The Return of ICOs: 500%+ Public Sale Returns Are Real

For the first time since the wild days of 2017, ICOs are back, but the mechanics look nothing like the gas-war chaos of the past. This isn’t a nostalgia tour. It’s a structurally different market, shaped by new rails, sharper allocation design, and clearer regulatory footing.

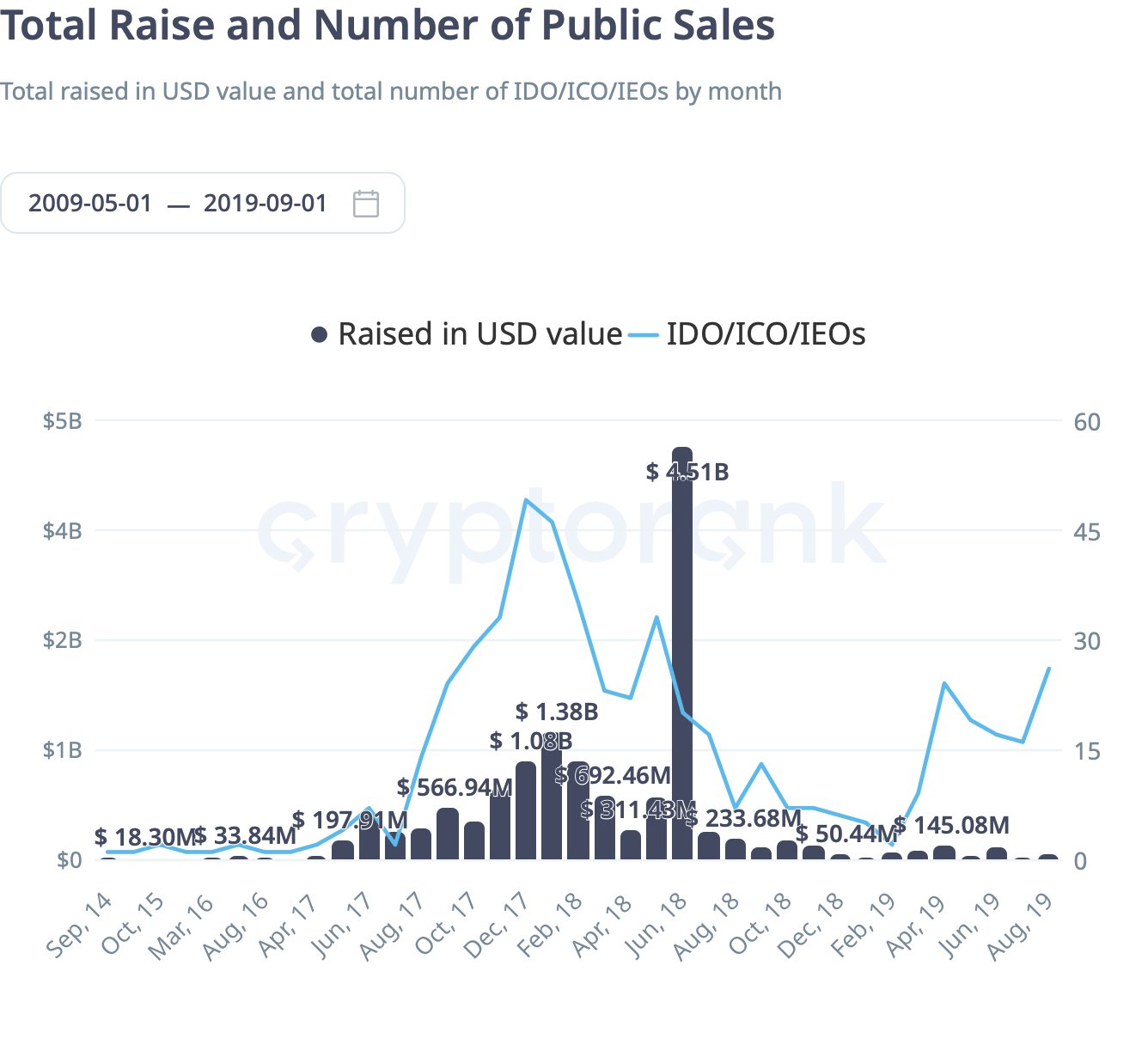

In 2017, anyone with an Ethereum contract and a whitepaper could raise millions in minutes. There were no standardized compliance processes, no structured allocation models, and certainly no post-sale liquidity frameworks. Most investors piled in blindly, and many watched their tokens crater shortly after listing. Regulators cracked down, and over the following years ICOs faded, replaced by VC rounds, SAFTs, exchange IEOs, and later retroactive airdrops.

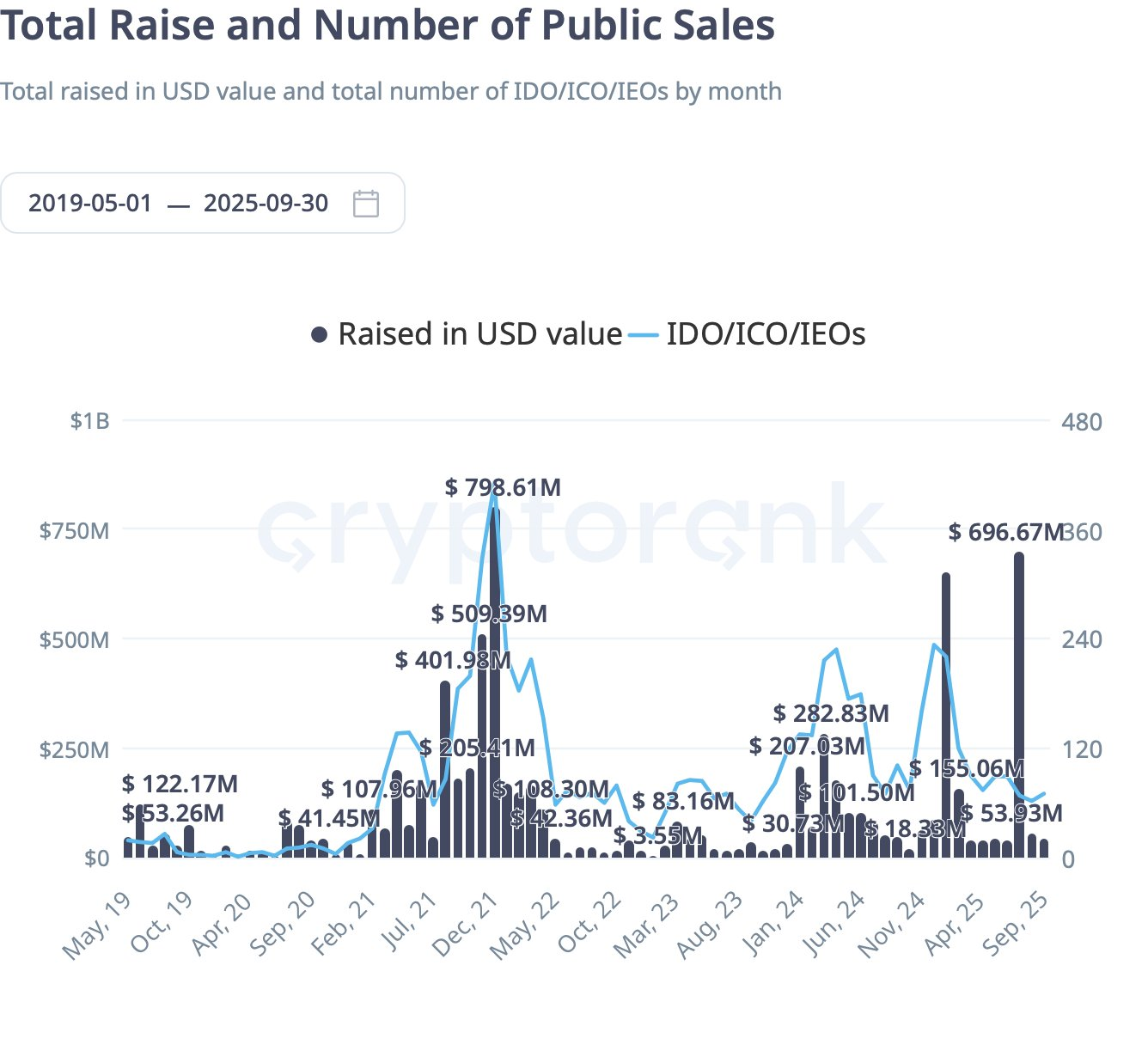

Now, in 2025, the pendulum has swung back.

But the change isn’t that projects are launching at lower valuations, if anything, FDVs are often higher than before. What’s changed is how access is structured.

Launchpads no longer rely on pure speed or gas wars. Instead, they filter participation through KYC, reputation scoring, or social impact, then spread allocations across thousands of participants using micro-tickets rather than whale tranches.

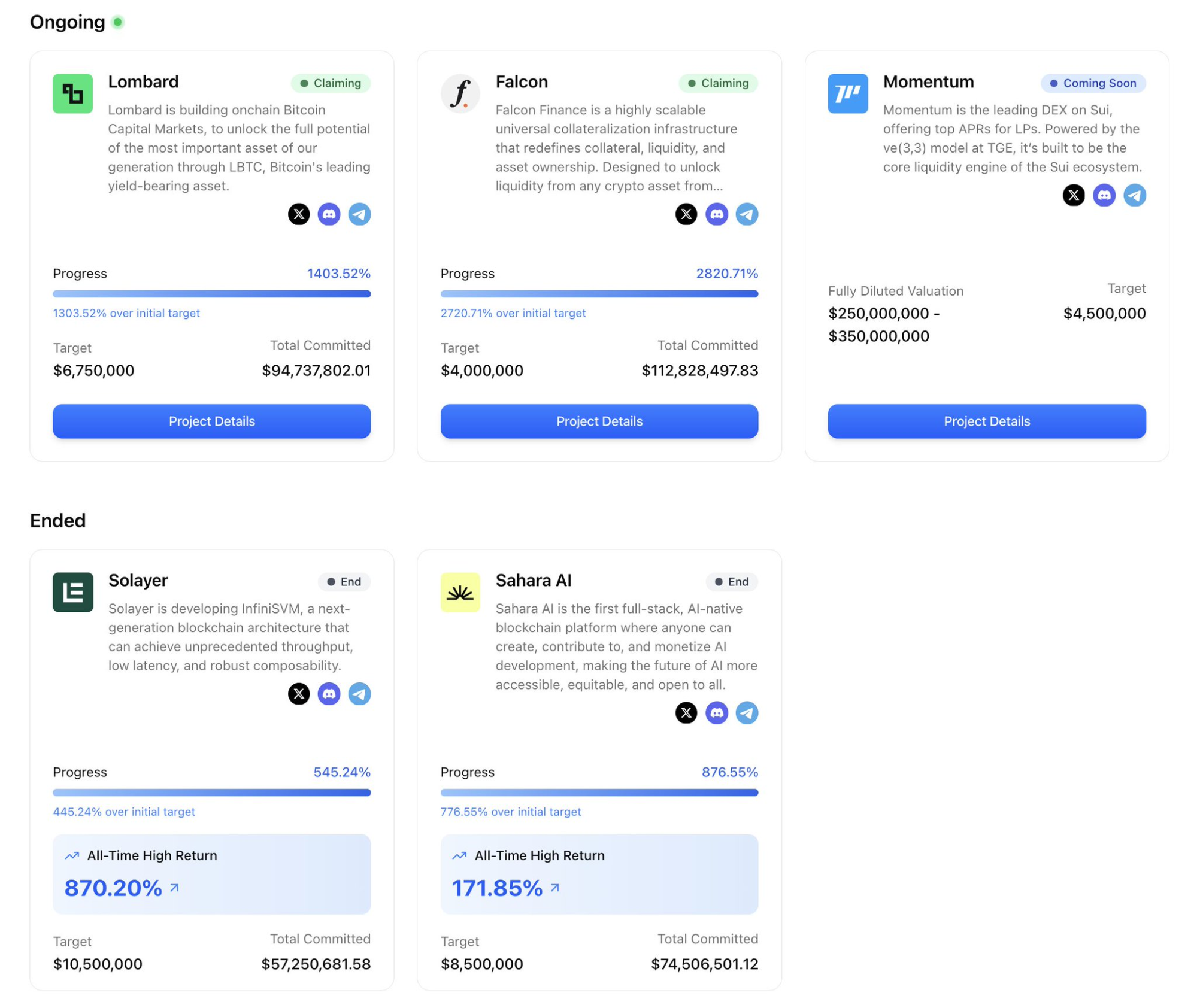

For example, on @ buidlpad, I committed $5,000 to @ FalconStable received just $270 in allocation, with the rest refunded because the sale was heavily oversubscribed. The same pattern appeared with @ SaharaLabsAI, where $600 of a $5,000 commitment was accepted.

Oversubscription doesn’t push prices down, it shrinks individual allocations, preserving high FDVs while broadening distribution.

Regulation has also caught up. Frameworks like MiCA in Europe now provide clear paths for compliant retail participation, and launch platforms have turned KYC, geofencing, and eligibility checks into simple configuration toggles.

On the liquidity side, some platforms go further, encoding post-sale policy directly into smart contracts, seeding LPs automatically, or using buy-below/sell-above bands to stabilize early trading.

ICOs now represent roughly a fifth of all token sale volume in 2025, up from just a sliver two years ago.

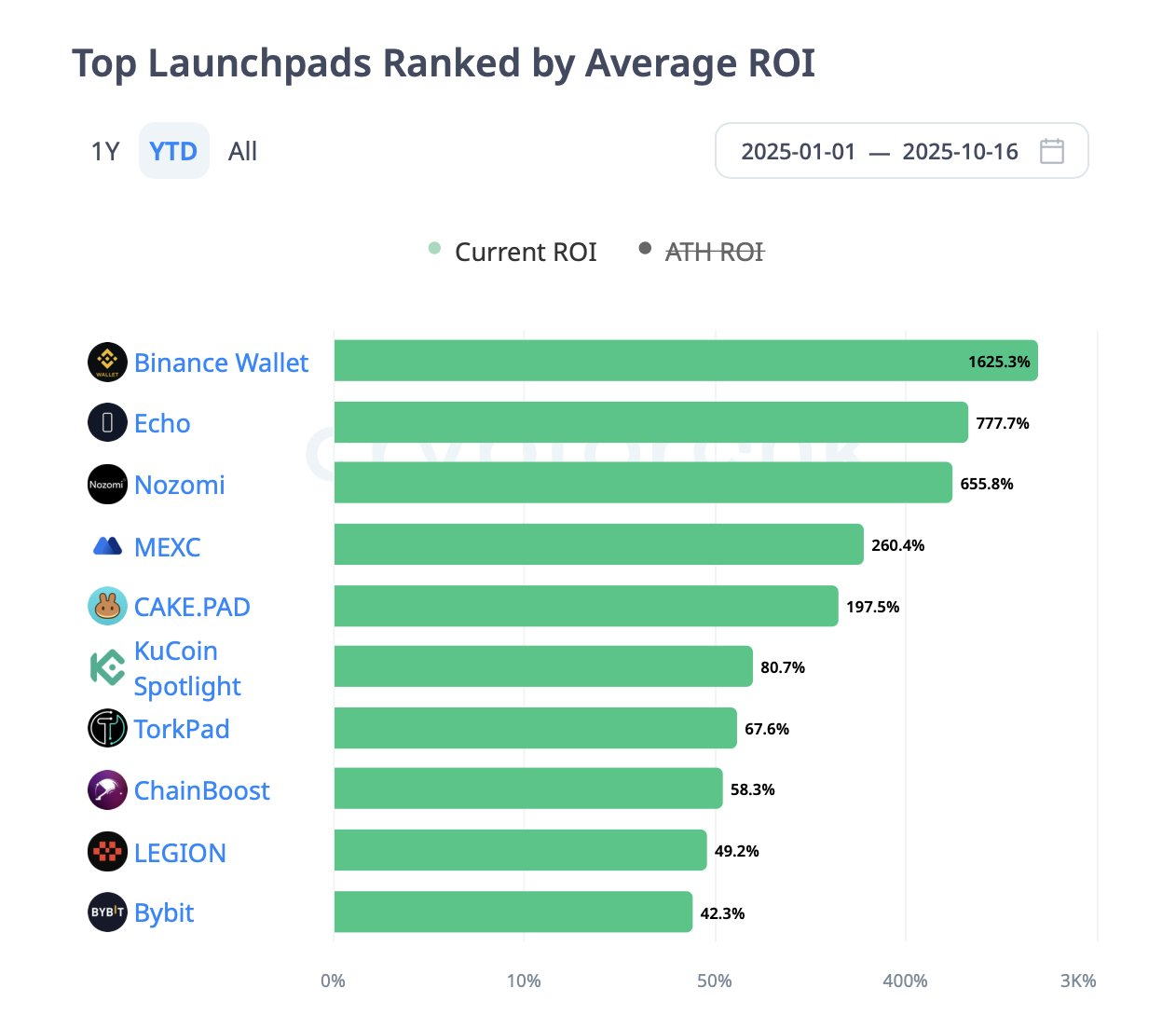

And this resurgence isn’t driven by a single platform. It’s emerging from a new generation of launch systems, each solving different pain points:

- @ echodotxyz’s Sonar enables self-hosted, compliance-toggleable sales across chains.

- @ legiondotcc × Kraken Launch integrates reputation-based allocations into exchange flow.

- @ MetaDAOProject builds treasury controls and liquidity bands into the launch itself.

- @ buidlpad focuses on KYC-gated, community-first distribution with structured refunds.

Together, these platforms have transformed ICOs from a chaotic funding tool into a deliberate market structure, where access, pricing, and liquidity are designed rather than improvised.

Each of these platforms tackles a different set of pain points that plagued the first ICO wave. Together, they form a more structured, transparent, and arguably more investable environment. Let’s dive in.

Echo: Self-Hosted, Compliance-Toggleable, and Wildly Popular

Echo, founded by Cobie, emerged as one of the breakout launch infrastructures of 2025 with Sonar, its self-hosted public sale tool. Unlike centralized launchpads or exchange IEOs, Echo provides infrastructure, not a marketplace. Teams choose their sale format (fixed-price, auctions, or vault/credit models), set their KYC/accreditation/geofencing rules via Echo Passport, and distribute their own sale links, all while launching on multiple chains including Solana, Base, Hyperliquid, and Cardano.

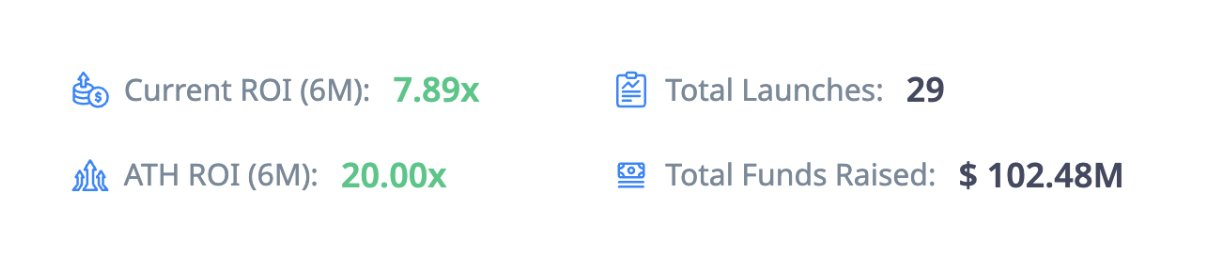

The platform has grown rapidly:

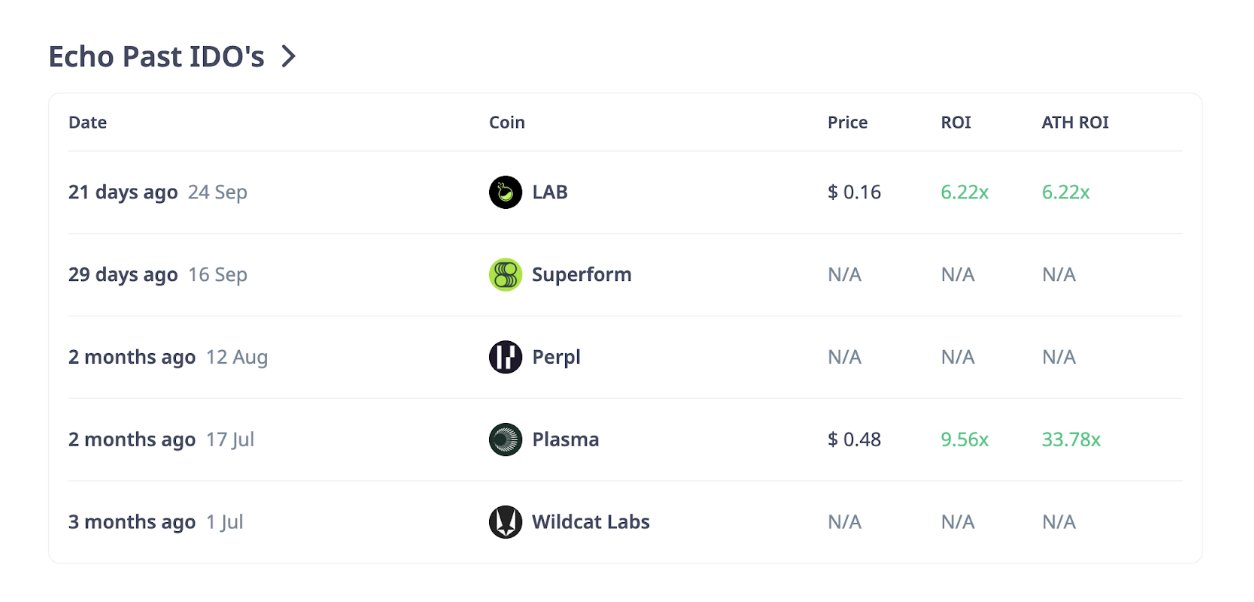

Echo’s biggest breakout was @ Plasma, which sold 10% of its supply at $0.05 in July using a time-weighted vault model, drawing over $50M in commitments. Plasma peaked at a 33.78× ATH ROI and became one of the top-performing ICOs of the year. $LAB followed with a 6.22× ROI at launch.

Here’s a snapshot of Echo’s recent sales:

These results show both the upside and variability. While Plasma and LAB delivered strong multiples, other projects like Superform or Perpl haven’t yet listed or published metrics. Echo itself doesn’t enforce post-sale liquidity frameworks – LP seeding, market-maker mandates, and unlock schedules are issuer-defined, not platform-mandated.

Investor takeaway: Echo’s flexibility has made it the highest-ROI launch infrastructure in this cycle, but it demands due diligence. Always check:

- Compliance toggles (KYC/accreditation rules)

- Sale format (vault vs auction vs fixed)

- Issuer’s liquidity plan, since Echo doesn’t standardize it

Legion & Kraken Launch: Reputation Meets Regulation

If Echo represents founder-controlled flexibility, Legion is the opposite: a structured, reputation-gated funnel for public sales.

In September, Kraken Launch went live, powered exclusively by Legion’s infrastructure. For the first time, token sales are happening directly inside Kraken accounts, under MiCA compliance, with reputation scoring deciding who gets priority.

The platform has grown rapidly:

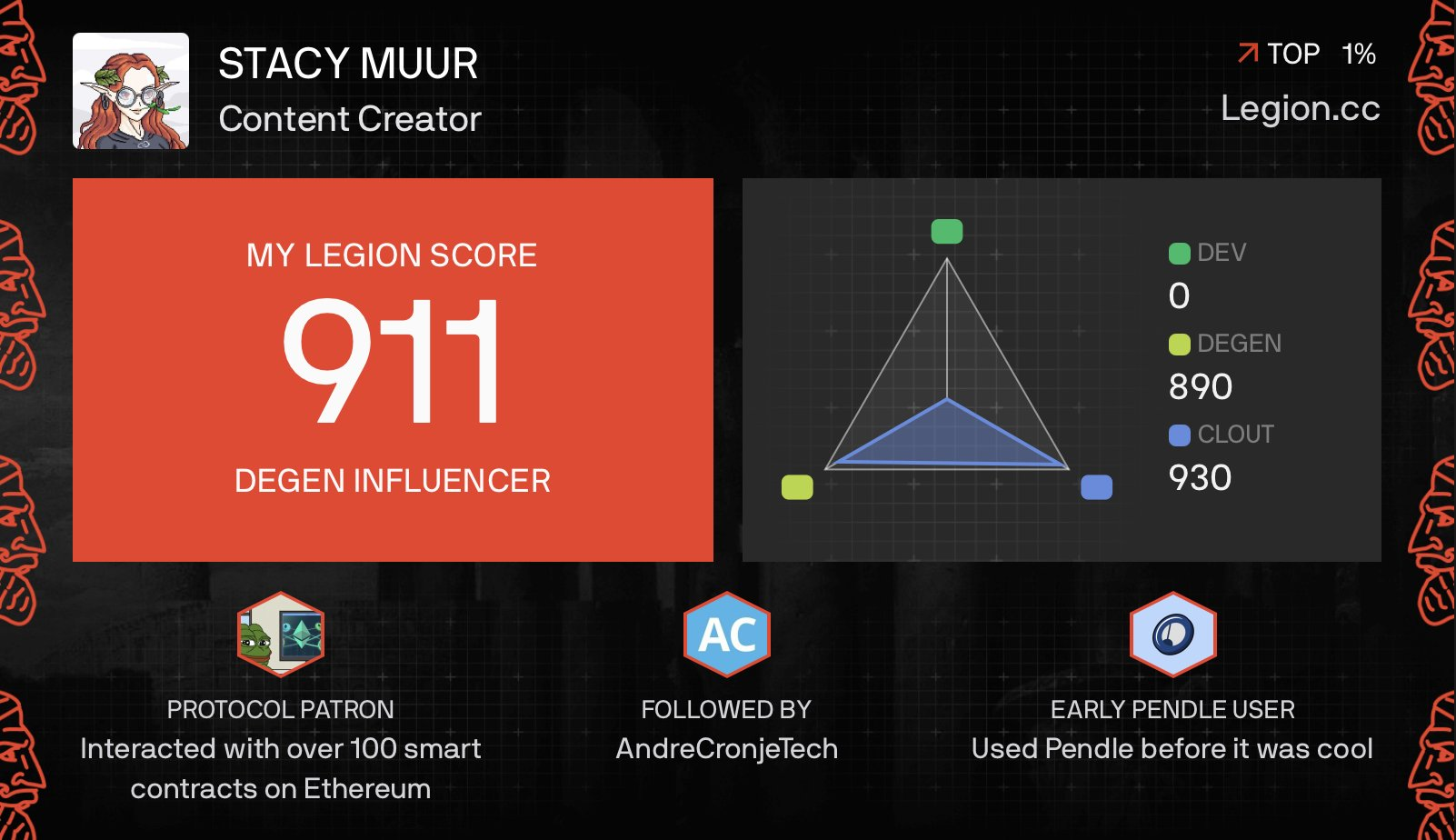

At the heart of Legion is the Legion Score, a 0–1000 reputation metric built from on-chain activity, technical contributions (e.g., GitHub), social engagement, and endorsements.

Projects can reserve a percentage of their token allocations, often 20–40%, for high-scoring users before opening the remainder to FCFS or lottery phases. This flips the typical ICO allocation model: instead of rewarding whoever bots the fastest, it rewards builders, contributors, and influential community members.

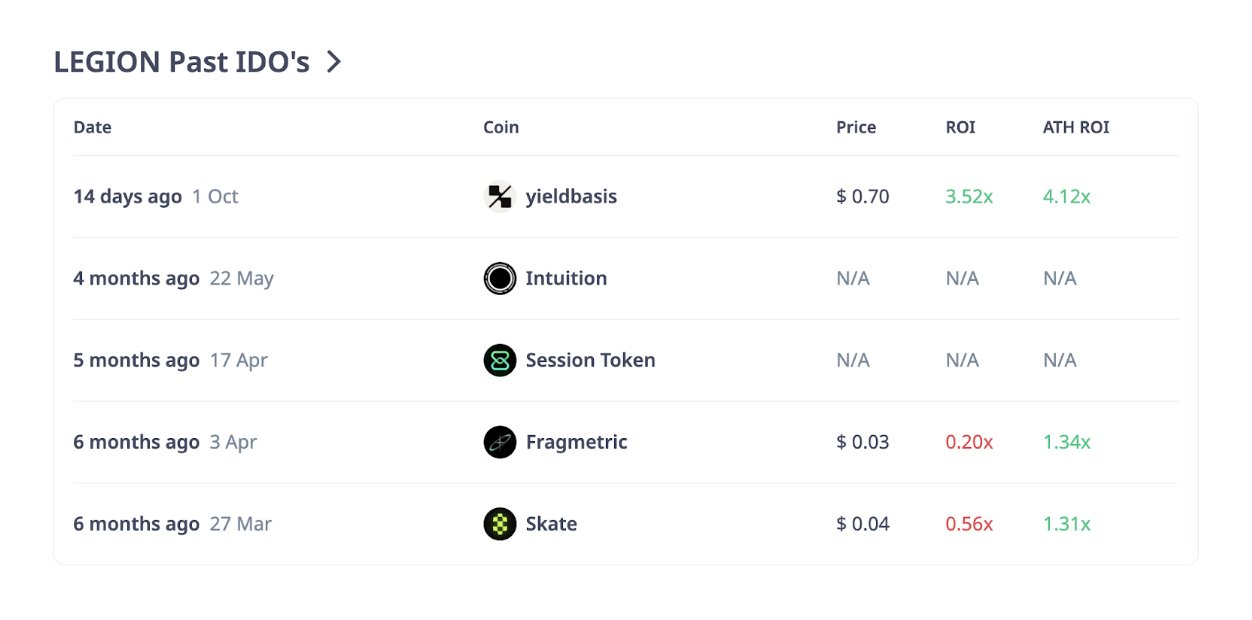

Here’s a snapshot of Legion’s recent sales:

Kraken’s integration adds another layer: exchange-grade KYC/AML and day-1 liquidity. Think of it as “IPO-style” launches with community allocation mechanisms baked in. Early examples like YieldBasis and Bitcoin Hyper saw strong oversubscription in merit phases, with low-scorers funneled into capped public rounds.

It’s not all perfect. Some early users have pointed out that Legion’s scoring can overweight social clout, big X accounts can leapfrog real builders. Transparency on the weighting system isn’t always clear. But compared to the lottery madness of the past, it’s a meaningful upgrade.

Investor takeaway: Your Legion Score matters. If you want allocation in top sales, build your on-chain and contribution profile early. And always check how the merit/public split is structured for each drop, different projects tweak the formula.

MetaDAO: Mechanisms Over Marketing

MetaDAO is doing something no other ICO rail has tried: encoding post-sale market policy into the protocol itself.

Here’s how it works: if a MetaDAO sale succeeds, all the raised USDC goes into a market-governed treasury. Mint authority transfers to that treasury. 20% of the USDC plus 5 million tokens are seeded into LPs on Solana DEXs. The treasury is programmed to buy tokens below the ICO price and sell above it, creating a soft price band around the anchor price from day one.

This sounds simple, but it changes early trading dynamics dramatically. In a normal ICO, secondary prices can collapse if liquidity is thin or insiders dump. With MetaDAO’s policy band, early price action tends to oscillate within a defined range, with shallower wick-downs and capped blow-offs. It’s a mechanism, not a promise: if there’s no demand, the treasury eventually depletes, but it shapes behavior in the critical first days.

The breakout example is Umbra, a Solana privacy protocol. Umbra’s sale drew over 10,000 contributors and reportedly crossed $150M in commitments, with transparent top-ticket data displayed on the sale page. Watching that distribution live was a glimpse of a more structured ICO future: transparent, on-chain, and policy-governed.

Investor takeaway: For MetaDAO sales, write down the ICO price and understand the band. If you’re buying just above, expect the treasury to be your counterparty on the way up. If you’re buying just below, you might get scooped up by the buy-side. MetaDAO rewards understanding the mechanism, not chasing hype.

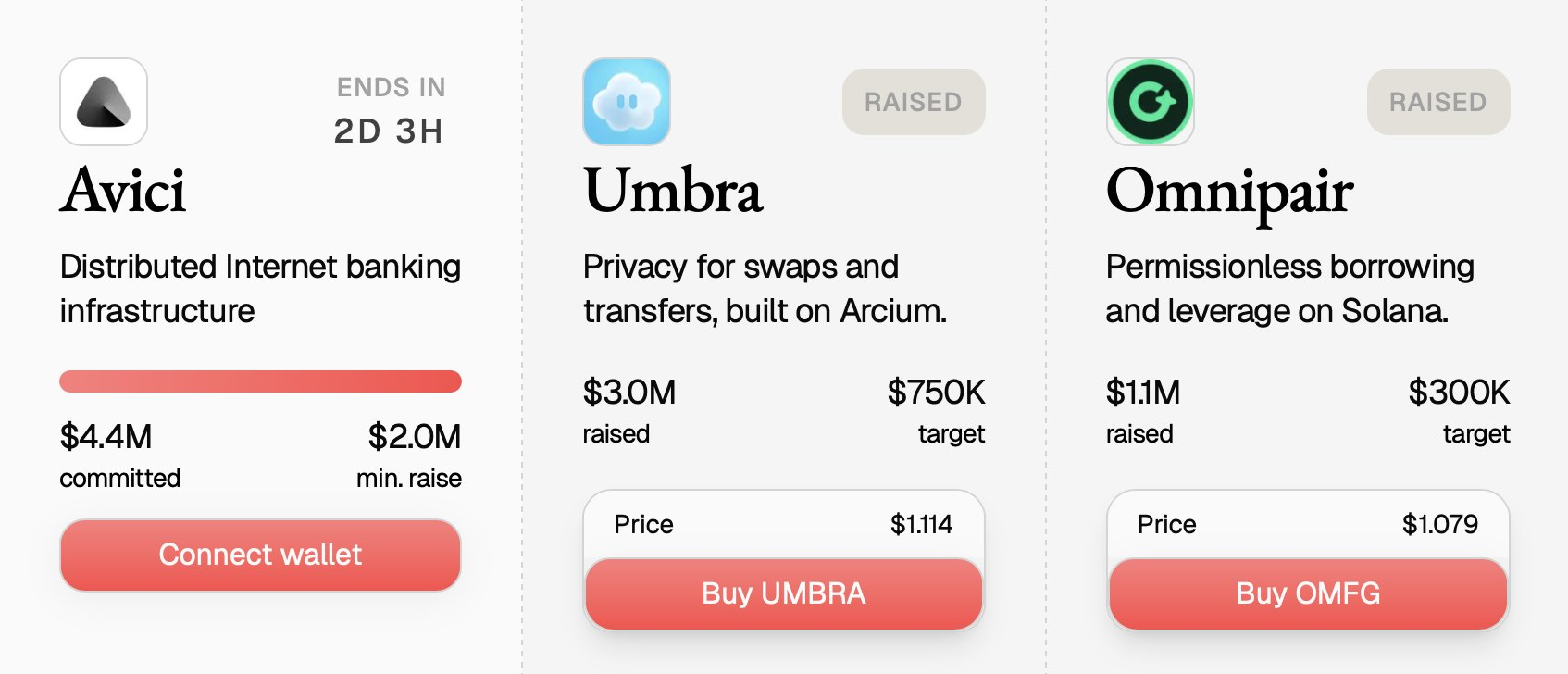

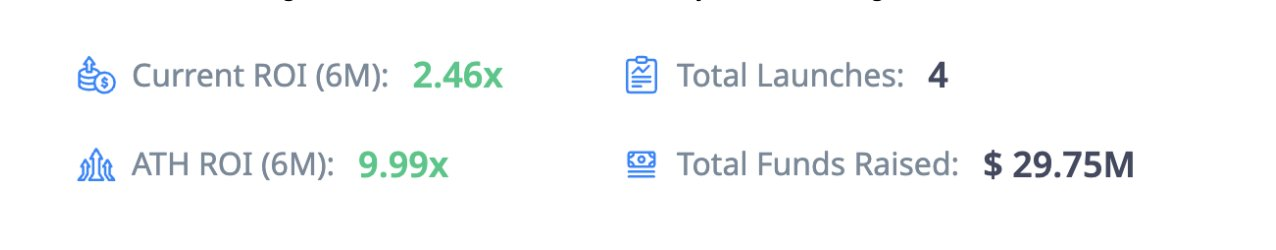

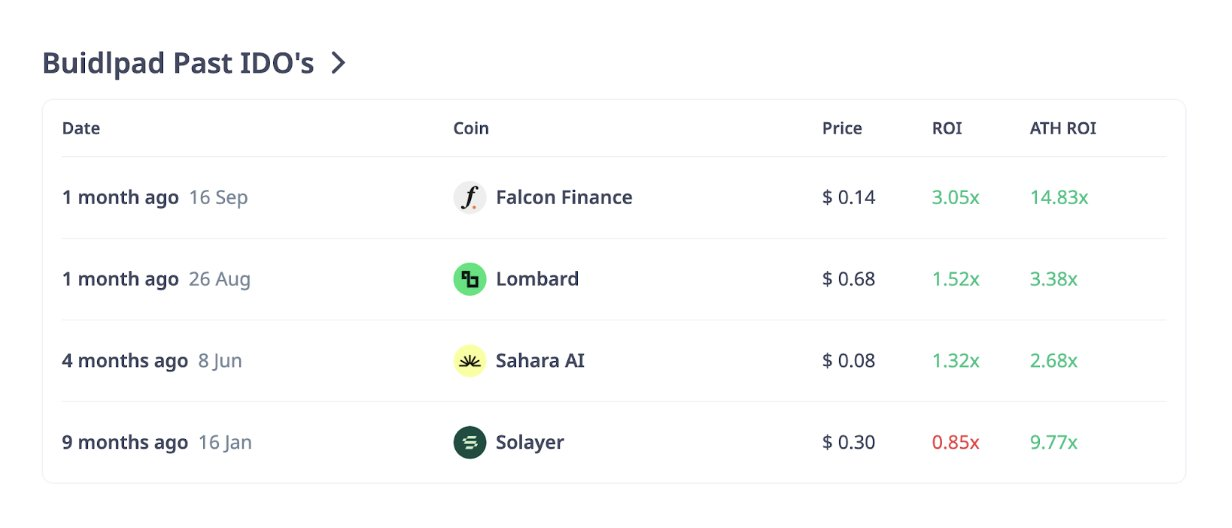

Buidlpad: KYC-Gated Retail at Scale

Buidlpad focuses on something simple but powerful: giving compliant retail a clean way to participate in community rounds. Founded in 2024, it’s structured around a two-phase flow: first, users complete KYC registration and subscription; then, during the contribution window, they commit capital. If a sale is oversubscribed, excess funds are refunded. Some sales use tiered FDVs to manage demand, lower FDVs for early tiers, and higher for later ones.

The headline moment for Buidlpad came in September with Falcon Finance ($FF). The sale had a $4M target and ended up with $112.8M in commitments, a staggering 28× oversubscription. KYC ran from September 16–19, contributions on 22–23, and refunds settled by the 26th. It was smooth, transparent, and entirely retail-driven.

Buidlpad’s simplicity is its edge. It doesn’t do fancy scoring or futarchic treasuries. It just provides structured access for communities who can clear compliance. That said, liquidity still depends entirely on the issuer’s planning, and fragmented multi-chain raises can occasionally splinter post-sale volume.

Investor takeaway: Mark your calendars. KYC/subscription windows are hard gates. If you miss them, you miss the allocation. And read the tier structure carefully: early tiers often get significantly better FDV entry points.

Cross-Platform Patterns and Risks

Step back, and a few patterns emerge across these platforms:

- Oversubscription is common, but not always sticky. Falcon’s 28x, Plasma’s nine-figure interest, Umbra’s massive demand: the headlines look spectacular. But without sustained usage, these elevated FDVs often mean early prices revert once the post-sale halo fades.

- Mechanisms shape volatility. MetaDAO’s buy/sell bands genuinely dampen chaos, but they also cap upside near the sell zone. Echo and Buidlpad rely entirely on issuer discipline; Legion leans on exchange listings to provide depth.

- Reputation systems change allocation games. With Legion, building your score early can mean the difference between getting a meaningful ticket or fighting in capped public pools.

- Compliance funnels are a feature, not a bug. KYC windows, accreditation toggles, and merit scoring filter who can participate. That makes these sales less chaotic but also more stratified.

And beneath it all, some risks remain: scoring systems can be gamed, treasuries can be mismanaged, whales can still dominate through multiple wallets, and regulatory enforcement can lag behind the marketing claims. None of these mechanisms are magic bullets; they just change the terrain.

A Smarter Investor Playbook for 2025

If you want to navigate this new ICO wave intelligently, think structurally:

- Map the mechanism before you FOMO. Fixed price or auction? Merit phase or pure FCFS? Treasury band or laissez-faire?

- Mark your eligibility windows. KYC/subscription deadlines, accreditation requirements, and region restrictions; missing a date can cost you the whole allocation.

- Understand the liquidity plan. Is it MetaDAO’s encoded LP band? Kraken’s exchange listing? Or an issuer-defined plan on Sonar? Liquidity dictates early price behavior.

- Position accordingly. On MetaDAO, know the band. On Legion, build your score early. On Buidlpad, aim for the early tier.

- Size sanely. Oversub headlines don’t guarantee secondary strength. Treat these as structured bets, not guaranteed moonshots.

Stacy’s Thoughts

The 2025 ICO revival isn’t about nostalgia; it’s about new rails, new rules, and a more disciplined market. Platforms like Echo, Legion, MetaDAO, and Buidlpad are each solving different parts of the broken 2017 playbook. Some focus on compliance, others on allocation, others on liquidity policy. Together, they’re making public token sales feel less like speculative stampedes and more like structured capital formation.

For investors, that means the edge is no longer just being early; it’s understanding the mechanics. Because in 2025, ICOs aren’t dying. They’re growing up.

Disclaimer:

- This article is reprinted from [stacy_muur]. All copyrights belong to the original author [stacy_muur]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?