2025.11.17

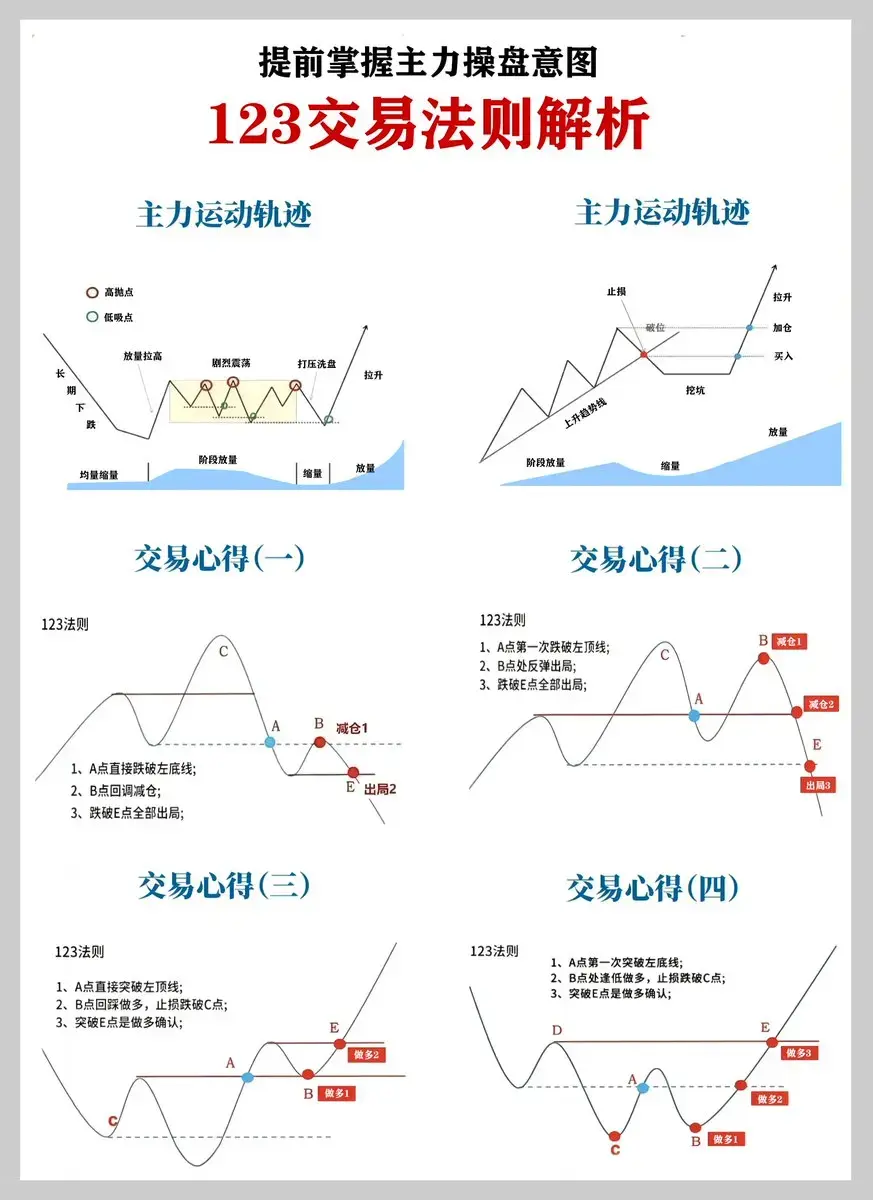

The experiences paved with the blood of predecessors are left here as a reference, hoping not to be blinded in future trades.

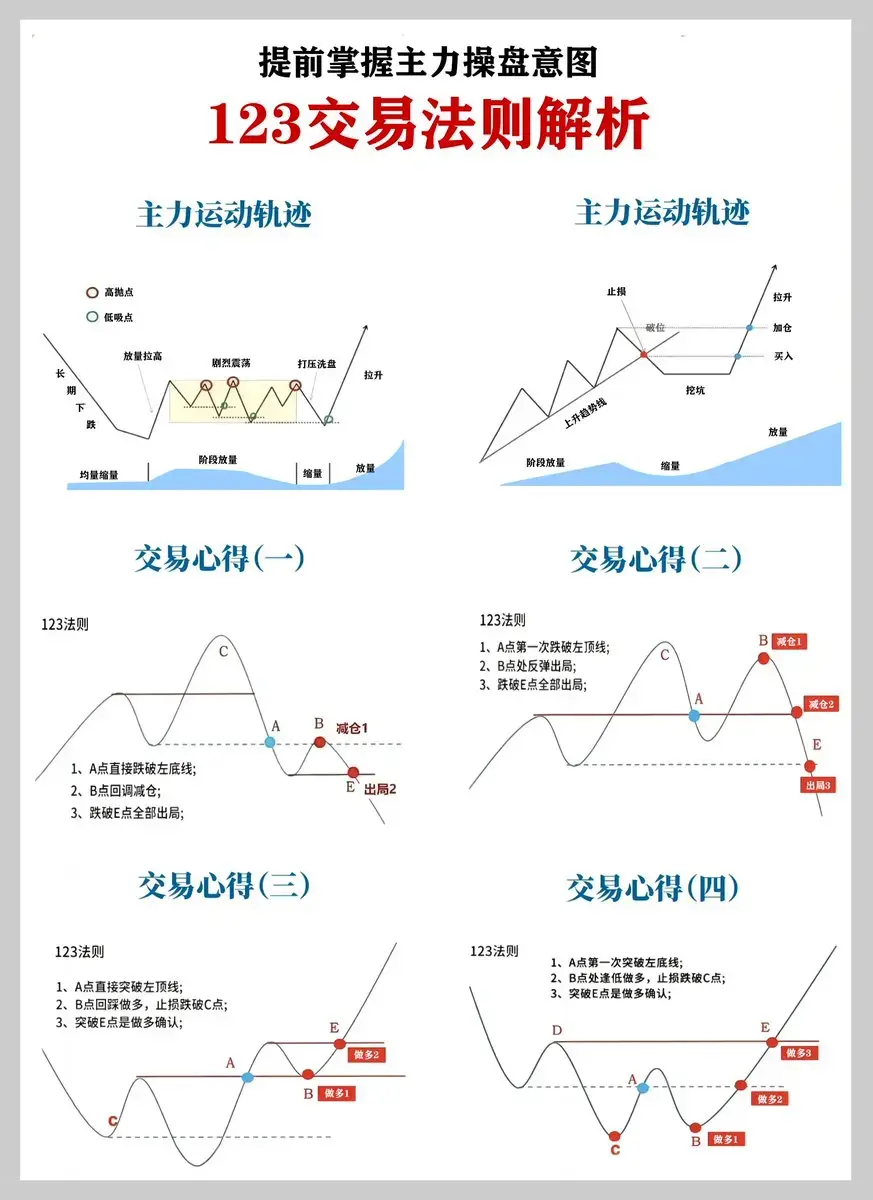

Gann Theory 24 Trading Rules. Read them once before each trade and after a loss. Guaranteed to be useful. Contract strategy...

1. The amount of funds used. Divide your funds into x parts, and do not let each loss exceed one part of the funds.

2. Set a stop-loss order. For example, set a stop-loss for ETH at $20, and for altcoins, set a stop-loss of 5-10 points. Establishing a stop-loss helps protect trade safety and reduce risk!

3. Never overtrade. This will

The experiences paved with the blood of predecessors are left here as a reference, hoping not to be blinded in future trades.

Gann Theory 24 Trading Rules. Read them once before each trade and after a loss. Guaranteed to be useful. Contract strategy...

1. The amount of funds used. Divide your funds into x parts, and do not let each loss exceed one part of the funds.

2. Set a stop-loss order. For example, set a stop-loss for ETH at $20, and for altcoins, set a stop-loss of 5-10 points. Establishing a stop-loss helps protect trade safety and reduce risk!

3. Never overtrade. This will

ETH0.39%