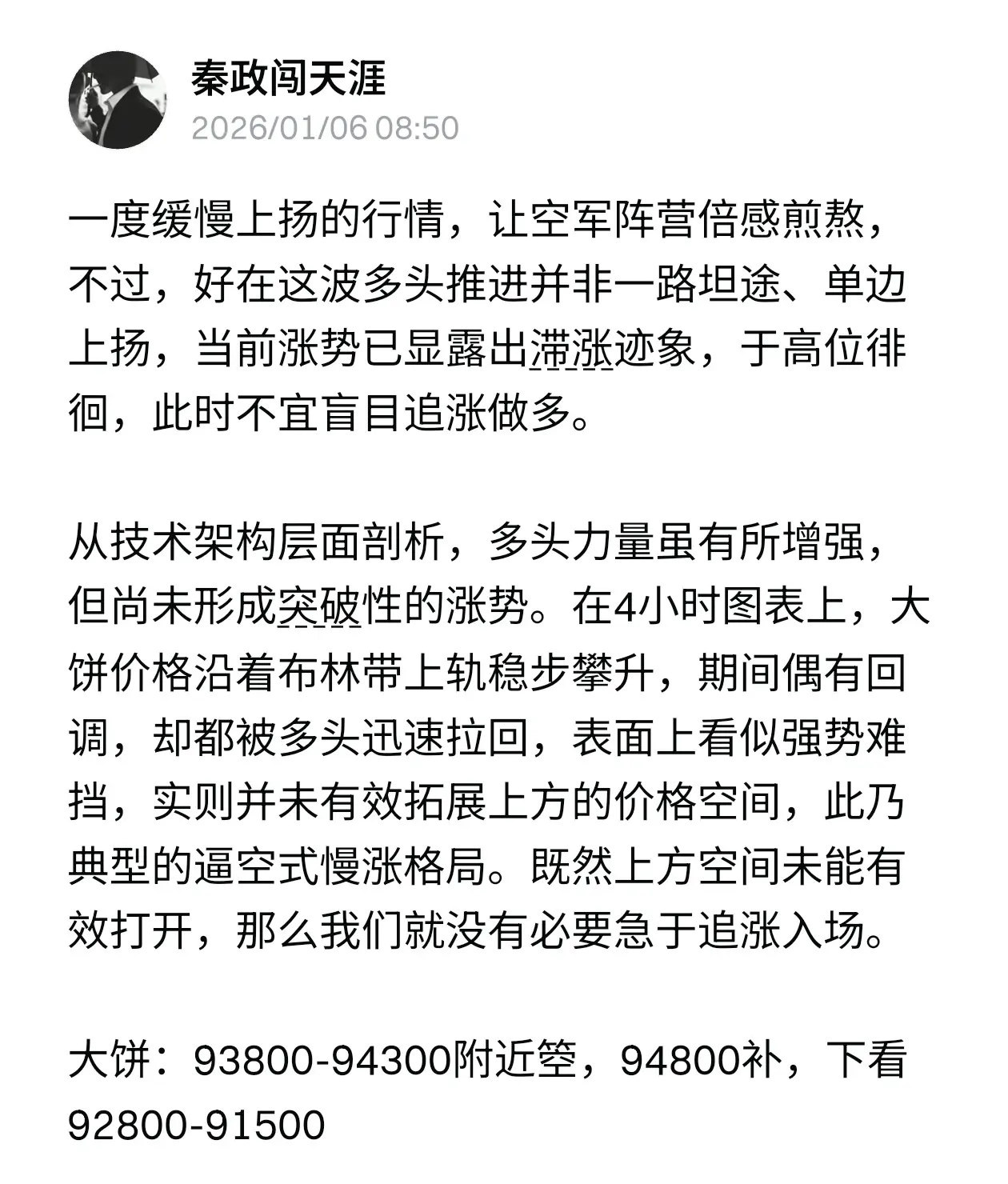

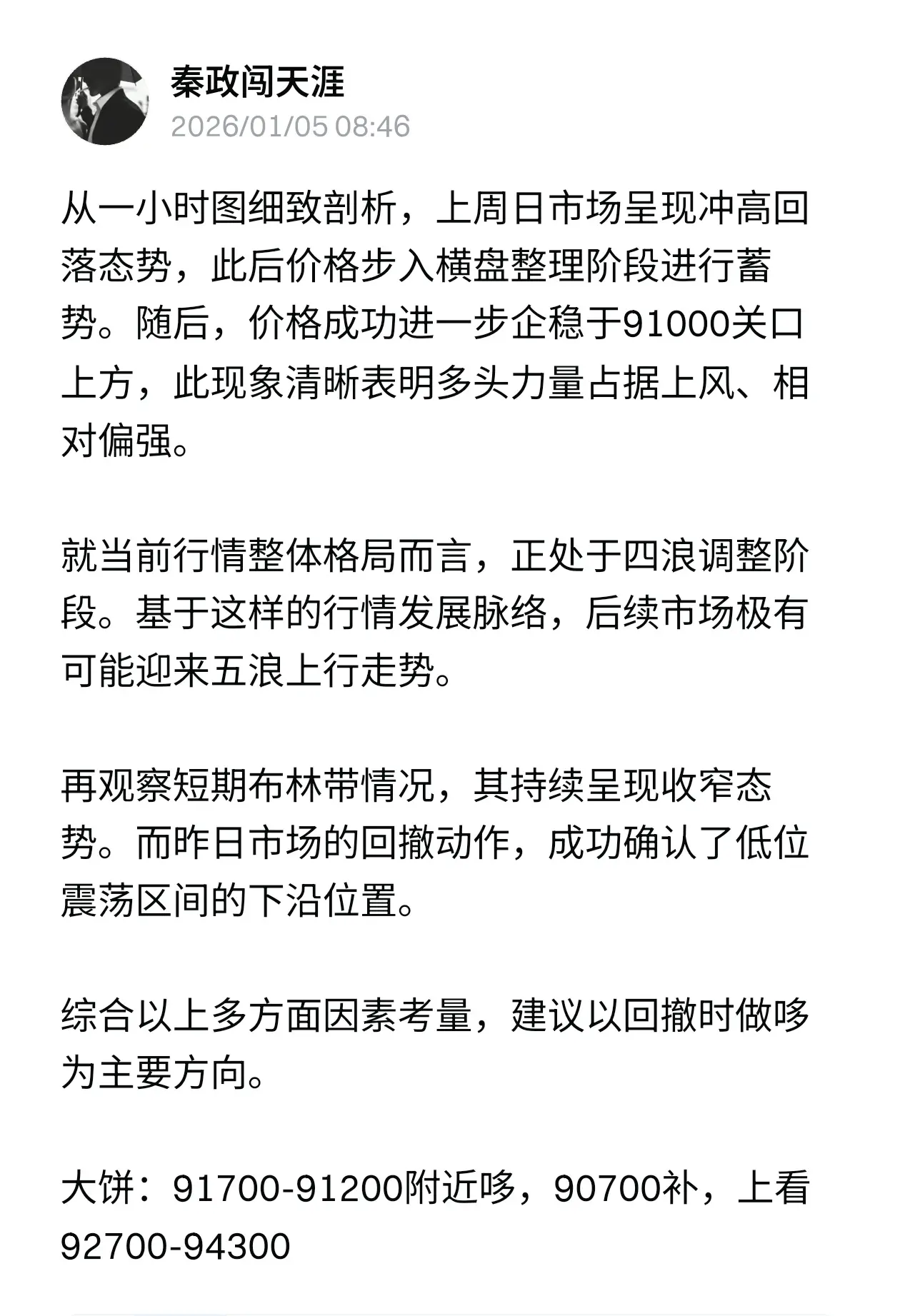

秦政闯天涯

Asian morning gold prices edged higher, with geopolitical risks serving as the main support.

Global geopolitical tensions remain high, causing international gold markets to fluctuate with a slight upward bias. In the Asian morning session, safe-haven buying pushed gold prices slightly higher, supported by concerns over escalating geopolitical conflicts.

Spot gold remained steady in the Asian morning session, rising 0.1% from the previous day's close to $4,462.34 per ounce. Although the increase was modest, it reaffirmed gold's safe-haven properties. Ongoing geopolitical frictions in multiple r

View OriginalGlobal geopolitical tensions remain high, causing international gold markets to fluctuate with a slight upward bias. In the Asian morning session, safe-haven buying pushed gold prices slightly higher, supported by concerns over escalating geopolitical conflicts.

Spot gold remained steady in the Asian morning session, rising 0.1% from the previous day's close to $4,462.34 per ounce. Although the increase was modest, it reaffirmed gold's safe-haven properties. Ongoing geopolitical frictions in multiple r