EyeOnChain

No content yet

EyeOnChain

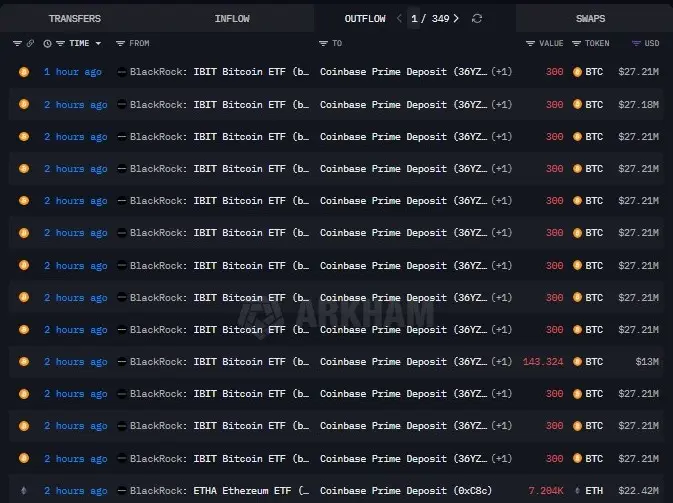

#blackRock is back on the move. Within the past two hours, another wave of assets flowed into Coinbase Prime, 3,290 $BTC , worth about $303M, alongside 5,692 $ETH , roughly $17.82M.

When BlackRock moves hundreds of millions twice in a day, it’s never random. The market may look calm on the surface, but under it, giants are repositioning.

Address:

When BlackRock moves hundreds of millions twice in a day, it’s never random. The market may look calm on the surface, but under it, giants are repositioning.

Address:

- Reward

- like

- Comment

- Repost

- Share

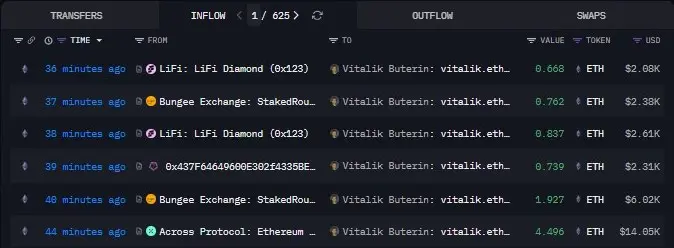

#Vitalik ’s wallet stirred again. Over the past 44 minutes, he quietly sold a batch of freely received tokens, converting them into 9.4 $ETH roughly $29.4K. It’s the same pattern we’ve seen for years: random projects send tokens, Vitalik eventually clears them out, and the chain catches a glimpse of it. Nothing flashy. Just housekeeping at the highest level.

Address of @VitalikButerin

Address of @VitalikButerin

ETH7,48%

- Reward

- like

- Comment

- Repost

- Share

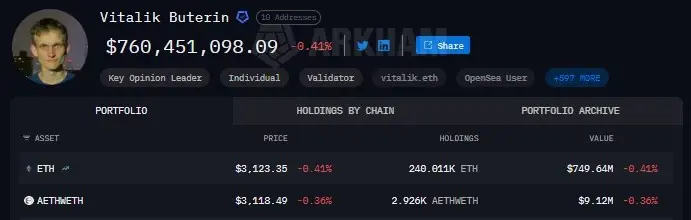

#Bitmine Is Turning ETH Into Infrastructure. This isn’t yield chasing anymore. This is strategy.

Bitmine has now cumulatively staked 1,344,224 $ETH worth up to $4.13B , representing 32.2% of its total holdings. And they’re not done.

In just the past 9 hours, another 154,208 #ETH flowed into staking. That’s roughly $478M locked, removed from liquid circulation, and handed over to the network.

But here’s where it gets bigger than charts. According to Bitmine’s latest official update, their total ETH holdings now stand at 4,167,768 tokens. They’re already working with three staking service provid

Bitmine has now cumulatively staked 1,344,224 $ETH worth up to $4.13B , representing 32.2% of its total holdings. And they’re not done.

In just the past 9 hours, another 154,208 #ETH flowed into staking. That’s roughly $478M locked, removed from liquid circulation, and handed over to the network.

But here’s where it gets bigger than charts. According to Bitmine’s latest official update, their total ETH holdings now stand at 4,167,768 tokens. They’re already working with three staking service provid

ETH7,48%

- Reward

- like

- Comment

- Repost

- Share

ETH Slipped… But Trend Research Isn’t Flinching

ETH took a step back today. Not a collapse. Not a capitulation. Just one of those quiet pullbacks that make timelines nervous.

Trend Research, though, is still sitting on a mountain.

Right now, they hold 626,778.65 ETH — roughly $1.95B in value — with an average cost around $3,105.5. The position is slightly underwater after the dip, but nothing here looks like panic.

In fact, most of their book is still glowing.

Aside from $ASTER, which was already cut at a loss to stop the bleeding, and $ETH, which is experiencing this mild retrace, the rest of

ETH took a step back today. Not a collapse. Not a capitulation. Just one of those quiet pullbacks that make timelines nervous.

Trend Research, though, is still sitting on a mountain.

Right now, they hold 626,778.65 ETH — roughly $1.95B in value — with an average cost around $3,105.5. The position is slightly underwater after the dip, but nothing here looks like panic.

In fact, most of their book is still glowing.

Aside from $ASTER, which was already cut at a loss to stop the bleeding, and $ETH, which is experiencing this mild retrace, the rest of

- Reward

- 1

- Comment

- Repost

- Share

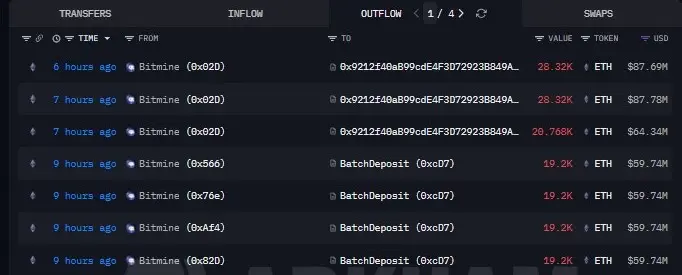

#blackRock Moved the Market… Without Saying a Word.

Over the past 2 hours, BlackRock sent:

3,743 $BTC — about $339.45M

7,204 $ETH — around $22.42M

straight into Coinbase Prime.

When an institution of this scale shifts nearly $362M in crypto, it’s never random. It doesn’t mean “sell.” It doesn’t mean “buy.” It simply means something is being prepared.

Risk management. Rebalancing. Settlement. Custody flow.

We don’t get the memo -- we just see the shadow.

Retail watches candles. Institutions move inventory.

And sometimes, the chain whispers before the market ever speaks.

Address:

Over the past 2 hours, BlackRock sent:

3,743 $BTC — about $339.45M

7,204 $ETH — around $22.42M

straight into Coinbase Prime.

When an institution of this scale shifts nearly $362M in crypto, it’s never random. It doesn’t mean “sell.” It doesn’t mean “buy.” It simply means something is being prepared.

Risk management. Rebalancing. Settlement. Custody flow.

We don’t get the memo -- we just see the shadow.

Retail watches candles. Institutions move inventory.

And sometimes, the chain whispers before the market ever speaks.

Address:

- Reward

- like

- Comment

- Repost

- Share