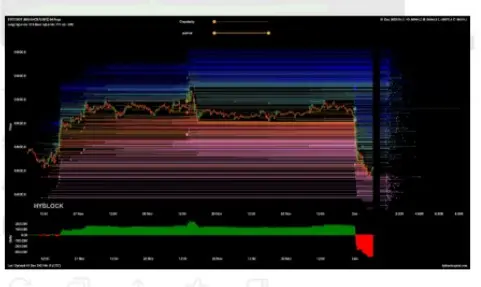

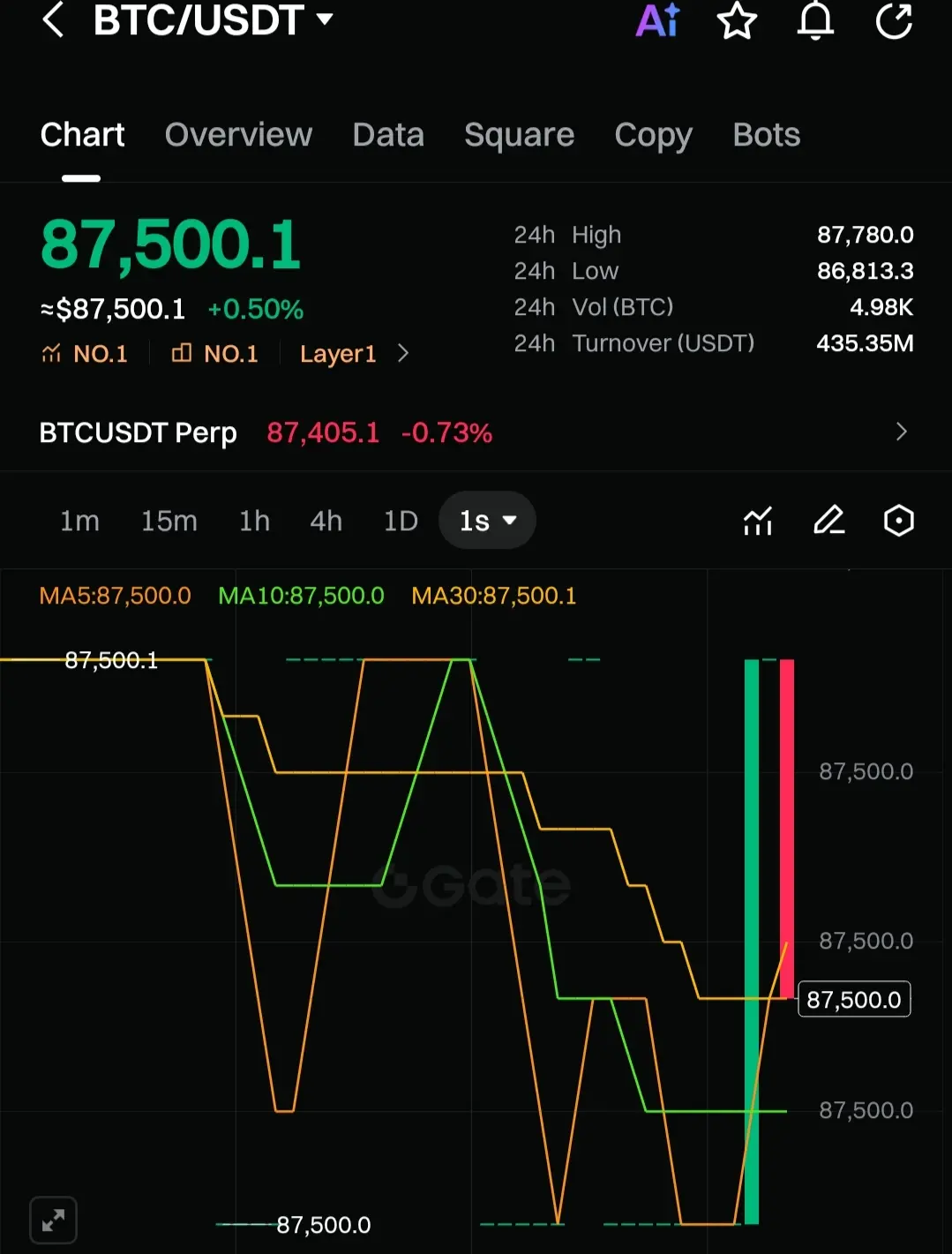

#Bitcoin is heading into a major options expiry, and positioning is driving price.

Open interest is heavily clustered around $82K (puts) and $95K–$96K (calls), with max pain near $96K. That setup keeps BTC pinned in the high-$80Ks as dealers hedge and volatility stays compressed.

Into expiry, price action is more about liquidity and positioning than trend. Once this expiry clears, $BTC is unlikely to stay range-bound for long.

Open interest is heavily clustered around $82K (puts) and $95K–$96K (calls), with max pain near $96K. That setup keeps BTC pinned in the high-$80Ks as dealers hedge and volatility stays compressed.

Into expiry, price action is more about liquidity and positioning than trend. Once this expiry clears, $BTC is unlikely to stay range-bound for long.

BTC0,13%