# CryptoMarketWatch

225.43K

Recent market volatility has intensified, with growing divergence between bulls and bears. Are you leaning bullish or cautious on what comes next? What signals are you watching and how are you positioning? Share your views.

EagleEye

#CryptoMarketWatch

Vigilancia del Mercado Cripto: Análisis Estratégico en Medio de una Volatilidad Aumentada y Sentimientos Divergentes

El mercado de criptomonedas está navegando actualmente por una de sus fases más volátiles y con sentimientos divergentes en la memoria reciente. En las últimas semanas, los principales activos digitales, incluyendo Bitcoin, Ethereum y una variedad de altcoins, han experimentado oscilaciones de precios de amplio rango, reflejando una combinación de presiones macroeconómicas, rotación de liquidez y narrativas específicas de activos. Estas condiciones resaltan l

Ver originalesVigilancia del Mercado Cripto: Análisis Estratégico en Medio de una Volatilidad Aumentada y Sentimientos Divergentes

El mercado de criptomonedas está navegando actualmente por una de sus fases más volátiles y con sentimientos divergentes en la memoria reciente. En las últimas semanas, los principales activos digitales, incluyendo Bitcoin, Ethereum y una variedad de altcoins, han experimentado oscilaciones de precios de amplio rango, reflejando una combinación de presiones macroeconómicas, rotación de liquidez y narrativas específicas de activos. Estas condiciones resaltan l

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

#CryptoMarketWatch Destacados de la Comunidad 🟢

1️⃣ Análisis de mercado muy sólido. El equilibrio entre la presión macro, los niveles técnicos y las señales en cadena hace que este análisis sea extremadamente valioso para todos los participantes.

2️⃣ Gran desglose de BTC y ETH en zonas clave de decisión. La clara distinción entre alivio a corto plazo y riesgo estructural más amplio es muy perspicaz.

3️⃣ Este es el tipo de análisis cripto realista que los traders necesitan ahora mismo—sin hype, solo niveles, liquidez y planificación de escenarios disciplinada.

4️⃣ Fuerte visión sobre la limpie

Ver originales1️⃣ Análisis de mercado muy sólido. El equilibrio entre la presión macro, los niveles técnicos y las señales en cadena hace que este análisis sea extremadamente valioso para todos los participantes.

2️⃣ Gran desglose de BTC y ETH en zonas clave de decisión. La clara distinción entre alivio a corto plazo y riesgo estructural más amplio es muy perspicaz.

3️⃣ Este es el tipo de análisis cripto realista que los traders necesitan ahora mismo—sin hype, solo niveles, liquidez y planificación de escenarios disciplinada.

4️⃣ Fuerte visión sobre la limpie

- Recompensa

- 1

- 1

- Republicar

- Compartir

Discovery :

:

GOGOGO 2026 👊#CryptoMarketWatch 1️⃣ Análisis de mercado muy sólido. El equilibrio entre la presión macro, los niveles técnicos y las señales en cadena hace que este análisis sea extremadamente valioso.

2️⃣ Gran desglose de BTC y ETH en zonas de decisión. Me gusta la clara separación entre alivio a corto plazo y riesgo estructural más amplio.

3️⃣ Este es el tipo de análisis cripto realista que los traders necesitan ahora mismo. Sin hype, solo niveles, liquidez y escenarios disciplinados.

4️⃣ Fuerte visión sobre la limpieza de apalancamiento y su impacto en la estructura del mercado. El contexto de la caída

Ver originales2️⃣ Gran desglose de BTC y ETH en zonas de decisión. Me gusta la clara separación entre alivio a corto plazo y riesgo estructural más amplio.

3️⃣ Este es el tipo de análisis cripto realista que los traders necesitan ahora mismo. Sin hype, solo niveles, liquidez y escenarios disciplinados.

4️⃣ Fuerte visión sobre la limpieza de apalancamiento y su impacto en la estructura del mercado. El contexto de la caída

- Recompensa

- 4

- 2

- Republicar

- Compartir

MingDragonX :

:

GOGOGO 2026 👊Ver más

📢 #CryptoMarketWatch | Gate Square Diario — 3 de febrero de 2026

El tono del mercado de hoy está cambiando silenciosamente — de pánico a posicionamiento estratégico.

Esto es lo que realmente está sucediendo debajo de la volatilidad 👇

1️⃣ La acumulación institucional continúa

La estrategia ahora posee 713,502 BTC a un precio promedio de $76,052.

Los grandes actores no están huyendo — están construyendo exposición a largo plazo de manera constante.

2️⃣ Rotación de capital en Ethereum

Bitmine añadió 41,788 ETH, acercando las participaciones totales de ETH a casi $9.9B.

Mientras los minoristas d

Ver originalesEl tono del mercado de hoy está cambiando silenciosamente — de pánico a posicionamiento estratégico.

Esto es lo que realmente está sucediendo debajo de la volatilidad 👇

1️⃣ La acumulación institucional continúa

La estrategia ahora posee 713,502 BTC a un precio promedio de $76,052.

Los grandes actores no están huyendo — están construyendo exposición a largo plazo de manera constante.

2️⃣ Rotación de capital en Ethereum

Bitmine añadió 41,788 ETH, acercando las participaciones totales de ETH a casi $9.9B.

Mientras los minoristas d

- Recompensa

- 2

- 1

- Republicar

- Compartir

MrFlower_ :

:

GOGOGO 2026 👊#CryptoMarketWatch

El mercado de criptomonedas muestra un rebote de alivio después de un fin de semana muy difícil. Los precios cayeron bruscamente debido a tensiones geopolíticas, altas tasas de interés y la incertidumbre regulatoria en EE. UU., pero los compradores intervinieron cerca de niveles clave de soporte.

Bitcoin cayó hasta $74,000, y Ethereum bajó cerca de $2,100 antes de recuperarse. Este movimiento parece marcar el fin de una fase bajista que comenzó con una limpieza de apalancamiento en finales de 2025. Ahora, tanto BTC como ETH están en zonas de decisión importantes.

Resumen de

Ver originalesEl mercado de criptomonedas muestra un rebote de alivio después de un fin de semana muy difícil. Los precios cayeron bruscamente debido a tensiones geopolíticas, altas tasas de interés y la incertidumbre regulatoria en EE. UU., pero los compradores intervinieron cerca de niveles clave de soporte.

Bitcoin cayó hasta $74,000, y Ethereum bajó cerca de $2,100 antes de recuperarse. Este movimiento parece marcar el fin de una fase bajista que comenzó con una limpieza de apalancamiento en finales de 2025. Ahora, tanto BTC como ETH están en zonas de decisión importantes.

Resumen de

- Recompensa

- 9

- 8

- Republicar

- Compartir

Ryakpanda :

:

Carrera de 2026 👊Ver más

$ARC #arc #$ARC #ARC #CryptoMarketWatch

🔴 ALERTA DE VENTA FUERTE ARC

🚨 Zona de riesgo activa

📉 $0.070 – $0.075

→ Posibilidad de RECHAZO fuerte

→ Entrada en intercambio ↑

→ Pago a Market Maker + bot

⚠️ En esta etapa, la CODICIA = PÉRDIDA

⸻

❌ ¿QUÉ PASA?

• El precio resiste la resistencia

• Grandes carteras agotan liquidez

• Minoristas compran, los inteligentes salen

Esta es una estructura clásica de FALSA ALZA → CAÍDA.

⸻

🔻 PLAN

• VENDER gradualmente

• Retrasar el TP

• MANTENER solo si se recupera el soporte

📌 Si se rompe el soporte:

➡️ Por debajo d

🔴 ALERTA DE VENTA FUERTE ARC

🚨 Zona de riesgo activa

📉 $0.070 – $0.075

→ Posibilidad de RECHAZO fuerte

→ Entrada en intercambio ↑

→ Pago a Market Maker + bot

⚠️ En esta etapa, la CODICIA = PÉRDIDA

⸻

❌ ¿QUÉ PASA?

• El precio resiste la resistencia

• Grandes carteras agotan liquidez

• Minoristas compran, los inteligentes salen

Esta es una estructura clásica de FALSA ALZA → CAÍDA.

⸻

🔻 PLAN

• VENDER gradualmente

• Retrasar el TP

• MANTENER solo si se recupera el soporte

📌 Si se rompe el soporte:

➡️ Por debajo d

ARC57,37%

- Recompensa

- 3

- Comentar

- Republicar

- Compartir

#CryptoMarketWatch

CryptoMarketWatch

Este análisis de 600 palabras cubre las cinco principales criptomonedas con niveles clave de soporte, zonas de resistencia y posibles próximos movimientos del mercado basados en la acción del precio actual y la estructura técnica.

Bitcoin BTC

Bitcoin sigue siendo el líder del mercado y continúa controlando el sentimiento general de las criptomonedas.

El precio actual está alrededor de 77211 USD.

Niveles de soporte. El soporte inmediato se encuentra entre 74000 y 75000. Esta zona ha actuado como una fuerte área de demanda durante los retrocesos recientes. P

Ver originalesCryptoMarketWatch

Este análisis de 600 palabras cubre las cinco principales criptomonedas con niveles clave de soporte, zonas de resistencia y posibles próximos movimientos del mercado basados en la acción del precio actual y la estructura técnica.

Bitcoin BTC

Bitcoin sigue siendo el líder del mercado y continúa controlando el sentimiento general de las criptomonedas.

El precio actual está alrededor de 77211 USD.

Niveles de soporte. El soporte inmediato se encuentra entre 74000 y 75000. Esta zona ha actuado como una fuerte área de demanda durante los retrocesos recientes. P

- Recompensa

- 4

- 4

- Republicar

- Compartir

HighAmbition :

:

Observando de cerca 🔍️Ver más

#CryptoMarketWatch 📉 Resumen del Mercado Cripto – Principios de Febrero de 2026

Bitcoin (BTC) está luchando por mantenerse por debajo de niveles clave de soporte, cotizando cerca de $75K–$78K después de una gran venta que provocó liquidaciones generalizadas en el mercado. La caída eliminó más de $2.5B en posiciones de BTC y ha llevado los precios a mínimos de varios meses.

Ethereum (ETH) también siente la presión, con precios por debajo de $2,200–$2,100 en medio de un sentimiento de aversión al riesgo en el mercado.

XRP enfrenta una volatilidad aumentada; los mercados de predicción esperan

Ver originalesBitcoin (BTC) está luchando por mantenerse por debajo de niveles clave de soporte, cotizando cerca de $75K–$78K después de una gran venta que provocó liquidaciones generalizadas en el mercado. La caída eliminó más de $2.5B en posiciones de BTC y ha llevado los precios a mínimos de varios meses.

Ethereum (ETH) también siente la presión, con precios por debajo de $2,200–$2,100 en medio de un sentimiento de aversión al riesgo en el mercado.

XRP enfrenta una volatilidad aumentada; los mercados de predicción esperan

- Recompensa

- 1

- Comentar

- Republicar

- Compartir

La volatilidad del mercado se intensifica: toros contra osos en una cuerda floja

Los recientes movimientos del mercado de criptomonedas se han intensificado, destacando una divergencia clara entre el impulso alcista y la presión bajista. Los traders ahora enfrentan un momento crucial: ¿es esto una corrección a corto plazo o el inicio de una corrección más profunda?

Dragon Fly Official está monitoreando de cerca las señales clave:

Bitcoin ($76K–$78K): Vigilar el soporte sostenido. Una resistencia fuerte podría indicar una continuación alcista, mientras que una caída por debajo podría desencaden

Ver originalesLos recientes movimientos del mercado de criptomonedas se han intensificado, destacando una divergencia clara entre el impulso alcista y la presión bajista. Los traders ahora enfrentan un momento crucial: ¿es esto una corrección a corto plazo o el inicio de una corrección más profunda?

Dragon Fly Official está monitoreando de cerca las señales clave:

Bitcoin ($76K–$78K): Vigilar el soporte sostenido. Una resistencia fuerte podría indicar una continuación alcista, mientras que una caída por debajo podría desencaden

- Recompensa

- 7

- 8

- Republicar

- Compartir

Yusfirah :

:

Comprar para ganar 💎Ver más

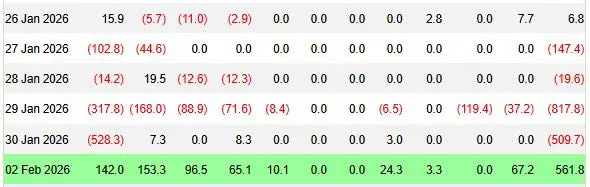

📈 FLUJO DE ENTRADAS DE ETF DE BITCOIN REGRESA

Los ETF de Bitcoin al contado registraron $561.9M en entradas netas ayer, poniendo fin a 4 días consecutivos de salidas.

Ni un solo ETF registró salidas.

Fidelity lideró con $153M, seguido por BlackRock con $142M.

El PRIMER día de entrada de febrero ya superó a TODO enero.

LA OFERTA HA REGRESADO.

$BTC

#WhenWillBTCRebound?

#StrategyBitcoinPositionTurnsRed

#BTCKeyLevelBreak

#CryptoMarketWatch

#USGovernmentShutdownRisk

Los ETF de Bitcoin al contado registraron $561.9M en entradas netas ayer, poniendo fin a 4 días consecutivos de salidas.

Ni un solo ETF registró salidas.

Fidelity lideró con $153M, seguido por BlackRock con $142M.

El PRIMER día de entrada de febrero ya superó a TODO enero.

LA OFERTA HA REGRESADO.

$BTC

#WhenWillBTCRebound?

#StrategyBitcoinPositionTurnsRed

#BTCKeyLevelBreak

#CryptoMarketWatch

#USGovernmentShutdownRisk

BTC-3,17%

- Recompensa

- 2

- 1

- Republicar

- Compartir

Discovery :

:

Gracias por la información útil.Cargar más

Únete a 40M usuarios en nuestra comunidad en crecimiento.

⚡️ Únete a 40M usuarios en el debate sobre la fiebre cripto

💬 Interactúa con tus creadores favoritos

👍 Explora lo que te interesa

Temas de actualidad

20.73K Popularidad

13.37K Popularidad

122.62K Popularidad

978 Popularidad

5.53K Popularidad

6.86K Popularidad

19.37K Popularidad

16.19K Popularidad

13.83K Popularidad

15.5K Popularidad

12.34K Popularidad

2.92K Popularidad

36.47K Popularidad

31.14K Popularidad

225.43K Popularidad

Noticias

Ver másLa policía de Hong Kong realiza la operación “谋攻” y detiene a 682 personas, desmantelando una banda de lavado de dinero con criptomonedas por un valor de 44 millones de HKD

1 m

Datos: en las últimas 24 horas, liquidaciones en toda la red por valor de 7.58 mil millones de dólares, liquidaciones de posiciones largas por 5.5 mil millones de dólares, liquidaciones de posiciones cortas por 2.08 mil millones de dólares

1 m

Maji enfrenta 10 liquidaciones más en un día, quedando solo 57,700 dólares de los 250,000 dólares iniciales.

1 m

Machi enfrenta 10 liquidaciones más, y el depósito de $250K USDC cae a $57.7K en un día.

2 m

ARC (AI Rig Complex) subió un 57.12% en 24 horas

2 m

Anclado