Trump’s Gambit: The Quiet War Between the White House and JPMorgan

A monetary power struggle is erupting in plain sight - and almost no one understands the stakes. Here is my highly speculative take.

Over the past few months, a pattern has emerged across politics, markets, and media. Scattered headlines suddenly connect, market anomalies look less accidental, and institutional actors are behaving with unusual aggression. Something deeper is happening beneath the surface.

This is not a normal monetary cycle.

This is not traditional partisanship.

This is not “market volatility.”

What we are witnessing is a direct confrontation between two competing monetary regimes:

The old order… centered around JPMorgan, Wall Street, and the Federal Reserve.

And the new order… centered around Treasury, stablecoins, and a Bitcoin-anchored digital architecture.

This conflict is not theoretical anymore. It is live. It is accelerating. And for the first time in decades, it is spilling into public view.

The following is an attempt to map the real battlefield… the one most analyst can’t see because they are still applying a 1970–2010 framework to a world breaking out of its own restraints.

I. JPMorgan Steps Out of the Shadows

Most people think of JPMorgan as a bank. That is a mistake.

JPM is the operational arm of the global financial establishment… the entity that sits closest to the Federal Reserve’s core mechanisms, influences dollar settlement worldwide, and acts as the primary enforcer of the legacy monetary architecture.

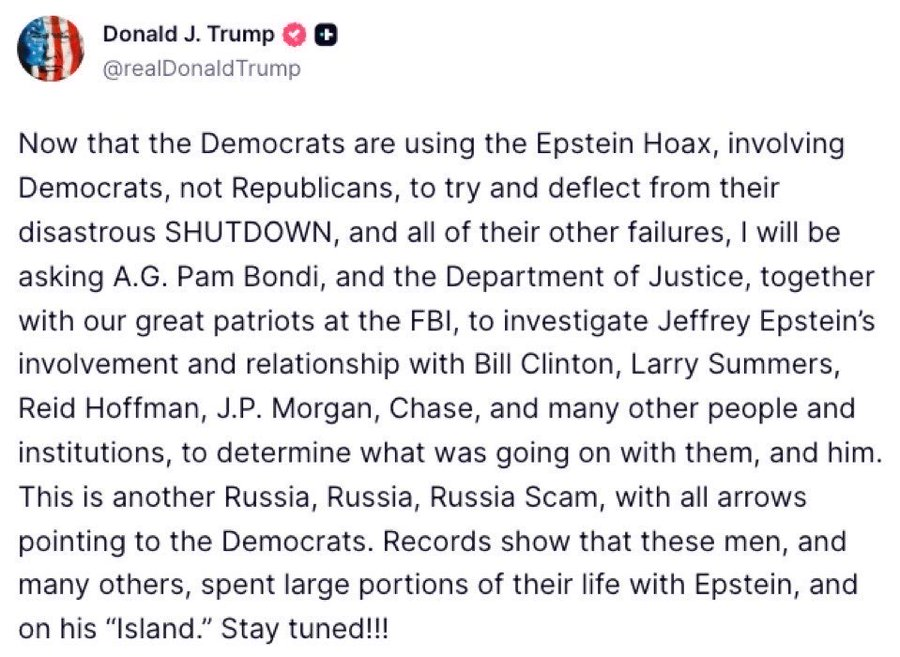

So when Trump posted about Epstein’s network and explicitly named JPMorgan (instead of isolating individuals) it wasn’t rhetorical flourish. He pulled the system’s most embedded institution into the narrative.

Meanwhile:

- JPM is a primary facilitator in aggressive short pressure on Strategy (“MSTR”), precisely at a moment when Bitcoin’s macro narrative threatens legacy monetary interests.

- Clients trying to transfer their MSTR shares out of JPM report delivery delays, hinting at custody stress… the kind that appears only when internal plumbing is under strain. - https://x.com/EMPD_BTC/status/1991886467694776531?s=20

- JPM sits in the strategic heart of the Fed ecosystem, both structurally and politically. Undermining its position is equivalent to undermining the old monetary regime itself.

None of this is normal.

All of this is part of the same story.

II. The Administration’s Silent Pivot: Return Monetary Power to Treasury

While media fixates on culture war distractions, the real strategic agenda is monetary.

The Administration is quietly working to pull the center of monetary issuance back toward the U.S. Treasury… using:

- Treasury-integrated stablecoins

- Programmable settlement rails

- Bitcoin reserves as long-duration collateral

This shift doesn’t tweak the existing system.

It replaces the system’s core power center.

Right now, the Fed and the commercial banks (led by JPMorgan) intermediate virtually all dollar creation and distribution. If Treasury plus stablecoins becomes the issuance and settlement backbone, the banking system loses authority, profits, and control.

JPMorgan understands this.

They understand exactly what stablecoins represent.

They understand what happens if Treasury becomes the issuer of programmable dollars.

So they fight… not with press releases, but with market tactics:

- derivatives pressure,

- liquidity choke points,

- narrative suppression,

- custodial delays,

- and political influence.

This isn’t a policy dispute.

It is an existential struggle.

III. Bitcoin: The Unintended Battleground

Bitcoin is not the target… it is the terrain.

The Administration wants quiet strategic accumulation before making any explicit move toward a Treasury-anchored digital settlement system. A premature announcement would ignite a gamma squeeze, send Bitcoin to escape velocity, and make accumulation prohibitively expensive.

The problem?

The old system is using gold-style suppression mechanisms to crush the Bitcoin signal:

- paper derivatives flooding,

- massive synthetic shorting,

- perception warfare,

- liquidity raids at key technical levels,

- custodial bottlenecks at major prime brokers.

JPMorgan has spent decades mastering these techniques on gold. Now they’re applying them to Bitcoin.

Not because Bitcoin threatens banking profits directly.. but because Bitcoin strengthens Treasury’s future monetary architecture and weakens the Fed’s.

The Administration faces a brutal strategic choice:

- Let JPM continue suppressing Bitcoin, preserving the ability to accumulate at low prices.

- Make a strategic announcement, triggering a Bitcoin breakout but losing stealth positioning before political alignment is secured.

This is why the Administration remains publicly quiet on Bitcoin.

Not because they don’t understand it.. but because they understand it too well.

IV. Both Sides Are Fighting on a Fragile Foundation

This entire struggle is occurring atop a monetary regime built over six decades of:

- financialization,

- structural leverage,

- artificially low rates,

- asset-first growth,

- reserve concentration,

- and institutional cartelization.

Historical correlations are breaking everywhere because the system is no longer coherent. TradFi pundits who treat this like a normal cycle fail to grasp that the cycle itself is dissolving.

The regime is fracturing.

The plumbing is unstable.

The incentives are diverging.

And both factions (JPMorgan’s legacy order and Treasury’s emerging order) are fighting on the same brittle infrastructure. One miscalculation risks cascading instability.

This is why the moves appear so strange, so disjointed, and so frantic.

V. MSTR: The Conversion Bridge Under Direct Assault

Now we introduce a critical layer that most commentators miss.

MicroStrategy is not just another corporate Bitcoin holder.

It has become the conversion mechanism - the bridge between legacy institutional capital and the emergent Bitcoin-Treasury monetary architecture.

MSTR’s structure, its leveraged Bitcoin strategy, and its preferred equity product effectively convert fiat, credit, and treasury assets into long-duration Bitcoin exposure. In doing so, MSTR has become a de facto on-ramp for institutions and retail who cannot (or will not) hold spot Bitcoin directly, but will need relief from artificially suppressed yields from YCC.

Which means:

If the Administration envisions a future where Treasury-backed digital dollars and Bitcoin reserves coexist, MSTR is a crucial corporate conduit toward that transition.

And JPMorgan knows that.

So when JPM:

- facilitates heavy shorting,

- introduces delivery delays,

- pressures MSTR liquidity,

- and fuels negative market narratives,

It’s not simply attacking Michael Saylor.

It’s attacking the conversion bridge that makes the Admin’s long-term accumulation strategy viable.

There is even a plausible scenario (one still very speculative, but increasingly logically) where the U.S. government eventually steps in and takes a strategic investment in MSTR. As suggested recently by (@ joshmandell6) That could come in the form of:

- Receiving MSTR ownership in return for the injection of US Treasuries,

- which would explicitly support of MSTR’s preferred vehicles and support higher credit ratings.

Such a move would carry risk, politically and financially.

But it would also send a signal the world could not ignore:

The United States is defending a critical node in its emerging monetary architecture.

And that possibility alone explains the intensity of JPMorgan’s attacks.

VI. The Critical Window: Control of the Federal Reserve Board

Here’s where the timeline turns urgent.

As @ caitlinlong recently suggested: Trump needs functional control of the Fed’s governance before Powell leaves the stage. Right now, the balance is against him… he trails by roughly three to four votes on the Board.

Several choke points now collide at once:

- Lisa Cook’s Supreme Court challenge, which could drag on for months and delay key shifts.

- The February 2025 Fed Governor vote, which could cement hostile governance for years.

- The coming midterms, where an underperforming GOP would cripple the Administration’s ability to realign monetary authority.

This is why economic momentum is essential now, not six months from now.

This is why Treasury issuance strategy is changing.

This is why stablecoin regulation is suddenly high-stakes.

This is why Bitcoin suppression matters.

And this is why the fight over MSTR is not trivial but structural.

If the Administration loses Congress, Trump becomes a lame duck… unable to restructure the monetary regime, boxed in by the very institution he aims to circumvent. And by 2028, the window would be gone.

The clock is real. The pressure is immense.

VII. The Broader Strategic Picture

When you stand back, the pattern becomes unmistakable:

- JPMorgan is waging a defensive war to preserve the Fed-banking system where it is the primary global node.

- The Administration is executing a stealth transition to restore monetary primacy to Treasury through stablecoins and Bitcoin reserves.

- Bitcoin is the proxy battleground, where price suppression protects the old system and stealth accumulation empowers the new one.

- MSTR is the conversion bridge, the institutional on-ramp that threatens JPMorgan’s chokehold on capital flows.

- Fed governance is the choke point, and political timing is the constraint.

- Everything is happening on an unstable foundation, where the wrong move triggers unpredictable systemic consequences.

This isn’t a financial story. It isn’t a political story.

It is a civilizational-scale monetary transition.

And for the first time in sixty years, the conflict is no longer hidden.

VIII. Trump’s Gambit

The Administration’s strategy comes into focus:

Let JPMorgan overplay its hand on suppression.

Accumulate Bitcoin quietly.

Defend and potentially empower the MSTR bridge.

Move quickly to reshape Fed governance.

Position Treasury as the issuer of digital dollars.

And wait for the right geopolitical moment (potentially the “Mar-a-Lago Accords”) to unveil the new architecture.

This is not a gentle reform. It is a full inversion of the 1913 order… a return of monetary power to the political body rather than the financial one.

If the gambit succeeds, the United States enters a new monetary era built on transparency, digital rails, and a hybrid-Bitcoin collateral framework.

If it fails, the old system tightens its grip, and the window for transformation may not reopen for another generation.

Either way, the war is already underway.

And Bitcoin isn’t just an asset anymore… it’s the fault line between two competing futures.

What either side fails to understand is that both will ultimately loose the battle against absolute scarcity and mathematical truth.

Expect the unexpected as these two behemoths battle for control, stay safe out there - MarylandHODL

@ DarkSide2030_ @ Puncher522 @ jacksage_

Note to Readers:

If these concepts feel unfamiliar or complex, here’s a simple way to understand them:

- Copy the text.

- Open GROK (or your preferred AI assistant).

- Paste the text and use this prompt:

“Please summarize the key concepts and ideas. Explain them in a way that an average person can easily understand. Describe the potential implications for individuals and society as a whole. Finally, highlight the most important ideas I should take away.”

Authors Comments:

This article was completed using Original Thought, Chat Enhanced or “OTCE”. I’m not a professional writer and don’t aspire to become one. My goal is to present both familiar and novel ideas with a twist, making them easy for readers to digest and understand. Whenever possible, I will provide credit to the original source of ideas.

The questions and concepts explored here reflect my personal thoughts about what the future might hold for my family. None of my articles should be considered financial advice. Instead, I encourage you to engage actively with the content: copy the article into your preferred LLM, activate voice mode, and have a dynamic conversation. Feel free to ask questions, explore the implications, or challenge the ideas presented.

Like you, I’m simply a pleb navigating the next steps. Individually, we are each just a part of the broader collective. Together, we form the hive mind, and it is this collective intelligence that will propel us into the next evolution.

— MarylandHODL

Disclaimer:

- This article is reprinted from [MarylandHODL]. All copyrights belong to the original author [MarylandHODL]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

BTC and Projects in The BRC-20 Ecosystem

What Is a Cold Wallet?

Blockchain Profitability & Issuance - Does It Matter?

What is the Altcoin Season Index?