阿亿Allin

No content yet

阿亿Allin

12.22 BTC Evening Simplified Market Report: Weak Fluctuations Practical Guide

View OriginalSubscribers Only

Subscribe now to view exclusive content- Reward

- 1

- Comment

- Repost

- Share

12.22 ETH evening market analysis

1. Core Logic

- Macro: Federal Reserve hawkish + short-term liquidity injection of 6.8 billion, coexistence of suppression and support

- Capital: Small net inflow into ETFs, but the pressure for institutions to realize profits remains at year-end.

View Original1. Core Logic

- Macro: Federal Reserve hawkish + short-term liquidity injection of 6.8 billion, coexistence of suppression and support

- Capital: Small net inflow into ETFs, but the pressure for institutions to realize profits remains at year-end.

Subscribers Only

Subscribe now to view exclusive content- Reward

- 1

- Comment

- Repost

- Share

Tomorrow, the live broadcast should be stable. The sound card will arrive tomorrow, and after debugging the equipment, you can start broadcasting. Market analysis and discussions on various cryptocurrencies are welcome. Please follow the host, so you can see the broadcast promptly tomorrow.

View Original

- Reward

- 1

- Comment

- Repost

- Share

12.18 ETH Evening Market Analysis

Core Conclusion: Before CPI release, the market is expected to be volatile and slightly bearish, focusing on a range of 2790-2900 for sideways trading. After the data is released, follow the trend if a breakout occurs; avoid chasing trades without clear signals.

I. Logical Support

1. Technical: The 4-hour moving averages are under pressure, MACD remains below zero indicating bearish momentum, and after testing the bottom at 2790 yesterday, the rebound was weak, failing to break through the key level of 2900.

2. Capital: 24-hour total liquidation on the network

Core Conclusion: Before CPI release, the market is expected to be volatile and slightly bearish, focusing on a range of 2790-2900 for sideways trading. After the data is released, follow the trend if a breakout occurs; avoid chasing trades without clear signals.

I. Logical Support

1. Technical: The 4-hour moving averages are under pressure, MACD remains below zero indicating bearish momentum, and after testing the bottom at 2790 yesterday, the rebound was weak, failing to break through the key level of 2900.

2. Capital: 24-hour total liquidation on the network

ETH-0.91%

- Reward

- like

- Comment

- Repost

- Share

12.18 BTC Evening Market Analysis

Core conclusion: Before the CPI release, the market is oscillating and slightly bearish, focusing on the 85,000-88,500 range. After the data is released, operate accordingly; do not chase trades without signals.

1. Logical support

1. Technical: Daily chart shows a bearish descending three-method pattern, 4-hour moving averages are under pressure, MACD indicates continued bearish momentum.

2. Capital: 24-hour liquidation reached $697 million (mainly long positions), ETF support is weak, liquidity is insufficient.

3. Macro: As the US CPI data is released at 21:3

View OriginalCore conclusion: Before the CPI release, the market is oscillating and slightly bearish, focusing on the 85,000-88,500 range. After the data is released, operate accordingly; do not chase trades without signals.

1. Logical support

1. Technical: Daily chart shows a bearish descending three-method pattern, 4-hour moving averages are under pressure, MACD indicates continued bearish momentum.

2. Capital: 24-hour liquidation reached $697 million (mainly long positions), ETF support is weak, liquidity is insufficient.

3. Macro: As the US CPI data is released at 21:3

- Reward

- like

- Comment

- Repost

- Share

12.18 BNB Afternoon Market Analysis

1. Opening Tone

BNB current price is 831, caught between macro suppression and the 820-830 support zone. No unilateral trend before 17:30. Key breakout points will determine the direction. Light position trading is the core strategy.

2. Technical Anchors

1. Price signals: Resistance at 845-850 (4-hour EMA60 + high trading volume zone), support at 820-815 (lower end of oscillation). Breakouts or breakdowns require volume to increase by 1.5 times to be valid.

2. Indicator signals: 4-hour MACD shows a death cross with shrinking green bars, RSI≈40; RSI breaking

1. Opening Tone

BNB current price is 831, caught between macro suppression and the 820-830 support zone. No unilateral trend before 17:30. Key breakout points will determine the direction. Light position trading is the core strategy.

2. Technical Anchors

1. Price signals: Resistance at 845-850 (4-hour EMA60 + high trading volume zone), support at 820-815 (lower end of oscillation). Breakouts or breakdowns require volume to increase by 1.5 times to be valid.

2. Indicator signals: 4-hour MACD shows a death cross with shrinking green bars, RSI≈40; RSI breaking

BNB0.14%

- Reward

- 1

- Comment

- Repost

- Share

December 18 BTC Afternoon Market Analysis

1. Core Logical Support (Strong Logical Closed-Loop)

1. Macro and Capital: Liquidity tightening + end-of-year caution: Diverging Fed rate cut expectations, increasing macro vulnerability, combined with year-end risk-averse sentiment; CME Bitcoin futures open interest drops to yearly lows, spot trading volume decreases by 12% week-on-week, market participation contracts.

2. Technical Structure: Downtrend persists + Support Battles: Daily MACD forms death cross, moving averages press downward, 4-hour chart is under descending trendline constraint; howeve

View Original1. Core Logical Support (Strong Logical Closed-Loop)

1. Macro and Capital: Liquidity tightening + end-of-year caution: Diverging Fed rate cut expectations, increasing macro vulnerability, combined with year-end risk-averse sentiment; CME Bitcoin futures open interest drops to yearly lows, spot trading volume decreases by 12% week-on-week, market participation contracts.

2. Technical Structure: Downtrend persists + Support Battles: Daily MACD forms death cross, moving averages press downward, 4-hour chart is under descending trendline constraint; howeve

- Reward

- 2

- 1

- Repost

- Share

GateUser-9b420c44 :

:

HODL Tight 💪December 18 ETH Afternoon Market Analysis

1. Core Logical Support (Strong Logical Closed-Loop)

1. Macroeconomic Pressure: The probability of the Bank of Japan raising interest rates exceeds 90%, and the unwinding of yen arbitrage trades triggers liquidity drainage in crypto assets. Historical data shows that at such policy nodes, ETH typically retraces 15%-20%; the Federal Reserve’s rate cut expectations for 2026 have been revised from 4 to 2 cuts, lowering the valuation center of risk assets.

2. Capital Outflows: Single-day net outflows from ETH spot ETFs exceed $350 million, and BlackRock’s

View Original1. Core Logical Support (Strong Logical Closed-Loop)

1. Macroeconomic Pressure: The probability of the Bank of Japan raising interest rates exceeds 90%, and the unwinding of yen arbitrage trades triggers liquidity drainage in crypto assets. Historical data shows that at such policy nodes, ETH typically retraces 15%-20%; the Federal Reserve’s rate cut expectations for 2026 have been revised from 4 to 2 cuts, lowering the valuation center of risk assets.

2. Capital Outflows: Single-day net outflows from ETH spot ETFs exceed $350 million, and BlackRock’s

- Reward

- 4

- 1

- Repost

- Share

GateUser-9b420c44 :

:

Bull Run 🐂12.17 BTC Midday Market Analysis

1. Logical Support (Strong Logical Closed-Loop)

1. Trend Foundation: The daily chart remains in a downward channel since October's high, with moving averages in a bearish alignment. Price stays below EMA7/EMA30/EMA120. The weekly downtrend persists, but the 4-hour chart shows consecutive long lower shadows, RSI has exited the oversold zone, indicating a short-term weak correction is needed.

2. Core Battle Between Bulls and Bears: The support zone at 85500-86000 combines Fibonacci retracement and previous lows, with three tests without breaking through, showing

View Original1. Logical Support (Strong Logical Closed-Loop)

1. Trend Foundation: The daily chart remains in a downward channel since October's high, with moving averages in a bearish alignment. Price stays below EMA7/EMA30/EMA120. The weekly downtrend persists, but the 4-hour chart shows consecutive long lower shadows, RSI has exited the oversold zone, indicating a short-term weak correction is needed.

2. Core Battle Between Bulls and Bears: The support zone at 85500-86000 combines Fibonacci retracement and previous lows, with three tests without breaking through, showing

- Reward

- 2

- Comment

- Repost

- Share

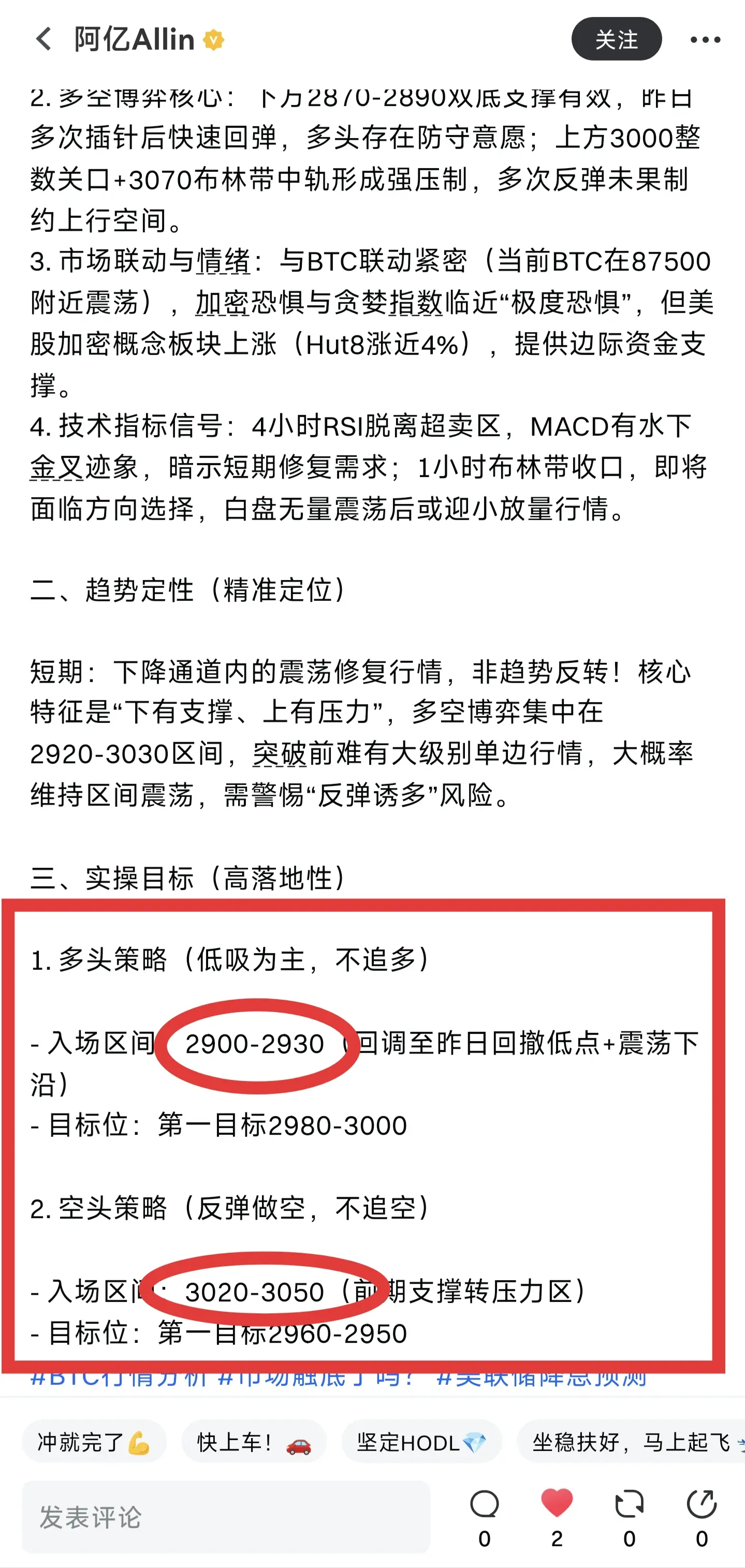

12.17 ETH Midday Market Analysis

1. Logical Support (Strong Logical Closed-Loop)

1. Trend Continuity: ETH remains in a downward channel since the high of 3170, with the daily MA5/MA10 death cross downward, and the price below all moving averages. The bearish pattern has not changed, but on the 4-hour chart, a double bottom rebound has formed from 2870, indicating short-term correction momentum is easing.

2. Core of Bull-Bear Battle: The double bottom support at 2870-2890 is effective. After multiple pin-like dips yesterday, there was a quick rebound, showing bulls' defensive willingness; above

View Original1. Logical Support (Strong Logical Closed-Loop)

1. Trend Continuity: ETH remains in a downward channel since the high of 3170, with the daily MA5/MA10 death cross downward, and the price below all moving averages. The bearish pattern has not changed, but on the 4-hour chart, a double bottom rebound has formed from 2870, indicating short-term correction momentum is easing.

2. Core of Bull-Bear Battle: The double bottom support at 2870-2890 is effective. After multiple pin-like dips yesterday, there was a quick rebound, showing bulls' defensive willingness; above

- Reward

- 2

- Comment

- Repost

- Share

12.14 ETH Afternoon Market Analysis

I. Logical Support

1. Macro: After the Federal Reserve cuts interest rates, easing expectations cool down, risk assets lack liquidity, and ETH lacks incremental funds.

2. Technical: Narrow compression between 3050-3180, resistance at 3150-3180 during rebounds, declines supported at 3050, volatility remains low.

3. Market: Significant bullish and bearish divergence, selling pressure above, support from chips below, trading volume is light.

II. Trend Qualification

The trend is sideways with a bias to the downside, within the core range of 3050-3180, rebounds a

View OriginalI. Logical Support

1. Macro: After the Federal Reserve cuts interest rates, easing expectations cool down, risk assets lack liquidity, and ETH lacks incremental funds.

2. Technical: Narrow compression between 3050-3180, resistance at 3150-3180 during rebounds, declines supported at 3050, volatility remains low.

3. Market: Significant bullish and bearish divergence, selling pressure above, support from chips below, trading volume is light.

II. Trend Qualification

The trend is sideways with a bias to the downside, within the core range of 3050-3180, rebounds a

- Reward

- 1

- Comment

- Repost

- Share

12.14 BTC Afternoon Market Analysis

1. Logical Support

1. Macro bearish pressure: The US 20/30-year Treasury yields broke above 4.8% on 12.13, coupled with collective declines in European and American stock markets, increasing risk aversion towards risk assets. BTC, as a highly volatile asset, is dragged down; internal Fed dissent on interest rate cuts intensifies, liquidity expectations tighten, further suppressing price elasticity.

2. Technical bearish dominance: The hourly chart broke below the middle band of the Bollinger Bands with the bands opening downward; MACD fast and slow lines are

View Original1. Logical Support

1. Macro bearish pressure: The US 20/30-year Treasury yields broke above 4.8% on 12.13, coupled with collective declines in European and American stock markets, increasing risk aversion towards risk assets. BTC, as a highly volatile asset, is dragged down; internal Fed dissent on interest rate cuts intensifies, liquidity expectations tighten, further suppressing price elasticity.

2. Technical bearish dominance: The hourly chart broke below the middle band of the Bollinger Bands with the bands opening downward; MACD fast and slow lines are

- Reward

- like

- Comment

- Repost

- Share

12.13ETH Precise Entry Point Dropped into Hand! How to Profit Straight from Volatile Market

ETH stuck around the 3100 level, are you buying then it drops, selling then it rises?

Staring at the candlestick chart for a long time, but still missing out and getting trapped?

Don't panic! 3080 is a strong support at the lower Bollinger Band, 3150 is a short-term resistance top, and 3050-3150 is the golden zone for sideways movement. No breakout means no trending market!

Operational strategy, just copy the method

This wave of volatility isn't annoying, it's money! Follow the key levels to operate, no

ETH stuck around the 3100 level, are you buying then it drops, selling then it rises?

Staring at the candlestick chart for a long time, but still missing out and getting trapped?

Don't panic! 3080 is a strong support at the lower Bollinger Band, 3150 is a short-term resistance top, and 3050-3150 is the golden zone for sideways movement. No breakout means no trending market!

Operational strategy, just copy the method

This wave of volatility isn't annoying, it's money! Follow the key levels to operate, no

ETH-0.91%

- Reward

- 1

- 3

- Repost

- Share

LZZzz :

:

View More

Getting into the family, don't miss out on this wave of crypto dividends!

After so long of waiting, those who are trapped, missed the boat, or watching the market anxiously—aren't you about to lose your patience?

The crypto world has never been about gambling; it's about vision and timing. If you choose the wrong direction, all your efforts are in vain.

I've been in the crypto space for 6 years, from early-stage market positioning to mid-stage swing trading. I've accurately caught the BTC halving market, led followers to bottom fish SOL and ARB, and everyone who followed at least gained 30%+ p

View OriginalAfter so long of waiting, those who are trapped, missed the boat, or watching the market anxiously—aren't you about to lose your patience?

The crypto world has never been about gambling; it's about vision and timing. If you choose the wrong direction, all your efforts are in vain.

I've been in the crypto space for 6 years, from early-stage market positioning to mid-stage swing trading. I've accurately caught the BTC halving market, led followers to bottom fish SOL and ARB, and everyone who followed at least gained 30%+ p

- Reward

- 1

- Comment

- Repost

- Share

ETH big gains in hand! Profits are not by chance, following the rhythm to eat the meat is the key

Just cleared the ETH long position, some people in the crypto world have waited all day just to get soup, while others have already grabbed the meat as soon as they made a move. It's not luck, but rhythm and judgment!

Now the ETH trend has already shown a clear direction, a major market opportunity is right in front of us. Miss this one, and you'll have to wait for the next wave!

Different positions, different strategies

I never react late; the real trading is right here. If you want to fo

View OriginalJust cleared the ETH long position, some people in the crypto world have waited all day just to get soup, while others have already grabbed the meat as soon as they made a move. It's not luck, but rhythm and judgment!

Now the ETH trend has already shown a clear direction, a major market opportunity is right in front of us. Miss this one, and you'll have to wait for the next wave!

Different positions, different strategies

I never react late; the real trading is right here. If you want to fo

- Reward

- 1

- Comment

- Repost

- Share

ETH big rally has been achieved! Those who endured in the crypto world are now making huge profits.

FOMO and panic, holding losses, most people in the crypto space are always caught in the cycle of chasing gains and selling at lows, repeatedly getting cut.

The current dip in ETH is not the top, but a golden opportunity to buy in!

Institutional funds are continuously entering the market, and ETH's narrative and fundamentals haven't collapsed. The next move will only be a trend-following market. Missed this chance, and you'll have to wait another half year!

Tiered strategy, profits available at

View OriginalFOMO and panic, holding losses, most people in the crypto space are always caught in the cycle of chasing gains and selling at lows, repeatedly getting cut.

The current dip in ETH is not the top, but a golden opportunity to buy in!

Institutional funds are continuously entering the market, and ETH's narrative and fundamentals haven't collapsed. The next move will only be a trend-following market. Missed this chance, and you'll have to wait another half year!

Tiered strategy, profits available at

- Reward

- 1

- Comment

- Repost

- Share

BTC 12.13 Afternoon Market Analysis

Mainly consolidating and pulling back, with a preference for short positions

1. Logical support: Triple resonance suppression

- Major funds: Yesterday, they shorted at 93,000 and completed arbitrage at 90,000. Today, trading volume has shrunk, weekend liquidity is poor, and a strong rebound is unlikely.

- Technical aspect: 93,000-93,500 is a strong resistance zone; 4-hour moving averages are in a bearish alignment; volume-price divergence; upper Bollinger Band on the 4-hour chart provides obvious resistance.

- Fundamental aspect: The US dollar index has retr

View OriginalMainly consolidating and pulling back, with a preference for short positions

1. Logical support: Triple resonance suppression

- Major funds: Yesterday, they shorted at 93,000 and completed arbitrage at 90,000. Today, trading volume has shrunk, weekend liquidity is poor, and a strong rebound is unlikely.

- Technical aspect: 93,000-93,500 is a strong resistance zone; 4-hour moving averages are in a bearish alignment; volume-price divergence; upper Bollinger Band on the 4-hour chart provides obvious resistance.

- Fundamental aspect: The US dollar index has retr

- Reward

- 2

- Comment

- Repost

- Share

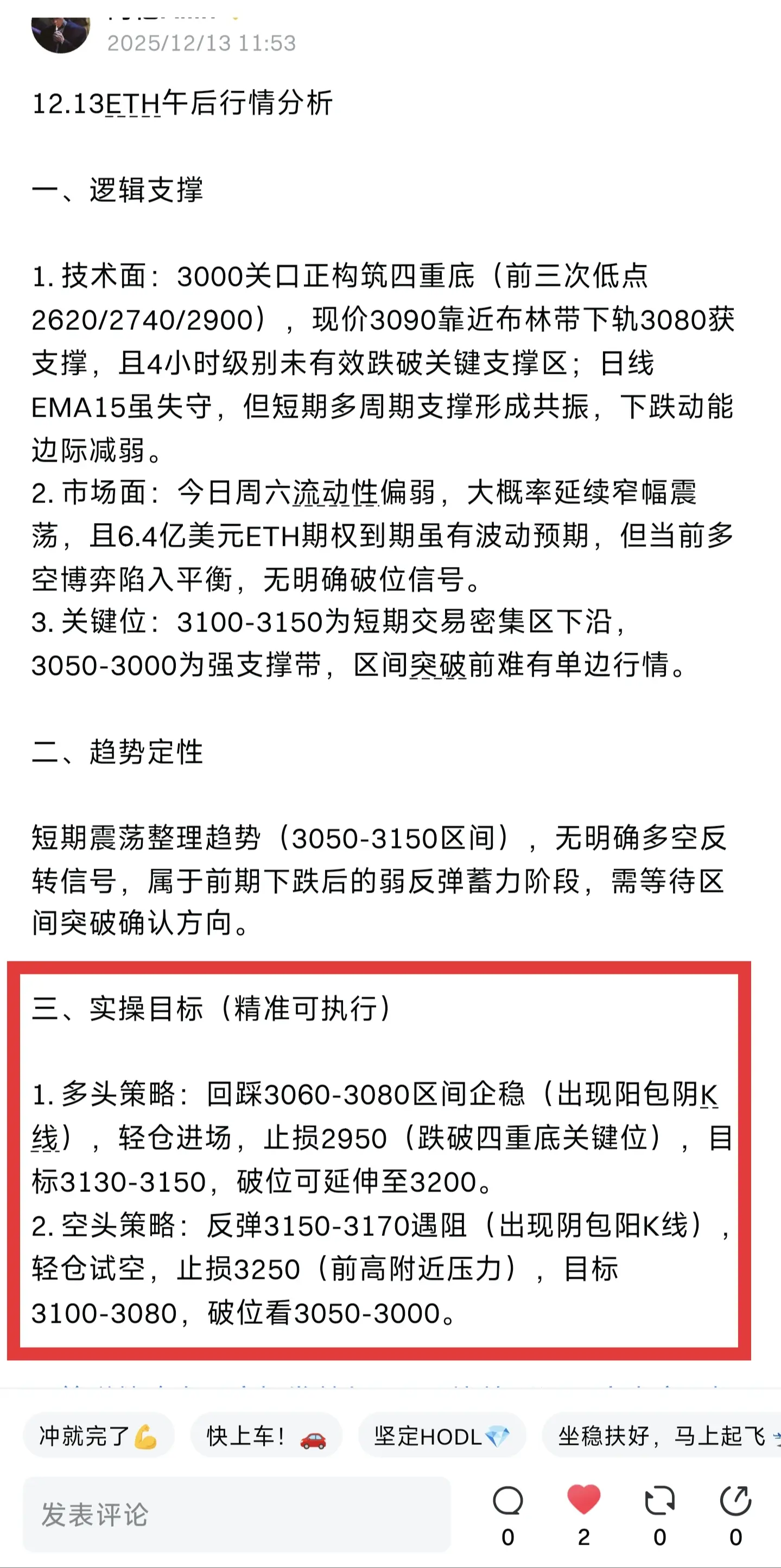

12.13 ETH Afternoon Market Analysis

I. Logical Support

1. Technical Perspective: The 3000 level is forming a quadruple bottom (the previous three lows were 2620/2740/2900). The current price of 3090 is near the lower Bollinger Band at 3080, receiving support, and the 4-hour chart has not effectively broken below the key support zone; although the daily EMA15 has been lost, short-term multi-cycle support is resonating, and downward momentum is weakening marginally.

2. Market Perspective: Today is Saturday, and liquidity is relatively weak, likely continuing narrow-range consolidation. Although

View OriginalI. Logical Support

1. Technical Perspective: The 3000 level is forming a quadruple bottom (the previous three lows were 2620/2740/2900). The current price of 3090 is near the lower Bollinger Band at 3080, receiving support, and the 4-hour chart has not effectively broken below the key support zone; although the daily EMA15 has been lost, short-term multi-cycle support is resonating, and downward momentum is weakening marginally.

2. Market Perspective: Today is Saturday, and liquidity is relatively weak, likely continuing narrow-range consolidation. Although

- Reward

- 2

- Comment

- Repost

- Share