Post content & earn content mining yield

placeholder

JinshanYinshan

#Gate广场创作者新春激励

When Bitcoin was at 69,000 last cycle, there were plenty of people shouting for 150,000, and at the time, it all sounded "particularly reasonable." By the end of 2024, almost everyone expects 150,000 to be achieved, and few people ask, what if it doesn't happen? Interestingly, now gold is hovering near the bottom, but suddenly few people dare to say more bullish words. They complain about being slow, boring, or unexciting. But the market has always been like this—faith at high levels, doubt at low levels. When you fully believe, the space has already been almost exhausted; true

View OriginalWhen Bitcoin was at 69,000 last cycle, there were plenty of people shouting for 150,000, and at the time, it all sounded "particularly reasonable." By the end of 2024, almost everyone expects 150,000 to be achieved, and few people ask, what if it doesn't happen? Interestingly, now gold is hovering near the bottom, but suddenly few people dare to say more bullish words. They complain about being slow, boring, or unexciting. But the market has always been like this—faith at high levels, doubt at low levels. When you fully believe, the space has already been almost exhausted; true

- Reward

- 4

- 3

- Repost

- Share

ItWillDefinitelyGetB :

:

Hold on tight, we're about to take off 🛫View More

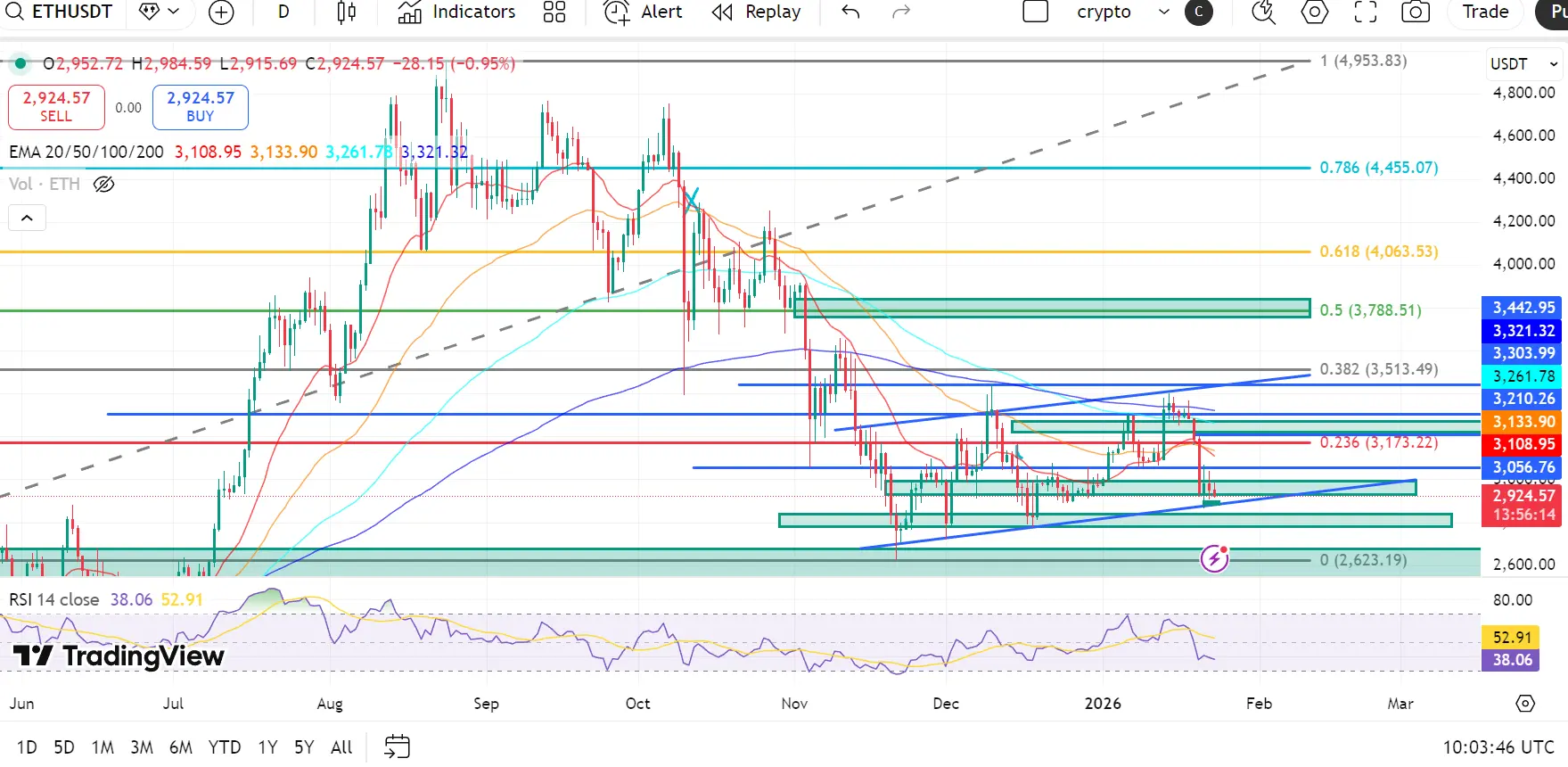

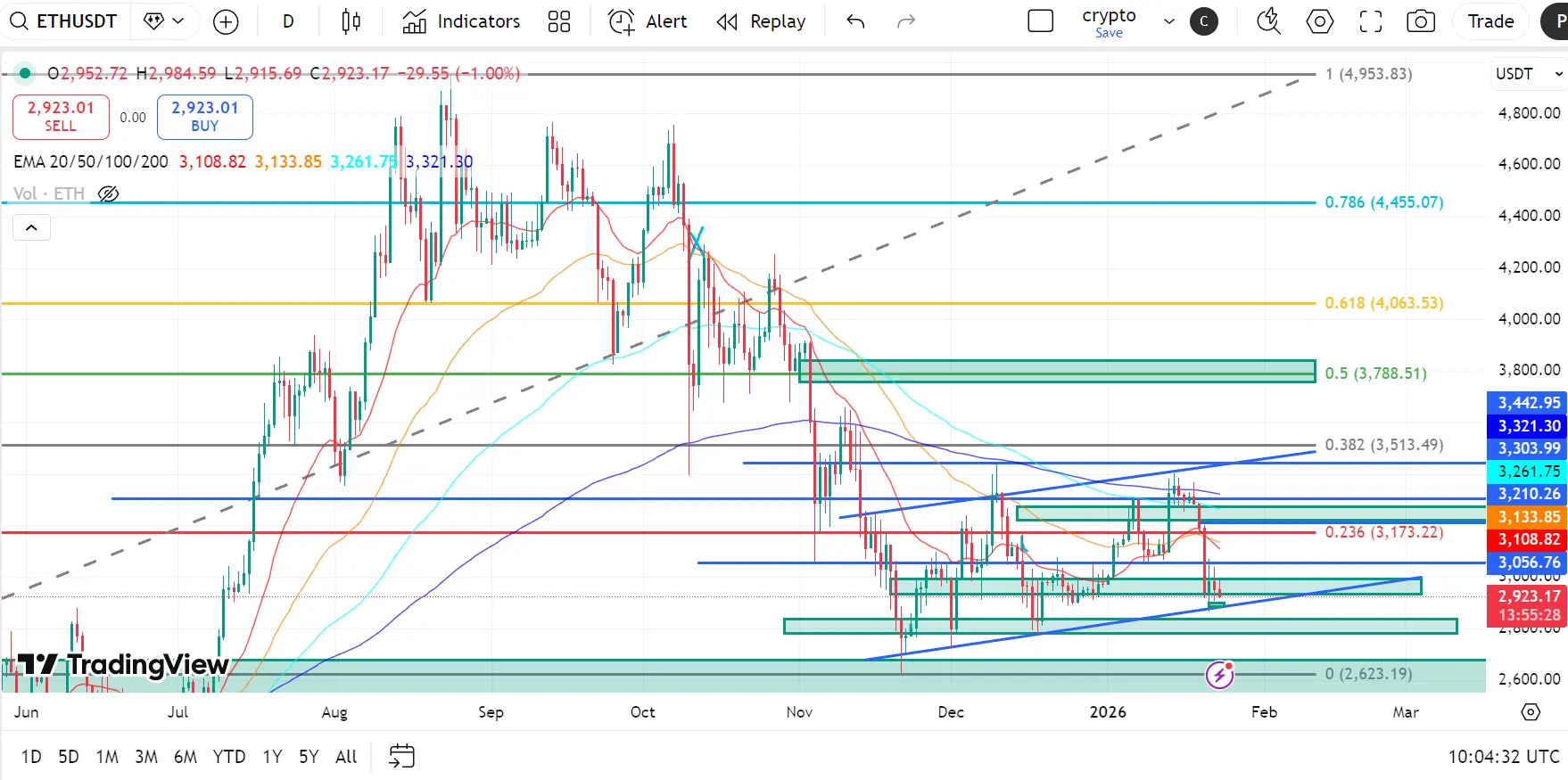

ETH Technical Outlook: Ethereum Consolidates Below Key Fib Resistance After Sharp Corrective Decline

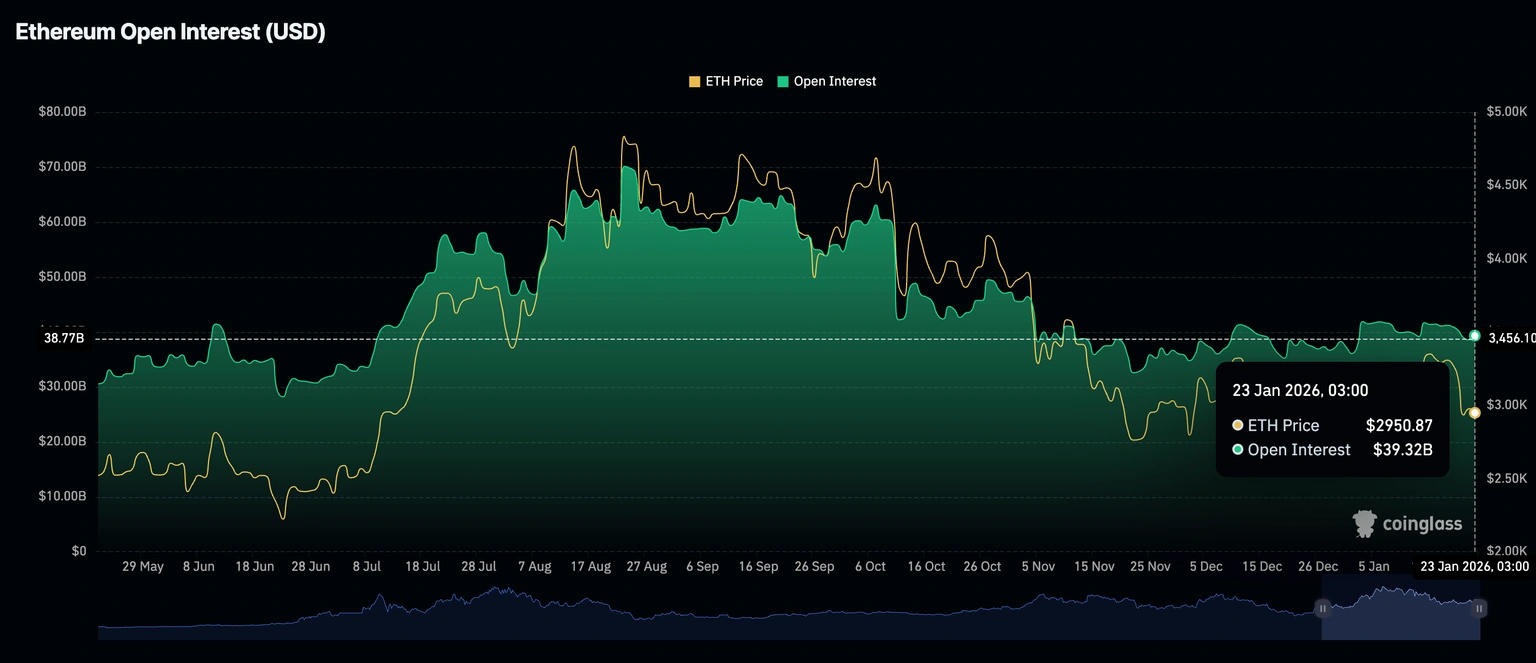

Ethereum remains in a medium-term corrective structure following the rejection from the $4,450–$4,950 macro resistance region. The breakdown below the rising trendline and subsequent loss of the 0.382–0.5 Fibonacci cluster confirmed a transition from bullish continuation into a neutral-bearish market phase.

Price is currently stabilizing near the $2,950–$3,050 region, attempting to form a base after the impulsive selloff from the $4,000+ highs. This zone represents a critical decision area for

Ethereum remains in a medium-term corrective structure following the rejection from the $4,450–$4,950 macro resistance region. The breakdown below the rising trendline and subsequent loss of the 0.382–0.5 Fibonacci cluster confirmed a transition from bullish continuation into a neutral-bearish market phase.

Price is currently stabilizing near the $2,950–$3,050 region, attempting to form a base after the impulsive selloff from the $4,000+ highs. This zone represents a critical decision area for

ETH-1,26%

- Reward

- 2

- Comment

- Repost

- Share

Tariff exemption remarks spark a market rebound

- Reward

- like

- Comment

- Repost

- Share

咸丰当五十

XFDB

Created By@RichList

Listing Progress

0.00%

MC:

$3.4K

Create My Token

- Technical Analysis of Altcoins: Volatility in Ethereum and XRP Amid Increasing Selling Pressure:

Ethereum's price fluctuates between $2900 and $3000 amid the overall bearish trend in the cryptocurrency market. The RSI( is accelerating at the 38 level on the daily chart toward the oversold region, with sellers gaining more control.

The MACD indicator on the same chart remains below the signal line, which may prompt investors to reduce their exposure and protect their capital. Breaking below the $2900 level could accelerate the downward trend toward its December 1 low at $2716.

Conversely, a

View OriginalEthereum's price fluctuates between $2900 and $3000 amid the overall bearish trend in the cryptocurrency market. The RSI( is accelerating at the 38 level on the daily chart toward the oversold region, with sellers gaining more control.

The MACD indicator on the same chart remains below the signal line, which may prompt investors to reduce their exposure and protect their capital. Breaking below the $2900 level could accelerate the downward trend toward its December 1 low at $2716.

Conversely, a

- Reward

- 1

- 1

- Repost

- Share

Before00zero :

:

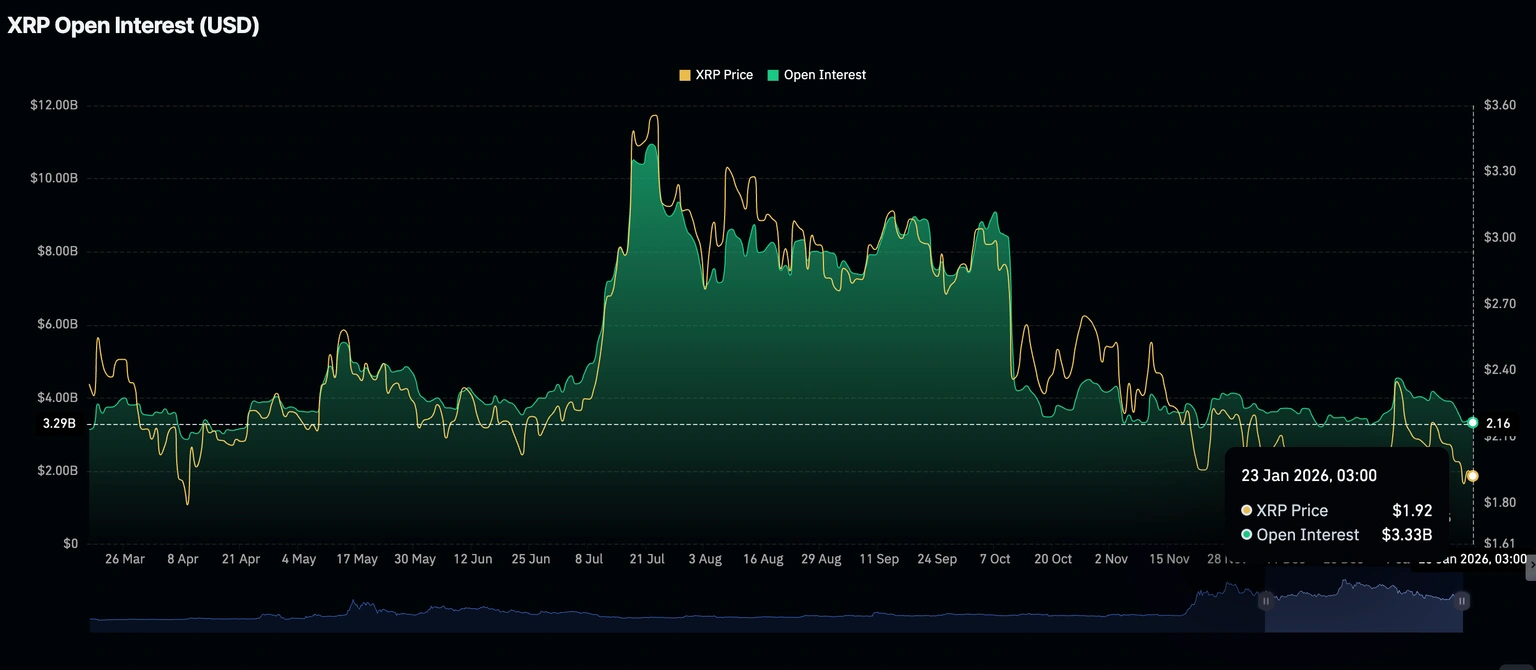

Ethereum continues its correction for the second consecutive day despite a slight increase in open interest to $39.32 billion. XRP is trading below the 50-day, 100-day, and 200-day exponential moving averages, reinforcing short-term bearish expectations.

#GateWeb3UpgradestoGateDEX

Gate Web3 Enters a New Phase

The upgrade of Gate Web3 to Gate DEX marks a significant milestone in the platform’s long-term Web3 strategy. This transition is more than a simple name change it reflects a deeper shift toward decentralization, improved on-chain performance, and a stronger focus on user autonomy. As decentralized finance continues to mature, Gate DEX positions itself as a next-generation decentralized exchange designed to meet the growing demands of traders, developers, and the broader Web3 ecosystem.

🔹 From Gate Web3 to Gate DEX: What Changed and Why

Gate Web3 Enters a New Phase

The upgrade of Gate Web3 to Gate DEX marks a significant milestone in the platform’s long-term Web3 strategy. This transition is more than a simple name change it reflects a deeper shift toward decentralization, improved on-chain performance, and a stronger focus on user autonomy. As decentralized finance continues to mature, Gate DEX positions itself as a next-generation decentralized exchange designed to meet the growing demands of traders, developers, and the broader Web3 ecosystem.

🔹 From Gate Web3 to Gate DEX: What Changed and Why

DEFI-4,21%

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊Sam Trabucco could do the funniest thing right now.\n\nCrypto history suggests:\n\nSilence never lasts\nCycles resurrect characters\nMarkets love plot twists \n\nWe’ve seen this movie before.

- Reward

- like

- Comment

- Repost

- Share

#GoldandSilverHitNewHighs 📌 Gold is steady, Silver is aggressive — capital is already diverging

Both metals are hitting new highs, but the type of money behind them is different.

Gold is being driven by conservative capital, while silver is attracting aggressive traders.

Gold advantages:

✔️ Central bank accumulation

✔️ Lower volatility

✔️ Macro risk hedge

Silver advantages:

✔️ Financial + industrial demand

✔️ High volatility (more elastic)

✔️ Trend accelerator in market shifts

📈 Silver usually breaks out when the market debates:

“Inflation may fall short” or “monetary easing could come soone

Both metals are hitting new highs, but the type of money behind them is different.

Gold is being driven by conservative capital, while silver is attracting aggressive traders.

Gold advantages:

✔️ Central bank accumulation

✔️ Lower volatility

✔️ Macro risk hedge

Silver advantages:

✔️ Financial + industrial demand

✔️ High volatility (more elastic)

✔️ Trend accelerator in market shifts

📈 Silver usually breaks out when the market debates:

“Inflation may fall short” or “monetary easing could come soone

- Reward

- like

- Comment

- Repost

- Share

Think experienced players don\'t get scared? You\'re mistaken. The higher the metric peak, the more aggressive the selling from old hands.

- Reward

- like

- Comment

- Repost

- Share

#WarshLeadsFedChairRace Kevin Warsh and the Future of Global Monetary Policy

The global financial community is watching closely as the race to succeed Jerome Powell reaches its final stages. Among the frontrunners, Kevin Warsh has surged ahead, transforming the #WarshLeadsFedChairRace from a speculative hashtag into a tangible market factor. With his nomination increasingly probable, investors are already pricing in the implications for interest rates, liquidity, and financial stability in 2026 and beyond.

Kevin Warsh stands out as a candidate outside the traditional status quo. While other co

The global financial community is watching closely as the race to succeed Jerome Powell reaches its final stages. Among the frontrunners, Kevin Warsh has surged ahead, transforming the #WarshLeadsFedChairRace from a speculative hashtag into a tangible market factor. With his nomination increasingly probable, investors are already pricing in the implications for interest rates, liquidity, and financial stability in 2026 and beyond.

Kevin Warsh stands out as a candidate outside the traditional status quo. While other co

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- like

- 1

- Repost

- Share

诺先生 :

:

Jumping up and crashing down—what kind of trick is this?Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3863?ref=VQURBLSNVQ&ref_type=132&utm_cmp=NVHYRllJ

- Reward

- like

- Comment

- Repost

- Share

#AIBT With AIBT in hand, there’s no need to worry. There’s no fear of missing out—everything is under control. ☺️

View Original

- Reward

- like

- Comment

- Repost

- Share

抬起你的蛋蛋,把屁股掰开

抬起你的蛋蛋,把屁股掰开

Created By@XiaoliangIsGoingToSu

Listing Progress

0.00%

MC:

$3.38K

Create My Token

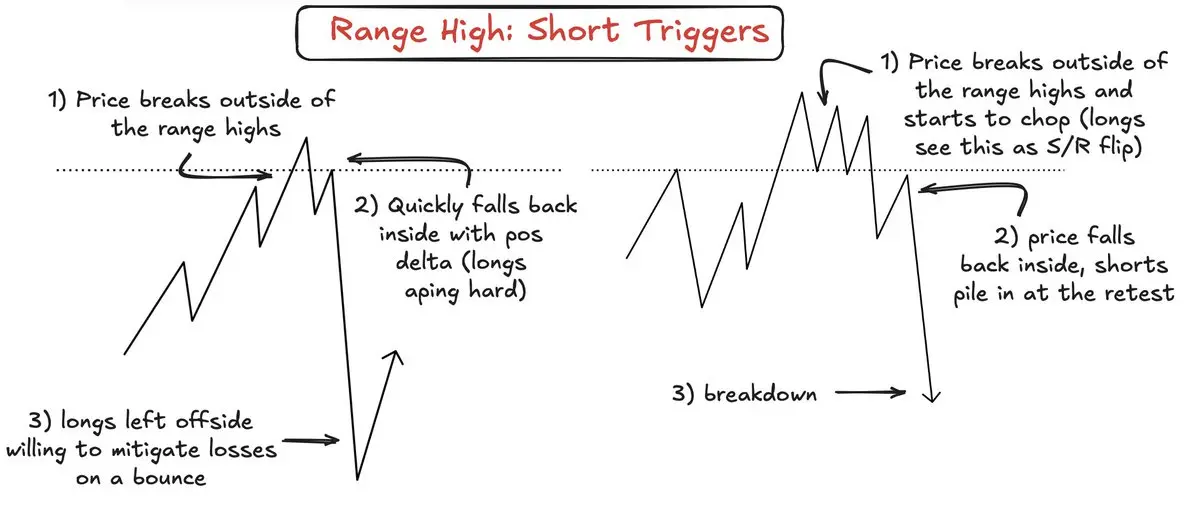

Trading the range remains the most important skillTwo Types Of Short triggers attached below👇

- Reward

- like

- Comment

- Repost

- Share

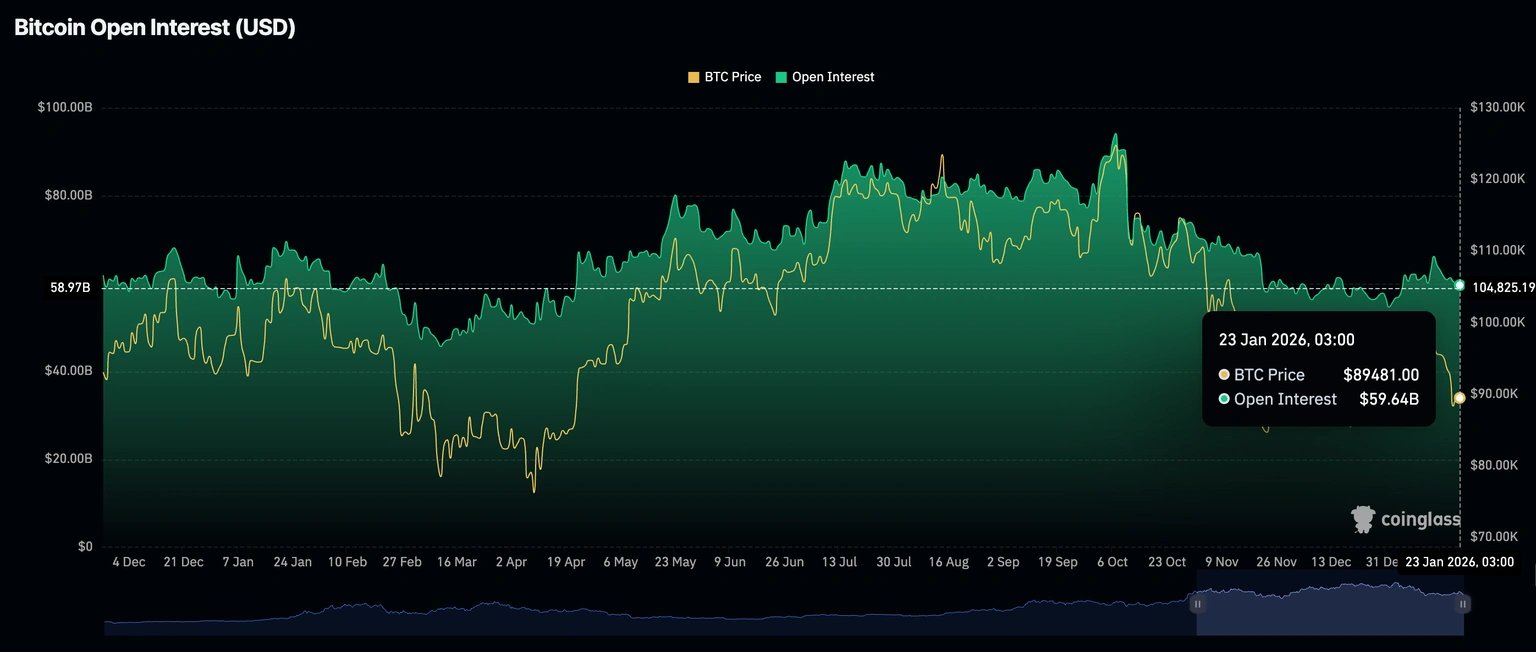

- Declining retail demand exposes Bitcoin, Ethereum, and XRP to further losses:

Demand for Bitcoin has remained largely weak since the October 10 crash, with the average open interest in futures contracts at $59.64 billion on Friday, down from $60.13 billion the day before, and $66.17 billion on January 15.

The OI index represents the nominal value of outstanding derivative contracts. CoinGlass data indicates that demand for Bitcoin derivatives pushed the OI index for futures contracts to a record high of $94.12 billion in October. Bitcoin reached an all-time high of $126,199 on October 6, con

Demand for Bitcoin has remained largely weak since the October 10 crash, with the average open interest in futures contracts at $59.64 billion on Friday, down from $60.13 billion the day before, and $66.17 billion on January 15.

The OI index represents the nominal value of outstanding derivative contracts. CoinGlass data indicates that demand for Bitcoin derivatives pushed the OI index for futures contracts to a record high of $94.12 billion in October. Bitcoin reached an all-time high of $126,199 on October 6, con

XRP-1,19%

- Reward

- 1

- 1

- Repost

- Share

Before00zero :

:

Bitcoin (BTC) struggles to stay above the support level of $89,000 as of this report, with the challenges facing the cryptocurrency market intensifying on Friday. Both Ethereum (ETH) and Ripple (XRP) are experiencing a decline in demand from individuals and institutions, while bearish indicators continue to show subtle signs of potential further losses.🔹 Warning: If Bitcoin loses $88,000, it could trigger $638 million in cascading long liquidations

- Reward

- 3

- 2

- Repost

- Share

NovaCryptoGirl :

:

Not necessarily. Unlocks can cause short-term pressure, but a sharp drop depends on how much supply unlocks, who receives it, and market demand. Often, strong projects see limited impact if sell-off is already priced in.View More

How can I marry an asset class? Do u want to be a loser forever?

- Reward

- like

- Comment

- Repost

- Share

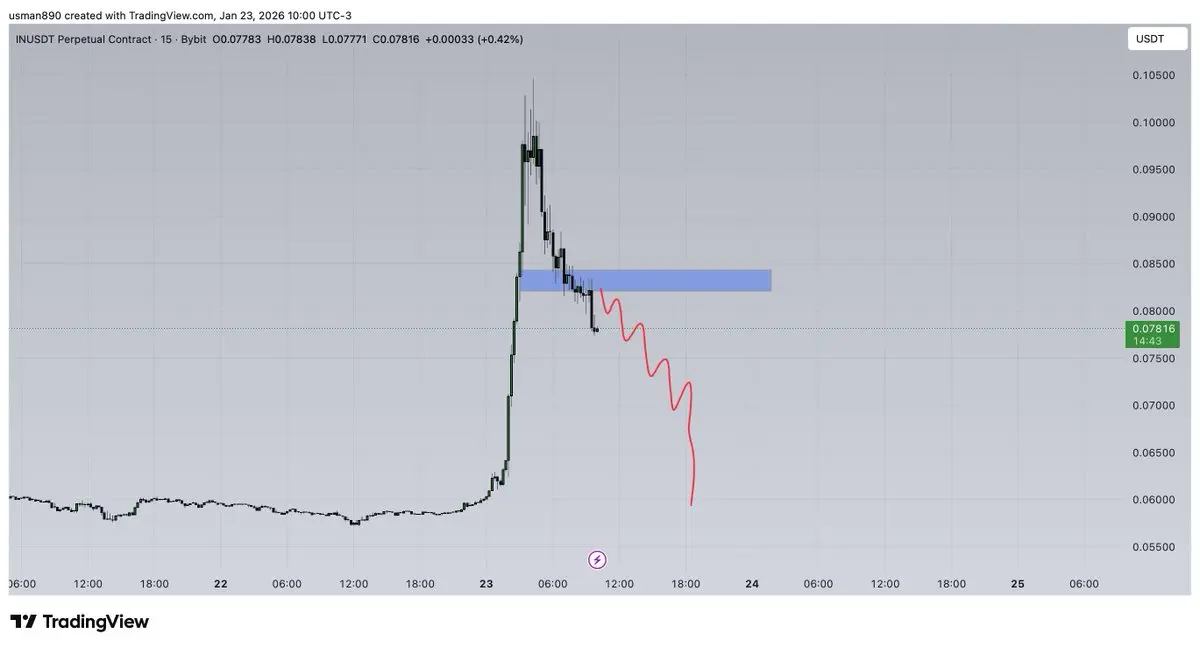

【$SPACE Signal】Short | Volume Breakout Downward

$SPACE is experiencing a volume surge and a sharp decline, with a daily drop of -28.49%. Combined with high open interest, this presents a typical scenario of long liquidation or main force distribution.

🎯 Direction: Short (Short)

🎯 Entry: 0.0175 - 0.0180

🛑 Stop Loss: 0.0195 ( Rigid stop loss, breaking this level invalidates the downward structure )

🚀 Target 1: 0.0150

🚀 Target 2: 0.0120

$SPACE Price drops vertically with massive trading volume, indicating a market logic of long liquidation or main force distribution. This price collapse u

$SPACE is experiencing a volume surge and a sharp decline, with a daily drop of -28.49%. Combined with high open interest, this presents a typical scenario of long liquidation or main force distribution.

🎯 Direction: Short (Short)

🎯 Entry: 0.0175 - 0.0180

🛑 Stop Loss: 0.0195 ( Rigid stop loss, breaking this level invalidates the downward structure )

🚀 Target 1: 0.0150

🚀 Target 2: 0.0120

$SPACE Price drops vertically with massive trading volume, indicating a market logic of long liquidation or main force distribution. This price collapse u

View Original

- Reward

- like

- Comment

- Repost

- Share

1️⃣ Historic Launch:

Dogecoin hits Nasdaq with the first SEC-approved spot Dogecoin ETF – 21Shares TDOG! 🐶💰

2️⃣ Key Features:

✅ Direct DOGE exposure without holding crypto

✅ Institutional-grade custody & SEC-approved

✅ Available on Robinhood, Fidelity, Schwab & TD Ameritrade

3️⃣ Market Impact:

📈 Analysts expect $1–2B inflows in year one, blending meme culture with mainstream investing

4️⃣ Why It Matters:

Legitimizes Dogecoin ✅ Boosts adoption 🌐 Opens doors for altcoin ETFs 🔥

5️⃣ Caution:

⚠️ DOGE is volatile – social trends & celebrity buzz affect price. Research before investing!

$BTC

Dogecoin hits Nasdaq with the first SEC-approved spot Dogecoin ETF – 21Shares TDOG! 🐶💰

2️⃣ Key Features:

✅ Direct DOGE exposure without holding crypto

✅ Institutional-grade custody & SEC-approved

✅ Available on Robinhood, Fidelity, Schwab & TD Ameritrade

3️⃣ Market Impact:

📈 Analysts expect $1–2B inflows in year one, blending meme culture with mainstream investing

4️⃣ Why It Matters:

Legitimizes Dogecoin ✅ Boosts adoption 🌐 Opens doors for altcoin ETFs 🔥

5️⃣ Caution:

⚠️ DOGE is volatile – social trends & celebrity buzz affect price. Research before investing!

$BTC

BTC-0,15%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More26.62K Popularity

9.58K Popularity

5.58K Popularity

2.16K Popularity

3.74K Popularity

News

View MoreDow Jones Industrial Average opens down 154.65 points, while the Nasdaq rises slightly by 6.1 points.

1 m

Spacecoin has opened the SPACE token airdrop claim

1 m

173rd Ethereum ACDC Meeting: Glamsterdam Upgrade Scope May Not Align with Schedule Planning

2 m

U.S. stocks open, Dow Jones down 0.24%, Nvidia up 1.4%

3 m

Spacecoin has opened the SPACE token airdrop claim. eligible addresses can participate through the Penguinbase portal.

9 m

Pin