The Internet Service You Use Every Day Just Launched Its Own Stablecoin

You may not recognize the name Cloudflare, but if you use the internet, you almost certainly rely on its services.

Cloudflare is an invisible giant in the digital world. Whether you’re ordering food online, watching short videos, opening your email, or logging into a company system, you’re very likely passing through its network. Acting as a vast digital shield and accelerator, Cloudflare delivers security and content distribution for nearly one-fifth of all websites worldwide.

Every time a webpage loads instantly or your favorite app fends off hacker attacks, Cloudflare is often powering the experience behind the scenes. It’s the true utility provider of the internet, forming the foundational infrastructure that keeps global data moving efficiently and securely.

On September 25, Cloudflare made a milestone strategic move, expanding its infrastructure into a new domain by announcing the launch of its own stablecoin—NET Dollar.

Why launch a proprietary stablecoin?

Cloudflare CEO Matthew Prince put it this way: “For decades, the internet’s business model has relied on advertising platforms and bank transfers. But the next era will be driven by pay-per-use, micro-payments, and micro-transactions.”

With annual revenue exceeding $1.6 billion and trillions of daily requests processed, Cloudflare is the backbone utility of the internet. Yet payments remain the only major element outside its control within this massive digital network—a growing concern for large enterprises.

Apple settles tens of billions each year with App Store developers. Amazon manages massive funds for third-party sellers. Tesla maintains payment relationships with over 3,000 global suppliers. All these giants face the same friction: long settlement cycles, high fees, complex cross-border compliance, and, most importantly, a loss of control over their core transaction loop.

As business becomes increasingly digital and automated, outdated financial infrastructure has become a bottleneck. So enterprises are responding directly: if you can’t change the old system, build a new one yourself.

Why Major Corporations Need Their Own Stablecoins

NET Dollar’s debut prompts a new look at why companies issue stablecoins. Unlike USDT and USDC, which aim for universal circulation, Cloudflare’s approach is more pragmatic—it’s starting by solving payment challenges within its own business ecosystem.

That’s a significant difference.

USDT and USDC targeted the entire crypto market from the start, scaling through broad acceptance; NET Dollar, for now, is more like an internal currency tailored for Cloudflare’s commercial network.

Of course, these boundaries can shift. PayPal’s PYUSD is a prime example—when launched in 2023, it only served PayPal’s own payment system, but now it supports exchanges with hundreds of cryptocurrencies, vastly exceeding its original scope.

Corporate stablecoins could follow a similar path, evolving from internal efficiency tools to broader circulation.

The key difference is motivation. Traditional stablecoin issuers profit mainly from reserve investments, whereas companies issue stablecoins to optimize processes and gain control. This different starting point shapes their design, application, and future direction.

For big companies, payments have always been the “last mile” of the commercial cycle, but banks and payment institutions control this segment—and all the issues mentioned above. Integrating payments into their own systems and rebuilding a controlled loop with stablecoins has become a strategic choice.

The real value of enterprise stablecoins isn’t in hype, but in their ability to cut through pain points like a scalpel and drive dramatic efficiency gains.

This value is especially clear in supply chain finance.

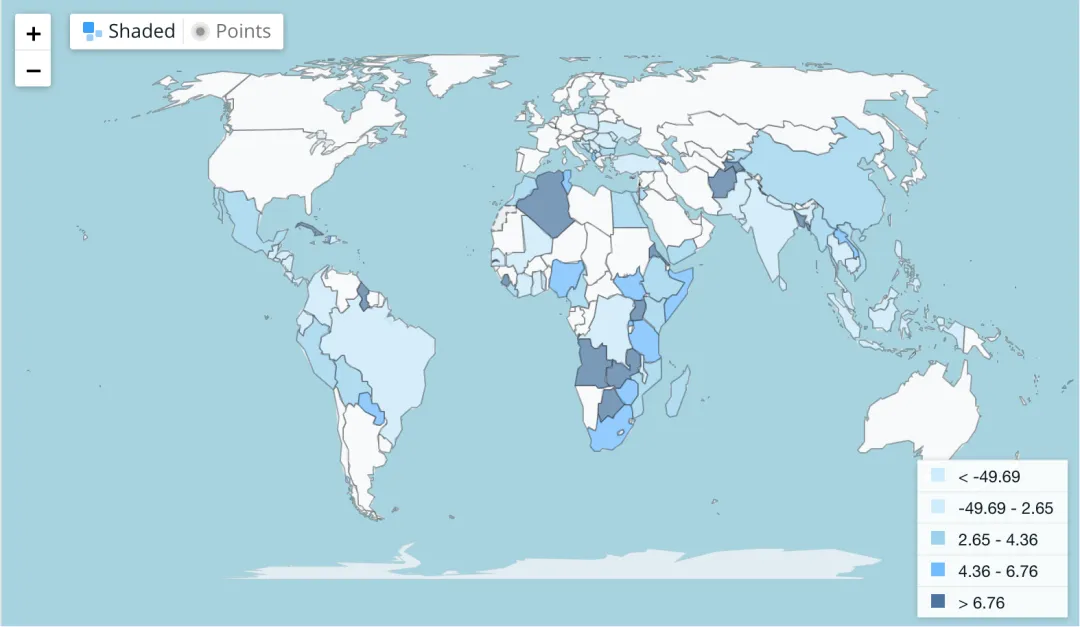

International supply chain finance is inherently full of friction. When a U.S. company makes a payment to Vietnam, it must navigate multiple time zones, currencies, and banks. World Bank data shows the global average remittance cost is still above 6%.

Average transaction cost for remittance to specific countries/regions (%) | Source: WORLD BANK GROUP

Enterprise stablecoins can compress this process to just minutes. A U.S. company can pay a Vietnamese supplier directly in minutes, with costs dropping below 1%. The time funds are in transit is dramatically reduced, improving overall supply chain efficiency.

More importantly, settlement power shifts.

Banks used to act as intermediaries, dictating transaction speed and cost. In a stablecoin network, companies themselves control this crucial step.

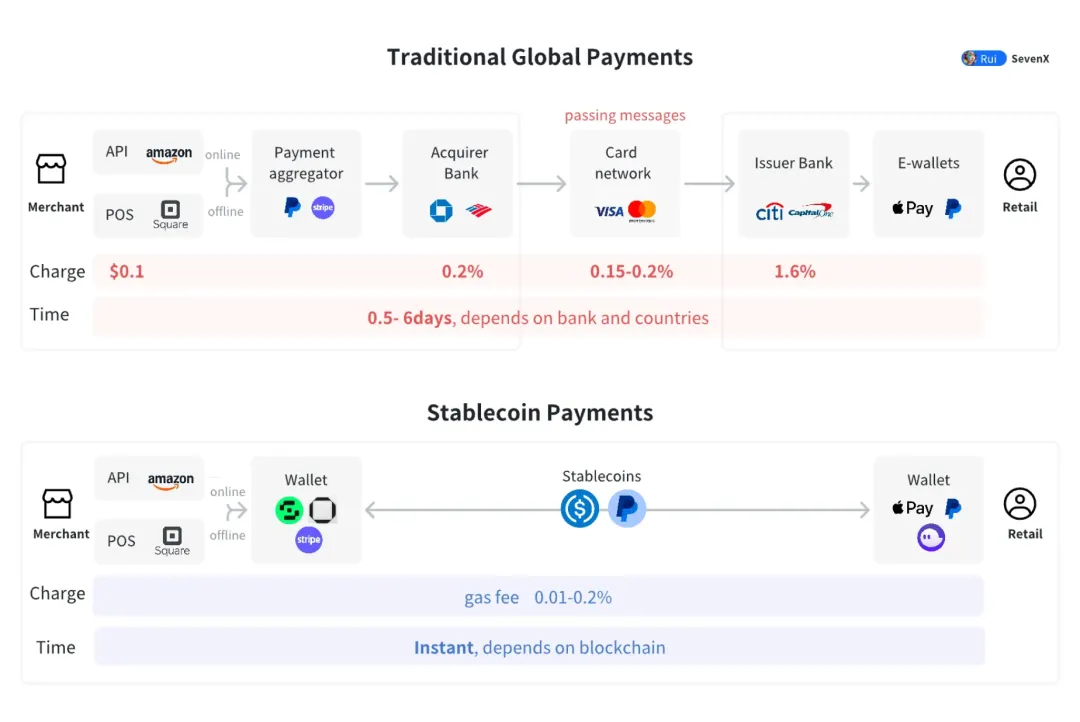

Efficiency isn’t the only benefit—cost is another critical factor. Cross-border payments involve exchange rate losses, bank processing fees, card network fees: minor individually, but enough to erode competitiveness when combined.

Enterprise stablecoins bypass traditional financial intermediaries and reconstruct the cost structure. It’s not just about lower totals—the structure is simpler and more transparent. In the old model, companies face complex fee systems: fixed fees, variable fees, exchange rate spreads, intermediary charges, all calculated opaquely and hard to predict.

With stablecoins, costs are reduced to a single on-chain transaction fee—transparent, predictable, and relatively stable. This allows companies to budget and forecast expenses and profits with greater confidence.

Traditional global payment steps vs. stablecoin payment steps | Source: SevenX Ventures

Cash flow management also transforms. Manual processes and bank systems are complex, inefficient, and error-prone.

Combine enterprise stablecoins with smart contracts, and fund flows can execute automatically under preset conditions. Once a supplier delivers and passes inspection, payment is released; upon reaching a project milestone, funds are disbursed instantly. Instead of manual account monitoring, rules are coded into contracts.

This mechanism doesn’t just improve efficiency. Transparent, tamper-proof payment logic reduces trust costs and preemptively resolves disputes.

As more partners join the same payment system, network effects grow: suppliers, distributors, partners, even end-users settle in the same stablecoin, exponentially increasing network value.

This value goes beyond scale—it creates lock-in. Once deeply integrated with a company’s stablecoin system, switching to a new network becomes costly—not just technically, but in terms of learning, relationships, and opportunity.

This stickiness is the firm’s most robust competitive advantage. In competitive markets, companies with stablecoin ecosystems gain tighter cost and cash flow control, and long-term advantages through network effects.

How Enterprise Stablecoins Expand Across Industries

Each industry has unique pain points, and enterprise stablecoins are emerging as solutions. While not yet widespread, they’re already showing potential for real-world application.

E-Commerce Platforms: Automating Deposits, Commissions, and Refunds

In e-commerce, stablecoins are a proving ground for next-generation payments. Shopify’s partnership with Coinbase now lets merchants in 34 countries accept USDC, but that’s just the start.

Merchant security deposits can be written into smart contracts, automatically deducted for violations and refunded at contract completion. Platform commissions are settled in real time, with each transaction instantly transferring stablecoins from the merchant to the platform.

The refund process is also transformed. Previously, cross-border refunds took weeks and multiple banking steps; with stablecoins, funds arrive in minutes, offering a wholly new experience.

Stablecoins also enable micropayments. Consumers can pay to browse product pages, for personalized recommendations, or priority customer service—transactions nearly impossible with traditional payments, now feasible with stablecoins.

Manufacturing Giants: Supplier Payments and Inventory Financing on Unified Networks

Manufacturing is highly global, with supply chains spanning dozens of countries. For companies like Apple and Tesla, coordinating payments, financing, and deposits for thousands of suppliers is a massive logistical challenge.

If these firms issue their own stablecoins, they can build efficient, low-cost payment networks internally. Payments to suppliers, inventory financing, and quality deposits—once reliant on banks, currencies, and manual processes—can be completed instantly on a single network.

Even more, digital payment systems can integrate with existing enterprise management. ERP systems detect parts shortages and automatically trigger orders and payments; quality controls can instantly deduct funds from suppliers for problematic batches.

Consider Tesla—over 3,000 suppliers in more than 30 countries. A unified “Tesla Coin” for settlements, with Tesla managing USD conversion, would lower costs and give greater control over every key stage.

Content Platforms: New Revenue Sharing and Micropayment Models

The content industry is shifting toward creator-driven models. Whether it’s YouTube, TikTok, Substack, or Medium, the core challenge is efficiently and fairly distributing revenue globally.

Enterprise stablecoins are a potential solution: platforms can instantly settle payments with creators worldwide, bypassing complex banking and high fees. Micropayment mechanisms allow for more granular splits.

YouTube pays creators billions each year, but payment methods vary by country, exchange rates affect income, and tax processes are cumbersome. A proprietary stablecoin network would enable truly unified global settlements.

This approach could inspire new business models—readers pay per article, viewers are charged per video clip, listeners are charged per song. More precise value distribution gives creators direct rewards and motivates higher-quality content.

Cloud Providers: Settlement Testbeds for the Machine Economy

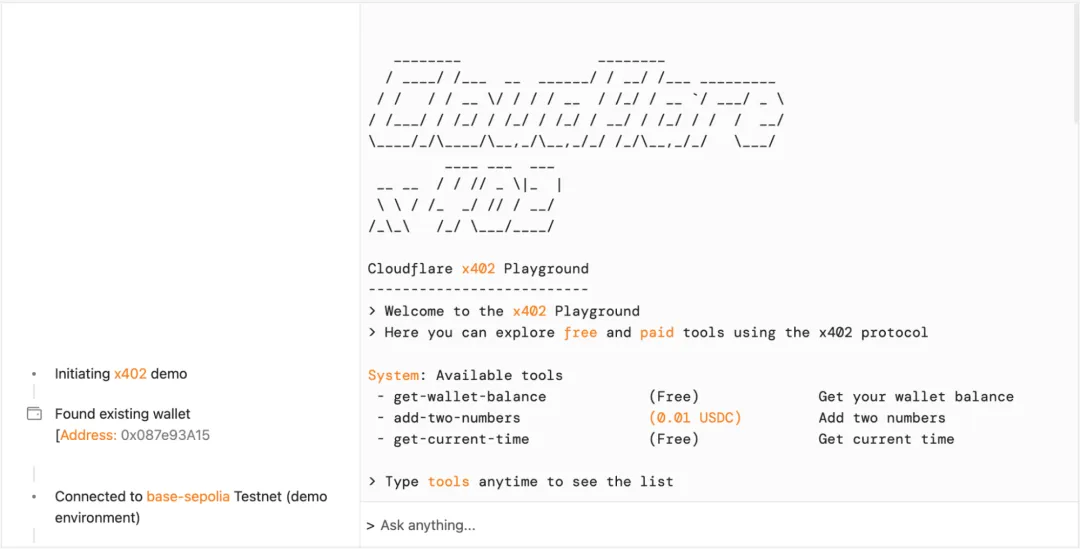

Cloudflare’s NET Dollar is a case study for cloud providers experimenting with stablecoins. As AI and IoT grow, machine-to-machine transactions are becoming more frequent—high-volume, low-value, and fully automated, which traditional payment systems cannot handle.

In these scenarios, an AI model might pay to call another’s API, an IoT device pays for compute usage, or a self-driving car pays for map data. These transactions may be only a few cents or fractions thereof, triggered thousands of times per second.

Stablecoins, especially programmatic ones like NET Dollar, can support such high-frequency, low-value payments. Machines follow preset rules to autonomously decide when, how much, and to whom to pay—no human involvement needed.

Cloudflare and Coinbase have founded the x402 Foundation, developing protocols for direct machine-to-machine payments. When one AI model calls another’s service, fees settle instantly—laying the groundwork for tomorrow’s machine economy.

Cloudflare’s x402 testbed demo | Source: Cloudflare

Stablecoin Swaps and the New B2B Payment Network

When every major company issues its own stablecoin, the next challenge is interoperability: how do these corporate currencies connect? The answer lies in a new B2B payment network.

In this network, different stablecoins swap seamlessly via protocols, likely relying on decentralized exchange liquidity pools. A supplier paid in “Tesla Coin” can instantly convert it to “Apple Coin” or USD, bypassing traditional banking delays.

There are hurdles to overcome:

First, exchange rate pricing—how are conversion rates between corporate stablecoins set? A forex-like supply-demand system may be needed.

Second, liquidity—who provides it? Professional market makers or inter-company channels? The industry is still exploring.

Third, risk management—how do you control credit and operational risks in swaps? This requires both technical and regulatory solutions.

Stripe is already moving in this direction. In May 2025, it debuted the world’s first payment AI model and rolled out a stablecoin payment solution. Companies can activate USDC settlements on Ethereum, Solana, Polygon, and other blockchains with a single click.

Stripe’s strategy is clear: instead of issuing its own coin, it’s making stablecoin settlement easy for everyone, positioning itself as the infrastructure backbone for stablecoin payments.

Further, consortium-issued stablecoins may emerge for specific sectors. For example, several automakers could jointly issue “Auto Coin” for end-to-end supply chain settlements. This unified currency system would cut transaction costs and boost industry collaboration.

The auto supply chain’s complexity makes it an ideal use case. A car has tens of thousands of parts from global suppliers. Using one stablecoin for all payments eliminates redundant multi-currency, multi-bank steps and greatly streamlines settlements.

Consortium stablecoins offer clear advantages: industry scale supports liquidity, standardized transactions, and closed loops reduce reliance on traditional finance. But challenges remain—how to balance interests, prevent dominance by big players, and ensure transparent governance will require practical experimentation.

All corporate stablecoin ideas ultimately depend on regulatory compliance. Whether issued by a company or a consortium, real market acceptance demands transparent reserve management, third-party audits, and full regulator disclosure.

In July 2025, the U.S. GENIUS Act takes effect, setting clear legal boundaries for stablecoins. Coins with over $10 billion in circulation must be federally regulated; reserves are limited to USD, bank deposits, or short-term Treasuries, fully segregated from other issuer assets.

In August 2025, Hong Kong’s Stablecoin Ordinance launches, requiring issuers to hold at least HK$25 million in paid-up capital, submit to ongoing oversight and annual audits, and implement robust AML and customer ID systems.

For companies, compliance isn’t just mandatory—it’s the foundation for trust. Without transparent, credible reserve management, even the strongest business logic won’t convince suppliers, partners, or customers to participate.

Stablecoins and the New Commercial Order

Enterprise stablecoins are more than a new payment tool—they’re a signal of a coming reorganization in global commerce.

They integrate payments deeply with business systems, giving devices and software independent economic capability. Self-driving cars can automatically charge and pay when low on battery; industrial robots can place and pay for orders when parts are worn out—machines become true economic actors, not just tools.

Micropayments unlock new distribution models for content: videos are charged per second, novels by chapter, software by feature. Revenue is split more precisely, shifting incentives throughout the ecosystem.

Combined with AI, the possibilities expand further. Once AI agents have stablecoin budgets, they can autonomously purchase data, computing power, or other services to complete complex tasks.

In September 2025, Google launched the Agent Payments Protocol (AP2), partnering with sixty institutions to build payment channels for AI agents, enabling direct settlement while performing tasks. AI becomes a digital employee with economic agency, enabling new forms of collaboration between humans and machines.

Banks and payment companies face a structural challenge. If enterprises build their own payment and clearing systems, traditional financial institutions’ role in cross-border settlement and treasury management shrinks. Banks may shift to reserve custody, compliance, and audit roles, while payment processors become stablecoin infrastructure providers.

Broadly, enterprise stablecoins may mark the start of a new commercial order. Value creation and distribution will achieve unprecedented efficiency, and business relationships will be more transparent and effective.

From the bills of exchange in medieval Venice to today’s stablecoins, the pursuit of more efficient exchange mediums has remained constant. In this technology-driven transformation, any business seeking a foothold in the future digital economy cannot afford to sit on the sidelines.

Statement:

- This article is reprinted from [Sleepy.txt] and the copyright belongs to the original author [Sleepy.txt]. If you have any objection to this reprint, please contact the Gate Learn team, who will address your request promptly.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Translated articles may not be copied, distributed, or plagiarized unless Gate is referenced.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

Stripe’s $1.1 Billion Acquisition of Bridge.xyz: The Strategic Reasoning Behind the Industry’s Biggest Deal.