# TrumpWithdrawsEUTariffThreats

16.46K

Amid ongoing trade tensions, Trump cancels tariffs on several European countries originally set for Feb 1. Do you think this easing signal will meaningfully impact market trends?

Discovery

#TrumpWithdrawsEUTariffThreats

From Threats to the Table: Trump’s Strategic Retreat

In the opening weeks of January 2026, U.S. President Donald Trump sent shockwaves through global markets by announcing additional customs tariffs—ranging from 10% to 25%—against eight European nations (UK, France, Germany, Denmark, Netherlands, Sweden, Finland, and Norway) that opposed his Arctic strategy and the proposal to purchase Greenland. However, the recent summit in Davos has fundamentally shifted the narrative.

Summit Diplomacy: Following what he described as a "highly productive" meeting with NATO Se

From Threats to the Table: Trump’s Strategic Retreat

In the opening weeks of January 2026, U.S. President Donald Trump sent shockwaves through global markets by announcing additional customs tariffs—ranging from 10% to 25%—against eight European nations (UK, France, Germany, Denmark, Netherlands, Sweden, Finland, and Norway) that opposed his Arctic strategy and the proposal to purchase Greenland. However, the recent summit in Davos has fundamentally shifted the narrative.

Summit Diplomacy: Following what he described as a "highly productive" meeting with NATO Se

- Reward

- 60

- 63

- Repost

- Share

ToTheYUE :

:

2026 GOGOGO 👊View More

🌐 Macro Outlook 2026: The Structural Backdrop

From a macro perspective, the foundation is relatively stable:

Global GDP growth: ~3.1%–3.3% (IMF & Bloomberg estimates)

Growth supported by the U.S., Europe, and Asia

AI investment is becoming a core productivity and earnings driver

After 2025 rate cuts, markets expect the Fed in 2026 to remain

→ mostly neutral, possibly 1–2 limited cuts

This environment is broadly supportive for risk assets

However, key risks remain active:

Political uncertainty (Trump’s trade and fiscal policy reversals)

Geopolitical tensions

Slowing Chinese growth

The risk tha

From a macro perspective, the foundation is relatively stable:

Global GDP growth: ~3.1%–3.3% (IMF & Bloomberg estimates)

Growth supported by the U.S., Europe, and Asia

AI investment is becoming a core productivity and earnings driver

After 2025 rate cuts, markets expect the Fed in 2026 to remain

→ mostly neutral, possibly 1–2 limited cuts

This environment is broadly supportive for risk assets

However, key risks remain active:

Political uncertainty (Trump’s trade and fiscal policy reversals)

Geopolitical tensions

Slowing Chinese growth

The risk tha

- Reward

- 32

- 37

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

A Geopolitical Reading of the Greenland Statement

Recent remarks by Donald Trump have once again brought the idea of the United States purchasing Greenland into public discussion, with suggestions that talks on the matter should be initiated. Greenland is an autonomous territory under Danish sovereignty, but its strategic position has long made it a point of interest for global powers.

I don’t see this statement as merely a discussion about acquiring land. More importantly, it reflects the growing strategic importance of the Arctic region. Energy resources, emerging shipping routes, military p

Recent remarks by Donald Trump have once again brought the idea of the United States purchasing Greenland into public discussion, with suggestions that talks on the matter should be initiated. Greenland is an autonomous territory under Danish sovereignty, but its strategic position has long made it a point of interest for global powers.

I don’t see this statement as merely a discussion about acquiring land. More importantly, it reflects the growing strategic importance of the Arctic region. Energy resources, emerging shipping routes, military p

- Reward

- 29

- 30

- Repost

- Share

melankolik71 :

:

Buy To Earn 💎View More

#TrumpWithdrawsEUTariffThreats

As of January 22, 2026, global markets are reacting to a notable shift in trade rhetoric as former U.S. President Donald Trump has stepped back from previously signaled tariff threats against the European Union, easing fears of an imminent transatlantic trade confrontation. The move has been interpreted by investors and policymakers as a de-escalation signal at a time when global markets are already navigating heightened volatility, slowing growth expectations, and sensitive geopolitical dynamics. Trade tensions between the U.S. and EU have historically carried

As of January 22, 2026, global markets are reacting to a notable shift in trade rhetoric as former U.S. President Donald Trump has stepped back from previously signaled tariff threats against the European Union, easing fears of an imminent transatlantic trade confrontation. The move has been interpreted by investors and policymakers as a de-escalation signal at a time when global markets are already navigating heightened volatility, slowing growth expectations, and sensitive geopolitical dynamics. Trade tensions between the U.S. and EU have historically carried

- Reward

- 4

- 6

- Repost

- Share

Falcon_Official :

:

DYOR 🤓View More

#TrumpWithdrawsEUTariffThreats

Trump Withdraws EU Tariff Threats: Macro Markets and Crypto React

In a surprising and potentially market-moving development, Trump has officially canceled tariffs on several European countries that were originally scheduled to take effect on February 1.

This decision comes amid a prolonged period of trade uncertainty and heightened geopolitical risk, which has been weighing on global equities, commodities, and risk-on assets, including cryptocurrencies.

The immediate effect is a relief in risk sentiment. U.S. and European equities are likely to see renewed buyin

Trump Withdraws EU Tariff Threats: Macro Markets and Crypto React

In a surprising and potentially market-moving development, Trump has officially canceled tariffs on several European countries that were originally scheduled to take effect on February 1.

This decision comes amid a prolonged period of trade uncertainty and heightened geopolitical risk, which has been weighing on global equities, commodities, and risk-on assets, including cryptocurrencies.

The immediate effect is a relief in risk sentiment. U.S. and European equities are likely to see renewed buyin

BTC0,04%

- Reward

- 13

- 21

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

##TrumpWithdrawsEUTariffThreats

From Threats to the Table: Trump’s Strategic Retreat

In the opening weeks of January 2026, U.S. President Donald Trump sent shockwaves through global markets by announcing additional customs tariffs—ranging from 10% to 25%—against eight European nations (UK, France, Germany, Denmark, Netherlands, Sweden, Finland, and Norway) that opposed his Arctic strategy and the proposal to purchase Greenland. However, the recent summit in Davos has fundamentally shifted the narrative.

Summit Diplomacy: Following what he described as a "highly productive" meeting with NATO S

From Threats to the Table: Trump’s Strategic Retreat

In the opening weeks of January 2026, U.S. President Donald Trump sent shockwaves through global markets by announcing additional customs tariffs—ranging from 10% to 25%—against eight European nations (UK, France, Germany, Denmark, Netherlands, Sweden, Finland, and Norway) that opposed his Arctic strategy and the proposal to purchase Greenland. However, the recent summit in Davos has fundamentally shifted the narrative.

Summit Diplomacy: Following what he described as a "highly productive" meeting with NATO S

- Reward

- 3

- 4

- Repost

- Share

Thynk :

:

2026 GOGOGO 👊View More

#TrumpWithdrawsEUTariffThreats

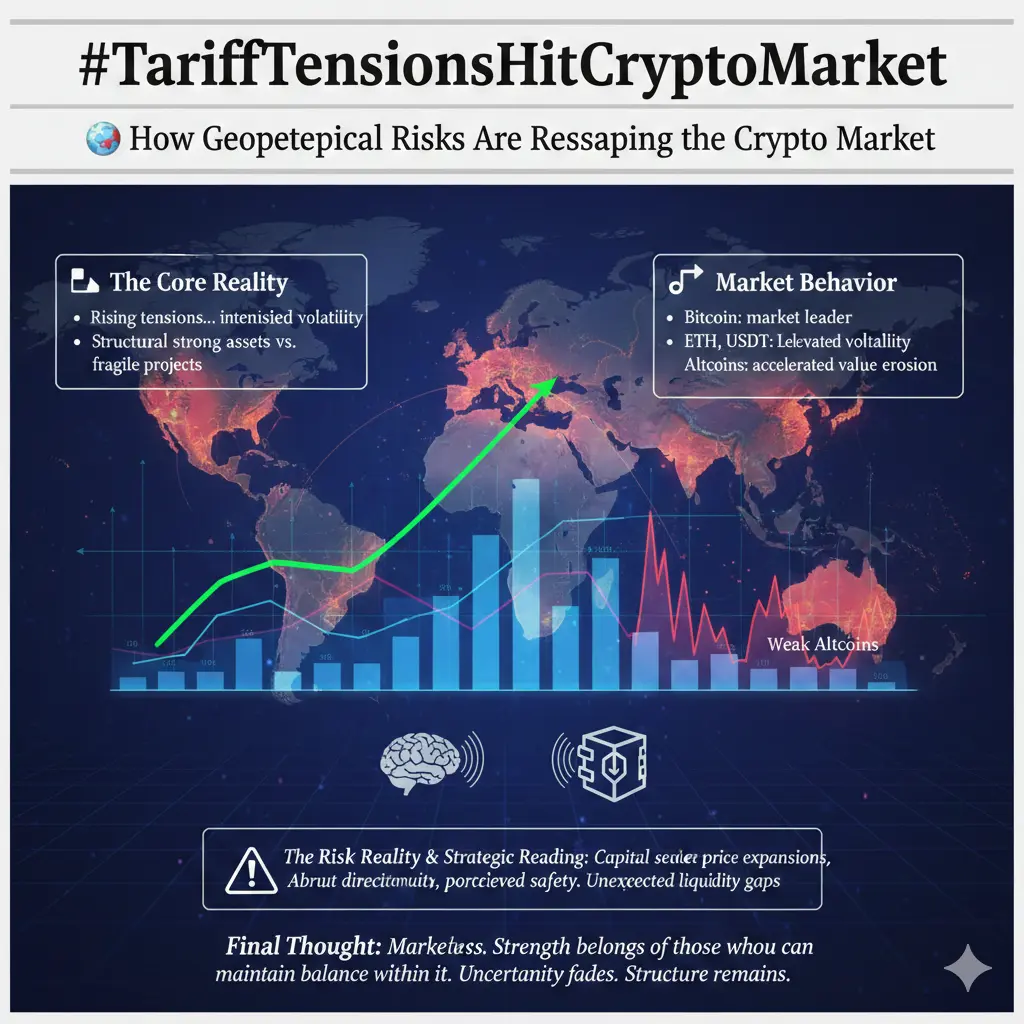

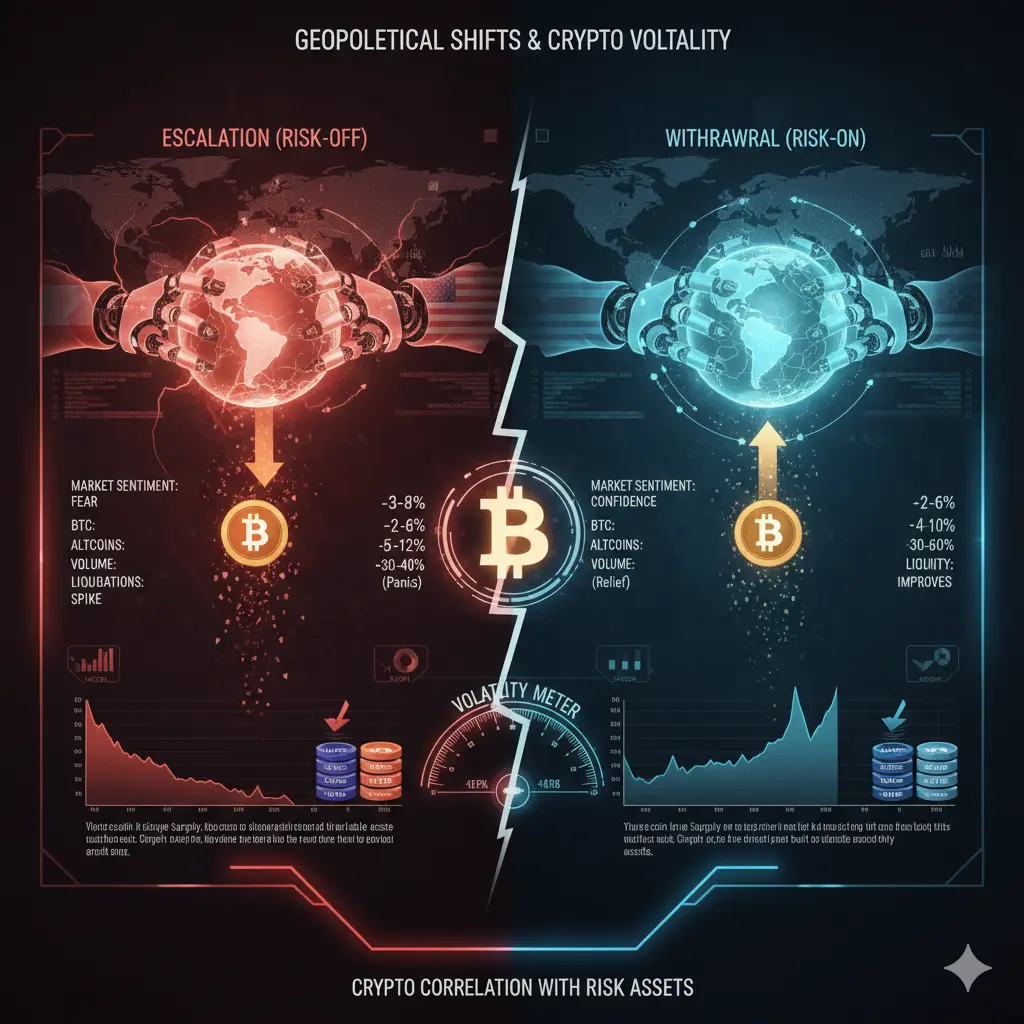

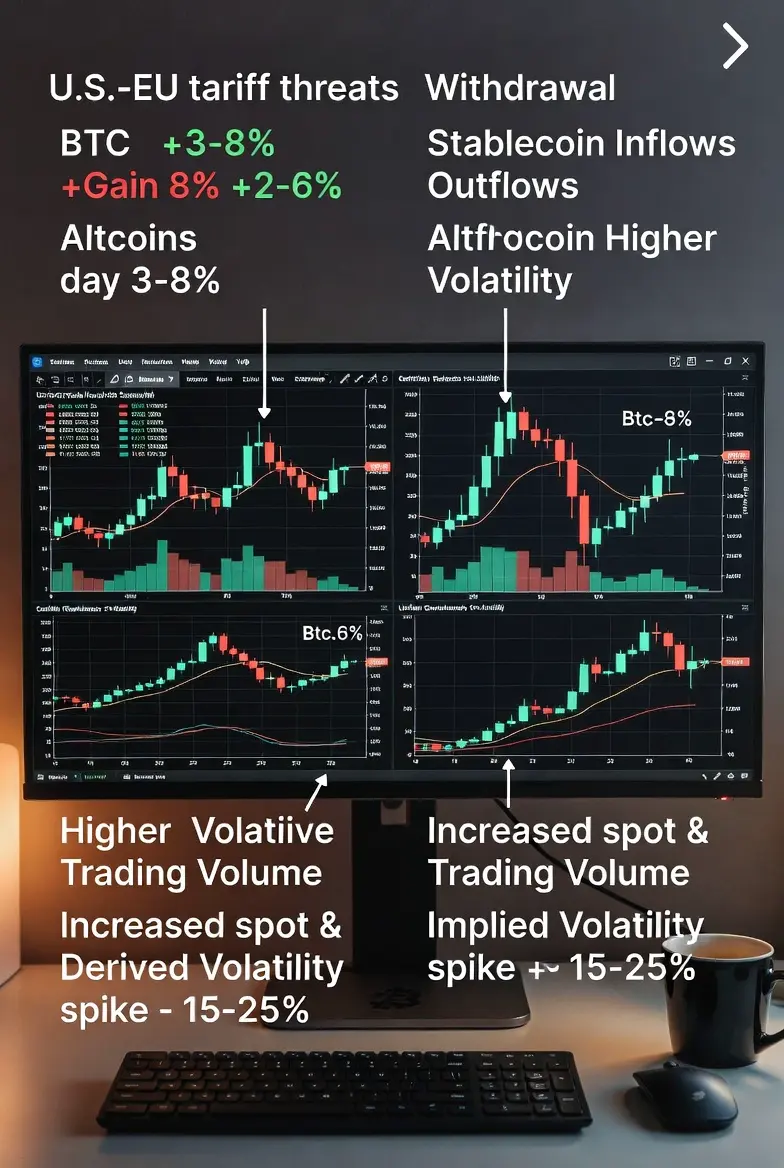

When geopolitical risk like U.S.–EU tariff threats escalates or is withdrawn, crypto markets respond dynamically.

1. Market Sentiment & Risk Appetite

Escalation → Risk-Off:

Investors move out of risky assets. Crypto behaves like equities, not gold, in the short term.

Withdrawal → Risk-On:

Relief restores confidence; traders re-enter positions, raising volume and leverage.

Key Insight:

Crypto’s correlation with traditional risk assets (equities, tech-heavy indices) strengthens during sudden tariff moves.

2. Price & Percentage Changes

Scenario

BTC

Altcoins

Stable

When geopolitical risk like U.S.–EU tariff threats escalates or is withdrawn, crypto markets respond dynamically.

1. Market Sentiment & Risk Appetite

Escalation → Risk-Off:

Investors move out of risky assets. Crypto behaves like equities, not gold, in the short term.

Withdrawal → Risk-On:

Relief restores confidence; traders re-enter positions, raising volume and leverage.

Key Insight:

Crypto’s correlation with traditional risk assets (equities, tech-heavy indices) strengthens during sudden tariff moves.

2. Price & Percentage Changes

Scenario

BTC

Altcoins

Stable

- Reward

- 21

- 28

- Repost

- Share

GateUser-7fb9e999 :

:

hhahhhdkfmnajgggxyudjebbebjakakndbrbbebajaixiicucuuehebbrjakskndbdbwbhahchcuxieowjrbbrbrvbwbajxjcudusView More

#TrumpWithdrawsEUTariffThreats

#TrumpWithdrawsEUTariffThreats shifts the tone in global markets from tension to temporary relief.

After recent risk-off reactions, this move could calm trade fears and improve short-term sentiment across equities and crypto.

Markets often react strongly to tariff headlines, and removing the threat may reduce pressure on risk assets.

But the real question is whether this relief is lasting or just a pause in a larger trade narrative.

If uncertainty fades, we might see confidence return and volatility cool down.

I’m watching how BTC and major assets respond to th

#TrumpWithdrawsEUTariffThreats shifts the tone in global markets from tension to temporary relief.

After recent risk-off reactions, this move could calm trade fears and improve short-term sentiment across equities and crypto.

Markets often react strongly to tariff headlines, and removing the threat may reduce pressure on risk assets.

But the real question is whether this relief is lasting or just a pause in a larger trade narrative.

If uncertainty fades, we might see confidence return and volatility cool down.

I’m watching how BTC and major assets respond to th

BTC0,04%

- Reward

- 13

- 21

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

Tariff threat withdrawal is a "relief" for the market, not a "reversal"

Trump's cancellation of the tariff threat against Europe has the most direct impact on the market, which is not creating new opportunities but eliminating a potential uncertainty. This change is more reflected in the decline of risk premiums rather than a complete reversal of the trend.

Previously, the expectation of tariff escalation has been one of the important factors suppressing market sentiment. Whether in stocks, forex, or commodities, funds have been reserving space for the worst-case scenario. When this threat is

View OriginalTrump's cancellation of the tariff threat against Europe has the most direct impact on the market, which is not creating new opportunities but eliminating a potential uncertainty. This change is more reflected in the decline of risk premiums rather than a complete reversal of the trend.

Previously, the expectation of tariff escalation has been one of the important factors suppressing market sentiment. Whether in stocks, forex, or commodities, funds have been reserving space for the worst-case scenario. When this threat is

- Reward

- 5

- 4

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

#TrumpWithdrawsEUTariffThreats In a dramatic shift in U.S.–European relations, President Donald Trump has withdrawn his threat to impose new tariffs on the United Kingdom and several European Union countries. The tariffs were originally linked to a broader dispute over Greenland and Arctic strategy, but Trump announced that he would no longer pursue them after talks with NATO leadership. He made this announcement publicly during the World Economic Forum in Davos, stating that he had reached a framework for a future deal on Greenland and Arctic security with NATO Secretary General Mark Rutte. A

- Reward

- 14

- 26

- Repost

- Share

CryptoChampion :

:

Ape In 🚀View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

33.02K Popularity

16.46K Popularity

11.6K Popularity

3.02K Popularity

7.62K Popularity

7.96K Popularity

7.74K Popularity

73.89K Popularity

35.66K Popularity

19.81K Popularity

6.58K Popularity

108.95K Popularity

253.7K Popularity

20.19K Popularity

178.83K Popularity

News

View MoreData: 7,499,900 ZRO transferred from BitGo to Wintermute, valued at approximately $17.1 million

12 m

Turkish Foreign Minister: There are signs that Israel is still seeking to attack Iran

33 m

The Trump administration considers implementing a maritime blockade on Cuba's oil imports

33 m

CryptoQuant: Bitcoin holders experience net realized losses for the first time since October 2023

34 m

Wall Street's enthusiasm for the new Dogecoin ETF product is limited

38 m

Pin