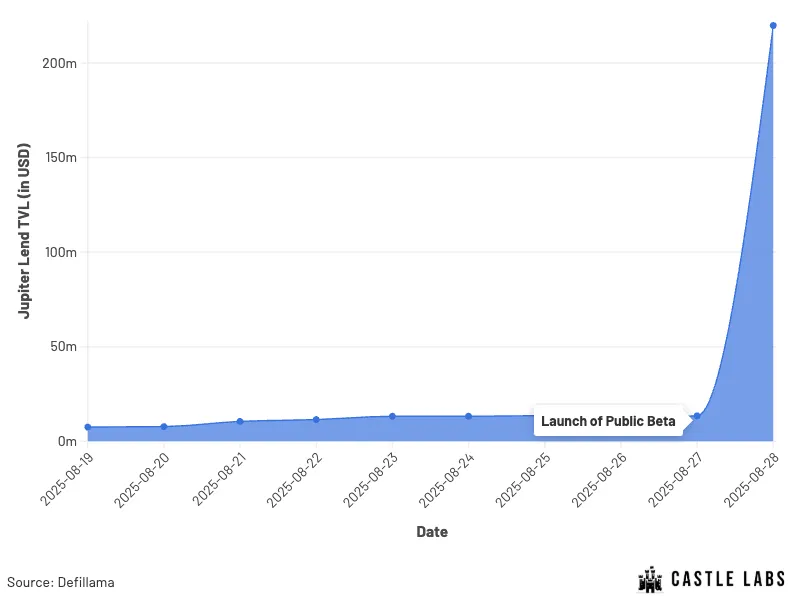

Jupiter Lend: Fluid’s entry to Solana

Fluid expansion to Solana has been done in collaboration with @JupiterExchange">@ JupiterExchange.

Jupiter is the largest DEX aggregator on Solana, with a cumulative trading volume of over $970 billion and is also a leading Perpetual Exchange and a Staking Solution on Solana.

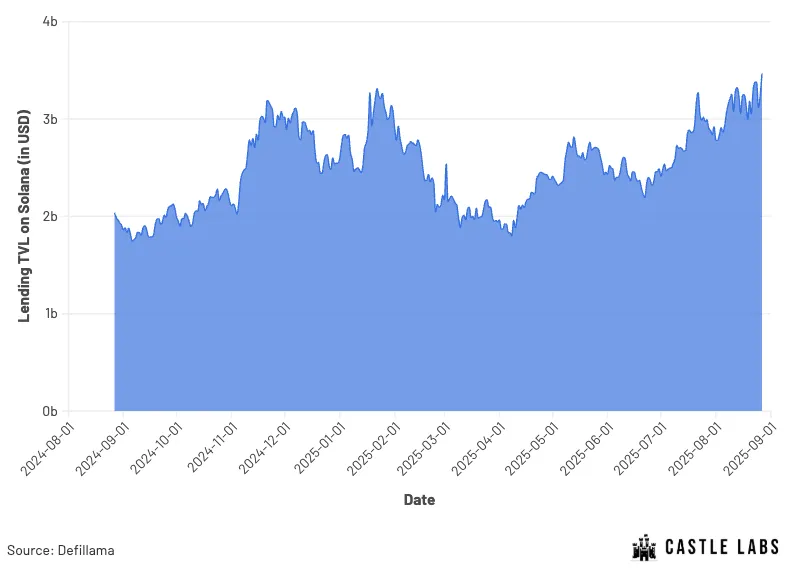

Solana Lending’s TVL is currently over $3.5 billion, with @KaminoFinance">@ KaminoFinance being the major contributor. The lending vertical on Solana represents huge potential for Fluid’s growth.

@jup_lend">@ jup_lend public beta has gone live recently, following a few days of its private beta. Currently, it has a TVL of over $250 million, making it the second-largest money market on the Solana blockchain, only behind Kamino.

Jupiter Lend, launched in collaboration with Fluid, offers similar features and efficiency, with Smart Collateral and Smart Debt set to launch later this year on the platform.

Additionally, 50% of the platform’s revenue will be allocated to Fluid.

Fluid DEX Iterations

Fluid has gone live with its DEX Lite and is planning to launch its V2 soon. This section will cover both of them and explain how these iterations will help Fluid grow even further.

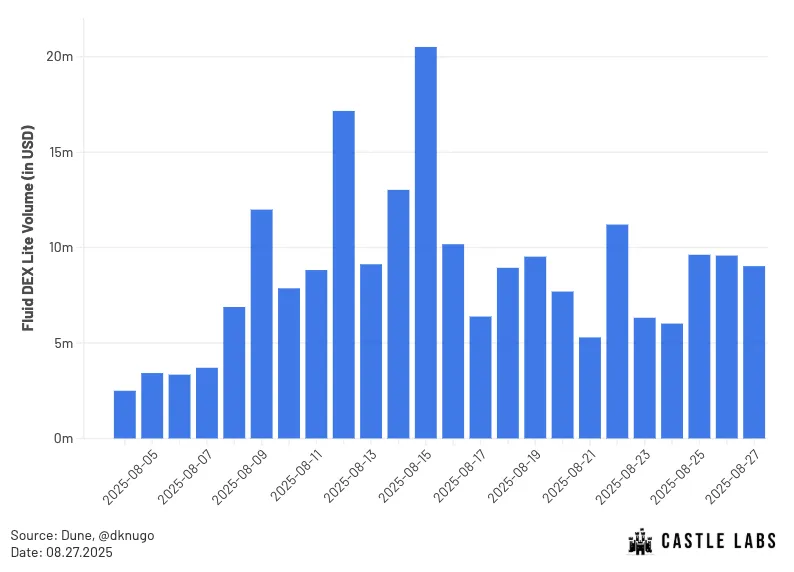

Fluid DEX Lite

Fluid DEX Lite was launched in August and introduced as a credit layer on Fluid, enabling it to borrow directly from the Fluid Liquidity Layer. It has started to serve the volume of correlated pairs, beginning with the USDC-USDT pair.

This version of Fluid DEX is highly gas-efficient and costs ~60% less to make a swap compared to its other version. It was created to capture a larger share of the correlated pairs volume, where Fluid is already a dominant protocol.

In its first week of launch, Fluid Lite generated more than $40 million in volume, with an initial liquidity of $5 million borrowed from the liquidity layer.

Fluid DEX Lite Volume, Source: Dune, @dknugo">@ dknugo

Visit our recent piece on Fluid Lite for a more detailed analysis:

https://x.com/castle_labs/status/1950511751981678799

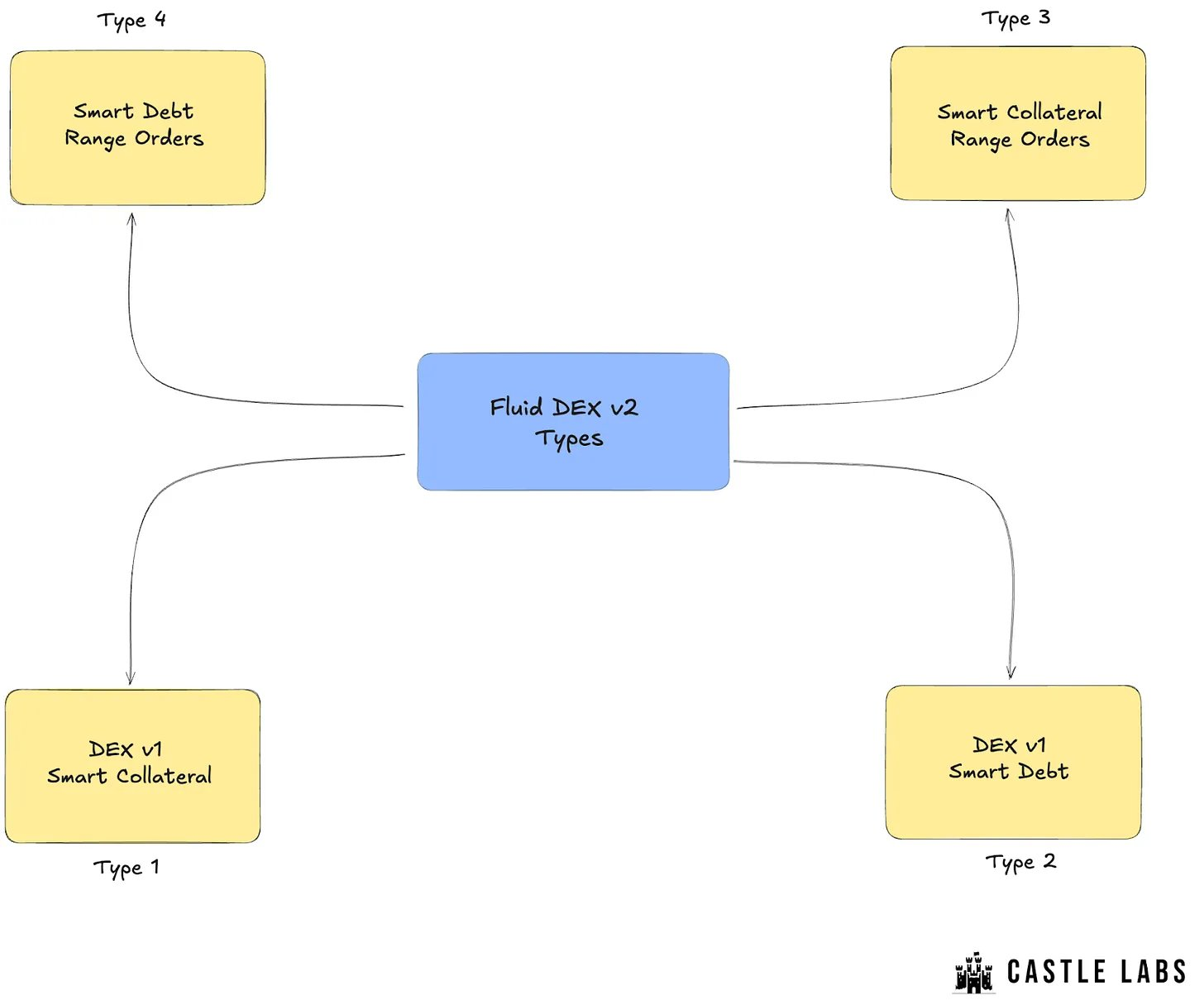

Fluid DEX V2

Fluid DEX V1 was launched in October 2024 and surpassed $10 billion in cumulative volume on Ethereum in just 100 days, faster than any dex ever did. To support this growth, Fluid is launching its V2, which is designed with modularity and permissionless expansion in mind, allowing users to create multiple custom strategies.

To start with, V2 will introduce four different types of DEXs supported within the protocol, with two of them carrying over from its V1. The type of DEXs supported by Fluid will not be limited to these four, with more types deployable through governance.

The two new types introduced are Smart Collateral Range Orders and Smart Debt Range Orders. Both of them allow the borrowers to help increase their capital efficiency.

- Smart Collateral Range Orders function like Uniswap V3, where users can provide liquidity by depositing collateral within a specific price range, while also earning a lending APR.

- Smart Debt Range Orders work similarly and allow users to create range orders on the debt side by borrowing assets and earn trading APR.

Additionally, it introduces features such as hooks (similar to Uniswap V4) for custom logic and automation, flash accounting, which boosts gas efficiency for CEX-DEX arbitrage, and onchain yield accruing limit orders, meaning that limit orders earn a lending APR while waiting to be filled.

Conclusion

Fluid is continually growing and improving to become more capital-efficient by providing a distinct set of features that contribute to its success.

- Smart Collateral: Collateral deposited on the platform can be utilised to earn lending interest and trading fees.

- Smart Debt: Smart Debt makes debt borrowed by users productive by reducing it through the payment of a portion of the debt using the trading fees generated from it.

- Unified Liquidity Layer: A fluid unified liquidity layer improves capital efficiency across the ecosystem by providing features such as higher LTVs, an advanced liquidation mechanism, and automated ceilings for better risk management.

Its latest expansion to Solana, through collaboration with Jupiter, expands its market share in the lending category to a non-EVM network. At the same time, Fluid DEX Lite and DEX V2 are designed to enhance the user experience on EVM chains and increase volume.

Moreover, DEX V2 is set to launch on Solana later this year, positioning Fluid to tap into both the lending and exchange verticals of the network.

Disclaimer:

- This article is reprinted from [castle_labs]. All copyrights belong to the original author [castle_labs]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

Dive into Hyperliquid

What is Stablecoin?

Arweave: Capturing Market Opportunity with AO Computer