Gate ETF Leveraged Tokens Explained: How to Efficiently Amplify Returns in Trend Trading

What Are Gate ETF Leveraged Tokens?

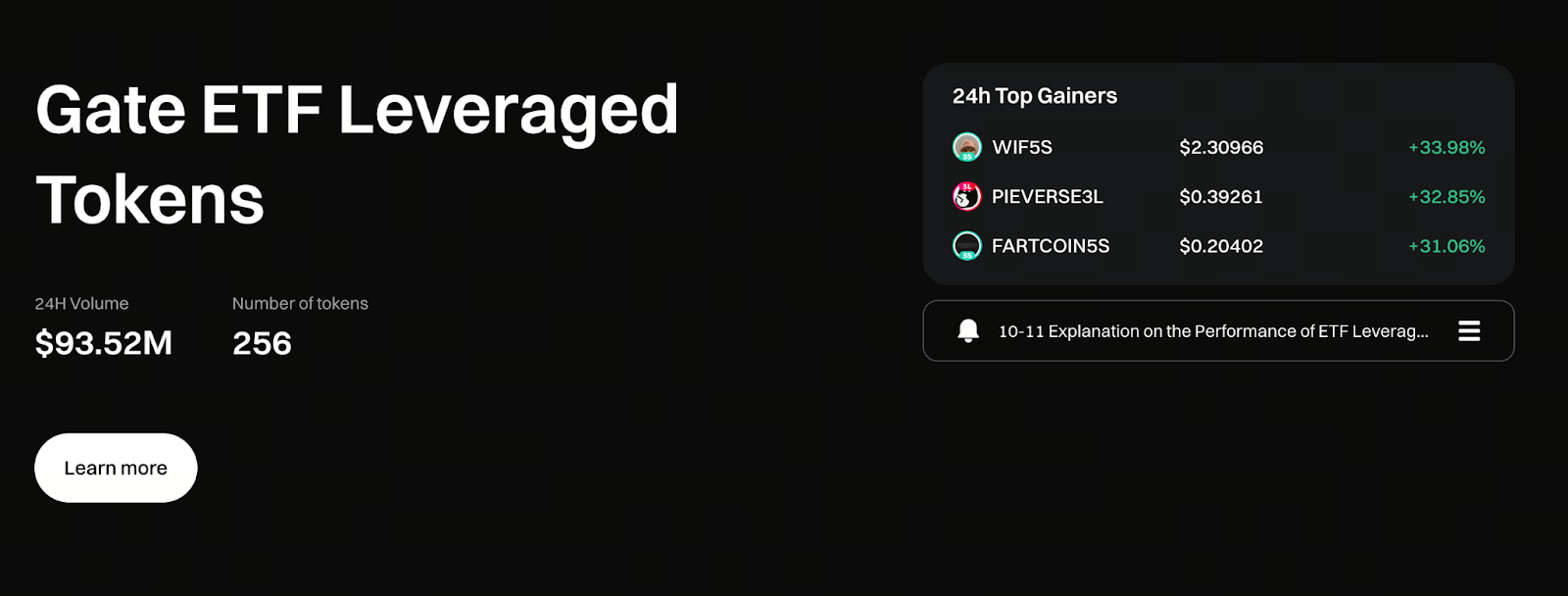

Source: https://www.gate.com/leveraged-etf

Gate ETF Leveraged Tokens are crypto-derivative tokens constructed on perpetual contract strategies, aiming to deliver users a fixed multiple (such as 2x or 3x) of amplified returns for both gains and losses.

Unlike traditional contract trading, ETF Leveraged Tokens function as directly tradable tokens. Users can engage in leveraged markets simply by buying and selling them like spot assets.

For example:

- Bullish tokens: BTC3L, ETH3L

- Bearish tokens: BTC3S, ETH3S

When the underlying asset trends in one direction, ETF Leveraged Tokens proportionally amplify both gains and losses.

Core Mechanisms of Gate ETF Leveraged Tokens

Gate ETF Leveraged Tokens do not simply mirror price movements; instead, they achieve target leverage through dynamically managed perpetual contract positions.

1. Automatic Rebalancing Mechanism

To maintain a fixed leverage ratio, the system adjusts positions under certain conditions. This rebalancing serves two main purposes:

- Risk management

- Ensuring the token’s leveraged attributes remain effective over time

Compared to manually managing contract positions, this mechanism is better suited for users looking to simplify operations.

2. No Forced Liquidation

ETF Leveraged Tokens do not have the forced liquidation thresholds found in traditional contracts. Even during significant market swings, tokens are not forcibly reduced to zero; instead, the rebalancing mechanism manages risk exposure.

It’s important to note that “no forced liquidation” does not mean “no risk.” Extreme market conditions can still cause substantial drawdowns.

3. Management Fee Structure

To maintain the underlying contract positions, ETF Leveraged Tokens charge a daily management fee. This is a long-term cost of the product and is why they are not suitable for long-term holding.

When Are Gate ETF Leveraged Tokens the Right Fit?

ETF Leveraged Tokens are not universal investment tools; they are highly scenario-specific trading products.

1. Clear Trending Markets

When the market shows sustained upward or downward trends, ETF Leveraged Tokens can significantly amplify returns, making them especially effective for trend-following strategies.

2. Short-Term and Swing Trading

Because of rebalancing and management fees, ETF Leveraged Tokens are better suited for short-term holding—such as intraday or multi-day swing trading—rather than long-term accumulation.

3. Hedging Spot Positions

Some traders use bearish ETF Leveraged Tokens to hedge spot holdings, reducing overall account volatility during market downturns.

ETF Leveraged Token Risks You Should Not Ignore

While Gate ETF Leveraged Tokens are easy to access, they still come with the following risks:

1. Net Value Decay in Volatile Markets

In choppy market conditions, frequent rebalancing may cause net value to erode over time. Even if prices return to their starting point, the token’s net value may fall below the initial level.

2. Leverage Magnifies Losses

If you misjudge the market direction, losses will also be multiplied, demanding strict risk controls.

3. Not Suitable for Long-Term Holding

Management fees and volatility decay make ETF Leveraged Tokens unsuitable as “buy and hold” assets.

How to Use Gate ETF Leveraged Tokens Wisely?

When using ETF Leveraged Tokens, the following principles are crucial:

- Only participate when the market trend is clear

- Maintain strict position sizing

- Do not treat them as long-term investments

- Combine with spot or other low-risk assets

Using ETF Leveraged Tokens as a “tactical tool” rather than a “core holding” is most consistent with their intended product design.

Conclusion: Gate ETF Leveraged Token Positioning

Gate ETF Leveraged Tokens are not designed for all investors; they are an efficient tool for active traders.

They can significantly amplify returns in trending markets, but require greater caution in choppy conditions. Understanding their mechanics and risk boundaries is far more important than simply chasing high returns.

As the crypto market matures, products like Gate ETF Leveraged Tokens—bridging the gap between spot and contracts—are becoming an increasingly popular choice among traders.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B

Bitcoin Spot ETF Vs. Bitcoin Futures ETF: What's the Difference?