Google and Visa are both making plans. What investment opportunities does the undervalued x402 protocol hold?

If you have been following crypto social media lately, you may have noticed a new term appearing frequently: x402.

Conversations about x402 are far more active on English-language Crypto Twitter, while Chinese circles remain relatively quiet. This information gap often signals the rise of a new narrative—and fresh opportunities.

The story starts with Coinbase.

At the end of September, Coinbase announced the creation of a foundation called x402 together with Cloudflare. The market’s initial response was muted—after all, Coinbase frequently launches new protocols and tools.

If you are not familiar with Cloudflare: this company controls access for more than 20% of the world’s web traffic, making it a cornerstone of internet infrastructure.

Cloudflare has rarely entered the crypto space, much less partnered with crypto companies to launch protocols.

Then, in mid-October, Visa announced support for the x402 standard. As the world’s largest payment network, Visa’s endorsement of a Coinbase-backed standard was seen as a bullish sign and a push toward broader mainstream adoption.

From Cloudflare to Visa, from internet infrastructure to legacy payment rails, Coinbase’s x402 protocol seems to be forging a bridge between two worlds.

This impression is reinforced by reviewing the early x402 participant list. Tech giants like Google, AWS, and Anthropic (parent of Claude AI) are all involved. Even more notably, a wave of AI-related projects—including several AI agent platforms—have begun integrating x402.

In summary, Coinbase has launched a payments protocol, with legacy payment and technology giants participating, and AI projects actively pursuing integration.

Is a new market narrative forming? If so, who stands to benefit most?

HTTP 402: The Internet’s Unfinished Payments Dream

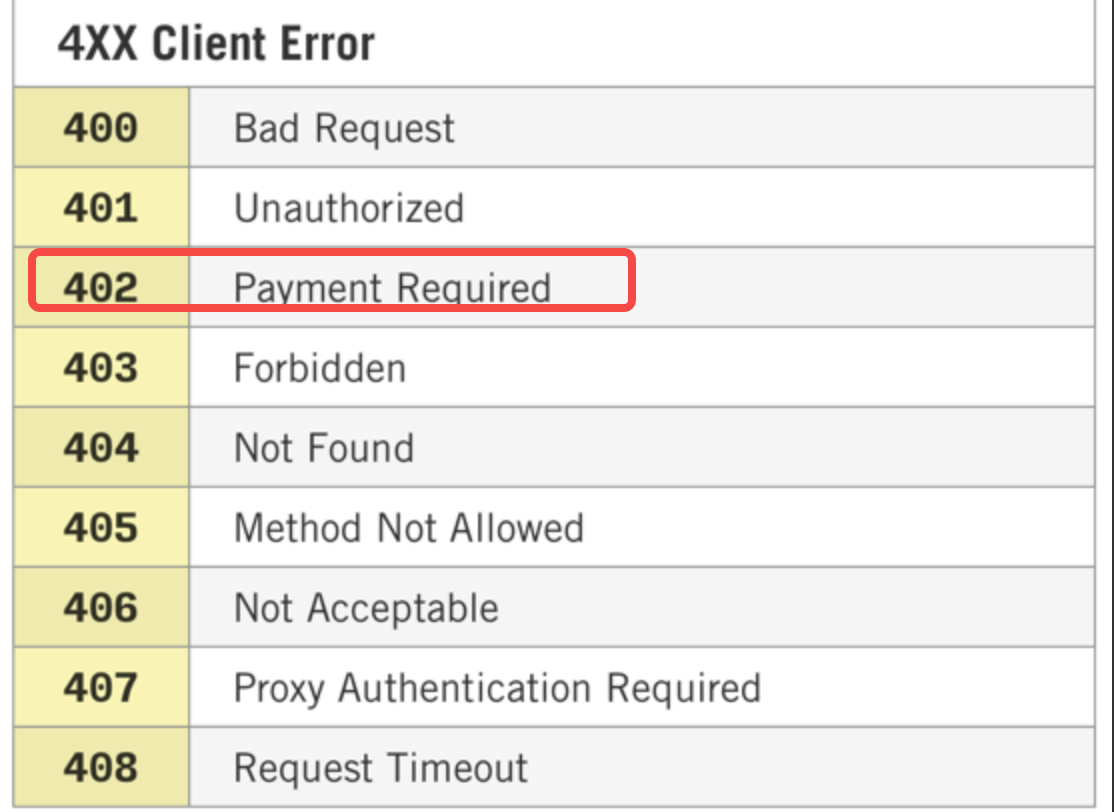

To see why x402 is so significant, you need to know a little-known fact: the internet protocol has always included a “payment required” function that was never activated.

When HTTP/1.1 was standardized in 1997, engineers defined a set of status codes to handle different scenarios and functions online.

Most people know 404 means “page not found.” 200 stands for “request successful,” though you rarely see it directly.

But 402 was defined as “Payment Required” by the original engineers.

However, this status code has remained reserved and unused in practice. The reason is simple: back then, the internet didn’t have a viable payment solution.

Credit cards required complicated merchant integrations. PayPal? That needed its own closed account ecosystem.

So, the internet went a different way—ad-driven business models. Giants like Google and Facebook rose because the web lacked native payment functionality.

Attempts to activate 402 have repeatedly failed over the past 30 years due to technical reasons. Now, as crypto payments gain mainstream traction, the conditions may finally be right:

First, public blockchains offer native stablecoins like USDC, making payments as easy as sending an email in theory. Second, Layer 2 networks are slashing transaction costs. On Base or Polygon, a transaction costs just pennies.

Most importantly, the AI boom has unleashed a flood of agent applications, potentially creating real demand for seamless internet payments.

For example: suppose I want my AI assistant to pay another AI for a translation service—$0.01. In the traditional payment system, this transaction is basically impossible, or would require complex integrations and channels.

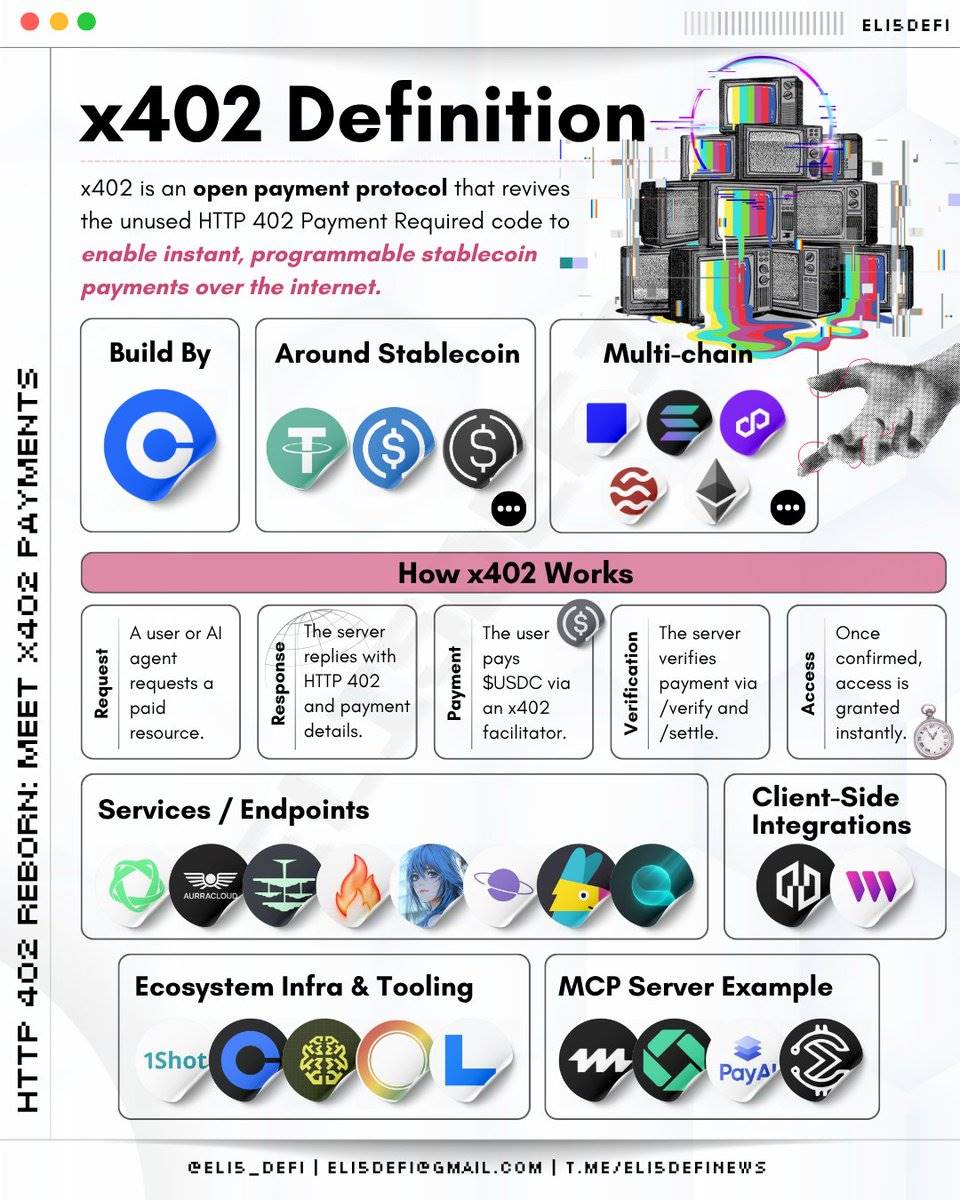

Enter x402. Coinbase has built a complete payments protocol on the HTTP 402 standard—not reinventing the wheel, but unlocking the potential of an unused status code.

With x402, when an AI accesses a paid API, it receives a 402 status code and payment request, then automatically pays in USDC—no human intervention needed.

This may explain why Cloudflare and Visa are on board.

They’re not just eyeing a crypto protocol, but the chance to reimagine the web’s payments layer. When payments become as simple as HTTP requests, new business models can emerge across the internet.

The API economy, content behind a paywall, AI service markets—all could see explosive growth powered by x402. Early adopters stand to gain a significant first-mover advantage.

x402: Crypto-Powered Payments, Unlocked

x402’s technology sounds complex, but its essence is simple. Once you understand how it works, you can spot the investment opportunities.

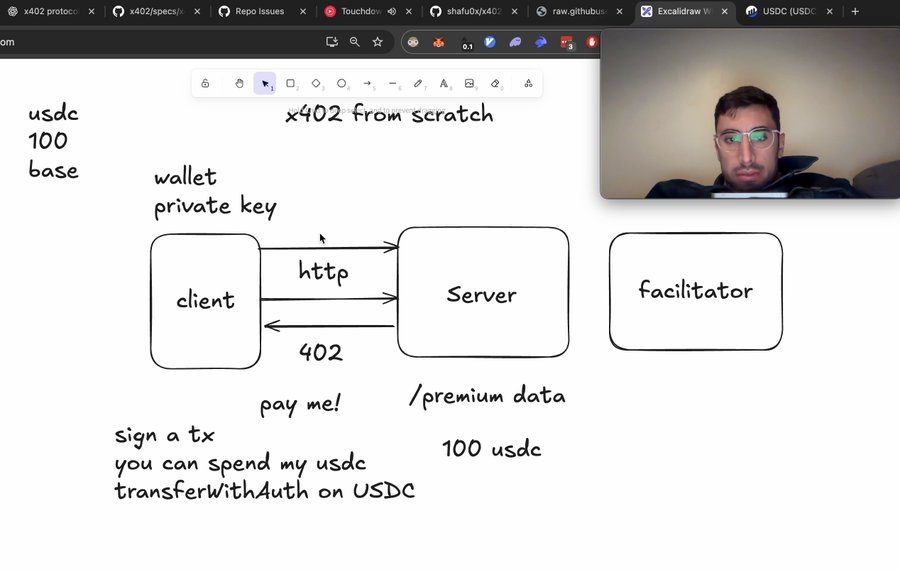

Here’s how a typical x402 transaction works:

- When a user or AI requests a paid resource, the server responds with a 402 status code: “This service costs 0.1 USDC—please pay to this address.”

- The client automatically initiates a USDC transfer.

- Once the server confirms payment, it instantly delivers the service.

How is this different from legacy payments?

Traditional payment gateways require accounts, card binding, and verification. Transactions pass through banks, card networks, and payment companies, settling at best on a T+1 timeline. Fees run 2–3%, plus hidden charges.

x402 changes the game. No accounts, no registration—anyone or any AI with a wallet can pay directly. Settlement is chain-dependent and instant, and the protocol itself charges zero fees.

You might wonder: how does anyone make money?

x402 benefits the crypto ecosystem—and Coinbase in particular—by enabling a free protocol and allowing platforms using it to charge service fees. For example, Coinbase can collect small transaction fees as a payment service provider, and the Base blockchain collects minimal gas fees. This model lets the ecosystem profit collectively, rather than allowing one platform to dominate.

Another crucial feature: x402 is chain-agnostic. Base, Polygon, Solana and others are all supported—users can pick the fastest, cheapest chain for any payment.

In the x402 vision, AI agent-driven economy becomes a reality: they can buy computing, data, and services from other AIs, creating a whole new agent-driven economy.

The technical details matter less than the implications: lower costs, faster speeds, and massive new markets. When payment friction is almost zero, business models that once seemed impossible become viable.

This is why not just crypto companies, but even giants like Visa, are getting involved.

Which Projects Are Worth Watching?

x402 is not just a technical upgrade—it’s a potential investment opportunity. The participant list may be the best indicator of its future.

Let’s start with the infrastructure trifecta:

Coinbase (NASDAQ: COIN) is the initiator, with the strongest incentive to drive adoption.

As the largest US crypto exchange, Coinbase has long sought non-trading revenue streams. x402 positions it as a payments infrastructure provider. Every x402 transaction can run over Base; every USDC payment reinforces Coinbase’s ecosystem.

If x402 gains real traction, Coinbase could become the “Visa” of crypto payments.

Cloudflare (NYSE: NET) has its own motivations.

Controlling 20% of global web traffic, Cloudflare has rarely entered finance—until now. The reason? AI.

Cloudflare recently launched the Workers AI platform. If websites can charge AIs directly using x402, Cloudflare stands to oversee a huge AI services market.

Visa (NYSE: V) is playing both offense and defense.

Defensively, Visa is ensuring its network isn’t sidelined by crypto payments. Offensively, it’s moving early in the AI payments race. Visa’s own TAP Protocol (Trusted Agent Protocol) is now interoperable with x402.

TAP is designed for AI agents, enabling them to use both legacy Visa rails and crypto payments. An AI assistant could buy a plane ticket with your credit card or use USDC to pay another AI for services.

Now, let’s look at the crypto projects—where investment opportunities are most concentrated:

- @ AEON_Community AEON

AEON is building AI payments infrastructure, enabling agents to autonomously search, shop, and pay with crypto. AEON partners with blockchains like BNB Chain, Solana, TON, and TRON, and won the BNB Chain Demo Day.

- @ PayAINetwork PayAI Network

PayAI Network is creating a global, always-on market for AI agents to hire and work for each other, using open source tools like libp2p, IPFS, ElizaOS, and Solana. Recently, two ElizaOS agents autonomously negotiated, signed, delivered, and paid for a contract—the first time in history.

With x402 integration, AI agents can now charge per service, making true commercialization possible.

- @ daydreamsagents Daydreams

Daydreams is a composable AI framework for on-chain task execution, enabling micropayments for AI services.

- @ GoKiteAI KITE AI

KITE AI is building the foundation for the agent internet—a system where autonomous agents can independently authenticate, transact, and operate in real environments.

In September, KITE raised $18 million in Series A funding, led by General Catalyst and PayPal Ventures. Their AIR (Agent Identity Resolution) system provides verifiable IDs and programmable payments for AI agents.

- @ questflow Questflow

Questflow is an orchestration layer for the multi-agent AI economy, coordinating global AI agents to autonomously execute tasks and earn on-chain rewards. With CDP wallet with x402 support, Questflow has processed over 130,000 microtransactions and integrated 30+ third-party agents. They partner with Circle, using USDC for settlement.

- @ peaq Peaq

peaq now supports the x402 protocol, enabling builders to leverage x402 for machine-to-machine (M2M) and agent-to-agent (A2A) payments. As a Layer-1 blockchain for DePIN (Decentralized Physical Infrastructure Networks), peaq connects over 850,000 machines, robots, and devices—and is a fixture in the “Robots x Crypto” narrative.

Several other projects haven’t launched tokens yet but are worth watching. Firecrawl, for example, offers a web data scraping API and plans to use x402 for pay-per-use. Pinata, the largest IPFS provider, will enable x402 payments for storage. If these projects launch tokens, they could quickly become prominent x402 developments.

For a more complete list of potentially relevant projects, click here to see a full roundup by @ eli5_defi.

Overall, if you want to invest in this trend, the participant list reveals three clear investment themes:

First, infrastructure beneficiaries, with Coinbase at the forefront.

Second, the AI agent ecosystem, especially projects already integrating x402.

Third, the Base ecosystem, which is becoming the primary battleground for x402.

Finally, investors should remember: x402 isn’t the only solution.

The Lightning Network’s L402 protocol also aims to activate HTTP 402, but with Bitcoin, not stablecoins. Google’s AP2 protocol, though compatible with x402, is developing its own payments standard.

If the tech giants launch their own protocols, x402 could face fierce competition.

Still, x402 has two key advantages: first-mover status and network effects. The Coinbase–Cloudflare–Visa alliance, plus dozens of early AI adopters, is already building momentum.

For investors, x402 offers a clear narrative: payments infrastructure for the AI era.

Whether you invest in infrastructure (Coinbase, Base) or the application layer (AI agent projects), the core logic is the same: investing in the potential of a new AI-driven economy.

If you believe AI agents are the future, they’ll need seamless payments—and x402 may be the best crypto solution available today.

Statement:

- This article is republished from [TechFlow], copyright belongs to the original author [TechFlow]. If you have concerns about this republication, please contact the Gate Learn team. We will promptly address any issues according to our established procedures.

- Disclaimer: The views and opinions expressed in this article are those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Do not copy, distribute, or plagiarize the translated article without reference to Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?