CoinWay

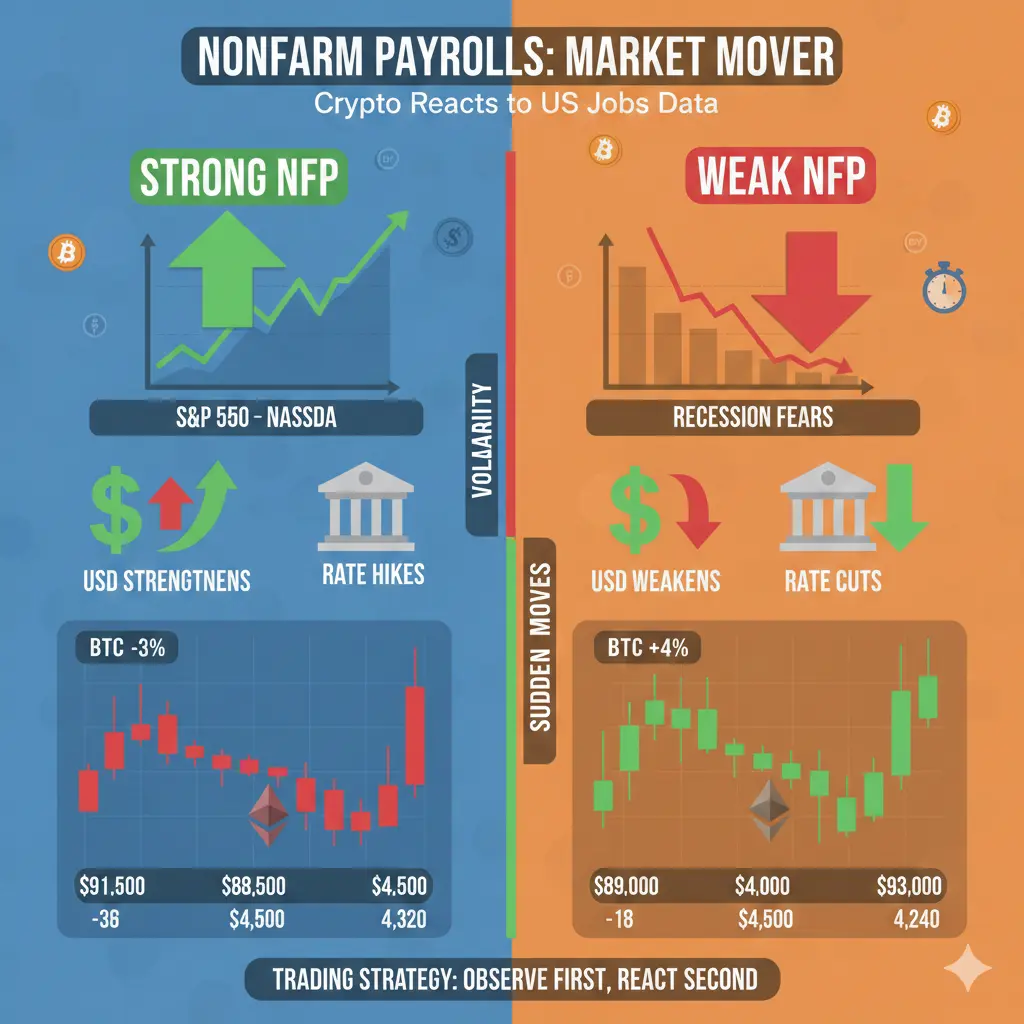

The core of non-farm payroll data is not about "how much new employment" but whether "interest rate cuts are still possible."

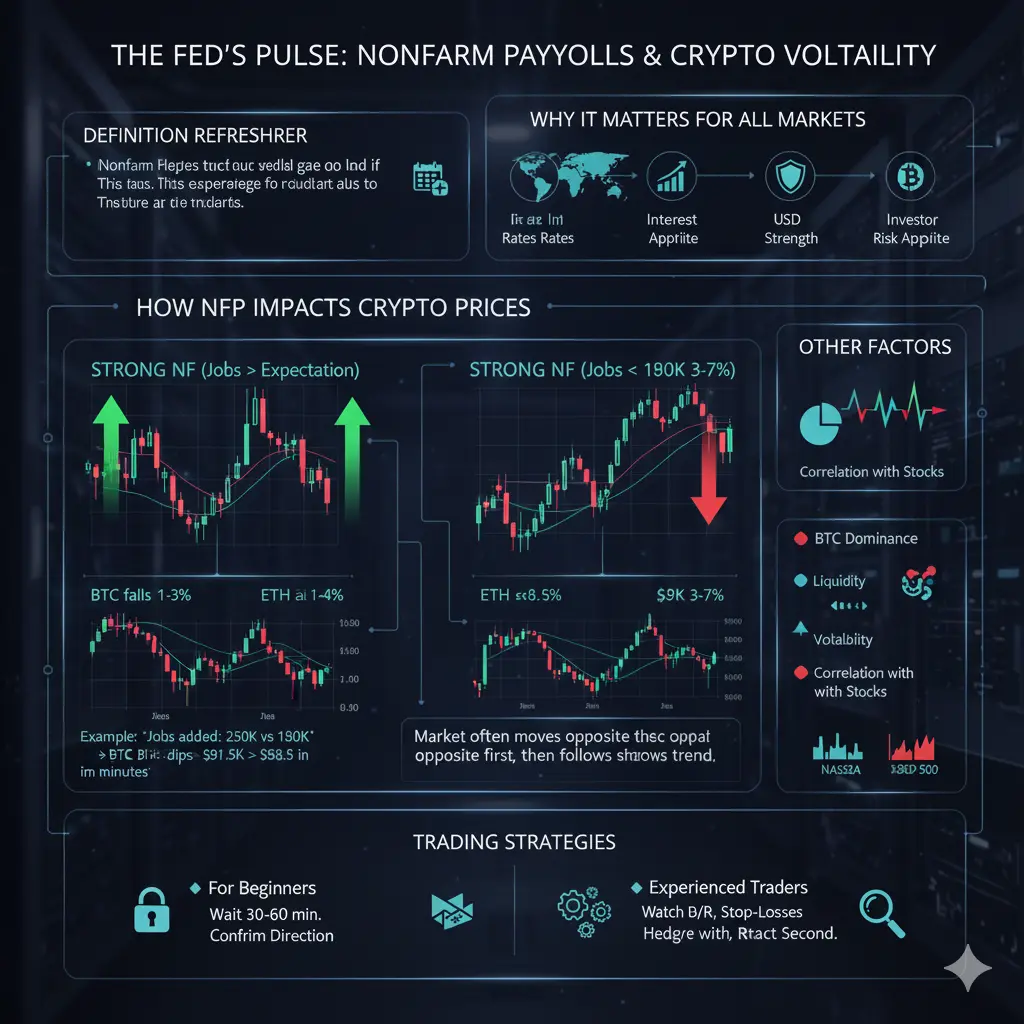

Entering 2026, the market significance of non-farm employment data has clearly diverged from the early stages of rate hike cycles. In the past, an increase in new jobs was often seen as a sign of an overheating economy; now, non-farm data more resembles a gauge of "whether the Federal Reserve has room to continue easing." In other words, non-farm data is not only an economic indicator but also a direct clue to the monetary policy path.

If employment growth continues to

View OriginalEntering 2026, the market significance of non-farm employment data has clearly diverged from the early stages of rate hike cycles. In the past, an increase in new jobs was often seen as a sign of an overheating economy; now, non-farm data more resembles a gauge of "whether the Federal Reserve has room to continue easing." In other words, non-farm data is not only an economic indicator but also a direct clue to the monetary policy path.

If employment growth continues to