How Wallet Tracking Took me From $50 to $1M+ at 18

I started memecoin trading in February 2024 with $80. Lost it all, twice.

That’s when I realized I didn’t really understand how the game worked.

I was playing it the wrong way.

I tried again with $50, but this time using wallet tracking.

In less than a year, by February 2025, that $50 had grown into over $1M.

My early mistakes

I used to buy memes thinking:

“Good meme, good content, clean website, let’s buy.”

Yes, sometimes it works. But most of the time, it’s still pure gambling. You have no real confirmation. No objective reason why price should reach a specific level.

If you want consistent results, you need a way to access information before the move, not after.

I was Listening to noise on X and Tg

“This coin is going to $100M this week, mark my words.” Most of the time they’re paid to shill or they already bought 15% of the supply earlier. You end up buying their exit liquidity.

If you don’t define your own take profit targets based on real information, you’re just reacting to other people’s incentives, not the market.

The Shift: Wallet Tracking

I quickly understood that something was missing.

I kept watching top traders and thinking:

“This guy knew and I didn’t.” So I needed a solution.

Wallet tracking completely changed my perspective. Instead of guessing tops and bottoms, chasing narratives, or reacting to Twitter hype, I started focusing on one thing:

Where the smart money was actually flowing.

Every major move starts somewhere, not on Twitter, not in Telegram groups, but in a small set of wallets that launch, bundle, enter early, etc. Insiders, influencers, kols, market makers, fresh wallets…

It wasn’t about one trade or one lucky hit.

It was about repeating patterns.

That’s when it clicked.

I didn’t need to be smarter than the market. No opinions, no hype.

Just data, behavior, and execution.

From that moment on, my goal was clear:

Build a system where I react to what smart money does, not what people say.

How I Actually Tracked Wallets

1. Easy Mode - Influencers

When I started in February 2024, wallet tracking was extremely easy. Almost no one was changing wallets yet.

All you had to do was identify the hidden wallet of an influencer with real push power, follow it, and that was it.

They would buy → shill → instant 10x.

In my first month, I turned $50 into $5,000.

The following month, $5,000 into $30,000.

For example on February 24:

A team launched a token specifically for an influencer.

The influencer (KOL) accumulated at around $20k market cap using multiple hidden wallets.

I followed his buys at around $30k market cap. Then he pushed on Tg and X. The price moved straight past $400k market cap instantly. I took partial profits there.

Later the same day, it pushed over $1M market cap, where I took more profits. That was roughly a 30x from my entry in a few hours.

And because my capital was still relatively small at the time, liquidity wasn’t an issue at all, I could exit cleanly.

2. Cabals

A few months later, I started tracking cabals instead of individuals. Wallets were changing more often, so it became much more reliable to look for group confirmation. 10 wallets from 10 different people, all part of the same circle, doing the same thing.

That gave me far more confidence than relying on a single wallet.

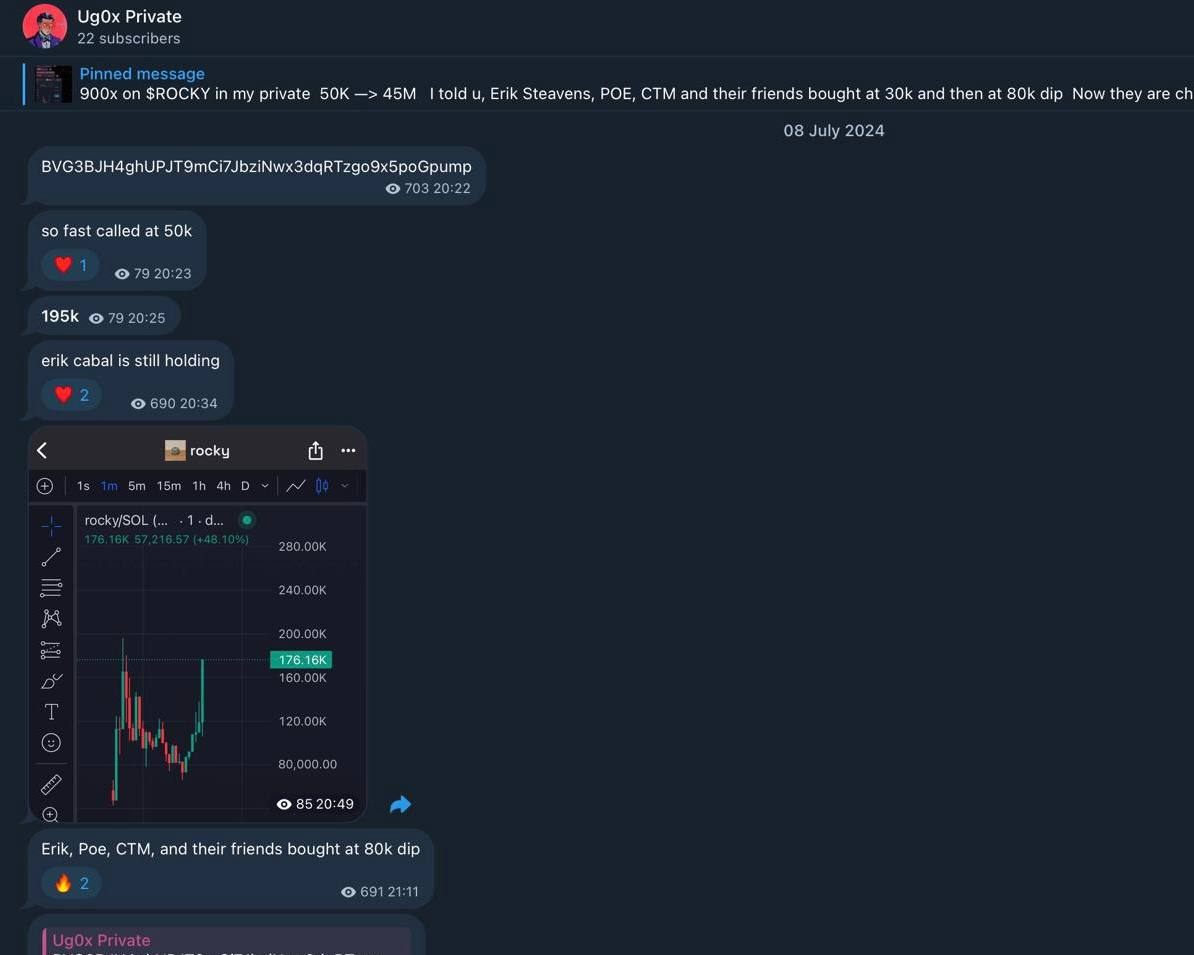

A good example was Erik Steavens, POE, DOGEN, and CTM on $ROCKY July 8, 2024.

They all bought between $10K and $80K market cap each.

That was all the confirmation I needed to know this wasn’t random, they were planning to push it.

I bought 2.8% at $40K market cap.

They pushed together for several days, all the way up to $45M market cap.

I took profits between $2M and $10M, with an average exit around $6M.

That’s a 150x from my entry. It could’ve been a 1100x but I followed my exit plan and I was more than happy taking my first six-figure PnL. (I don’t have any private group it was for my friends)

3. Fresh wallets / Dev & Bundles

In January 2025, market conditions were extremely favorable in the trenches, but wallet tracking was becoming harder and harder. To keep getting the best alpha, I had to constantly improve and adapt.

Tracking certain people required finding their fresh wallets directly funded via Binance or other CEXS. That meant retracing fund transfers across multiple Binance addresses at the exact timestamps. It takes time, but it’s worth it.

For example, I was heavily tracking Marcell, so every day I had his fresh Binance funded wallets ready. On January 31, he launched and bundled $BARRON.

I accumulated my supply between a 15k and 25k market cap on 3 wallets. About three minutes later, Marcell shilled and pushed it. I quickly took profits between 1M and 2.5M market cap.

It was one of my fastest trades ever, more than $110,000 in profit from a $1300 initial position (BullX shows $24k buy because I bought back dips on that wallet to maximize profits). (and for my tg pinned message, nothing personal it’s simply because he rugged me a few times before. He’s smart and hard to track)

4. Market Makers

Market makers wallets are wallets controlled by a token’s team, used to manipulate price for their own interests or for the token itself.

For example: large sells and buys to hunt stop-losses, or sudden 30% dumps in a few minutes to trigger panic selling from weak hands and allow new holders to enter.

The thing is that market makers often transfer tokens between themselves early after launch. When these wallets aren’t fresh or are easy to find, it becomes possible to track the team directly and catch all their launches early.

That’s exactly what I did on $HOOD on January 31.

It was a team that launches roughly once per month. They bundled up to ~$2M market cap, so I bought there, before any Tier-1 KOL shills. A few hours later, I took profits between $80M and $120M market cap, around a 50x.

At the same time, while taking profit on my initial bag, I used large market maker sells to re-enter with size and flip them minutes later for +40–70%.

Total profit: $152,000.

January 31 was my best trading day before $ASTER in September.

My rules

- I always kept strict money management. For example, I never allocated more than 5% of my capital per trade, and I adjusted my risk depending on the setup and the confidence level.

- With wallet tracking, you must never oversize. If the person or the team you’re tracking notices you, they can simply rug you.

- You also need to think like the entity you’re tracking and understand their incentives, their behavior, and their timing, to minimize the risk of getting rugged and stay consistently profitable.

- Of course, I always respected my plan and never let emotions take control. I rarely struggled with this because I started learning Forex trading at 14, so discipline was already ingrained.

That said, I did experience a few painful roundtrips, but instead of breaking me, I used that frustration as fuel to work harder and refine my edge even more.

Final Thoughts

I’m not posting this to flex. I’m posting it first to keep this as a journal for myself in 5 years, but also to inspire, help, and show people that there is always a way to reach a goal if you’re willing to adapt and work for it.

I want to be clear that I never use these methods against friends or people close to me. This is strictly about understanding market mechanics and positioning myself accordingly.

I’m also extremely grateful to the people I tracked, the ones who had the courage to actually build. I do all of this with respect and without any animosity.

I’m also deeply grateful for all the friends I made along the way, who helped me a lot throughout this journey.

Thank you, and thank God.

I never put myself out there on X in the early days because I never needed to.

I used these tracking methods many times, with countless examples, and I have several other methods to share as well.

Let me know if you want more details on how I track wallets exactly, how I build these strategies, which tools I use…

Part 2 soon.

Disclaimer:

- This article is reprinted from [ugotrd]. All copyrights belong to the original author [ugotrd]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?