# SEC

1.12M

Miwhu_

U.S. Crypto Market Faces Structural Constraints Without Congressional Action

Benchmark, a Wall Street brokerage firm, has indicated that the U.S. cryptocurrency market will face structural limitations if Congress fails to pass a market structure bill this year. According to Odaily, analyst Mark Palmer highlighted in a report that the absence of legislation will lead to a persistent structural risk premium, thereby restricting valuation expansion for platforms influenced by the U.S. This situation is expected to delay the maturation of cryptocurrencies, prompting investors to favor Bitcoin-cent

Benchmark, a Wall Street brokerage firm, has indicated that the U.S. cryptocurrency market will face structural limitations if Congress fails to pass a market structure bill this year. According to Odaily, analyst Mark Palmer highlighted in a report that the absence of legislation will lead to a persistent structural risk premium, thereby restricting valuation expansion for platforms influenced by the U.S. This situation is expected to delay the maturation of cryptocurrencies, prompting investors to favor Bitcoin-cent

BTC0,42%

- Reward

- like

- Comment

- Repost

- Share

#CLARITYBillDelayed

What the Delay of the CLARITY Bill Means for Crypto, DeFi & Stablecoins

The delay of the Digital Asset Market Clarity Act (CLARITY Bill) has once again placed the U.S. crypto industry in a waiting phase — highlighting how critical regulatory certainty has become for digital assets, DeFi protocols, and stablecoins.

The CLARITY Bill was introduced to finally end years of confusion by defining how cryptocurrencies are classified, which regulators oversee them, and how stablecoins and platforms should operate. Its goal is simple but powerful: replace regulation-by-enforcement w

What the Delay of the CLARITY Bill Means for Crypto, DeFi & Stablecoins

The delay of the Digital Asset Market Clarity Act (CLARITY Bill) has once again placed the U.S. crypto industry in a waiting phase — highlighting how critical regulatory certainty has become for digital assets, DeFi protocols, and stablecoins.

The CLARITY Bill was introduced to finally end years of confusion by defining how cryptocurrencies are classified, which regulators oversee them, and how stablecoins and platforms should operate. Its goal is simple but powerful: replace regulation-by-enforcement w

DEFI0,73%

- Reward

- 4

- 4

- Repost

- Share

Yanlin :

:

2026 GOGOGO 👊View More

U.S. CRYPTO REGULATION 2026 🚨 | Power Shift (Gate.io)

• 2026 shaping up as a defining year

• SEC pushes forward major reforms

• CFTC influence continues to rise

• Clearer rules attract institutional capital

• Market structure slowly taking form

• Fear turning into framework

• Volatility before stability

🔥 Smart money prepares early

#CryptoRegulation #SEC #CFTC #Gateio

• 2026 shaping up as a defining year

• SEC pushes forward major reforms

• CFTC influence continues to rise

• Clearer rules attract institutional capital

• Market structure slowly taking form

• Fear turning into framework

• Volatility before stability

🔥 Smart money prepares early

#CryptoRegulation #SEC #CFTC #Gateio

- Reward

- 3

- Comment

- Repost

- Share

🌈 #GateLiveStreamingInspiration - Dec.18

Go live with the following topics now to receive extra official support and promotional exposure!

Today's Topic Recommendations:

🔹 Short-term risk alert: If #Bitcoin breaks below $85,000, cumulative long liquidations across major CEXs could reach $1.052 billion

🔹 Whales keep loading up on #HYPE! Over $17 million added in a single week — signaling a potential explosive move?

🔹 Rate-cut expectations cool again as the Federal Reserve may keep rates unchanged in January

🔹 The U.S.# SEC seeks public comment: crypto trading on national securities exchan

Go live with the following topics now to receive extra official support and promotional exposure!

Today's Topic Recommendations:

🔹 Short-term risk alert: If #Bitcoin breaks below $85,000, cumulative long liquidations across major CEXs could reach $1.052 billion

🔹 Whales keep loading up on #HYPE! Over $17 million added in a single week — signaling a potential explosive move?

🔹 Rate-cut expectations cool again as the Federal Reserve may keep rates unchanged in January

🔹 The U.S.# SEC seeks public comment: crypto trading on national securities exchan

- Reward

- 7

- 4

- Repost

- Share

HighAmbition :

:

1000x Vibes 🤑View More

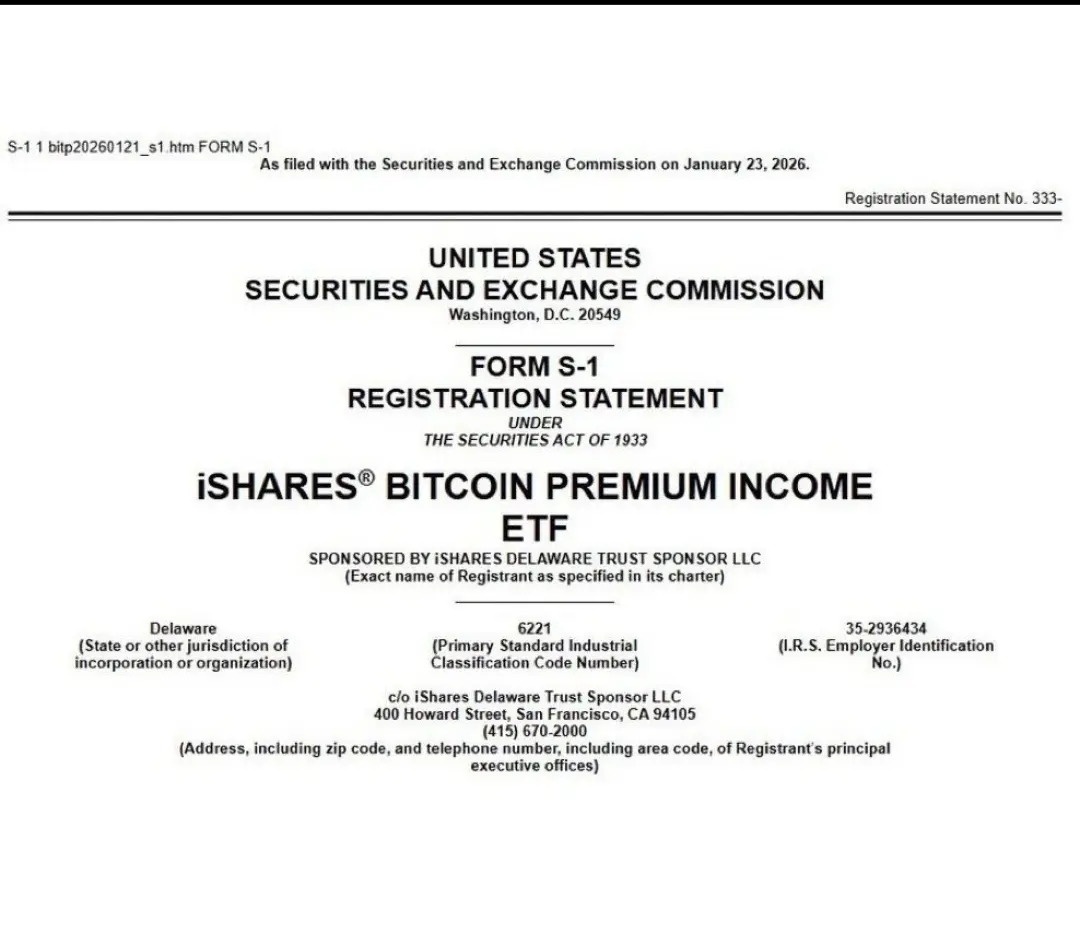

#عاجل🚨🚨🚨 : BlackRock files for a new Bitcoin income-focused exchange-traded fund (ETF)

BlackRock today filed (S-1#ETF with the U.S. Securities and Exchange Commission (SEC) to launch a new Bitcoin income-focused ETF from ).

• The fund offers an investment opportunity with attractive returns.

• The fund generates income by selling covered call options on the IBIT fund (, which has over $70 billion in assets under management ).

• The fund is designed to capitalize on Bitcoin price volatility and reduce potential risks compared to holding Bitcoin directly.

This fund represents the next stage

BlackRock today filed (S-1#ETF with the U.S. Securities and Exchange Commission (SEC) to launch a new Bitcoin income-focused ETF from ).

• The fund offers an investment opportunity with attractive returns.

• The fund generates income by selling covered call options on the IBIT fund (, which has over $70 billion in assets under management ).

• The fund is designed to capitalize on Bitcoin price volatility and reduce potential risks compared to holding Bitcoin directly.

This fund represents the next stage

BTC0,42%

- Reward

- 1

- 1

- Repost

- Share

BasheerAlgundubi :

:

BlackRock builds its products around Bitcoin, not away from it.Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

18.73K Popularity

82.52K Popularity

34.38K Popularity

11.53K Popularity

13.02K Popularity

10.8K Popularity

9.94K Popularity

10.07K Popularity

75.61K Popularity

22.84K Popularity

83.88K Popularity

21.84K Popularity

51.73K Popularity

44.87K Popularity

180.28K Popularity

News

View MoreTesla's stock price increased by 3% after hours

27 m

Tesla's stock price rose 4% after hours, with Q4 earnings per share exceeding expectations

52 m

U.S. stocks close with mixed gains and losses; Intel rises 11%

1 h

Chris Grisanti: Federal Reserve statement leans hawkish, inflation becomes the primary concern

1 h

Spot gold breaks through $5350/oz, reaching a new all-time high

1 h

Pin