AylaShinex

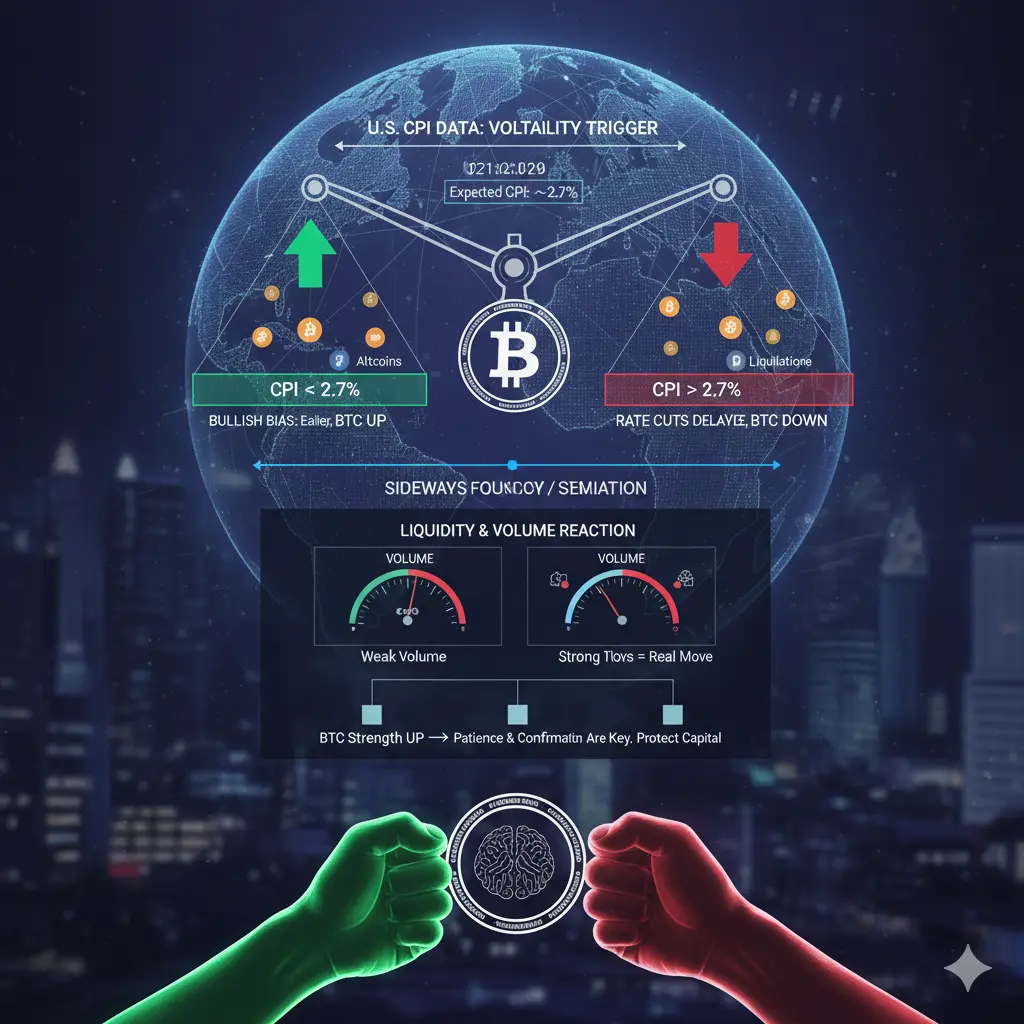

#CPIDataAhead 🔥 CPI Data Ahead — Market About To Make Its Move

All eyes are on CPI.

This is not just another economic report — this is the trigger that decides whether crypto breaks out or pulls back. Every major move in BTC, ETH and altcoins starts with macro pressure, and CPI is the ignition switch.

High CPI → Volatility explosion

Low CPI → Risk-on rally

Neutral CPI → Fake moves before real direction

Smart traders don’t wait for the candle — they prepare before it.

I’m watching: • BTC key support & resistance

• Altcoin momentum zones

• Meme coin volatility setups

• Liquidity sweeps after ne

All eyes are on CPI.

This is not just another economic report — this is the trigger that decides whether crypto breaks out or pulls back. Every major move in BTC, ETH and altcoins starts with macro pressure, and CPI is the ignition switch.

High CPI → Volatility explosion

Low CPI → Risk-on rally

Neutral CPI → Fake moves before real direction

Smart traders don’t wait for the candle — they prepare before it.

I’m watching: • BTC key support & resistance

• Altcoin momentum zones

• Meme coin volatility setups

• Liquidity sweeps after ne