Gate Research: Kalshi and Polymarket Hit Record Monthly Volume | Policy Shifts Open Mid-Term Upside for BTC

Summary

- SEC regulatory improvement and renewed rate cut expectations stimulated a V-shaped market rebound, with ETH strongly leading the charge, and capital expected to flow into Ethereum-related ecosystems like DeFi and Layer 2.

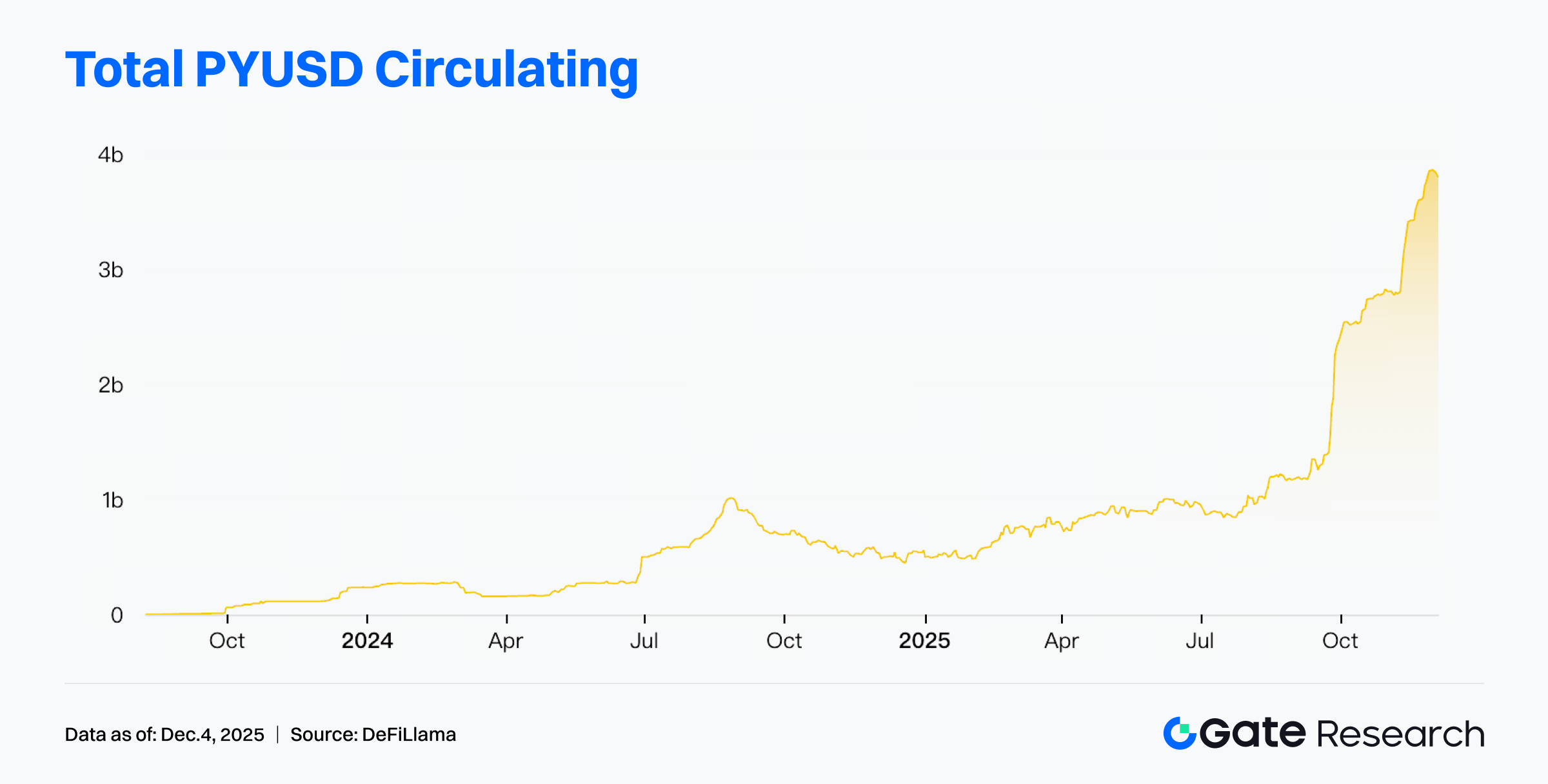

- The Ethereum Fusaka upgrade proceeded smoothly; Web3 project registrations surged in the Cayman Islands; and the PayPal stablecoin PYUSD experienced significant growth.

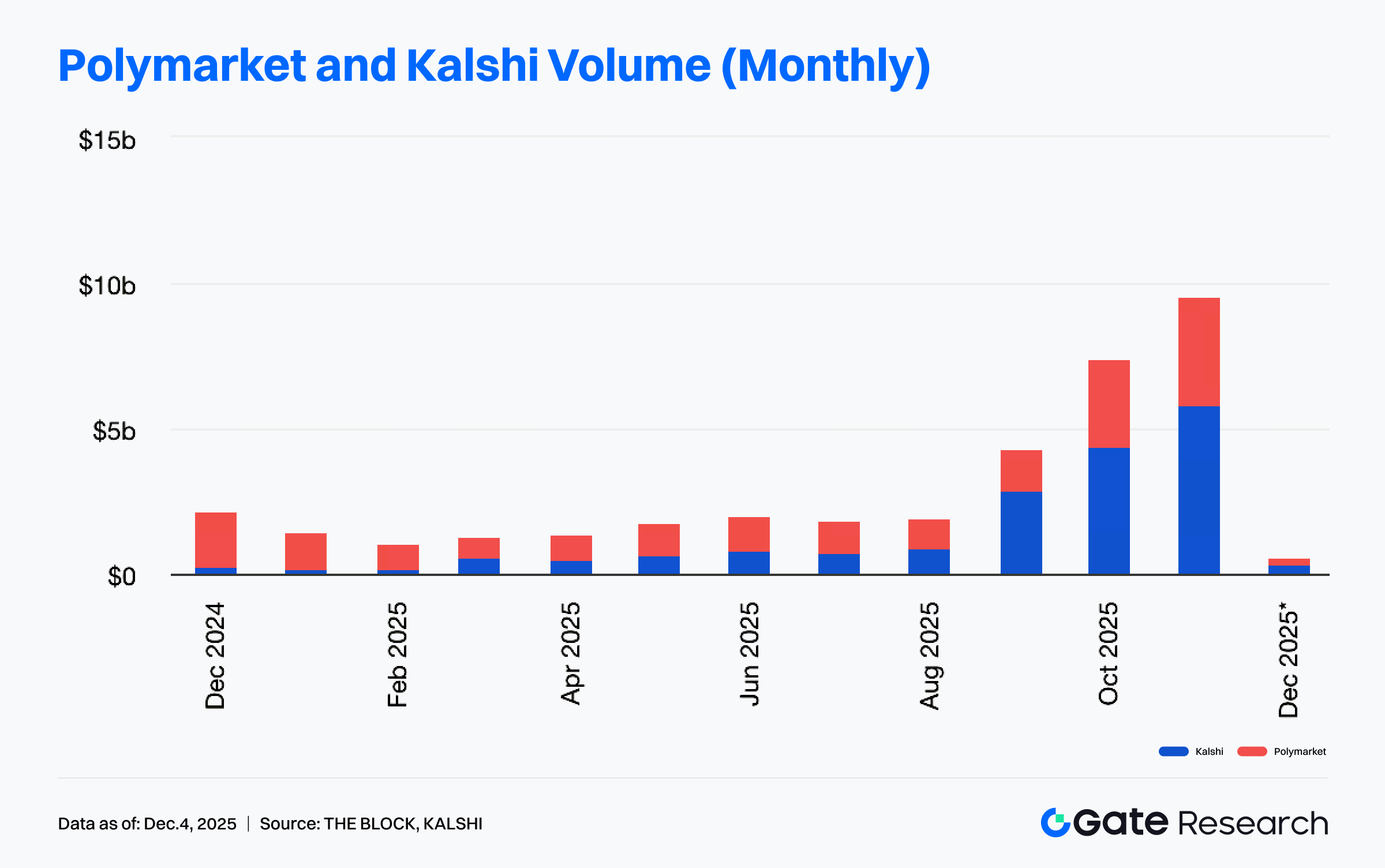

- Kalshi and Polymarket recorded nearly $10 billion in trading volume in November, setting a record for the strongest month.

- The current market is not suffering from genuine fundamental deterioration. Guidance for the 401(k) pension plan, expected next year, may allow the allocation of cryptocurrencies in the retirement market.

- ENA, LINEA, and BB are scheduled to unlock approximately $50.92 million, $12.75 million, and $2.51 million worth of tokens, respectively, over the next 7 days.

Market Overview

Market Commentary

- BTC Market Update — BTC’s recent daily trend has established a structure of “deep V-shaped rebound + high-level consolidation.” After dropping to $83,828 on December 2nd, the price rapidly reversed, stimulated by the dual catalysts of improved SEC regulatory expectations and renewed FED rate cut expectations, peaking at $94,189.8. Technically, the three moving averages, MA5, MA10, and MA30, have formed a standard bullish alignment, and the trend continues to maintain a strong bias. The current price is consolidating at a high level near $94k. As long as the central support above MA30 holds steady, the bullish structure remains intact, and the price is expected to challenge the $94k–$95k range again and attempt a breakout.

- ETH Market Update — ETH rapidly reversed after dropping to $2,719.28 on December 2nd, establishing a clearly defined V-shaped bottom structure, and has continuously refreshed phase highs in the subsequent rally. Technically, the three moving averages, MA5, MA10, and MA30, exhibit a typical bullish divergence structure, with steep slopes on the short-cycle moving averages indicating strong upward momentum. Since the rebound, the price has consistently tracked along MA5 and MA10, with limited pullbacks, demonstrating solid short-term buying support. Coupled with the improved macro expectations and the boost in sentiment from the implementation of the Ethereum Fusaka upgrade, ETH retains the conditions for continued upward trending and is poised to challenge $3.3k in the short term. It is important to note that if short-term momentum slows, a rapid retracement may occur, but as long as the price holds MA10 or MA30, any downward adjustment is likely a healthy consolidation, and the overall ascending structure remains unchanged.

- Altcoins — The market executed a V-shaped rebound, and with ETH strongly leading the rally, capital is expected to flow into Ethereum-related DeFi and Layer 2 ecosystems, indicating a recovery in risk appetite.

- Stablecoins — The current total market capitalization for stablecoins is $307.801 billion, having increased by $2.613 billion over the past week, representing a growth of 0.86%.

- Gas Fees — The Ethereum network’s Gas fee generally remained below 1 Gwei over the past week, with the highest single-hour peak reaching 2.63 Gwei. As of December 4th, the average Gas fee for the day was 0.013 Gwei.

Trending Tokens

Over the past 24 hours, cryptocurrency market sentiment has significantly recovered. The Fear & Greed Index rebounded to 26, escaping the “Extreme Fear” zone, signaling a rise in overall risk appetite. Driven by improved regulatory expectations and anticipated FED liquidity, the broader market executed a V-shaped rebound, with ETH leading mainstream assets. As ETH maintains its strength, capital has begun to diffuse into its associated DeFi and Layer 2 ecosystems, simultaneously stimulating strength in several trending small- and mid-cap tokens, including the derivatives token Tradoor, Bitcoin scaling token BOB, and AI-focused SAPIEN, all of which recorded impressive gains. The following will analyze the reasons for each token’s surge individually.

TRADOOR Tradoor(+176.85%,Market Cap: $19.83m)

According to Gate market data, the TRADOOR token is currently quoted at $1.3843, an increase of over 170% in 24 hours. Tradoor is an on-chain derivatives trading platform based on the TON blockchain, focused on providing a user-friendly leveraged trading experience. Core innovations include using machine learning to optimize the pricing model, ensuring zero slippage and fair transactions; supporting low-barrier entry, such as leveraged trading with small amounts of capital; and integrating an AI security mechanism to filter malicious orders.

The price increase of TRADOOR is likely primarily catalyzed by the Gate listing. Gate recently launched TRADOOR’s spot and perpetual futures trading pairs and introduced rewards for first trades, net deposits, and trading competitions, which triggered a market FOMO effect and attracted new capital inflows.

BOB BOB(+111.55%,Market Cap: $60.76m)

According to Gate market data, the BOB token is currently quoted at $0.0268, with a 24-hour gain exceeding 110%. BOB is a hybrid Layer 2 network designed to combine Bitcoin’s robust security and liquidity with Ethereum’s smart contract innovation, aiming to create the gateway to BTCFi.

The surge in BOB’s price was primarily driven by its listing on a Korean exchange and a short squeeze. BOB was listed on a Korean exchange yesterday, opening a KRW trading pair, which brought a massive influx of short-term buying from Korean investors. Following this demand from Korean investors, the rapid price increase triggered the forced liquidation of leveraged short positions (i.e., a short squeeze), forming a self-reinforcing upward spiral. Coinglass data shows that BOB’s open interest grew by over 700% to exceed $30 million, while contract trading volume increased by over 3,200% to $1.26 billion. Furthermore, BOB sustained the maximum negative funding rate, reaching an astonishing annualized negative funding rate of 1,600% on Gate.

SAPIEN Sapien(+51.46%,Market Cap: $45.76m)

According to Gate market data, the SAPIEN token is currently quoted at $0.18, an increase of over 50% within 24 hours. Sapien is a decentralized AI data network designed to address the pain points of a lack of reliability and transparency in AI training data. It uses a community-driven “Knowledge Minting” mechanism, allowing users to contribute, verify, and monetize human knowledge data for training AI models.

SAPIEN’s recent surge is primarily attributed to the comprehensive recovery of the AI and robotics sector narratives, combined with concentrated capital speculation. The recent acceleration of industrialization in the humanoid robot/embodied AI sector has increased market demand expectations for high-quality AI training data. As an upstream data service concept, Sapien has garnered widespread market attention. Sapien’s ecosystem includes over 30 enterprise clients, including Lenovo and Midjourney, giving it strong fundamentals and a relatively low token market capitalization. This makes it possible for even medium-sized capital inflows to drive significant price increases in the short term. Additionally, SAPIEN’s annualized negative funding rate across various exchanges has exceeded 600%, objectively creating a “short squeeze” effect that further amplified the upward trajectory.

Key Market Data Highlights

Ethereum Successfully Completes Fusaka Upgrade, Releasing Space for Layer 2 and On-Chain Ecosystem

Ethereum’s Fusaka upgrade is the second major network upgrade for Ethereum in 2025, following Pectra in May. It was officially activated at 21:49:11 UTC on December 3, 2025. This upgrade involves simultaneous optimization of Ethereum’s execution and consensus layers, aimed at addressing the explosive growth of Layer 2 networks and driving the network towards higher TPS (transactions per second).

Fusaka is more than just simple parameter adjustments or optimizations; it introduces a series of structural changes, with a particular focus on scalability, data availability, and fees/fee structure. Key components include:

- Peer-to-Peer Data Availability Sampling: Validators no longer need to download the complete blob or the entire dataset; they only need to sample and verify a portion of the data. This greatly reduces the storage and bandwidth requirements for nodes.

- Expanded Blob Capacity: Fusaka significantly increases the block capacity and gas limit, allowing each block to carry more transactions and data. This is highly favorable for batch submissions and rollup support for Layer 2 networks.

- Other Optimizations: Including Cell Proofs (a change in the blob proof format) and passkey signature verification (supporting FaceID/TouchID bridge-less authentication), which enhance user experience and smart contract compatibility.

Overall, Fusaka is designed to pave the way for Layer 2 networks and large-scale applications, enabling Ethereum to not only maintain security and decentralization but also to handle future higher-frequency and larger-scale on-chain activities.

Cayman Islands Becomes a Hotspot for Web3 Projects Seeking Legal Entities, Registrations Jump 70% Year-over-Year

The number of foundation company registrations in the Cayman Islands has surged by 70% year-over-year, exceeding 1,300 by the end of 2024, with over 400 new registrations already added in 2025. These structures are increasingly being used as legal wrappers for so-called Decentralized Autonomous Organizations (DAOs) and as ecosystem stewards for large Web3 projects, 17 of which have treasuries exceeding $100 million. This likely indicates that Web3 projects are shifting from early-stage, completely anonymous operations toward actively seeking legal and compliant structures.

The ruling in the Samuels v. Lido DAO case in 2024 served as a wake-up call for these so-called DAOs. An unwrapped DAO without a legal entity may be treated as a general partnership, meaning its participants, and potentially even token-holding voters, could face unlimited personal joint and several liability for the DAO’s actions. This has compelled numerous projects to rapidly seek legal entities to provide liability isolation for community members. Secondly, the Cayman Islands has announced the implementation of the Organisation for Economic Co-operation and Development’s (OECD) Crypto-Asset Reporting Framework (CARF), effective January 1, 2026, which mandates due diligence and information reporting obligations for crypto service providers. However, passive foundations or protocol treasuries that merely hold assets and do not engage in exchange services are expected to be exempt from mandatory reporting. Furthermore, the legal form of a foundation company established in the Cayman Islands is highly compatible with the structural needs of current Web3 projects advocating for DAO structures. It can exist without shareholders but function as a separate legal entity capable of entering contracts, holding assets (such as treasury funds and intellectual property), and employing personnel, while its articles of association can be customized to incorporate token voting governance.

Simply put, the surge in Cayman Islands Web3 foundations is a result of Web3 projects actively selecting the most suitable legal wrapper to meet their decentralized governance needs—a response to legal risks in major jurisdictions and adaptation to new global regulatory rules—in pursuit of safer, more long-term development.

PayPal Stablecoin PYUSD Grows Against the Trend, Up 36% in the Last 30 Days

PayPal’s stablecoin, PYUSD, has recently achieved astonishing growth in supply against the market trend. Its market capitalization surged from $1.2 billion to approximately $3.8 billion in just two months, from September to November 2025, with its supply increasing by over $1 billion in November alone. PYUSD has now surpassed USD1 to become the sixth-largest stablecoin globally, a feat largely attributable to a series of strategic moves by PayPal.

In September 2025, PayPal entered a strategic partnership with Spark, a leading DeFi liquidity platform launched by the original MakerDAO core team. PYUSD was integrated into Spark’s lending markets, establishing an institutional-grade on-chain liquidity foundation. This transformed PYUSD from a mere payment tool into an interest-bearing asset within DeFi, attracting significant capital seeking stable returns. Concurrently, PYUSD aggressively pursued a multi-chain expansion to capture payment and remittance use cases. PYUSD has expanded to multiple networks, including Solana and Sei, and integrated into the mainstream commercial ecosystem through collaborations with traditional payment giants like Mastercard and Fiserv. Furthermore, PYUSD’s core advantage lies in PayPal leveraging its vast traditional user base and clear business strategy as a moat for PYUSD’s growth. Users can seamlessly purchase, hold, and send PYUSD directly within the familiar PayPal and Venmo apps, eliminating the need to understand complex wallets and private keys, making the entry barrier extremely low. Additionally, PayPal introduced a PYUSD holding rewards program, offering users an annual holding reward of approximately 3.7%. This essentially passes on the interest earned from reserve assets to users, thereby enhancing user stickiness and willingness to hold the token.

Focus of the Week

Kalshi and Polymarket Recorded Nearly $10 Billion in Trading Volume in November, Marking the Strongest Month on Record

In November, Kalshi’s monthly trading volume surged from $4.4 billion in October to $5.8 billion, representing a month-over-month increase of 32%. Concurrently, Polymarket’s trading volume also rose from approximately $3.02–$3.04 billion to over $3.74 billion, a month-over-month increase of 23.8%. The combined trading volume of the two platforms approached $10 billion, making November the strongest month in the history of the crypto prediction market.

Kalshi and Polymarket have come to dominate global prediction market liquidity and volume, quickly consolidating into a “duopoly” structure. This surge in trading volume primarily stems from the return of retail interest, a high frequency of macro events, and the platforms’ continuous expansion of product offerings and liquidity infrastructure, enhancing their appeal to users and capital. This also suggests that prediction markets are becoming the next generation of high-frequency macro trading venues, and their data and liquidity are increasingly resembling a “crypto version of the CME,” potentially playing a vital role in pricing and sentiment guidance in future markets.

Circle Has Minted $13 Billion Worth of USDC on the Solana Chain Since October

According to monitoring by Onchain Lens, Circle has minted $750 million worth of USDC on the Solana chain this week, and since the “1011 Crash,” Circle has minted $13 billion worth of USDC on the Solana chain. Within 2025 alone, $49 billion worth of USDC has been minted.

Circle’s large-scale minting of USDC in a short period has significantly expanded the stablecoin supply on the Solana chain, providing an ample liquidity foundation for DeFi and cross-chain transactions. Over the past two months, the Solana chain has seen a large increase in trading volume, meme trading, and DeFi arbitrage activities, with the demand for stablecoin circulation growing accordingly. Furthermore, during periods of market volatility or downturns, some capital shifts to stablecoins, meaning the short-term minting data may be influenced by this risk-averse demand. Overall, this large-scale issuance reflects, on one hand, the strong market demand for stable assets, and on the other, indicates that institutions/traders are rotating a portion of their assets from highly volatile cryptocurrencies to stablecoins to mitigate risk.

Bitcoin Market Concerns Exaggerated; Policy Shifts Open Space for Mid-Term Upside

Vetle Lunde, Head of Research at K33, stated in the December market outlook report that several of the greatest fears facing Bitcoin are distant, hypothetical issues rather than near-term threats, such as quantum risk and the potential for a sale of BTC by Strategy. Although Bitcoin is currently undergoing the most severe correction since the 2022-23 bear market, the present wave of panic is driven by exaggerated long-term risks rather than any immediate structural threats. Derivatives overhang, concentrated selling by long-term holders, and broad supply distribution were the catalysts that drove the market to recent lows. However, a series of mid-term policy and structural developments could significantly enhance Bitcoin’s prospects. For instance, new guidance for the 401(k) pension plan is expected from regulators in February 2026, which may allow the allocation of cryptocurrencies within the $9-trillion retirement market.

The upcoming 401(k) pension plan guidance could have a major impact on the crypto market structure. If the plan genuinely allows the allocation of crypto assets, it would introduce a large amount of long-term capital from mainstream retirement fund pools into the crypto market, significantly boosting the overall demand base. Unlike the previous reliance mainly on high-risk-takers and speculative capital, the entry of retirement funds would help elevate the institutionalization, compliance, and stability characteristics of crypto assets, thus enhancing market confidence and the stability of asset pricing.

Funding Weekly Recap

According to RootData, seven crypto and related projects announced successful financing or mergers and acquisitions between November 28 and December 4, 2025, covering multiple sectors including Bitcoin savings accounts, DePIN, AI, and infrastructure. Below is a brief overview of the top-ranked projects by funding size this week:

Ostium

On December 3rd, Ostium announced the completion of a $20 million funding round, led by General Catalyst.

Ostium is a synthetic asset protocol that allows institutional and retail traders, as well as hedgers, to gain exposure to commodities through on-chain trading.

BitStack

BitStack announced the completion of a $15 million funding round on December 2nd, led by 13books Capital.

BitStack is a Bitcoin savings account application designed to make Bitcoin savings simple, fun, and effortless. It is based on the concept of automatically rounding up bank transaction amounts to the nearest euro, allowing for easy savings without any extra action. This spare change accumulates over the week and is automatically converted into Bitcoin the following Monday.

Gonka

Gonka announced the completion of a $12 million funding round on November 29th, led by BitFury.

Gonka is a decentralized computing network designed specifically for AI inference and training. Contributors in the network earn GNK tokens by dedicating their GPU computing power to the network; developers can run AI applications unconstrained by cloud limitations or closed models; and users drive demand through inference.

Next Week to Watch

Token Unlocks

According to data from Tokenomist, the market is set to see large unlocks of several important tokens over the next 7 days (December 5 - December 11, 2025). The top 3 unlocks are as follows:

- ENA will unlock tokens valued at approximately $50.92 million over the next 7 days, representing 2.3% of the circulating supply.

- LINEA will unlock tokens valued at approximately $12.75 million over the next 7 days, representing 8.4% of the circulating supply.

- BB will unlock tokens valued at approximately $2.51 million over the next 7 days, representing 7.4% of the circulating supply.

References:

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Gate, https://www.gate.com/crypto-market-data

- Coingecoko, https://www.coingecko.com/en/cryptocurrency-heatmap

- Rootdata, https://www.rootdata.com/Fundraising

- Tokenomist, https://tokenomist.ai/

- TheBlock, https://www.theblock.co/post/380909/kalshi-and-polymarket-post-strongest-months-yet-with-nearly-10-billion-in-combined-november-volume

- K33, https://k33.com/research/articles/zooming-in-rather-than-out

- X, https://x.com/OnchainLens/status/1995530252576248303

- Coinglass, https://www.coinglass.com/FundingRate

- CoinDesk, https://www.coindesk.com/tech/2025/12/03/ethereum-activates-fusaka-upgrade-aiming-to-cut-node-costs-speed-layer-2-settlements

- Cointelegraph, https://cointelegraph.com/news/cayman-islands-web3-foundation-companies

- DeFiLlama, https://defillama.com/stablecoin/paypal-usd

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

How to Do Your Own Research (DYOR)?

What Is Technical Analysis?

12 Best Sites to Hunt Crypto Airdrops in 2025