EyeOnChain

No content yet

EyeOnChain

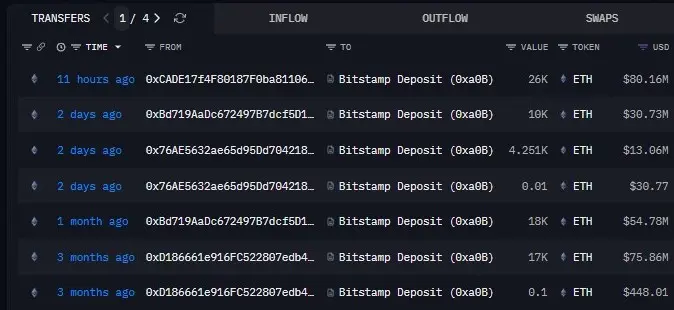

$517 Dreams to Nine-Figure Reality 😀 And He’s Still Letting Go.

Long before $ETH was a headline, this OG was already there.

He grabbed 154,076 ETH at an average of just $517, the kind of entry price that turns patience into legend.

Now? The unwind continues.

Over the past two days, he’s slowly pushed another 40,251 #ETH , about $124 million worth. Simple exits.

Even after all that, he’s still sitting on 26,001 #eth , roughly $80.5 million left in the chamber.

Address:

Long before $ETH was a headline, this OG was already there.

He grabbed 154,076 ETH at an average of just $517, the kind of entry price that turns patience into legend.

Now? The unwind continues.

Over the past two days, he’s slowly pushed another 40,251 #ETH , about $124 million worth. Simple exits.

Even after all that, he’s still sitting on 26,001 #eth , roughly $80.5 million left in the chamber.

Address:

ETH0,37%

- Reward

- like

- Comment

- Repost

- Share

Most blockchains grew up in public. Every balance visible. Every move traceable. It worked when crypto was just traders talking to traders. But the moment real finance started peeking in… things got awkward.

Banks don’t operate in public. Funds don’t publish their positions. Companies don’t want payroll looking like a feed. Real markets need privacy, and rules. Not one or the other. Both.

That’s the gap @DuskFoundation quietly stepped into.

Dusk isn’t trying to “disrupt finance” with chaos. It’s doing something harder — rebuilding markets in a way institutions can actually use. On-chain, yes.

Banks don’t operate in public. Funds don’t publish their positions. Companies don’t want payroll looking like a feed. Real markets need privacy, and rules. Not one or the other. Both.

That’s the gap @DuskFoundation quietly stepped into.

Dusk isn’t trying to “disrupt finance” with chaos. It’s doing something harder — rebuilding markets in a way institutions can actually use. On-chain, yes.

DUSK5,03%

- Reward

- like

- Comment

- Repost

- Share

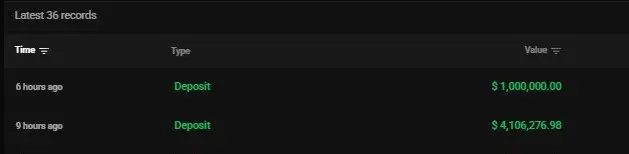

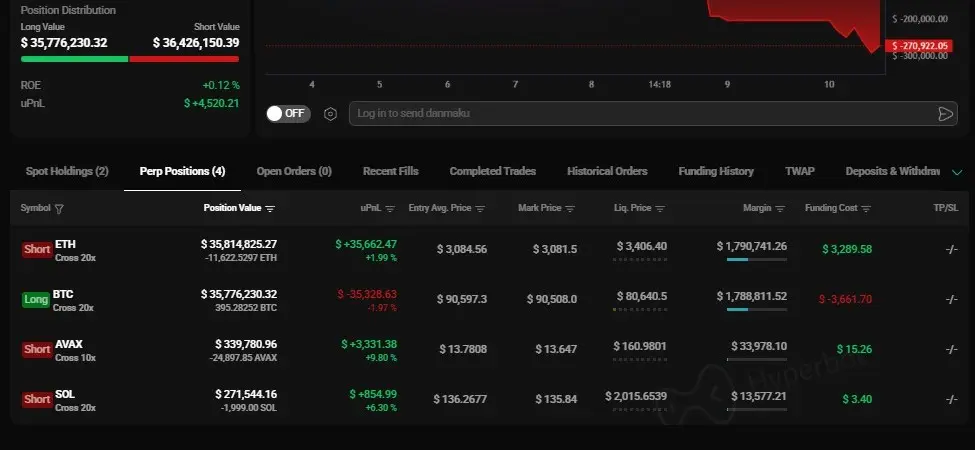

This Whale Isn’t Picking a Side -- He’s Playing the Whole Board.

In the last few hours, address 0x61CEeF212fF4a86933C69fb6aca2fe35D8F2A62B slid $5.1M into #Hyperliquid and then did something that feels almost surgical.

He went long on Bitcoin with a $35.77M $BTC position, cross 20×, opened around $90,597, now hovering near $90,508, with liquidation way down at $80,640. Slightly red on PnL, but still calm.

At the same time, he stacked the other side of the table.

A $35.81M $ETH short at 20×, opened near $3,084, now trading around $3,081, liquidation up at $3,406.

A $339K $AVAX short at 10×, in

In the last few hours, address 0x61CEeF212fF4a86933C69fb6aca2fe35D8F2A62B slid $5.1M into #Hyperliquid and then did something that feels almost surgical.

He went long on Bitcoin with a $35.77M $BTC position, cross 20×, opened around $90,597, now hovering near $90,508, with liquidation way down at $80,640. Slightly red on PnL, but still calm.

At the same time, he stacked the other side of the table.

A $35.81M $ETH short at 20×, opened near $3,084, now trading around $3,081, liquidation up at $3,406.

A $339K $AVAX short at 10×, in

- Reward

- like

- Comment

- Repost

- Share

This one isn’t SMALL at all. This whale just rolled up their sleeves and went all-in on the upside, more than $310 million spread across four majors.

The biggest bite is on $BTC . About 1,210 BTC, sitting at roughly $109.5M, entered around $90,294, now trading near $90,500. Liquidation’s way down at $69,365, with over $7.3M posted as margin. It’s already green by about $249K, even after funding nibbling away.

Then there’s $ETH , almost matching it in size. 32,474 ETH, worth $100.6M, scooped near $3,092.89. Mark price hovering around $3,097.5, liquidation sitting far below at $2,303.51. Margin’

The biggest bite is on $BTC . About 1,210 BTC, sitting at roughly $109.5M, entered around $90,294, now trading near $90,500. Liquidation’s way down at $69,365, with over $7.3M posted as margin. It’s already green by about $249K, even after funding nibbling away.

Then there’s $ETH , almost matching it in size. 32,474 ETH, worth $100.6M, scooped near $3,092.89. Mark price hovering around $3,097.5, liquidation sitting far below at $2,303.51. Margin’

- Reward

- 1

- Comment

- Repost

- Share

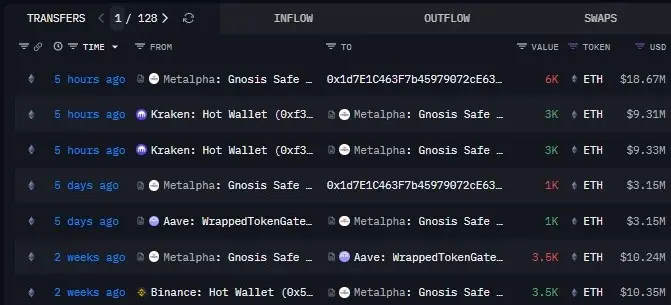

Metalpha Keeps Feeding the $ETH Machine.

About five hours ago, #metalpha pulled 6,000 ETH roughly $18.67 million, and sent it straight into Aave for staking.

We guess, it's more like slow confidence. Step by step, #ETH gets shuffled into staking, almost routine now, like they’ve done this dance enough times to stop explaining it.

it usually means the decision was made long before the transaction hit the chain.

Address, if you’re tracking it yourself:

About five hours ago, #metalpha pulled 6,000 ETH roughly $18.67 million, and sent it straight into Aave for staking.

We guess, it's more like slow confidence. Step by step, #ETH gets shuffled into staking, almost routine now, like they’ve done this dance enough times to stop explaining it.

it usually means the decision was made long before the transaction hit the chain.

Address, if you’re tracking it yourself:

- Reward

- like

- Comment

- Repost

- Share

A few hours ago, #blackRock did what BlackRock usually does acted without noise. 2,164 $BTC , roughly $195.12 million, along with 26,723 $ETH , about $83.34 million, were sent straight into Coinbase Prime.

Nothing about this feels rushed. It’s not panic. More like a chess move made three turns ahead. Institutions don’t shuffle assets for fun, and they definitely don’t move this kind of size by accident. Whether this is positioning, rebalancing, or just setting the stage… hard to say. But when capital this large changes hands, the ripples usually come later..

Address:

Nothing about this feels rushed. It’s not panic. More like a chess move made three turns ahead. Institutions don’t shuffle assets for fun, and they definitely don’t move this kind of size by accident. Whether this is positioning, rebalancing, or just setting the stage… hard to say. But when capital this large changes hands, the ripples usually come later..

Address:

- Reward

- like

- Comment

- Repost

- Share

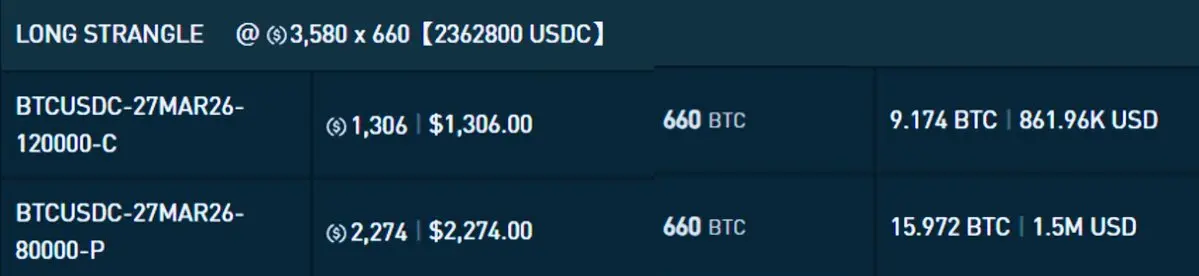

When Someone Bets Millions on Chaos… You Pay Attention.

Late March’s getting circled again. Hard. Because someone just walked into the options market and said, “I don’t care which way it breaks… just make it violent.” 🤪

About $2.36 million went down in one clean move. Half of it chased the sky 660 $BTC call options at $120K, roughly $860K. The rest leaned straight into the abyss, 660 BTC put options at $80K, costing around $1.5M. Same expiry. March 27. No hedging. No hesitation.

The math? Wild. Price needs to rip past $128K on the upside, or fall off a cliff toward $12K on the downside to rea

Late March’s getting circled again. Hard. Because someone just walked into the options market and said, “I don’t care which way it breaks… just make it violent.” 🤪

About $2.36 million went down in one clean move. Half of it chased the sky 660 $BTC call options at $120K, roughly $860K. The rest leaned straight into the abyss, 660 BTC put options at $80K, costing around $1.5M. Same expiry. March 27. No hedging. No hesitation.

The math? Wild. Price needs to rip past $128K on the upside, or fall off a cliff toward $12K on the downside to rea

BTC0,33%

- Reward

- like

- Comment

- Repost

- Share