# Cryptoanalysis

18.35K

AylaShinex

#WhaleActivityWatch #WhaleActivityWatch 🐋📊

When whales move, markets listen.

Large wallet transfers have started increasing — and that’s never random. Whether it’s accumulation, distribution, or strategic repositioning, whale activity often precedes major volatility.

Here’s what smart traders monitor:

🔹 Exchange inflows → Possible selling pressure

🔹 Exchange outflows → Accumulation signal

🔹 Large stablecoin movements → Preparing for deployment

🔹 Sudden spikes in open interest → High-leverage positioning

Retail reacts to candles.

Whales position before the candles print.

If big players ar

When whales move, markets listen.

Large wallet transfers have started increasing — and that’s never random. Whether it’s accumulation, distribution, or strategic repositioning, whale activity often precedes major volatility.

Here’s what smart traders monitor:

🔹 Exchange inflows → Possible selling pressure

🔹 Exchange outflows → Accumulation signal

🔹 Large stablecoin movements → Preparing for deployment

🔹 Sudden spikes in open interest → High-leverage positioning

Retail reacts to candles.

Whales position before the candles print.

If big players ar

BTC0,95%

- Reward

- 5

- 4

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

🚨 GT/USDT Market Analysis – Signals & Positioning

GT (GateToken), the native token of the Gate ecosystem, is currently showing mixed and choppy price action with structural weakness but also some emerging areas worth watching for potential opportunities.

GT trades around $8–$10 range after a sustained downtrend and price weakening over recent weeks.

📉 Current Technical Signals – Dragon Fly Official’s View

Bearish Momentum Dominates:

Most major technical indicators on daily timeframes currently signal Sell, with GT trading below key moving averages. RSI readings are in bearish or neutral terr

GT (GateToken), the native token of the Gate ecosystem, is currently showing mixed and choppy price action with structural weakness but also some emerging areas worth watching for potential opportunities.

GT trades around $8–$10 range after a sustained downtrend and price weakening over recent weeks.

📉 Current Technical Signals – Dragon Fly Official’s View

Bearish Momentum Dominates:

Most major technical indicators on daily timeframes currently signal Sell, with GT trading below key moving averages. RSI readings are in bearish or neutral terr

GT1,09%

- Reward

- 8

- 14

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

The crypto market is currently navigating one of its most intense periods of volatility in early 2026. Bitcoin (BTC) has experienced a sharp correction, dipping below $80,000 and briefly touching lows around $75,000–$78,000 in recent trading sessions—the weakest levels since mid-2025. Ethereum (ETH) has followed suit, sliding toward the $2,400 range amid broader sell-offs. Over the past weekend alone, liquidations surged dramatically, with billions in leveraged positions wiped out as panic selling intensified. The Fear & Greed Index has plunged into extreme fear territory, prompting the age-ol

- Reward

- 2

- Comment

- Repost

- Share

The crypto market is currently navigating one of its most intense periods of volatility in early 2026. Bitcoin (BTC) has experienced a sharp correction, dipping below $80,000 and briefly touching lows around $75,000–$78,000 in recent trading sessions—the weakest levels since mid-2025. Ethereum (ETH) has followed suit, sliding toward the $2,400 range amid broader sell-offs. Over the past weekend alone, liquidations surged dramatically, with billions in leveraged positions wiped out as panic selling intensified. The Fear & Greed Index has plunged into extreme fear territory, prompting the age-ol

- Reward

- 3

- 4

- Repost

- Share

HighAmbition :

:

thanks for the updateView More

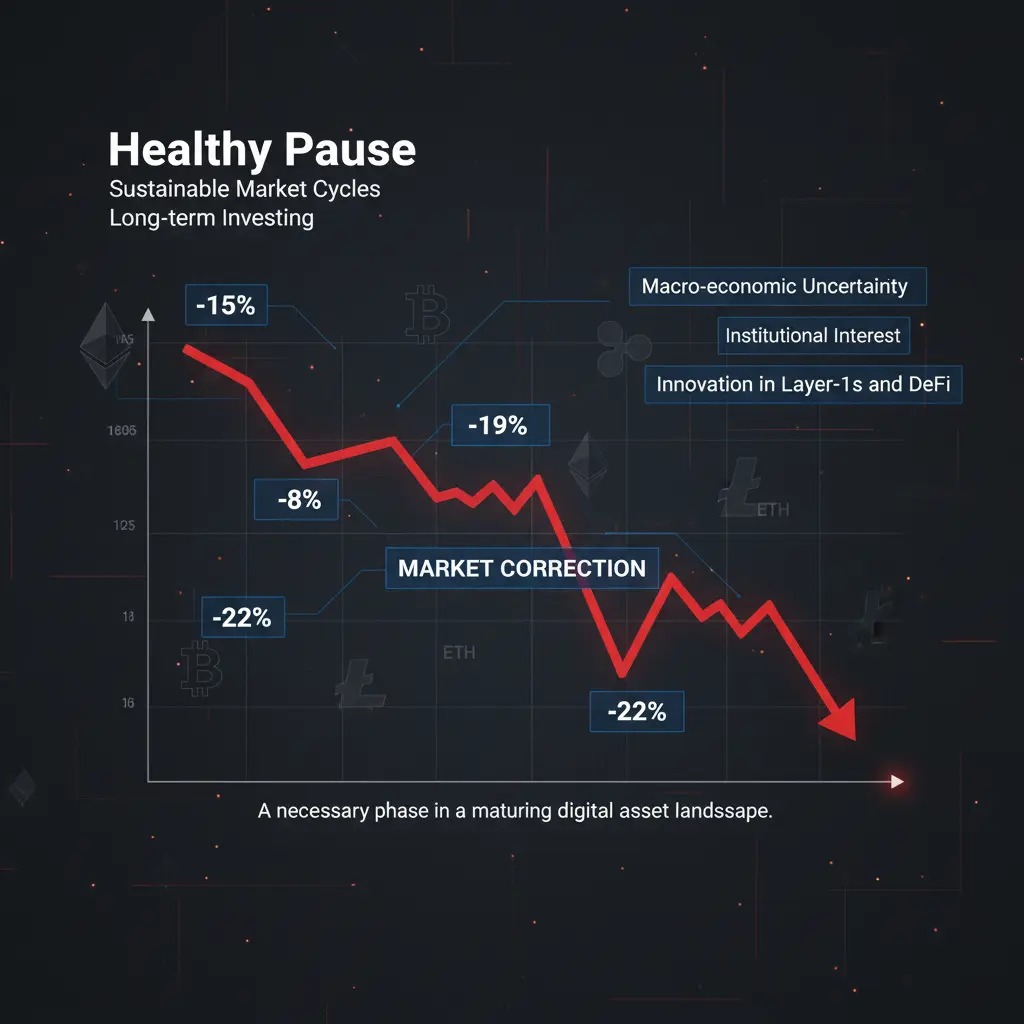

📉 Crypto Market Pullback: A Healthy Pause in a Maturing Market

The recent Crypto Market Pullback has caught the attention of traders and long-term investors alike, but it’s important to view this phase with perspective. After an extended period of strong rallies and optimistic sentiment, markets naturally cool down as profits are taken and leverage is reduced. Such pullbacks are not signs of weakness; rather, they are a normal and necessary part of sustainable market cycles.

Macro-economic uncertainty, shifting liquidity conditions, and cautious risk appetite have also contributed to the shor

The recent Crypto Market Pullback has caught the attention of traders and long-term investors alike, but it’s important to view this phase with perspective. After an extended period of strong rallies and optimistic sentiment, markets naturally cool down as profits are taken and leverage is reduced. Such pullbacks are not signs of weakness; rather, they are a normal and necessary part of sustainable market cycles.

Macro-economic uncertainty, shifting liquidity conditions, and cautious risk appetite have also contributed to the shor

DEFI0,94%

- Reward

- 7

- 11

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Solana has reached an important support level. If this level fails and breaks down, price can drop below $70. This zone will decide whether we get a bounce or further downside.View More

Bitcoin is showing some interesting movements today. After a period of consolidation, it seems like the bulls are trying to push through the major resistance levels. 📊

Key things to watch:

Support Zone: If BTC stays above the current support, we might see another leg up soon.

Volume: Trading volume on Gate.io is looking healthy, which is a good sign for volatility.

Market Sentiment: Whether you are looking to Open Long or wait for a better entry, always keep your stop-loss in place! 🛡️

What are your thoughts? Is BTC going to hit a new high this week or should we expect a correction? Let me k

Key things to watch:

Support Zone: If BTC stays above the current support, we might see another leg up soon.

Volume: Trading volume on Gate.io is looking healthy, which is a good sign for volatility.

Market Sentiment: Whether you are looking to Open Long or wait for a better entry, always keep your stop-loss in place! 🛡️

What are your thoughts? Is BTC going to hit a new high this week or should we expect a correction? Let me k

BTC0,95%

- Reward

- 2

- Comment

- Repost

- Share

#BitcoinUpdate 🚀

Bitcoin is compressing on higher timeframes — and the 3-day chart is starting to tell a story. Price action is shaping a potential reversal base, the kind that usually forms before momentum returns, not after.

This isn’t random volatility. It’s structure doing its work.

🔹 Key downside reference: $80,600

A sustained close below this level would weaken the setup and force a reassessment. Structure always comes first.

🔹 Alternative scenario:

A brief sweep toward the $78K area followed by a fast recovery would still support a bullish reversal narrative — classic liquidity grab

Bitcoin is compressing on higher timeframes — and the 3-day chart is starting to tell a story. Price action is shaping a potential reversal base, the kind that usually forms before momentum returns, not after.

This isn’t random volatility. It’s structure doing its work.

🔹 Key downside reference: $80,600

A sustained close below this level would weaken the setup and force a reassessment. Structure always comes first.

🔹 Alternative scenario:

A brief sweep toward the $78K area followed by a fast recovery would still support a bullish reversal narrative — classic liquidity grab

BTC0,95%

- Reward

- 14

- 15

- Repost

- Share

Falcon_Official :

:

2026 GOGOGO 👊View More

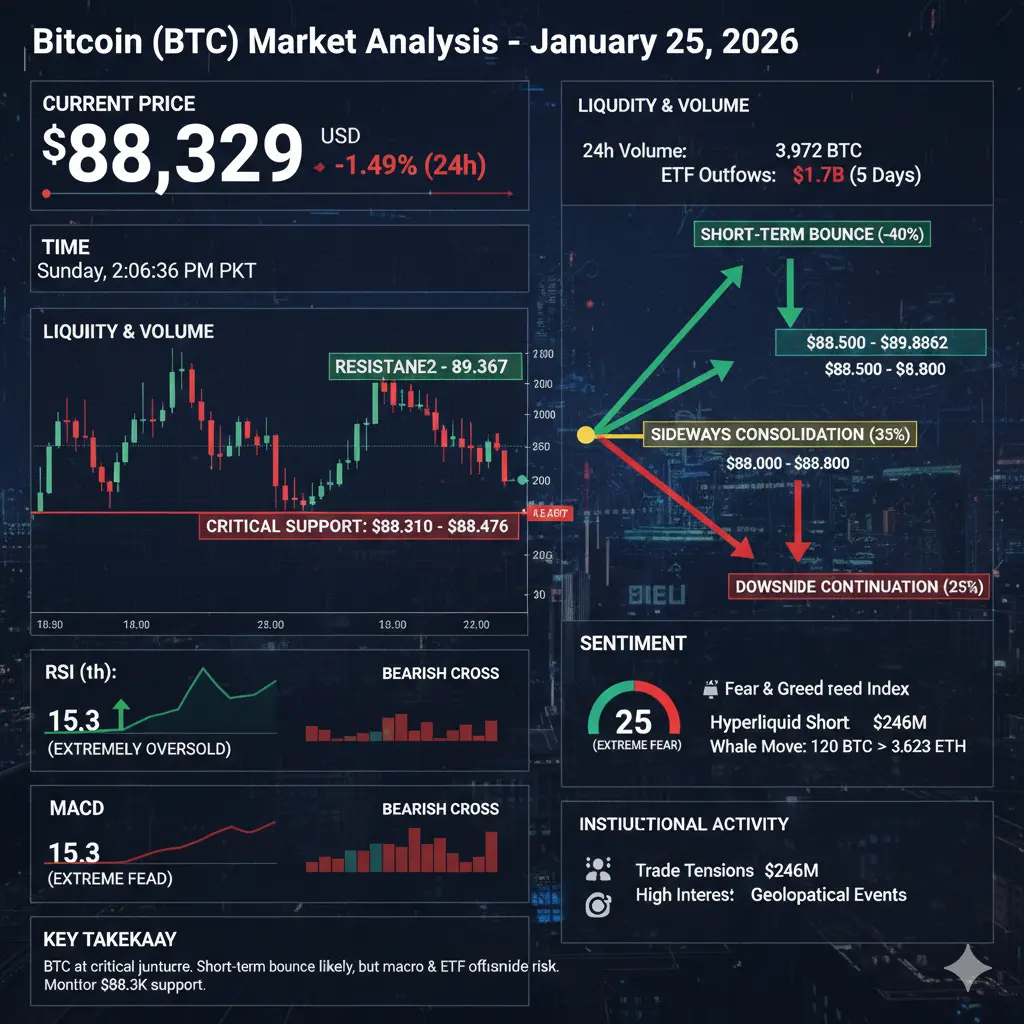

🚨 #BTCMarketAnalysis – Bitcoin Update

Current Price: $88,329 (↓1.49% 24h)

24h Range: $88,128 – $89,673 (~1.75% volatility)

Support / Resistance: $88,310–$88,476 | $88,862–$89,367

🔹 Key Highlights:

Extreme Fear: Fear & Greed Index 25 → panic selling visible

High Volume Sell-Off: 24h volume 3,972 BTC ($354M), ETF outflows $1.7B in 5 days

Technical Oversold: RSI (1h) 15.3, Bollinger Bands below lower band → short-term bounce possible

Liquidity Tightening: Bid-ask spreads widened, institutional shorts rising

📊 Short-Term Outlook (1–3 Days):

Bounce: $88,500–$88,862 (~40% chance)

Consolidation: $

Current Price: $88,329 (↓1.49% 24h)

24h Range: $88,128 – $89,673 (~1.75% volatility)

Support / Resistance: $88,310–$88,476 | $88,862–$89,367

🔹 Key Highlights:

Extreme Fear: Fear & Greed Index 25 → panic selling visible

High Volume Sell-Off: 24h volume 3,972 BTC ($354M), ETF outflows $1.7B in 5 days

Technical Oversold: RSI (1h) 15.3, Bollinger Bands below lower band → short-term bounce possible

Liquidity Tightening: Bid-ask spreads widened, institutional shorts rising

📊 Short-Term Outlook (1–3 Days):

Bounce: $88,500–$88,862 (~40% chance)

Consolidation: $

BTC0,95%

- Reward

- 2

- 1

- Repost

- Share

Karik254 :

:

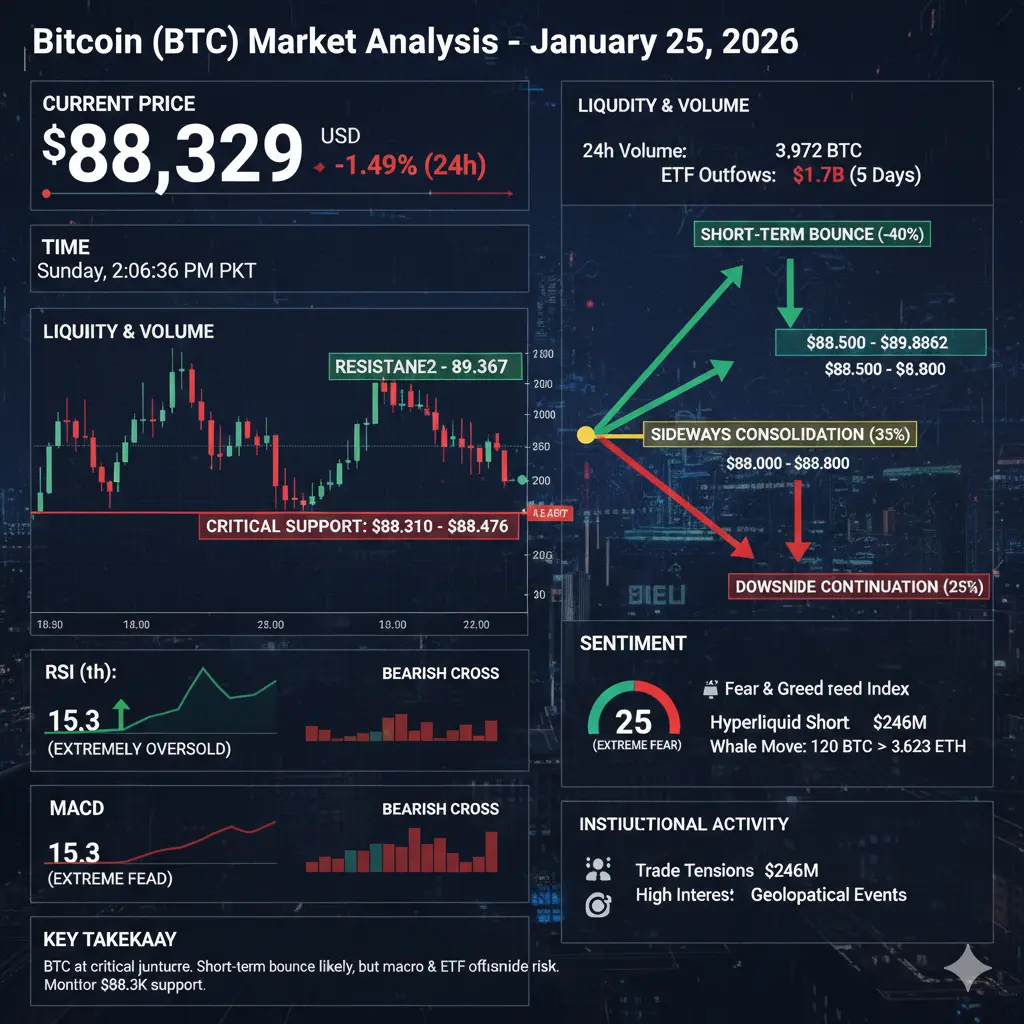

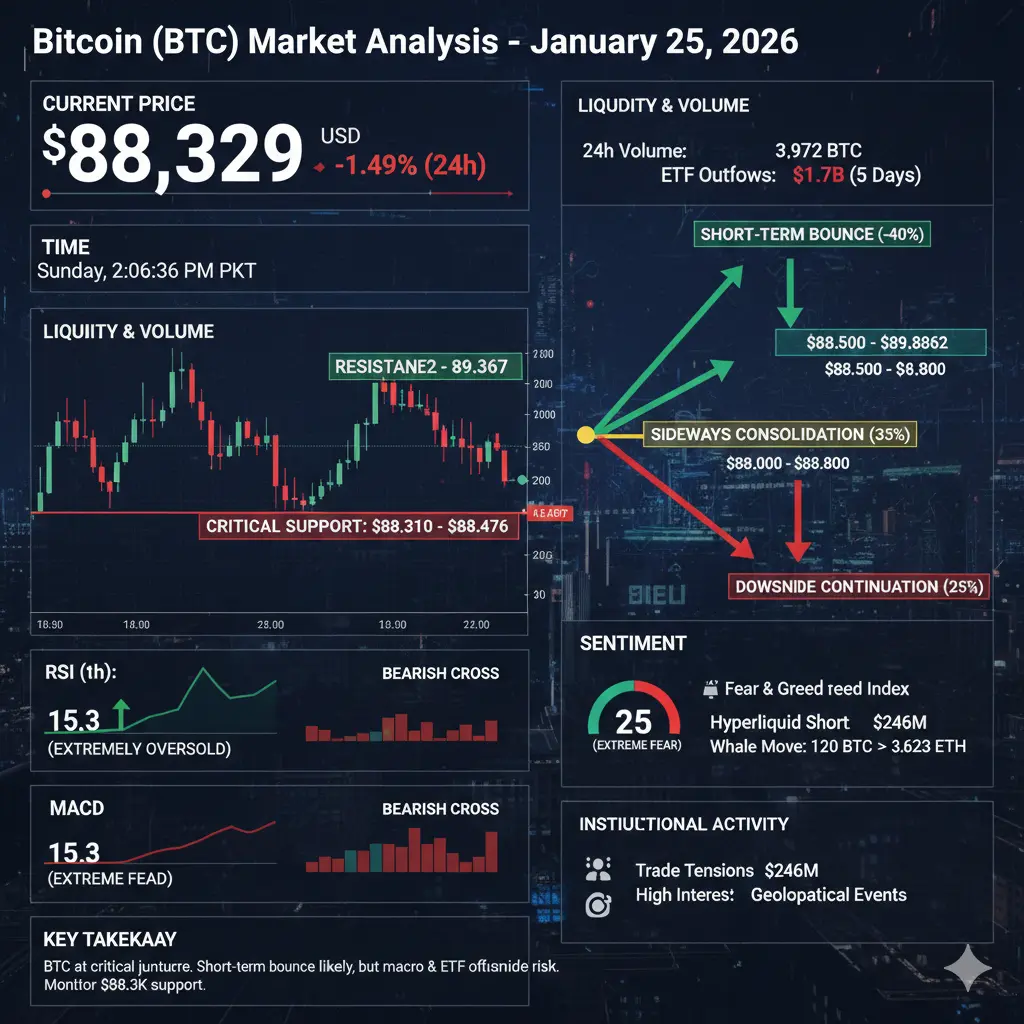

2026 GOGOGO 👊🚨 #BTCMarketAnalysis – Bitcoin Update

Current Price: $88,329 (↓1.49% 24h)

24h Range: $88,128 – $89,673 (~1.75% volatility)

Support / Resistance: $88,310–$88,476 | $88,862–$89,367

🔹 Key Highlights:

Extreme Fear: Fear & Greed Index 25 → panic selling visible

High Volume Sell-Off: 24h volume 3,972 BTC ($354M), ETF outflows $1.7B in 5 days

Technical Oversold: RSI (1h) 15.3, Bollinger Bands below lower band → short-term bounce possible

Liquidity Tightening: Bid-ask spreads widened, institutional shorts rising

📊 Short-Term Outlook (1–3 Days):

Bounce: $88,500–$88,862 (~40% chance)

Consolidation: $

Current Price: $88,329 (↓1.49% 24h)

24h Range: $88,128 – $89,673 (~1.75% volatility)

Support / Resistance: $88,310–$88,476 | $88,862–$89,367

🔹 Key Highlights:

Extreme Fear: Fear & Greed Index 25 → panic selling visible

High Volume Sell-Off: 24h volume 3,972 BTC ($354M), ETF outflows $1.7B in 5 days

Technical Oversold: RSI (1h) 15.3, Bollinger Bands below lower band → short-term bounce possible

Liquidity Tightening: Bid-ask spreads widened, institutional shorts rising

📊 Short-Term Outlook (1–3 Days):

Bounce: $88,500–$88,862 (~40% chance)

Consolidation: $

BTC0,95%

- Reward

- 1

- Comment

- Repost

- Share

🚀 $CYBER Spot Analysis: Identifying the Reversal Floor for a Long-Term Move

Market Context:

As we move into the second quarter of 2026, the decentralized social layer narrative is regaining traction۔ CyberConnect ($CYBER), a leader in the Web3 social space, is currently exhibiting a classic "Bottoming Out" pattern after a prolonged correction phase۔

The Reversal Zone:

Technical indicators suggest that $CYBER is entering a high-probability "Reversal Zone" between $0.60 and $0.82۔

• Support Base: This range has acted as a significant psychological floor.

• Technical Setup: We are seeing bull

Market Context:

As we move into the second quarter of 2026, the decentralized social layer narrative is regaining traction۔ CyberConnect ($CYBER), a leader in the Web3 social space, is currently exhibiting a classic "Bottoming Out" pattern after a prolonged correction phase۔

The Reversal Zone:

Technical indicators suggest that $CYBER is entering a high-probability "Reversal Zone" between $0.60 and $0.82۔

• Support Base: This range has acted as a significant psychological floor.

• Technical Setup: We are seeing bull

CYBER25,66%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

382.46K Popularity

12.95K Popularity

12.03K Popularity

8.07K Popularity

5.82K Popularity

8.56K Popularity

6.72K Popularity

6.99K Popularity

2.36K Popularity

43 Popularity

56K Popularity

74.25K Popularity

21.22K Popularity

28.12K Popularity

220.44K Popularity

News

View MoreGold prices have returned to $4,800, regaining the key support level. Investors are closely watching the market as geopolitical tensions and inflation concerns continue to influence gold's performance. Experts suggest that if gold can sustain above this level, it may signal further upward momentum. Meanwhile, market analysts advise caution due to potential volatility ahead.

3 m

Trump: I don't know about Abu Dhabi investing $500 million in WLFI; my sons are handling it.

10 m

OTC Whale Continues Accumulating ETH and CBBTC During Market Dip

31 m

Data: 25,600 BNB transferred from an anonymous address, worth approximately $19.84 million.

35 m

Vitalik Buterin Sells 493 ETH Worth $1.16M in Past 8 Hours

37 m

Pin