Satoshitalks

No content yet

Satoshitalks

🎰 What happens in Vegas is expanding beyond Vegas.

Sphere is bringing its iconic venue to the D.C. metro:

1. 6,000 seats

2. National Harbor, MD

3. 15 mins from Washington, D.C.

The experience economy keeps scaling.

Sphere is bringing its iconic venue to the D.C. metro:

1. 6,000 seats

2. National Harbor, MD

3. 15 mins from Washington, D.C.

The experience economy keeps scaling.

- Reward

- 1

- Comment

- Repost

- Share

🚨 BREAKING: NYSE plans to enable 24/7 trading for U.S. equities.

What this could change:

Global market access

Volatility dynamics

Wall Street goes always-on

What this could change:

Global market access

Volatility dynamics

Wall Street goes always-on

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🚨 JUST IN: $100B wiped from the crypto market cap in the past 12 hours.

What this signals:

Leverage flush

Risk-off momentum

Volatility reset

What this signals:

Leverage flush

Risk-off momentum

Volatility reset

- Reward

- 1

- Comment

- Repost

- Share

🟡 Gold has no gravity—and Japan is buying more.

Here’s what the $4,655 move in $XAU signals:

Yen weakness hedge

Central bank demand

Risk-off positioning

Here’s what the $4,655 move in $XAU signals:

Yen weakness hedge

Central bank demand

Risk-off positioning

- Reward

- like

- Comment

- Repost

- Share

🚨 JUST IN: Michael Saylor drops the Strategy #Bitcoin Tracker — hinting at buying more $BTC.

Tracker updated

Accumulation signaled

Institutional appetite rising

#BTC #HODL

Tracker updated

Accumulation signaled

Institutional appetite rising

#BTC #HODL

BTC-2,34%

- Reward

- 1

- Comment

- Repost

- Share

🇪🇺🇺🇸 BREAKING: The EU is poised to pause approval of a U.S. trade deal after Trump’s latest tariff threats, Bloomberg reports.

This could reshape transatlantic economics & markets.

This could reshape transatlantic economics & markets.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

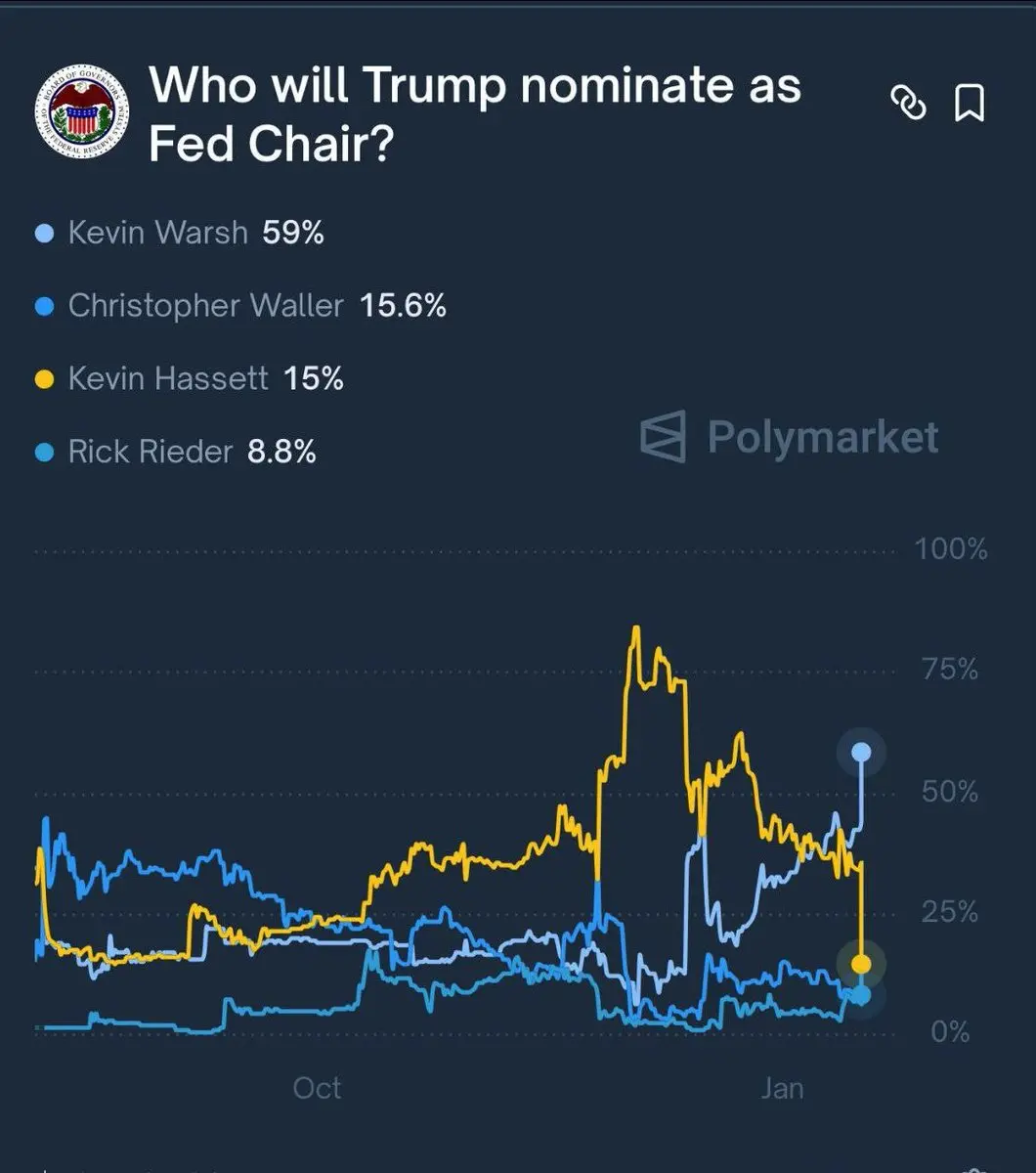

🚨 JUST IN: Odds of Bitcoin-friendly Kevin Warsh becoming Fed Chair jump to 59%.

Why markets care:

More pro-market signals

Softer stance on innovation

Macro tailwind for $BTC

Why markets care:

More pro-market signals

Softer stance on innovation

Macro tailwind for $BTC

- Reward

- like

- Comment

- Repost

- Share

📊 The Crypto Fear & Greed Index is back at neutral.

That means:

No panic selling

No irrational euphoria

Potential setup for sustainable moves

That means:

No panic selling

No irrational euphoria

Potential setup for sustainable moves

- Reward

- 1

- Comment

- Repost

- Share

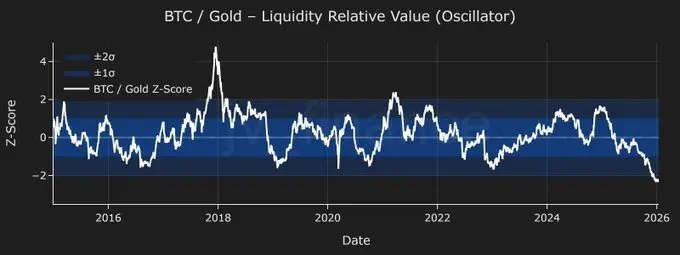

🚨 Bitcoin is the most undervalued asset vs. gold in years

BTC vs gold ratio dipping

Institutional interest rising

Macro liquidity flooding markets

#BTC #GOLD

BTC vs gold ratio dipping

Institutional interest rising

Macro liquidity flooding markets

#BTC #GOLD

BTC-2,34%

- Reward

- 1

- Comment

- Repost

- Share

🚀 #Ethereum on-chain activity hits an all-time high while fees drop to an all-time low — a major usability signal for $ETH adoption.

Why it matters:

1️⃣ More users + dApps

2️⃣ Cheaper transaction

3️⃣ Strong network demand

Why it matters:

1️⃣ More users + dApps

2️⃣ Cheaper transaction

3️⃣ Strong network demand

- Reward

- like

- 1

- Repost

- Share

LiuYang :

:

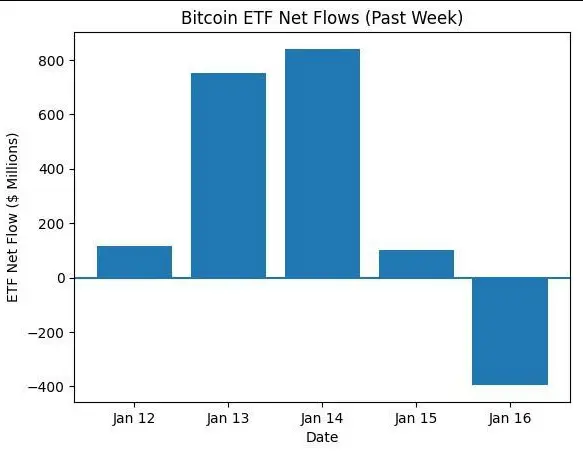

2026 GOGOGO 👊🚨 JUST IN: #BlackRock buys another $319.7M in #Bitcoin.

Institutional accumulation continues:

#ETFs driving demand

Supply tightening

Long-term conviction growing

$BTC

Institutional accumulation continues:

#ETFs driving demand

Supply tightening

Long-term conviction growing

$BTC

BTC-2,34%

- Reward

- like

- Comment

- Repost

- Share

🚨 Coinbase is going full “everything exchange.”

What’s coming next:

Stock trading for all users

Tokenized stocks on-chain

Dividends paid in Bitcoin

Crypto rails meet TradFi.

What’s coming next:

Stock trading for all users

Tokenized stocks on-chain

Dividends paid in Bitcoin

Crypto rails meet TradFi.

BTC-2,34%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share