# SEC

1.12M

MoonGirl

🏦 #SEConTokenizedSecurities: A New Era Begins! 🚨

The SEC has finally broken its silence on tokenized securities (RWA). The line between digital assets and traditional finance is now clearer than ever. Here’s the key takeaways from today’s update:

💎 1. “Format Changed, Law Didn’t”

The SEC made it clear: if a traditional security (stocks or bonds) is tokenized on a blockchain, it still remains a security. Changing the format does not remove regulatory obligations like registration or disclosure.

🏗️ 2. Project Crypto Rollout

Under the SEC’s new Project Crypto, starting Jan 2026, an “Innovatio

The SEC has finally broken its silence on tokenized securities (RWA). The line between digital assets and traditional finance is now clearer than ever. Here’s the key takeaways from today’s update:

💎 1. “Format Changed, Law Didn’t”

The SEC made it clear: if a traditional security (stocks or bonds) is tokenized on a blockchain, it still remains a security. Changing the format does not remove regulatory obligations like registration or disclosure.

🏗️ 2. Project Crypto Rollout

Under the SEC’s new Project Crypto, starting Jan 2026, an “Innovatio

RWA-5.35%

- Reward

- 6

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

🏛️🔗 #SEConTokenizedSecurities | Regulatory Watch 📊The U.S. SEC is increasing its focus on tokenized securities, highlighting the growing intersection between regulation, traditional finance, and blockchain technology. This development signals a critical phase for how digital assets may be structured, issued, and traded going forward. 👀⚖️🔍 Why This Matters:🧾 Greater regulatory clarity for tokenized assets🏦 Implications for institutions exploring on-chain securities🌐 Potential impact on market confidence and adoption💡 As regulation evolves, understanding compliance and structure becomes

- Reward

- 3

- Comment

- Repost

- Share

U.S. Crypto Market Faces Structural Constraints Without Congressional Action

Benchmark, a Wall Street brokerage firm, has indicated that the U.S. cryptocurrency market will face structural limitations if Congress fails to pass a market structure bill this year. According to Odaily, analyst Mark Palmer highlighted in a report that the absence of legislation will lead to a persistent structural risk premium, thereby restricting valuation expansion for platforms influenced by the U.S. This situation is expected to delay the maturation of cryptocurrencies, prompting investors to favor Bitcoin-cent

Benchmark, a Wall Street brokerage firm, has indicated that the U.S. cryptocurrency market will face structural limitations if Congress fails to pass a market structure bill this year. According to Odaily, analyst Mark Palmer highlighted in a report that the absence of legislation will lead to a persistent structural risk premium, thereby restricting valuation expansion for platforms influenced by the U.S. This situation is expected to delay the maturation of cryptocurrencies, prompting investors to favor Bitcoin-cent

BTC-6.31%

- Reward

- like

- Comment

- Repost

- Share

#CLARITYBillDelayed

What the Delay of the CLARITY Bill Means for Crypto, DeFi & Stablecoins

The delay of the Digital Asset Market Clarity Act (CLARITY Bill) has once again placed the U.S. crypto industry in a waiting phase — highlighting how critical regulatory certainty has become for digital assets, DeFi protocols, and stablecoins.

The CLARITY Bill was introduced to finally end years of confusion by defining how cryptocurrencies are classified, which regulators oversee them, and how stablecoins and platforms should operate. Its goal is simple but powerful: replace regulation-by-enforcement w

What the Delay of the CLARITY Bill Means for Crypto, DeFi & Stablecoins

The delay of the Digital Asset Market Clarity Act (CLARITY Bill) has once again placed the U.S. crypto industry in a waiting phase — highlighting how critical regulatory certainty has become for digital assets, DeFi protocols, and stablecoins.

The CLARITY Bill was introduced to finally end years of confusion by defining how cryptocurrencies are classified, which regulators oversee them, and how stablecoins and platforms should operate. Its goal is simple but powerful: replace regulation-by-enforcement w

DEFI-6.03%

- Reward

- 4

- 4

- Repost

- Share

Yanlin :

:

2026 GOGOGO 👊View More

U.S. CRYPTO REGULATION 2026 🚨 | Power Shift (Gate.io)

• 2026 shaping up as a defining year

• SEC pushes forward major reforms

• CFTC influence continues to rise

• Clearer rules attract institutional capital

• Market structure slowly taking form

• Fear turning into framework

• Volatility before stability

🔥 Smart money prepares early

#CryptoRegulation #SEC #CFTC #Gateio

• 2026 shaping up as a defining year

• SEC pushes forward major reforms

• CFTC influence continues to rise

• Clearer rules attract institutional capital

• Market structure slowly taking form

• Fear turning into framework

• Volatility before stability

🔥 Smart money prepares early

#CryptoRegulation #SEC #CFTC #Gateio

- Reward

- 3

- Comment

- Repost

- Share

🌈 #GateLiveStreamingInspiration - Dec.18

Go live with the following topics now to receive extra official support and promotional exposure!

Today's Topic Recommendations:

🔹 Short-term risk alert: If #Bitcoin breaks below $85,000, cumulative long liquidations across major CEXs could reach $1.052 billion

🔹 Whales keep loading up on #HYPE! Over $17 million added in a single week — signaling a potential explosive move?

🔹 Rate-cut expectations cool again as the Federal Reserve may keep rates unchanged in January

🔹 The U.S.# SEC seeks public comment: crypto trading on national securities exchan

Go live with the following topics now to receive extra official support and promotional exposure!

Today's Topic Recommendations:

🔹 Short-term risk alert: If #Bitcoin breaks below $85,000, cumulative long liquidations across major CEXs could reach $1.052 billion

🔹 Whales keep loading up on #HYPE! Over $17 million added in a single week — signaling a potential explosive move?

🔹 Rate-cut expectations cool again as the Federal Reserve may keep rates unchanged in January

🔹 The U.S.# SEC seeks public comment: crypto trading on national securities exchan

- Reward

- 7

- 2

- Repost

- Share

Crypto_Buzz_with_Alex :

:

HODL Tight 💪View More

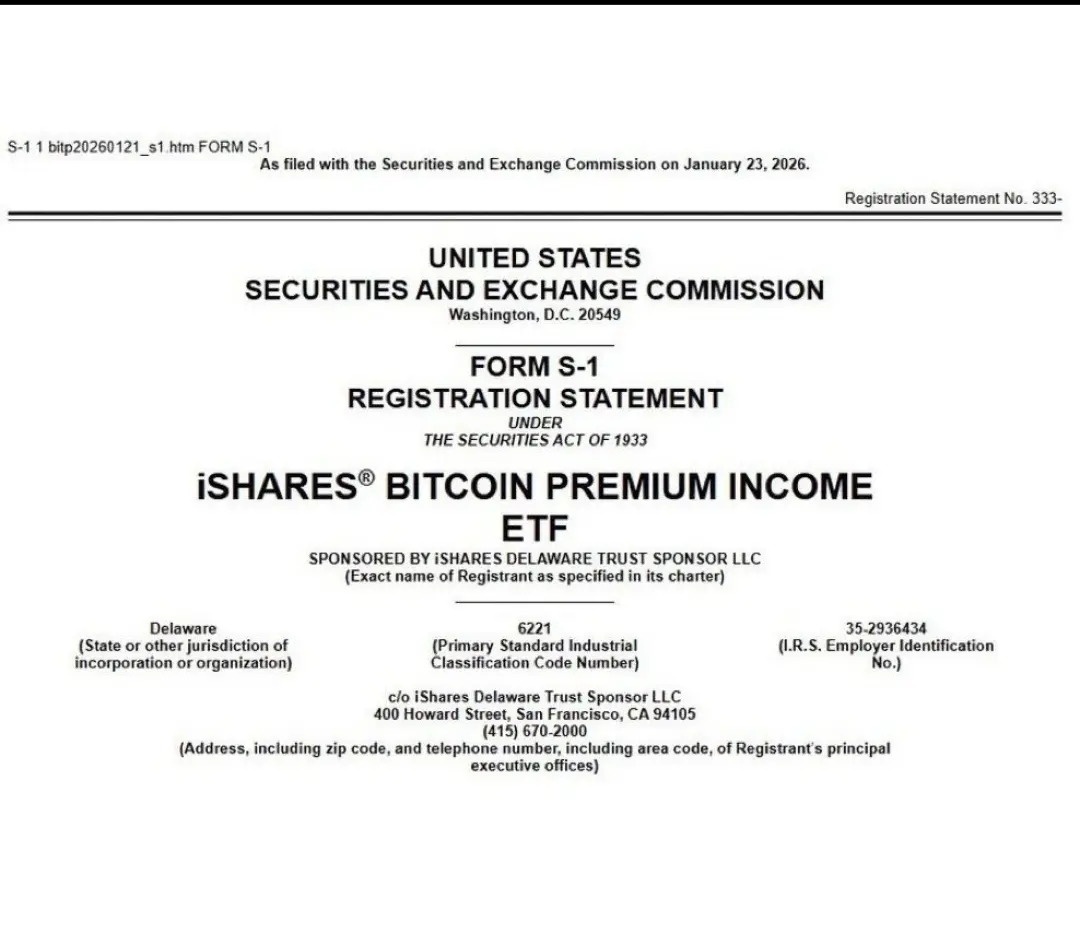

#عاجل🚨🚨🚨 : BlackRock files for a new Bitcoin income-focused exchange-traded fund (ETF)

BlackRock today filed (S-1#ETF with the U.S. Securities and Exchange Commission (SEC) to launch a new Bitcoin income-focused ETF from ).

• The fund offers an investment opportunity with attractive returns.

• The fund generates income by selling covered call options on the IBIT fund (, which has over $70 billion in assets under management ).

• The fund is designed to capitalize on Bitcoin price volatility and reduce potential risks compared to holding Bitcoin directly.

This fund represents the next stage

BlackRock today filed (S-1#ETF with the U.S. Securities and Exchange Commission (SEC) to launch a new Bitcoin income-focused ETF from ).

• The fund offers an investment opportunity with attractive returns.

• The fund generates income by selling covered call options on the IBIT fund (, which has over $70 billion in assets under management ).

• The fund is designed to capitalize on Bitcoin price volatility and reduce potential risks compared to holding Bitcoin directly.

This fund represents the next stage

BTC-6.31%

- Reward

- 1

- 1

- Repost

- Share

BasheerAlgundubi :

:

BlackRock builds its products around Bitcoin, not away from it.Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

6.84K Popularity

23.5K Popularity

351.66K Popularity

31.7K Popularity

47.49K Popularity

89 Popularity

18.95K Popularity

7.76K Popularity

82.26K Popularity

29.53K Popularity

12.41K Popularity

26.89K Popularity

7.44K Popularity

15.82K Popularity

187.87K Popularity

News

View MoreBitcoin and Ethereum ETFs lose nearly $1 billion in a single day, institutional withdrawals put pressure on the crypto market

4 m

The US Dollar Index rises, and non-US currencies generally decline.

4 m

Vitalik Buterin withdraws $17 million worth of ETH: What signals are being sent behind the Ethereum Foundation's "mild contraction"?

11 m

Brevis Co-founder and CEO Michael confirms attendance at ChainCatcher Hong Kong "Build and Scale in 2026" themed forum

11 m

Ethereum's $100 million 'Ghost Fund' resurrected: Originating from the 2016 DAO hack, will this rewrite the security landscape?

13 m

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889