$PIEVERSE #BitcoinGoldBattle GOOD NEWS🚨

💥LIQUIDITY BOMB DETECTED 💥

No press conference.

No breaking news.

Just $25.95 BILLION quietly injected by the Fed at 8:00 AM ET 👀

This smells like STEALTH QE.

And history is clear👇

When liquidity flows in quietly, risk assets move first before the headlines catch up.

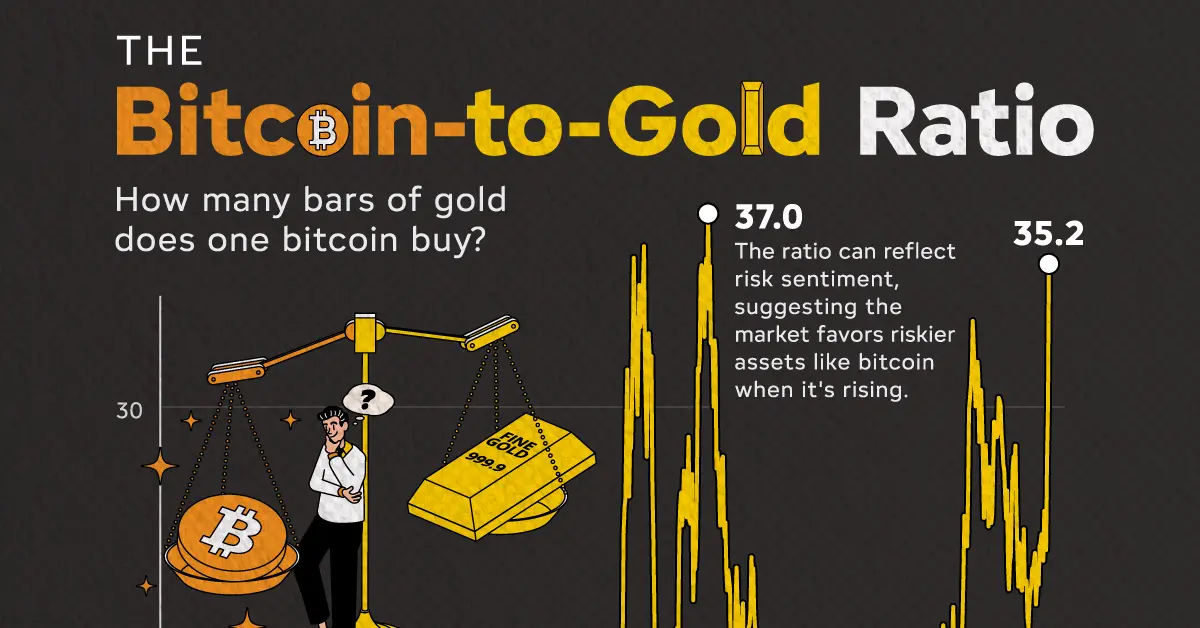

📊 Market signal:

• Crypto reacts early

• Silver sniffs it out even faster

• Smart money tracks liquidity,

not narratives

🔥 Meanwhile…

$PIEVERSE $PIEVERSE The more it drops, the more I add to my long position. So satisfying!$PIEVERSE Powerhouse, the dream has always been a trap, you

💥LIQUIDITY BOMB DETECTED 💥

No press conference.

No breaking news.

Just $25.95 BILLION quietly injected by the Fed at 8:00 AM ET 👀

This smells like STEALTH QE.

And history is clear👇

When liquidity flows in quietly, risk assets move first before the headlines catch up.

📊 Market signal:

• Crypto reacts early

• Silver sniffs it out even faster

• Smart money tracks liquidity,

not narratives

🔥 Meanwhile…

$PIEVERSE $PIEVERSE The more it drops, the more I add to my long position. So satisfying!$PIEVERSE Powerhouse, the dream has always been a trap, you

PIEVERSE-10,94%