Zcash has carved out its own niche in the crypto ecosystem

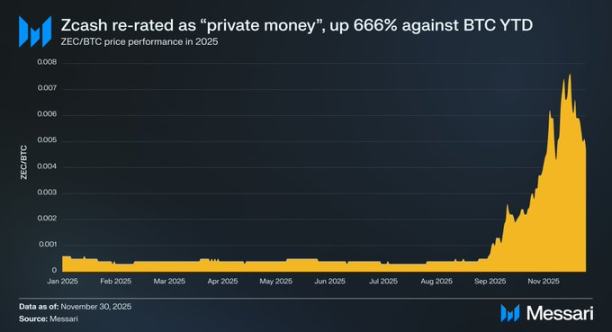

Among all crypto assets beyond Bitcoin and Ethereum, ZEC (Zcash) experienced the most dramatic shift in monetary perception in 2025. Historically, ZEC was viewed as a niche privacy coin rather than a mainstream monetary asset. However, as Bitcoin surveillance intensified and institutional adoption accelerated, privacy has reemerged as a core monetary attribute—no longer just a preference for a select few.

Bitcoin has proven that non-sovereign digital currencies can operate globally, but it fails to deliver the privacy users expect from physical cash. Every transaction is broadcast on a transparent public ledger, accessible to anyone via block explorers. Ironically, this tool—meant to disrupt the traditional financial system—has inadvertently created a financial panopticon.

Zcash leverages zero-knowledge proof cryptography to combine Bitcoin’s monetary policy with the privacy of cash. No other digital asset currently matches the proven and deterministic privacy guarantees of Zcash’s latest shielded pool. This makes Zcash a unique and valuable form of private money. We believe the market’s revaluation of ZEC relative to BTC reflects its status as the ideal private cryptocurrency, positioning it as a hedge against both the rise of surveillance states and the institutionalization of Bitcoin.

Since the start of this year, ZEC has surged 666% against Bitcoin, with its market cap reaching $7 billion and briefly surpassing Monero (XMR) as the largest privacy coin. This outperformance signals that the market now views ZEC, alongside XMR, as a viable private cryptocurrency.

Bitcoin’s Privacy Dilemma

Bitcoin is highly unlikely to adopt a shielded pool architecture, making the idea that it will eventually absorb Zcash’s value untenable. Bitcoin’s conservative culture prioritizes protocol ossification to minimize attack surfaces and safeguard monetary integrity. Adding privacy at the protocol level would require core architectural changes, potentially introducing inflation vulnerabilities and undermining Bitcoin’s credibility. Zcash, in contrast, embraces this risk because privacy is its fundamental value proposition.

Implementing zero-knowledge proof cryptography at the base layer also impacts blockchain scalability. It requires the use of nullifiers and hash memos to prevent double-spending, which can lead to long-term “state bloat.” Nullifiers accumulate in an ever-growing list, making it increasingly resource-intensive to run a full node. Mandating nodes to store this expanding dataset undermines Bitcoin’s decentralization by raising the barrier to node operation over time.

Furthermore, unless Bitcoin introduces a soft fork supporting zero-knowledge verification (such as OP_CAT), no Layer 2 solution can deliver Zcash-level privacy while fully inheriting Bitcoin’s security. Current options either introduce trusted intermediaries (federated models), accept lengthy and interactive withdrawals (BitVM), or offload execution and security to separate systems (sovereign rollups). As long as this persists, there’s no existing path to Zcash-level privacy without compromising Bitcoin’s security—reinforcing ZEC’s distinct value as a private cryptocurrency.

Hedging Against Central Bank Digital Currencies (CBDCs)

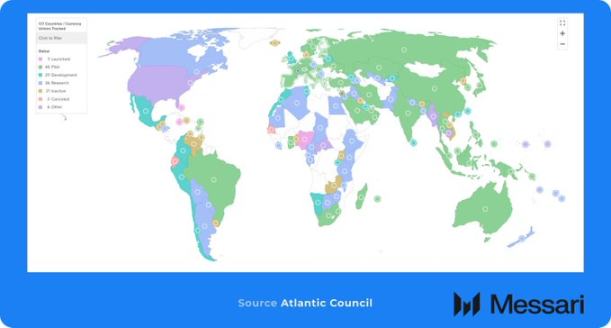

The rollout of central bank digital currencies has heightened the demand for privacy coins. Half the world’s countries are exploring or have launched CBDCs. These currencies are programmable, enabling issuers to track every transaction and control how, when, and where funds are used. Usage can be restricted to specific merchants or geographic regions.

This scenario may sound dystopian, but the weaponization of financial infrastructure is already happening:

- Nigeria (2020): During the EndSARS protests against police brutality, the Central Bank of Nigeria froze accounts belonging to key protest organizers and feminist groups, forcing the movement to rely on cryptocurrency.

- United States (2020–2025): Regulators and major banks, citing “reputational risk” and ideology, debanked lawful but politically disfavored industries—including oil and gas, firearms, adult content, and crypto. The problem grew so acute that the White House ordered a review, and the OCC’s 2025 report documented systematic restrictions on legal sectors.

- Canada (2022): During the “Freedom Convoy” protests, the government invoked the Emergencies Act to freeze protestors’ and small donors’ bank and crypto accounts without court orders. The RCMP even blacklisted 34 self-custodied crypto wallet addresses, requiring all regulated exchanges to block transactions with them. This demonstrates that even Western democracies will weaponize financial systems to suppress dissent.

In a world where money can be programmed to control individuals, Zcash offers a definitive exit. But Zcash is not just a tool to circumvent CBDCs—it’s also becoming essential for protecting Bitcoin itself.

Hedging Against Bitcoin “Capture” Risk

As thought leaders Naval Ravikant and Balaji Srinivasan have argued, Zcash serves as an “insurance policy” for Bitcoin’s vision of financial freedom.

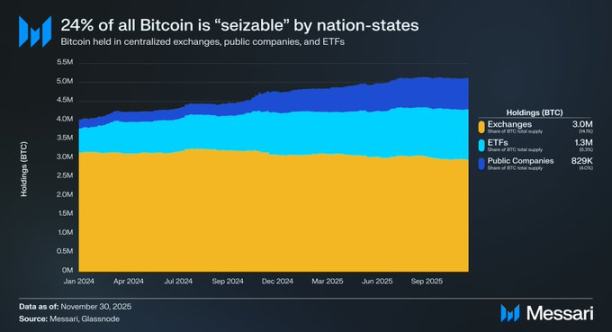

Bitcoin is rapidly concentrating in centralized hands. Centralized exchanges (about 3 million BTC), ETFs (about 1.3 million BTC), and public companies (about 829,000 BTC) together hold roughly 5.1 million BTC—24% of total supply.

This centralization means that nearly a quarter of Bitcoin’s supply is vulnerable to regulatory seizure, echoing the conditions that enabled the U.S. government’s 1933 gold confiscation. Back then, an executive order forced Americans to surrender gold holdings above $100 to the Federal Reserve, converting them to paper currency at $20.67 per ounce. This was enforced through the banking system, not by force.

With Bitcoin, the mechanism would be similar. Regulators don’t need your private keys—legal jurisdiction over custodians suffices to seize that 24%. Governments could simply order institutions like BlackRock or Coinbase to freeze and transfer their custodial Bitcoin. Nearly a quarter of supply could be effectively nationalized overnight, without breaking any cryptography. While extreme, this risk cannot be dismissed.

Given blockchain transparency, self-custody is no longer a perfect safeguard. Any Bitcoin withdrawn from KYC-compliant platforms can be traced and seized, since money trails will eventually lead authorities to the tokens’ final destination.

Bitcoin holders can convert assets to Zcash, breaking the custodial chain and isolating wealth from surveillance. Once funds enter Zcash’s shielded pool, the target address becomes a cryptographic black hole to outsiders. Regulators can trace funds leaving the Bitcoin network but cannot determine their destination, rendering the assets invisible to state actors. While converting back to fiat and depositing in banks remains a bottleneck, the assets themselves become censorship-resistant and difficult to proactively trace. Of course, the strength of this anonymity depends entirely on user operational security—reusing addresses before shielding or sourcing funds from KYC exchanges creates permanent, traceable links.

Toward Mainstream Adoption

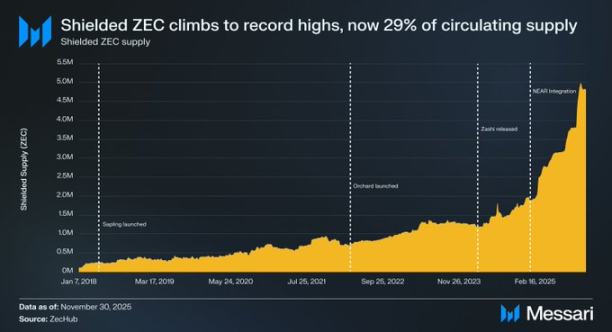

The demand for private money has always existed, but Zcash has historically been out of reach for most users. For years, the protocol was hindered by high memory requirements, long proof times, and cumbersome desktop setups, making shielded transactions slow and inaccessible. Recent infrastructure breakthroughs have systematically dismantled these barriers, paving the way for widespread adoption.

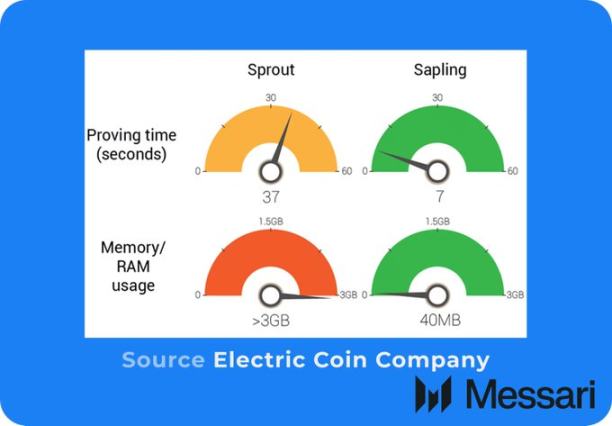

- Sapling Upgrade: Reduced memory requirements by 97% (to about 40MB) and proof times by 81% (to about 7 seconds), enabling shielded transactions on mobile devices.

- Orchard Upgrade & Halo 2: After resolving speed issues, trusted setup remained a privacy concern. The Orchard upgrade, by adopting Halo 2, eliminated Zcash’s reliance on trusted setup, achieving true trustlessness. The new “unified address” system merges transparent and shielded addresses, so users no longer need to choose address types manually.

- Zashi Wallet: In March 2024, Electric Coin Company released the Zashi mobile wallet. By abstracting unified addresses, it reduces shielded transactions to just a few taps, making privacy the default user experience.

- NEAR Intents Integration: Solved the last distribution bottleneck. Users can now swap supported assets (like BTC and ETH) directly for shielded ZEC within Zashi, without centralized exchanges. NEAR Intents also enables users to pay any supported asset to any address across 20 blockchains, using shielded ZEC as the funding source.

Together, these advancements have allowed Zcash to overcome historical barriers, tap into global liquidity, and precisely meet market needs.

Looking Ahead

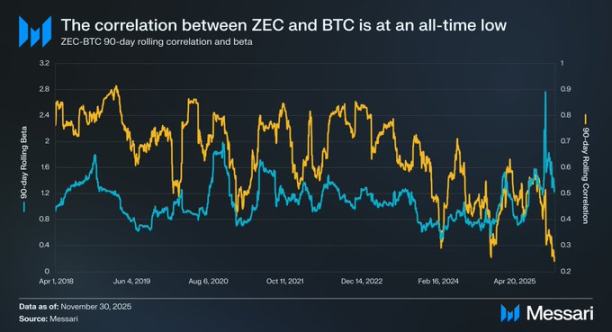

Since 2019, ZEC’s rolling correlation with BTC has steadily declined—from 0.90 to a recent low of 0.24. Meanwhile, ZEC’s rolling beta relative to BTC has hit record highs. This means that although their price movements are less correlated, ZEC’s price volatility is increasingly amplified by BTC’s moves. This divergence shows the market is assigning a unique “privacy premium” to Zcash’s privacy assurances.

Looking forward, we expect ZEC’s performance to be driven by this privacy premium—as the value of financial anonymity rises in an era of tightening surveillance and weaponized finance.

We see little chance of ZEC overtaking BTC. Bitcoin’s transparent supply and indisputable auditability have made it the soundest form of cryptocurrency. By contrast, Zcash always faces the inherent trade-offs of privacy coins: protecting privacy through an encrypted ledger sacrifices auditability and introduces theoretical risks of undetected inflation bugs within the shielded pool—risks that Bitcoin’s transparent ledger eliminates.

Still, Zcash can carve out its own niche without replacing BTC. The two assets are not direct competitors but serve distinct use cases in crypto. BTC is sound money, optimized for transparency and security. ZEC is private money, optimized for confidentiality and financial privacy. In this sense, ZEC’s success lies not in displacing BTC, but in complementing it by offering features Bitcoin intentionally lacks.

Statement:

- This article was republished from [Foresight News]. Copyright belongs to the original author [@ 0xYoussef_]. If you have any concerns about this republication, please contact the Gate Learn team, who will address it promptly according to established procedures.

- Disclaimer: The views and opinions expressed in this article are those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Without referencing Gate, you may not copy, distribute, or plagiarize the translated article.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?