What is NFT? A Comprehensive Beginner’s Guide

What Is an NFT?

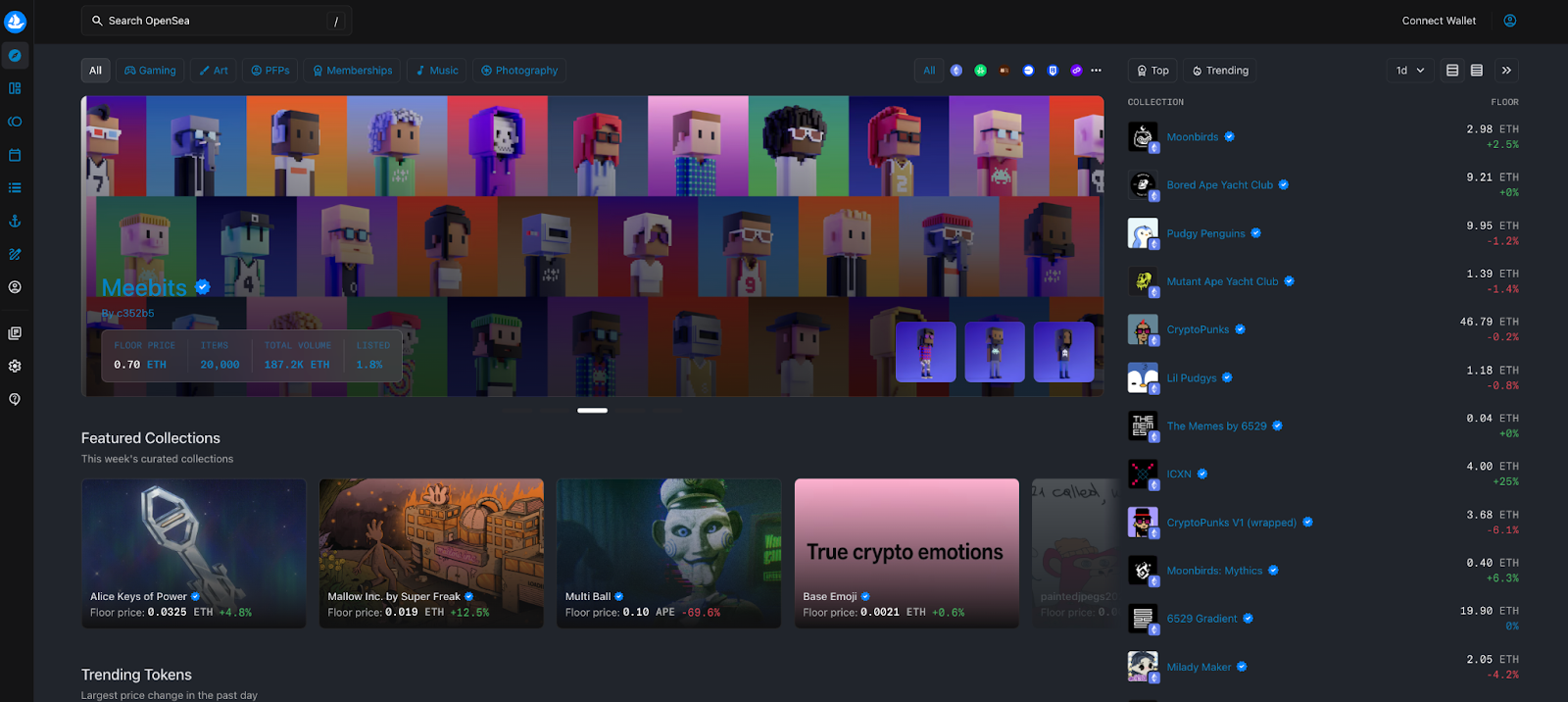

Image source: https://opensea.io/

In the digital asset space, NFTs (Non-Fungible Tokens) have become a major topic in recent years. In essence, an NFT is a unique digital asset—each NFT is one of a kind and cannot be replaced on a one-to-one basis, unlike fungible tokens such as Bitcoin or Ethereum. NFTs can represent digital artwork, music, video, in-game items, or even virtual real estate. The core value of NFTs lies in their scarcity and verifiable ownership.

How NFTs Work

NFTs are managed and traded using blockchain technology, allowing each NFT’s uniqueness and ownership to be fully verifiable. For instance, on the Ethereum blockchain, every NFT has a unique token ID and metadata. These details are fully transparent and cannot be altered. This setup enables artists to sell and profit from their works as NFTs, while collectors can securely confirm ownership of digital assets.

NFT Use Cases

NFTs are used in a wide range of scenarios:

- Art and collectibles: Artists use NFTs to digitize and sell their creations. Collections like CryptoPunks and Bored Ape Yacht Club have achieved high value thanks to scarcity and status.

- Gaming: Titles like Axie Infinity let players purchase NFT-based characters and items for a distinctive gameplay experience.

- Brands and virtual goods: Major brands like Gucci and Nike have released limited-edition NFTs, serving as both marketing strategies and collectibles.

Latest Market Updates

As of September 1, 2025, the total global NFT market cap stands at about $6 billion, with a 24-hour trading volume around $5.9 million. Popular collections such as Pudgy Penguins and Mutant Ape Yacht Club remain highly active. Investors can purchase NFTs on leading platforms like OpenSea and Rarible, and secure their assets in wallets such as MetaMask.

Getting Started with NFTs

- Gain a solid understanding of fundamental concepts and market trends.

- Select reputable platforms for transactions and prioritize asset security.

- Begin with small-scale investments and gradually gain hands-on experience.

- Participate in online communities, consult tutorials, and learn the full minting and trading process.

Summary

As a key segment of digital assets, NFTs are reshaping the value systems of art, gaming, and digital collectibles. Understanding what an NFT is marks the first step into the blockchain world. It is essential for staying ahead of future trends in the digital economy.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution