How to Use the Bottom Reversal Pattern—Rounding Bottom

Gate Learn's intermediate futures series helps users build a structured framework for technical analysis, covering candlestick basics, chart patterns, moving averages, and trendlines, as well as technical indicators. In this article, we focus on the bottom reversal pattern—Rounding Bottom, covering its definition, features, application in BTC markets, and key considerations.

What Is a Rounding Bottom

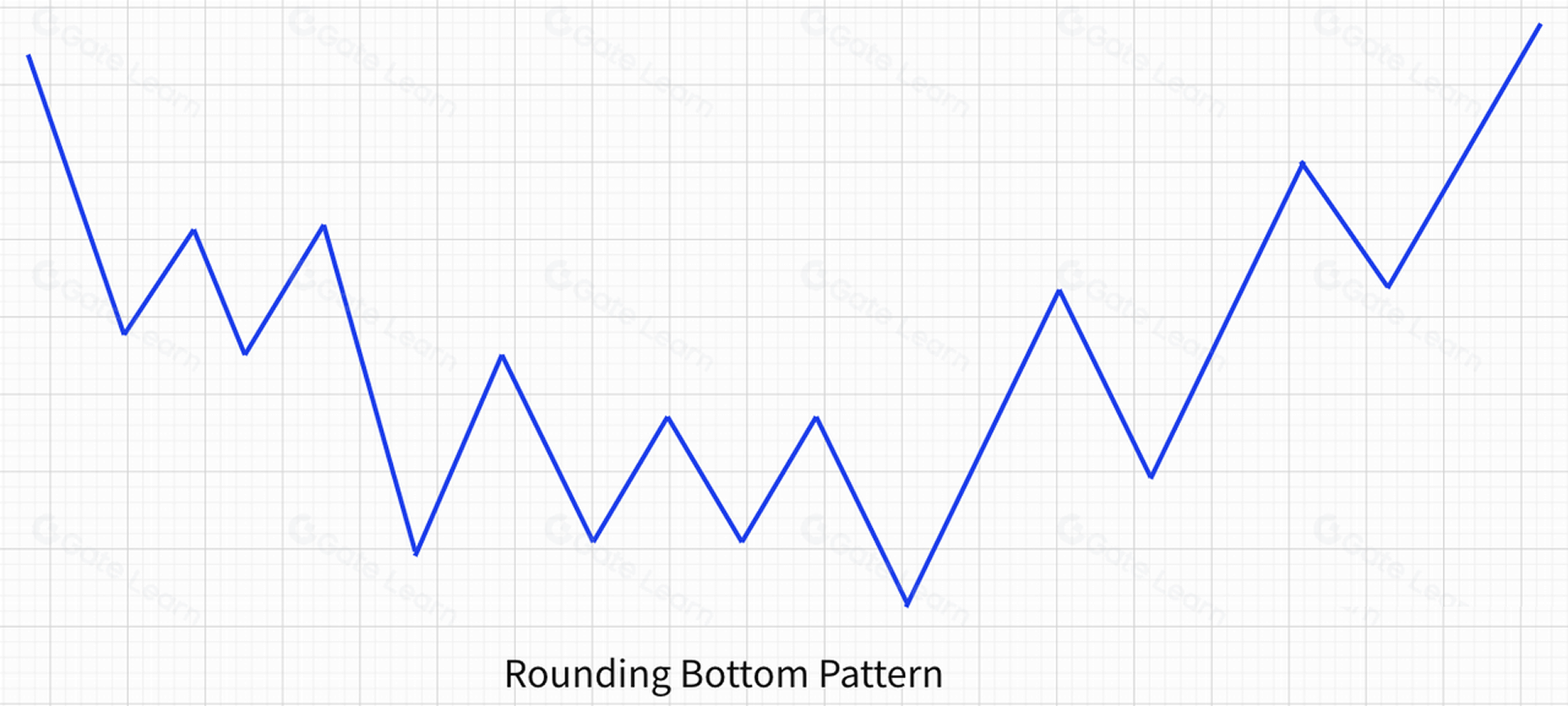

A Rounding Bottom pattern refers to a price pattern where the downturn slows gradually, accompanied by declining volume. The price then stops falling and moves sideways for a period, followed by a slow recovery that accelerates over time, with volume expanding as the price rises. Because the shape resembles a rounded arc, it is called a Rounding Bottom. See the figure below:

Technical Characteristics of a Rounding Bottom

- It may appear at the end of a downtrend or in the middle of an uptrend.

- Prices initially fall and rebound quickly. As traders’ participation weakens, both declines and rebounds become more subdued, eventually leading to sideways consolidation. When new capital flows in, prices begin to rise slowly, then gain momentum as more buyers enter, pushing the market upward.

- Volume contracts as the downtrend slows, reaching its minimum during sideways consolidation, then increases gradually during the rise. During strong rallies, volume expands significantly. On candlestick charts, the volume histogram often shows a rounded shape as well.

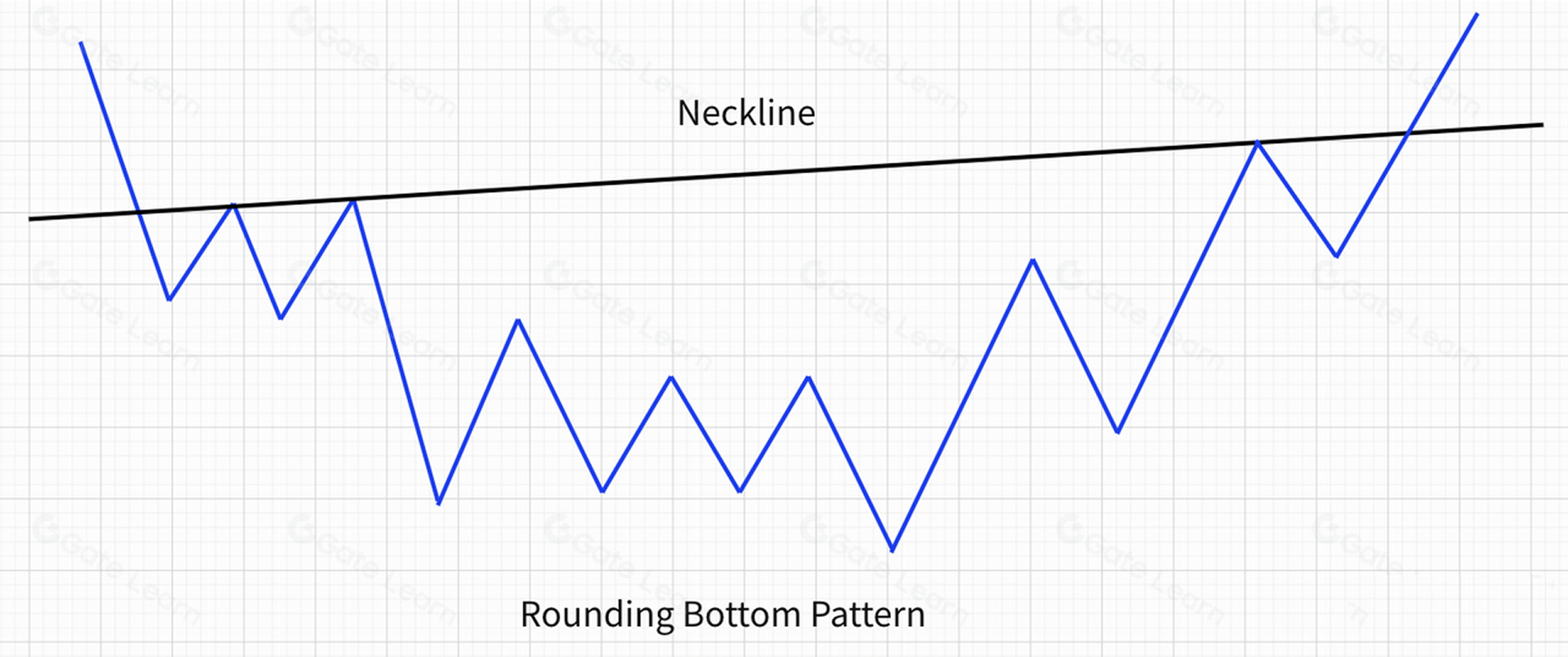

- A line drawn across the pattern’s highest resistance points is called the neckline, as shown below.

Technical Implications of a Rounding Bottom

- A rounding bottom is considered a reliable reversal signal. Traders may enter long when the price breaks above the neckline, or enter earlier—before the pattern fully completes—based on other trend signals and gradually build a long position.

- The uptrend following a successful rounding bottom is often reliable, sustained, fast, and strong, making this pattern relatively easier to trade profitably. However, as the pattern forms slowly with small price fluctuations, many traders overlook it or lose patience.

Applications of the Rounding Bottom Pattern

The longer a rounding bottom takes to form, the more energy it accumulates. A breakout after a long formation period often leads to a much stronger and more persistent rally, as shown below:

Take ETH as an example. From Jan 2018 to Jan 2019, ETH fell from around $1,300 to $81—over 90% in a single year. From Jan 2019 to Mar 2020, ETH consolidated between $100 and $400 for nearly a year. Technically, the entire structure formed a standard rounding bottom, and the extended duration stored substantial upward momentum. Starting in Mar 2020, ETH entered a massive bull market, rallying more than 5,000%.

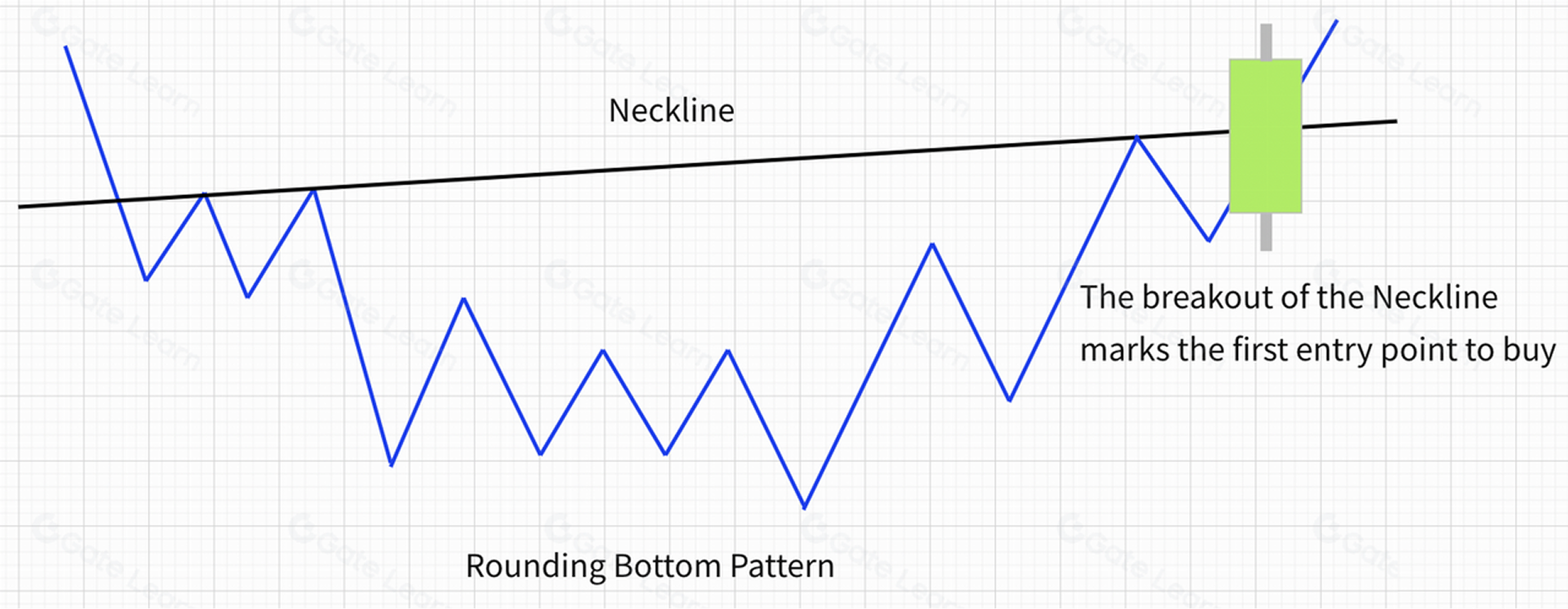

1.Rounding Bottom Entry Point 1: Breakout Above the Neckline

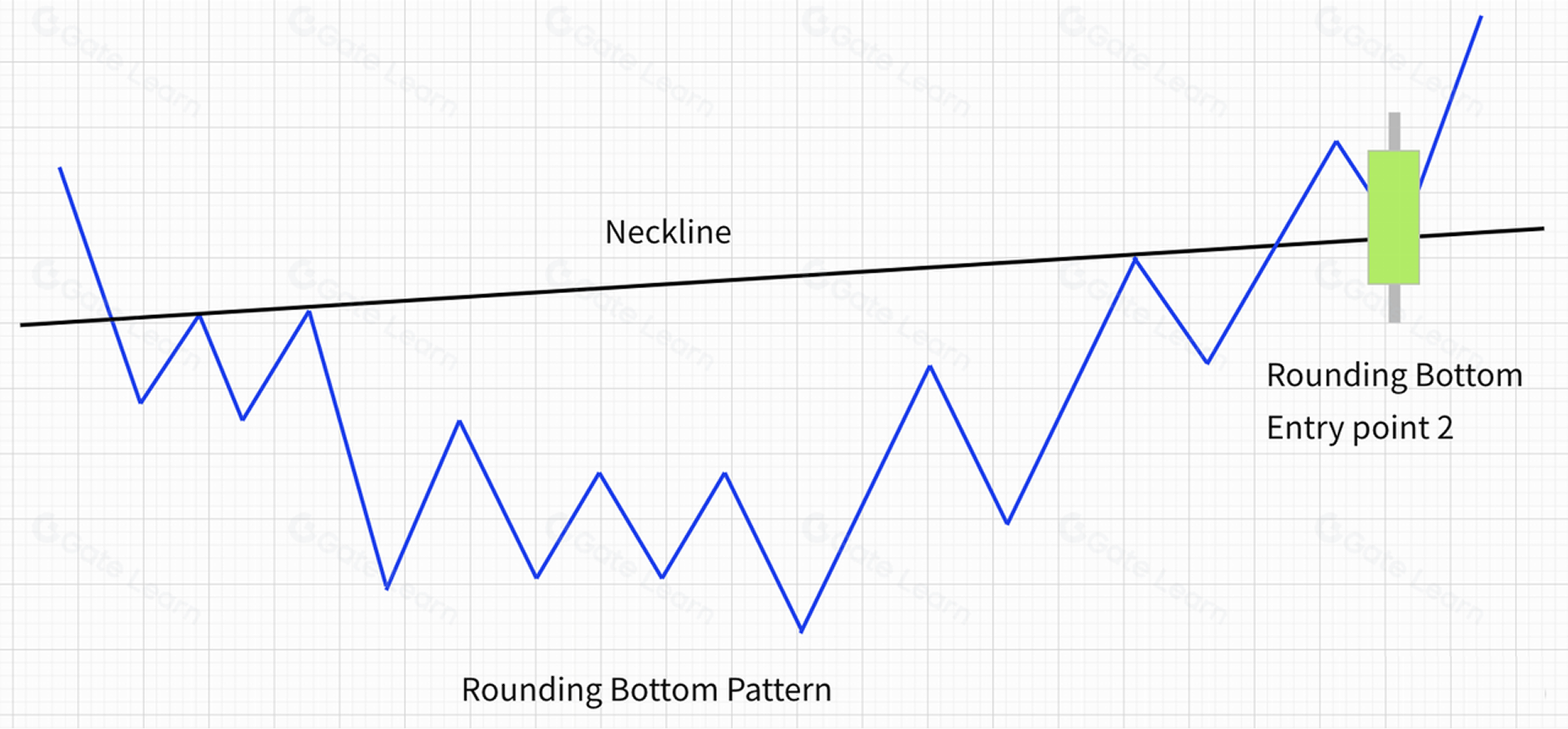

2.Rounding Bottom Entry Point 2: Retest of the Neckline

After breaking the neckline, aggressive buyers often push the price up, after which it pulls back. When the price successfully retests the neckline and holds, a second entry opportunity appears. See the figure below:

Some rounding bottom patterns provide early buy signals even before the neckline is broken. Because the pattern forms over a long period, other bullish signals—such as a breakout of a medium- or long-term downtrend line—may appear beforehand. Combining these with other indicators increases reliability.

• The length of the rounding bottom’s formation period often correlates with the strength and duration of the subsequent rally: the longer the base, the stronger the rise.

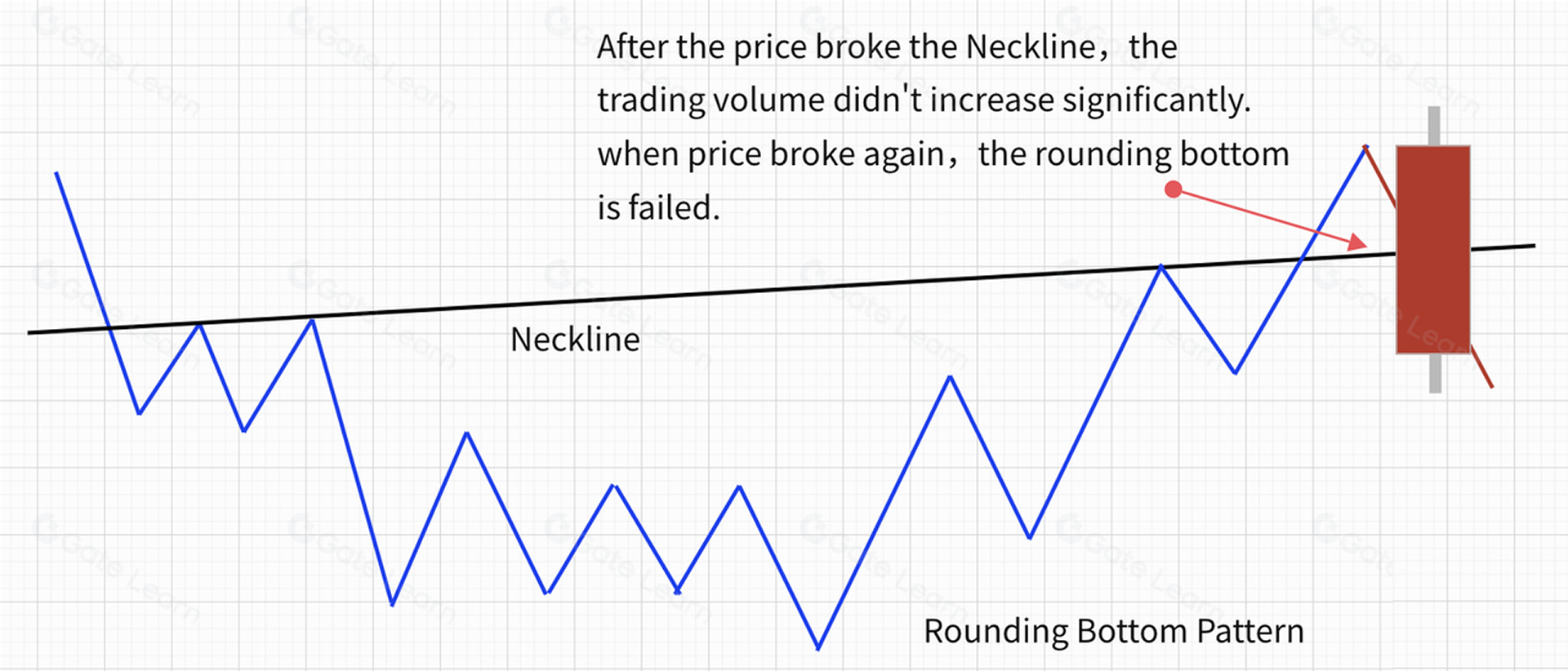

• If the neckline breakout occurs without sufficient volume, the rounding bottom may fail.

The figure above shows a failed rounding bottom pattern. In this example, although the price formed a nearly perfect rounding bottom, the neckline breakout failed due to strong resistance and heavy selling volume. The price then reversed downward, invalidating the pattern.

Summary

Rounding bottoms are common, especially during prolonged bear-market bottoms, as both capital and investor confidence take time to recover. Once a rounding bottom completes successfully, it provides reliable long entry opportunities and often leads to a strong upward trend.

For more information on futures trading, please visit the Gate futures platform and sign up to start your futures trading journey.

Disclaimer

This article is for informational purposes only. The information provided by Gate does not constitute investment advice, nor does Gate bear responsibility for any investment decisions made by users. Content involving technical analysis, market interpretation, trading strategies, or trader insights may include potential risks, uncertainties, and market variables. Nothing in this article guarantees profits, either explicitly or implicitly.