QuanZhilongHK

No content yet

QuanZhilongHK

In traditional DeFi, assets are often idle, liquidity is limited, and yield efficiency is low. @MultichainZ_ offers a brand-new solution to maximize asset value:

Asset appreciation: Users can earn yields without selling, achieving a "passive income" model. Cross-chain lending: Supports frictionless cross-chain operations with stable and reliable asset positioning. Intelligent risk management: Automated collateralization and liquidation mechanisms significantly reduce risks and ensure asset security.

MultichainZ builds not just a single protocol but an efficient, reliable, and futuristic DeFi i

View OriginalAsset appreciation: Users can earn yields without selling, achieving a "passive income" model. Cross-chain lending: Supports frictionless cross-chain operations with stable and reliable asset positioning. Intelligent risk management: Automated collateralization and liquidation mechanisms significantly reduce risks and ensure asset security.

MultichainZ builds not just a single protocol but an efficient, reliable, and futuristic DeFi i

- Reward

- like

- Comment

- Repost

- Share

Today, @apecoin once again sent a strong signal in the ecological narrative.

“ $APE won't stop until your cup runneth over.”

This is not only a slogan, but also represents the future vision built by ApeChain and BAYC: the deep integration of assets, identities, and applications.

The current Hermes cross-@ApeChainHUB exchange process is running smoothly, and the on-chain experience is maturing rapidly. The positive interaction between ApeCoin officials has further strengthened community consensus and developer confidence.

The synergy between ApeChain and BAYC is unfolding. An ecosystem with eff

“ $APE won't stop until your cup runneth over.”

This is not only a slogan, but also represents the future vision built by ApeChain and BAYC: the deep integration of assets, identities, and applications.

The current Hermes cross-@ApeChainHUB exchange process is running smoothly, and the on-chain experience is maturing rapidly. The positive interaction between ApeCoin officials has further strengthened community consensus and developer confidence.

The synergy between ApeChain and BAYC is unfolding. An ecosystem with eff

APE-5.33%

- Reward

- like

- Comment

- Repost

- Share

First time feeling the enjoyment of taxpayer benefits,

The facilities downstairs are fully equipped, there's absolutely no need to go to the gym!

This article is sponsored by #BCGAME|@bcgame

View OriginalThe facilities downstairs are fully equipped, there's absolutely no need to go to the gym!

This article is sponsored by #BCGAME|@bcgame

- Reward

- like

- Comment

- Repost

- Share

Today, I delved deeper into @Hypercroc_xyz’s ecosystem and found that the ways to play are becoming more and more diverse.

In traditional DeFi, users often have to manually chase yields: frequently hopping pools, monitoring charts, and adjusting positions—almost like doing “investment labor.”

However, HyperCroc achieves fully automated management through Smart Vaults: the system intelligently adjusts strategies, optimizes yields in real time, and automatically manages risk. Users only need to deposit funds, and all other operations are handled by the Vault.

More importantly, at this stage ther

View OriginalIn traditional DeFi, users often have to manually chase yields: frequently hopping pools, monitoring charts, and adjusting positions—almost like doing “investment labor.”

However, HyperCroc achieves fully automated management through Smart Vaults: the system intelligently adjusts strategies, optimizes yields in real time, and automatically manages risk. Users only need to deposit funds, and all other operations are handled by the Vault.

More importantly, at this stage ther

- Reward

- like

- Comment

- Repost

- Share

The ApeCoin ecosystem is entering a brand new phase. The latest update from @apecoin shows significant progress on the ApeChain L3 testnet, with on-chain interaction costs dropping notably, providing more flexibility for NFT game and metaverse development.

As a member of the BAYC community, I have completed APE staking and continue to participate in building the Otherside ecosystem. The low-cost, high-performance on-chain environment will further enhance user engagement and asset utilization efficiency.

Feel free to share your staking strategies and practical experiences within the ApeChain ec

As a member of the BAYC community, I have completed APE staking and continue to participate in building the Otherside ecosystem. The low-cost, high-performance on-chain environment will further enhance user engagement and asset utilization efficiency.

Feel free to share your staking strategies and practical experiences within the ApeChain ec

APE-5.33%

- Reward

- like

- Comment

- Repost

- Share

The accelerated development of quantum computing is reshaping the landscape of cryptographic security, with the traditional public blockchain cryptosystems facing the potential threat of "Store-Now-Decrypt-Later." Against this backdrop, Quranium has proposed an on-chain infrastructure roadmap centered on quantum security.

Quranium adopts the SLH-DSA signature scheme based on SHA-256 hashing, combined with a Proof-of-Stake (PoS) consensus mechanism, aiming to provide full-stack encryption guarantees for the quantum era. Its goal is not only to withstand the decryption capabilities of future qua

View OriginalQuranium adopts the SLH-DSA signature scheme based on SHA-256 hashing, combined with a Proof-of-Stake (PoS) consensus mechanism, aiming to provide full-stack encryption guarantees for the quantum era. Its goal is not only to withstand the decryption capabilities of future qua

- Reward

- 2

- 2

- Repost

- Share

XPapaDonsX :

:

HODL Tight 💪View More

Recently, I’ve noticed that while @RiverdotInc and @River4FUN have maintained a steady pace of updates, this hasn’t stopped me from sharing why River continues to lead in the DeFi space.

1. Stable Asset System

The core of satUSD+ lies in cross-chain asset abstraction and automatic yield compounding. Users can earn stable returns across multiple chains without relying on bridges or extra steps. This frictionless experience makes it a truly low-risk stable asset.

2. S3 Incentive Mechanism

Voting for the current S3 season is in full swing, where points equal governance power. Each 1 Pts equals 1

1. Stable Asset System

The core of satUSD+ lies in cross-chain asset abstraction and automatic yield compounding. Users can earn stable returns across multiple chains without relying on bridges or extra steps. This frictionless experience makes it a truly low-risk stable asset.

2. S3 Incentive Mechanism

Voting for the current S3 season is in full swing, where points equal governance power. Each 1 Pts equals 1

View Original

- Reward

- like

- Comment

- Repost

- Share

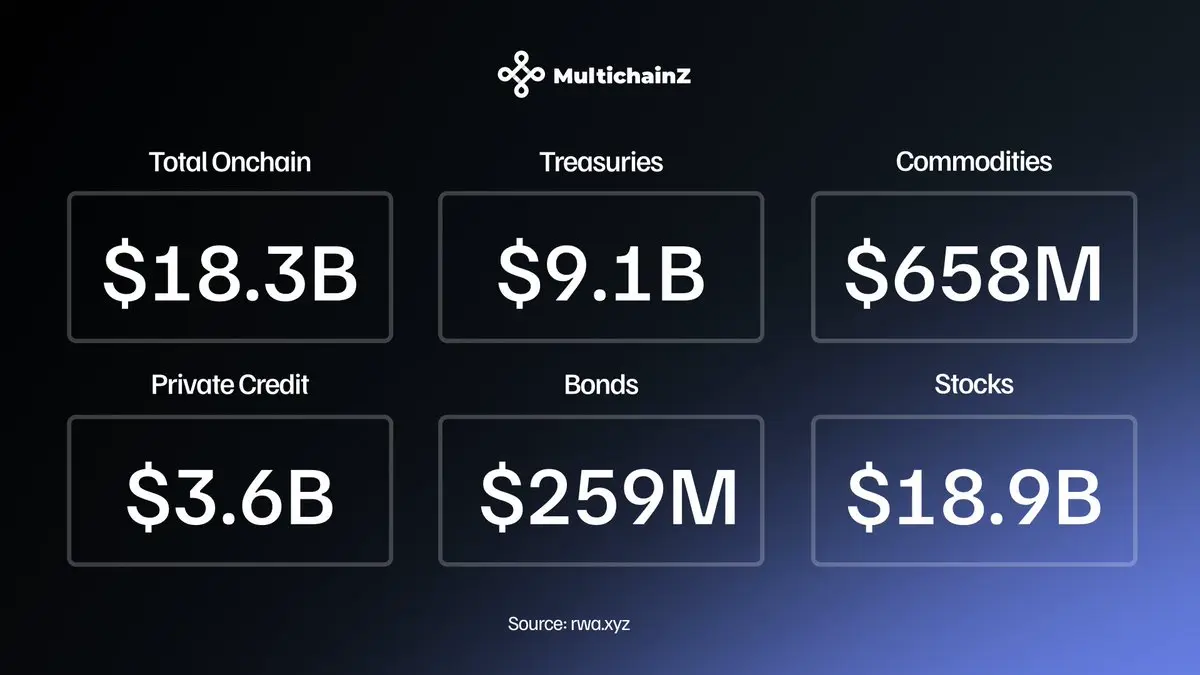

Just saw the in-depth conversation between Brian Armstrong and Larry, which once again confirms a trend: asset tokenization is becoming the next stage of global financial infrastructure.

@MultichainZ_’s perspective is very clear: Everything, on-chain.

When real-world assets can be borrowed and settled across networks and ecosystems on-chain, funding costs will be offset by returns, and liquidity friction will be eliminated. The boundaries between traditional finance and decentralized finance are rapidly blurring, and the definition of capital efficiency will be completely rewritten.

Who is alr

View Original@MultichainZ_’s perspective is very clear: Everything, on-chain.

When real-world assets can be borrowed and settled across networks and ecosystems on-chain, funding costs will be offset by returns, and liquidity friction will be eliminated. The boundaries between traditional finance and decentralized finance are rapidly blurring, and the definition of capital efficiency will be completely rewritten.

Who is alr

- Reward

- like

- Comment

- Repost

- Share

Just conducted an in-depth study of @MultichainZ_'s Omnichain Credit protocol, and it’s clear that this system is reshaping the fundamental paradigm of RWA lending.

This protocol uses yield-bearing real-world assets (RWAs) as collateral, allowing borrowing costs to be offset and structurally improving capital efficiency. At the same time, relying on its omnichain interoperability framework, it enables frictionless capital flows across multiple chains—no need for traditional bridging steps or additional trust assumptions.

In this model, the robust yield structures of traditional finance natural

View OriginalThis protocol uses yield-bearing real-world assets (RWAs) as collateral, allowing borrowing costs to be offset and structurally improving capital efficiency. At the same time, relying on its omnichain interoperability framework, it enables frictionless capital flows across multiple chains—no need for traditional bridging steps or additional trust assumptions.

In this model, the robust yield structures of traditional finance natural

- Reward

- like

- Comment

- Repost

- Share

Stay Untamed! The wildest party in Abu Dhabi this year is here

Organizer: @bcgame

Abu Dhabi in December is absolutely on fire: Bitcoin MENA, Solana Breakpoint, Global Blockchain Show...

And now, another massive party: Stay Untamed Party🔥

👉 Friends who want to attend can apply for tickets here:

🎧 The lineup is insane

DubVision, Mari Ferrari: Top 100 DJs

Esports (s1mple & electronic): Legendary CS duo

T10 Deccan Gladiators: Cricket star team

Top Web3 figures, KOLs, and creators all present

🎁 Lucky draws all night

iPhone 17 Pro, Labubu, $BC merchandise, and mysterious grand pri

Organizer: @bcgame

Abu Dhabi in December is absolutely on fire: Bitcoin MENA, Solana Breakpoint, Global Blockchain Show...

And now, another massive party: Stay Untamed Party🔥

👉 Friends who want to attend can apply for tickets here:

🎧 The lineup is insane

DubVision, Mari Ferrari: Top 100 DJs

Esports (s1mple & electronic): Legendary CS duo

T10 Deccan Gladiators: Cricket star team

Top Web3 figures, KOLs, and creators all present

🎁 Lucky draws all night

iPhone 17 Pro, Labubu, $BC merchandise, and mysterious grand pri

BC1.72%

- Reward

- like

- Comment

- Repost

- Share

🚀 I just studied the Omnichain Credit Protocol of @MultichainZ_, and I must say it is rewriting the underlying paradigm of RWA lending.

Core Mechanism Highlights:

1️⃣ Yield-bearing Collateral

Using sustainable income-generating assets like government bonds, money market funds, and stETH as collateral directly, the borrowing costs are offset, creating a *net positive yield credit position*. This is nearly impossible to achieve in traditional DeFi models.

2️⃣ Native Omnichain Liquidity Layer

No need for wrapped assets, no need for cross-chain bridges, and credit limits can be called in real-tim

Core Mechanism Highlights:

1️⃣ Yield-bearing Collateral

Using sustainable income-generating assets like government bonds, money market funds, and stETH as collateral directly, the borrowing costs are offset, creating a *net positive yield credit position*. This is nearly impossible to achieve in traditional DeFi models.

2️⃣ Native Omnichain Liquidity Layer

No need for wrapped assets, no need for cross-chain bridges, and credit limits can be called in real-tim

STETH0.85%

- Reward

- like

- Comment

- Repost

- Share