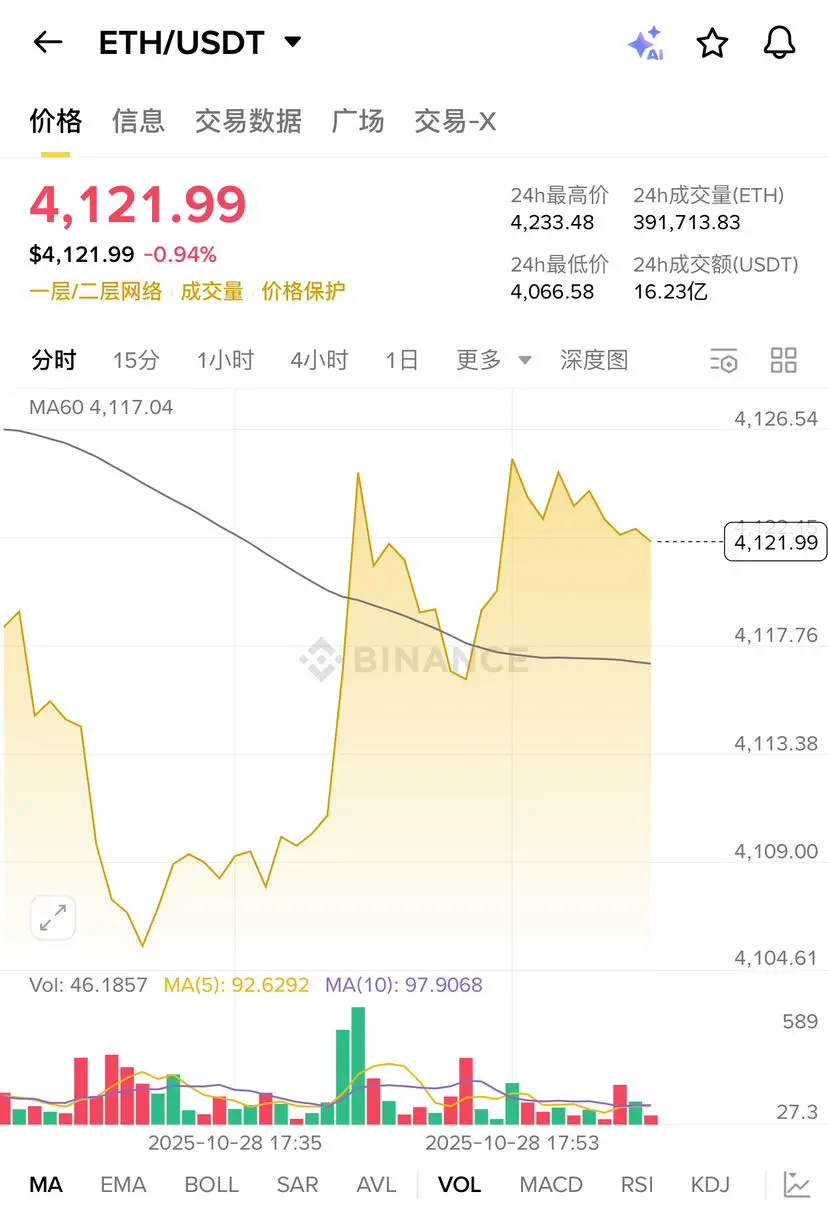

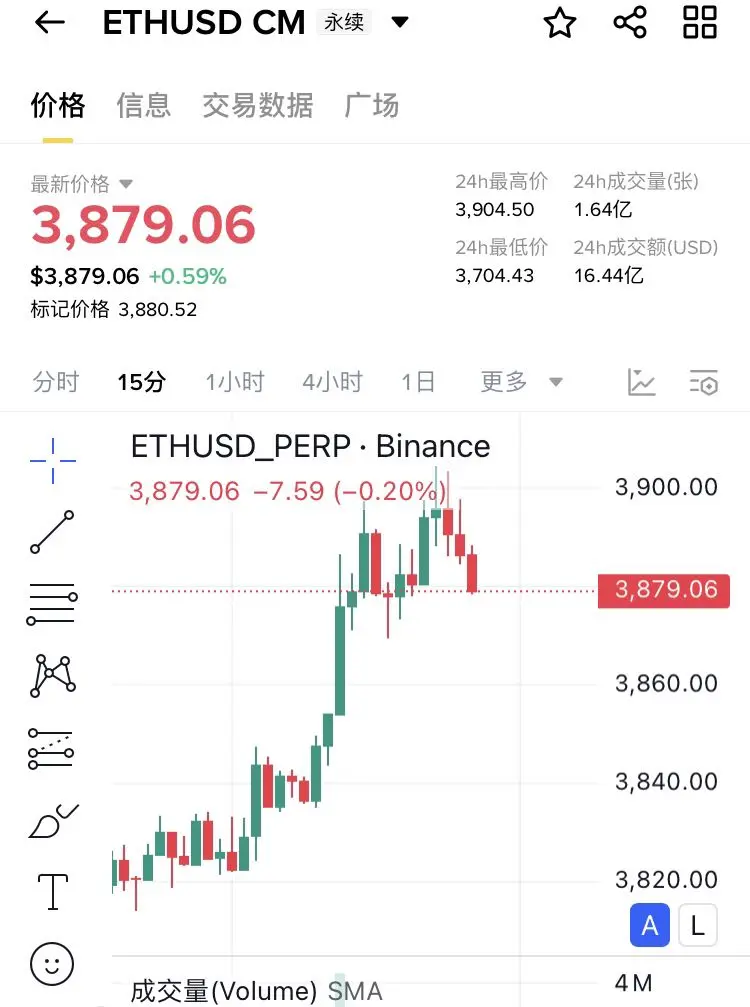

October 27, 2025 Cryptocurrency Market Analysis: BTC breaks through $115,000 and faces resistance, ETH bullish momentum continues to strengthen

As of October 27, 2025, the cryptocurrency market as a whole shows a recovery trend, with Bitcoin (BTC) and Ethereum (ETH) exhibiting divergent performances. The former faces pullback pressure after a surge, while the latter continues its strong upward momentum. Below is a detailed market analysis.

Bitcoin (BTC): After rising to $115,000, it has pulled back, and there is a risk of divergence between volume and price.

This morning, Bitcoin began a volat

View OriginalAs of October 27, 2025, the cryptocurrency market as a whole shows a recovery trend, with Bitcoin (BTC) and Ethereum (ETH) exhibiting divergent performances. The former faces pullback pressure after a surge, while the latter continues its strong upward momentum. Below is a detailed market analysis.

Bitcoin (BTC): After rising to $115,000, it has pulled back, and there is a risk of divergence between volume and price.

This morning, Bitcoin began a volat