Common Bullish Candlestick Patterns

Gate Learn's intermediate futures series helps users build a complete framework for technical analysis, covering candlestick basics, chart patterns, moving averages, and trendlines, and the use of technical indicators. In this lesson, we introduce common bullish candlestick patterns to help traders identify potential upward signals in real trading and better capture trading opportunities.

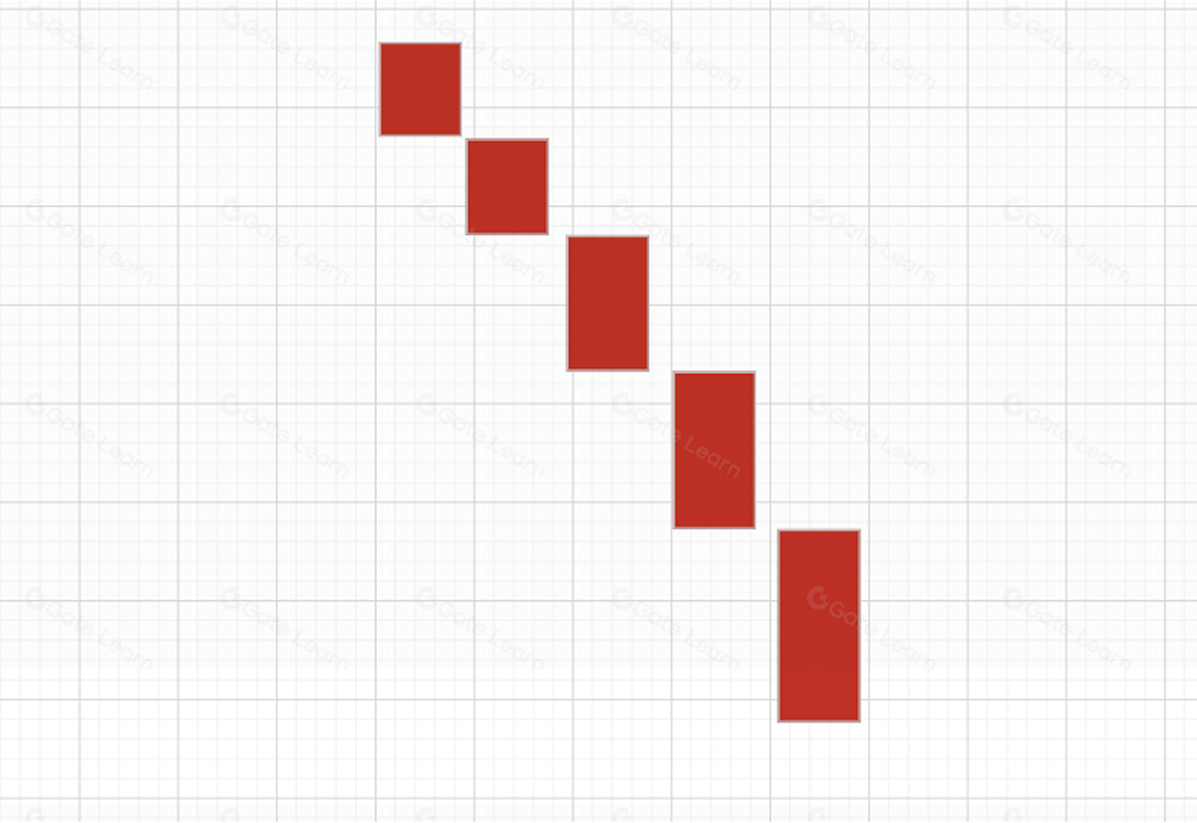

Bearish Acceleration

- Technical Characteristics A bearish acceleration pattern refers to a candlestick sequence where the price decline becomes increasingly rapid during a downtrend, as shown in Figure 2-1. (1) Appears in a downtrend. (2) The decline starts slowly, then accelerates, forming consecutive medium or large bearish candles.

- Technical Implications A bearish acceleration pattern often signals that the price is nearing a bottom, and a rebound becomes highly likely.

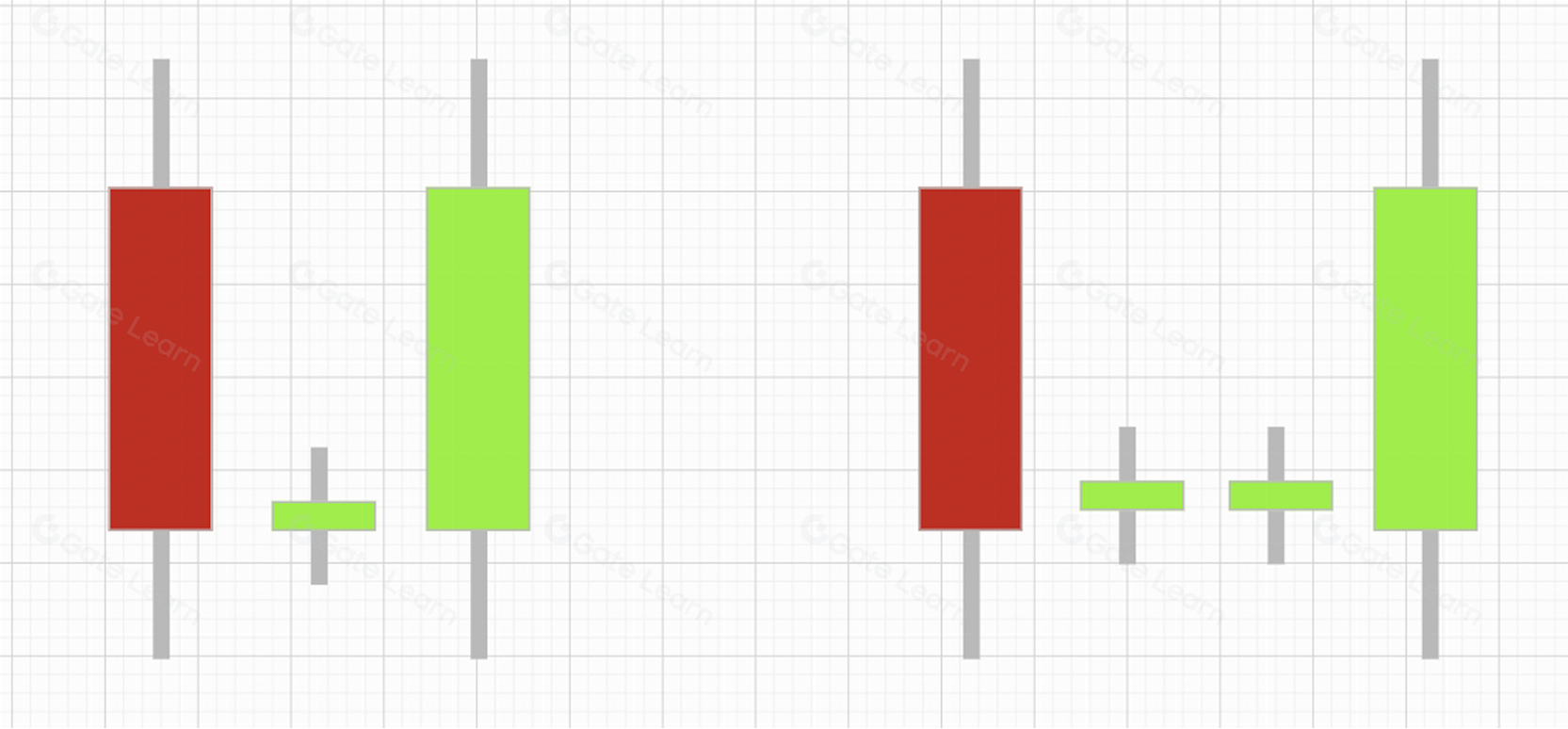

Morning Star

- Technical Characteristics (1) Appears in a downtrend. (2) Composed of three candlesticks—a bearish candle, followed by a small bearish or bullish candle (or a doji) with a lower opening, and finally a bullish candle; (3) The third candle’s body penetrates into the body of the first candle.

- Technical Implications The Morning Star is a classic bullish reversal pattern, indicating a potential trend reversal to the upside.

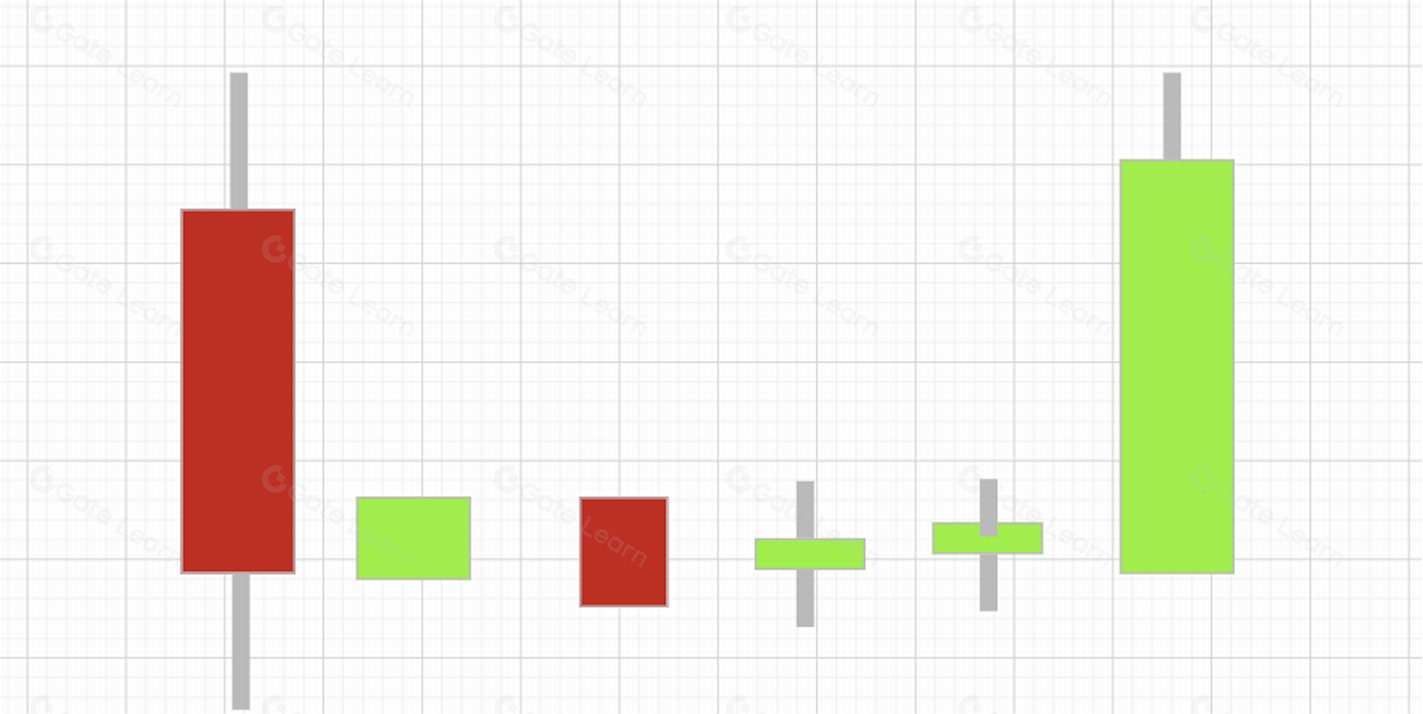

Rising Sun

- Technical Characteristics (1) Appears in a downtrend; (2) First forms a large bearish candle, followed by a large bullish candle that opens higher and closes higher; (3) The bullish candle’s close is above the bearish candle’s open.

- Technical Implication The bullish engulfing pattern is a strong bullish reversal pattern, suggesting a potential upward move.

Rounding Bottom

- Technical Characteristics (1) Appears in a downtrend or consolidation phase; (2) Begins with a large bearish candle, followed by several small bullish and bearish candles forming a rounded, arc-shaped bottom.

- Technical Implication The rounded bottom is a strong bullish reversal pattern, suggesting a potential upward move.

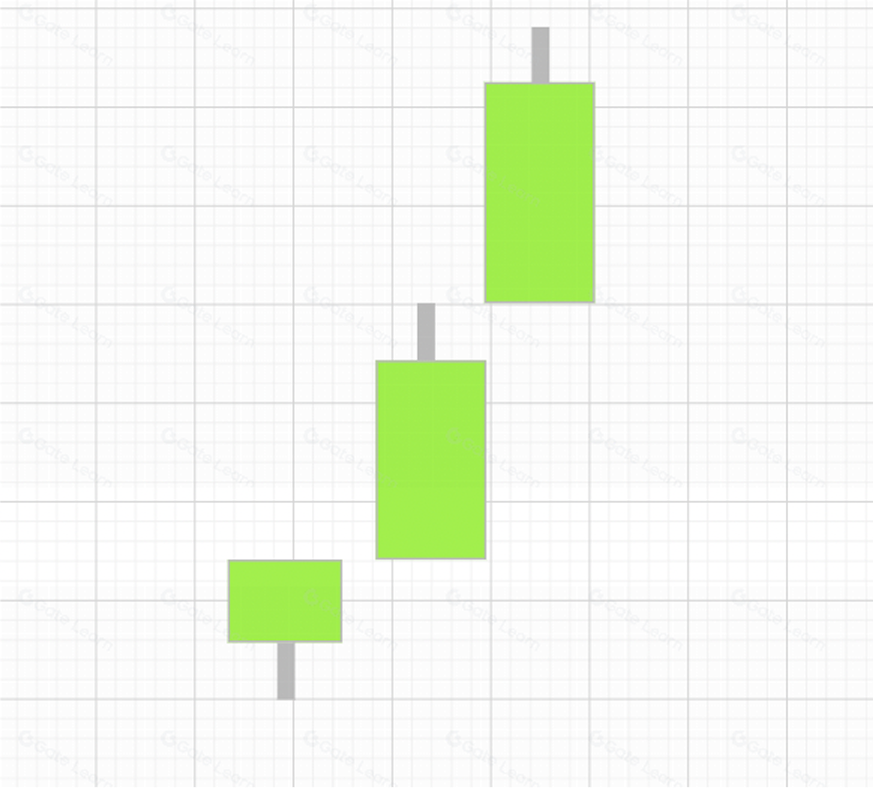

Three White Soldiers

- Technical Characteristics (1) Appears at the early stage of an uptrend or after consolidation; (2) Consists of three consecutive small bullish candles, each reaching a higher high.

- Technical Implication The three white soldiers pattern is a strong buy signal, indicating bullish continuation.

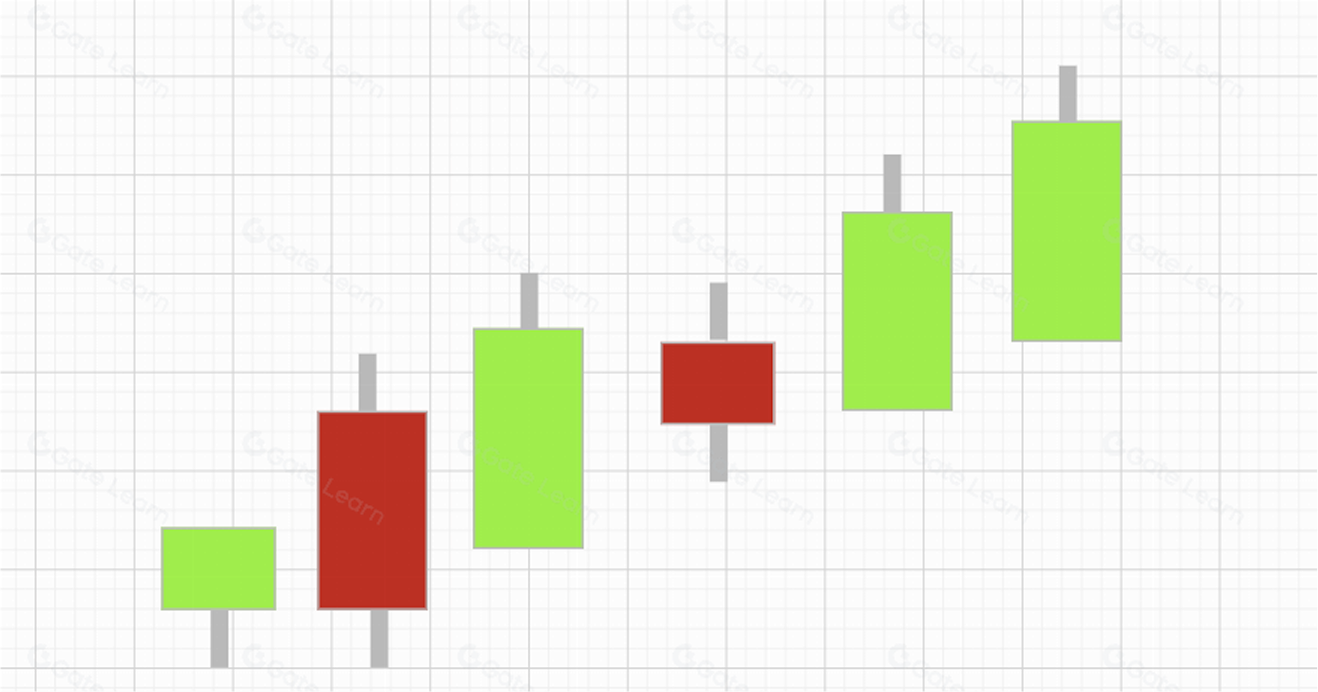

Steady Rise

- Technical Characteristics (1) Appears in an uptrend; (2) Many bullish candles are interspersed with a few small bearish candles; (3) The overall candlestick sequence slopes upward.

- Technical Implication A steady rise pattern signals bullish continuation and is a buy signal.

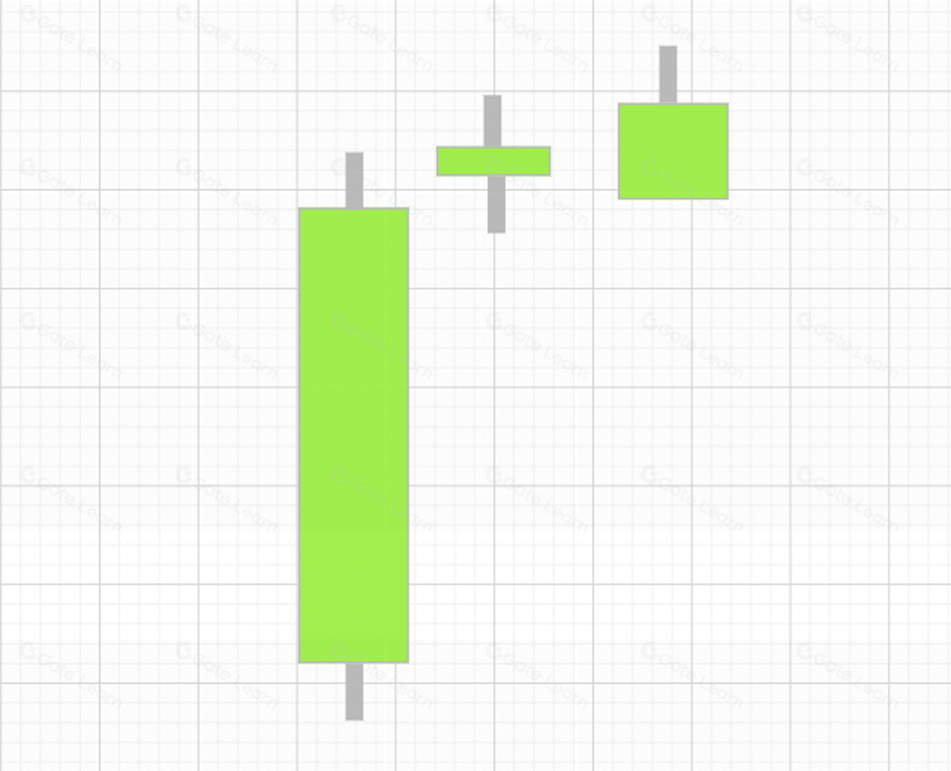

Rising Two Stars

- Technical Characteristics (1) Appears in an uptrend; (2) Composed of three candlesticks—a large bullish candle followed by two small candles above it. The small candles may be dojis, small bullish candles, or small bearish candles.

- Technical Implication This pattern is a bullish continuation pattern, indicating further upside potential.

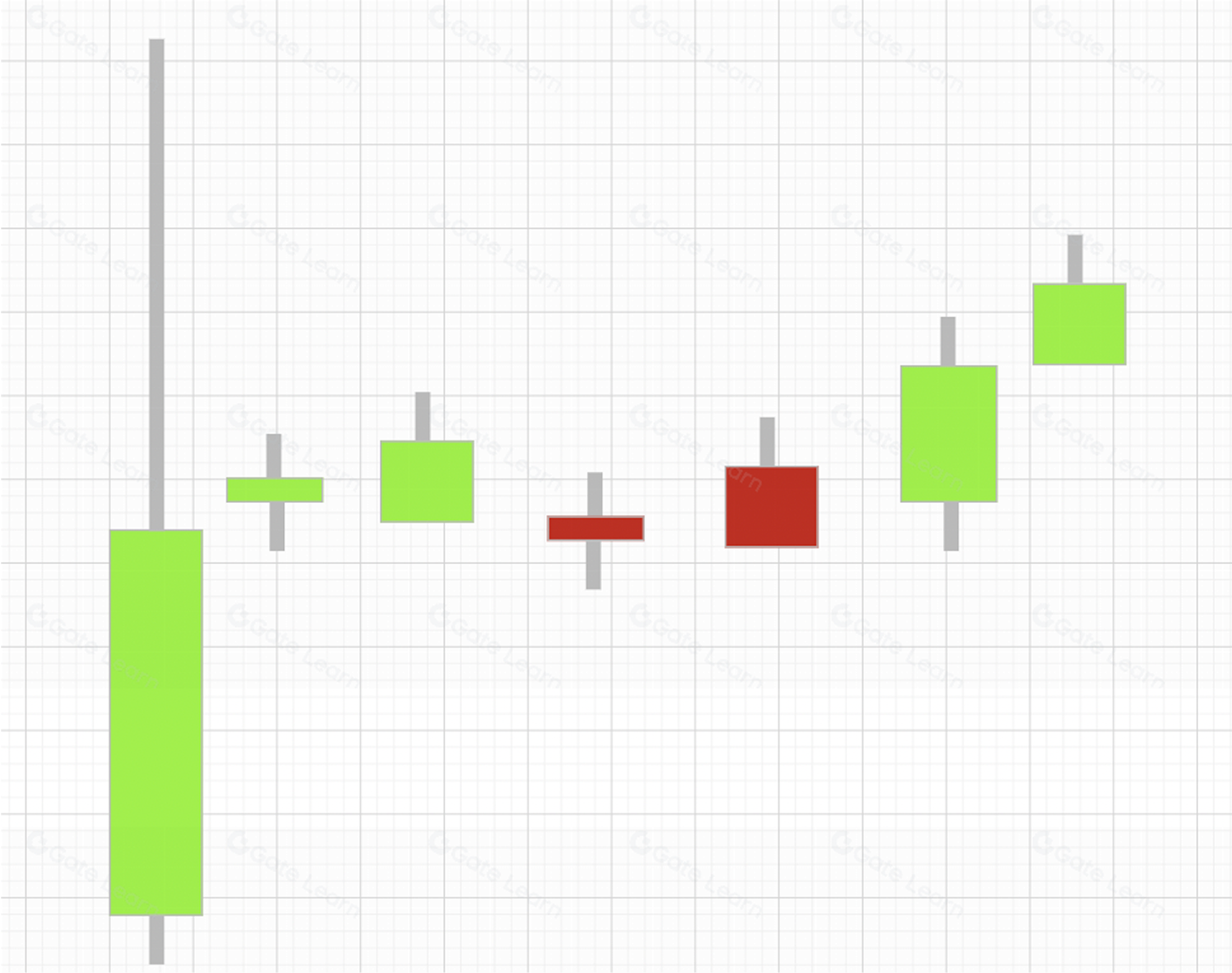

Guiding Candle

- Technical Characteristics (1) Appears in an uptrend; (2) Formed by a series of candlesticks; (3) A large bullish candle with a long upper shadow appears; (4) After a brief pullback, the price rises again above the upper shadow.

- Technical Implication This pattern is considered a buy signal, suggesting bullish continuation.

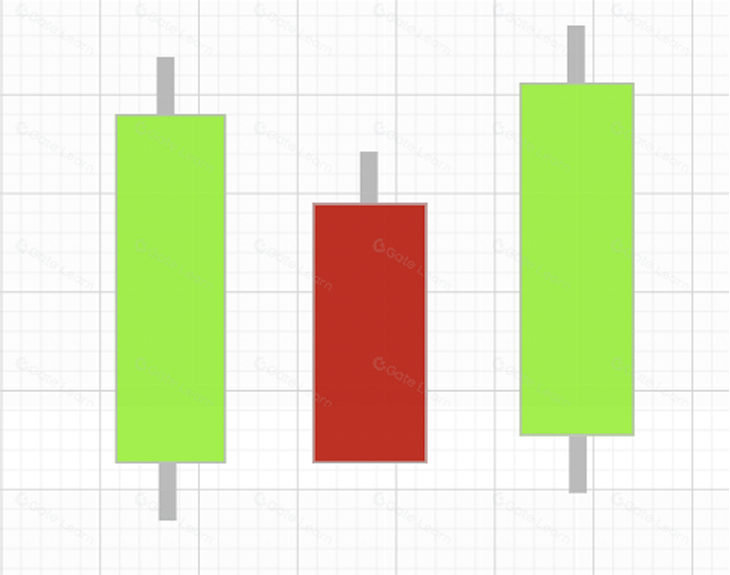

A Bearish Sandwiched Between Two Bearish

- Technical Characteristics (1) Can appear in both uptrends and downtrends; (2) Consists of a shorter bearish candle sandwiched between two longer bullish candles; (3) The three candles share a similar midpoint level.

- Technical Implication (1) In an uptrend: a bullish continuation signal—holding is recommended; (2) In a downtrend: may indicate a bottom and potential reversal.

Summary

This lesson covers the most common bullish candlestick combinations—from pattern structures to their technical implications. In practice, traders should avoid rigid interpretation. Using candlestick patterns alongside other strategies and indicators provides stronger confirmation and improves win rates. Apply what you’ve learned and train through practice—only then can you navigate the futures market with confidence. Visit the Gate futures platform and sign up to start your futures trading journey.

Disclaimer

This article is for informational purposes only. The information provided by Gate does not constitute investment advice, nor does Gate bear responsibility for any investment decisions made by users. Content involving technical analysis, market interpretation, trading strategies, or trader insights may include potential risks, uncertainties, and market variables. Nothing in this article guarantees profits, either explicitly or implicitly.