1783CLUB

No content yet

1783CLUB

Grandma who buys gold won, dad who invests in stocks won, mom who likes buying silver won, even the younger brother who loves playing on the computer won, only you lost because you play in the crypto circle.

View Original

- Reward

- like

- Comment

- Repost

- Share

As BTC drops to $88,000 and ETH falls to around $2,900

The distribution of chips is undergoing fundamental changes

As of January 21

BitMine $BMNR holds 4.203 million ETH, accounting for 3.48% of the total ETH supply

Strategy $MSTR holds 709,700 BTC, accounting for 3.38% of the total Bitcoin supply.

An easily overlooked but very critical fact:

The control ratio of a single institution over $ETH has already exceeded $BTC .

This indicates that the market pricing power of ETH is shifting

Is the "decentralization narrative" and the actual holding structure beginning to diverge significantly?

View OriginalThe distribution of chips is undergoing fundamental changes

As of January 21

BitMine $BMNR holds 4.203 million ETH, accounting for 3.48% of the total ETH supply

Strategy $MSTR holds 709,700 BTC, accounting for 3.38% of the total Bitcoin supply.

An easily overlooked but very critical fact:

The control ratio of a single institution over $ETH has already exceeded $BTC .

This indicates that the market pricing power of ETH is shifting

Is the "decentralization narrative" and the actual holding structure beginning to diverge significantly?

- Reward

- like

- Comment

- Repost

- Share

The blockchain media from the last cycle, SanYan Finance, was not shut down because of blockchain operations.

On the contrary, after transforming into internet media, it was shut down.

View OriginalOn the contrary, after transforming into internet media, it was shut down.

- Reward

- like

- Comment

- Repost

- Share

A-shares, Hong Kong stocks, US stocks, and Crypto are all rising

The profit-making effect of the big A-shares has outperformed all markets

Currently, Crypto surprisingly has become the drag

View OriginalThe profit-making effect of the big A-shares has outperformed all markets

Currently, Crypto surprisingly has become the drag

- Reward

- like

- Comment

- Repost

- Share

Elon Musk has monopolized the overall narrative of technological innovation.

View Original

- Reward

- like

- Comment

- Repost

- Share

There has always been a superstition that during holidays in China,

the crypto market tends to experience a surge.

In this wave, $PEPE had the largest increase, soaring nearly 60% in a few days, surpassing $DOGE to become the meme king.

It's also considered a small but meaningful红包 for everyone.

View Originalthe crypto market tends to experience a surge.

In this wave, $PEPE had the largest increase, soaring nearly 60% in a few days, surpassing $DOGE to become the meme king.

It's also considered a small but meaningful红包 for everyone.

- Reward

- like

- Comment

- Repost

- Share

Meta invests $2.5 billion in AI Agent platform Manus

Meta's acquisition of Manus is valued at approximately $2.5 billion, which also includes long-term retention incentives for the core team.

Interestingly, Manus only completed Series B funding in May 2025, led by Benchmark, raising $75 million, with a valuation of just $500 million at the time.

In just half a year, Manus's valuation has directly multiplied several times.

ZhenFund, Sequoia China, Tencent, and other early investors have become the biggest winners, achieving returns of dozens of times.

Manus's main focus is not on chatbots, but

View OriginalMeta's acquisition of Manus is valued at approximately $2.5 billion, which also includes long-term retention incentives for the core team.

Interestingly, Manus only completed Series B funding in May 2025, led by Benchmark, raising $75 million, with a valuation of just $500 million at the time.

In just half a year, Manus's valuation has directly multiplied several times.

ZhenFund, Sequoia China, Tencent, and other early investors have become the biggest winners, achieving returns of dozens of times.

Manus's main focus is not on chatbots, but

- Reward

- like

- Comment

- Repost

- Share

When the era leaves you behind, there isn't even a goodbye.

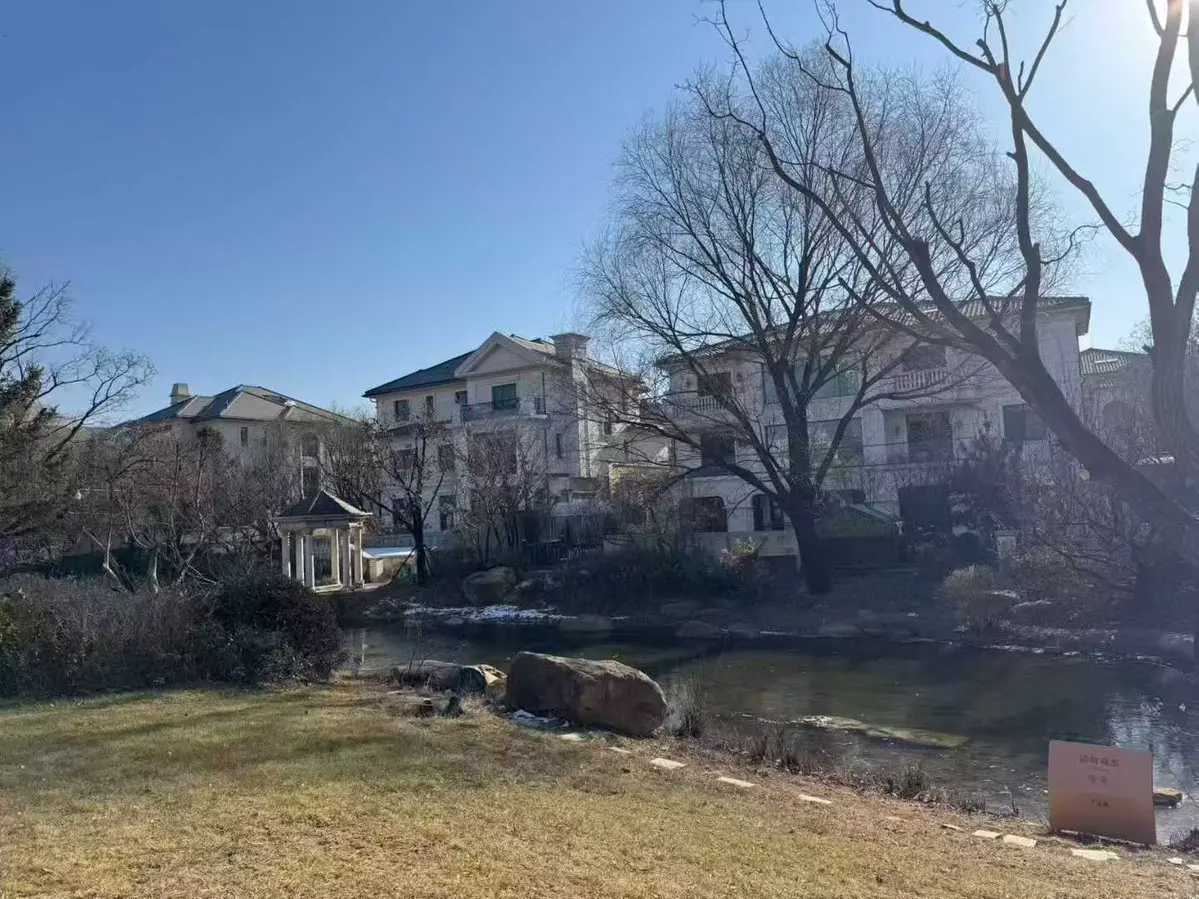

On the weekend, I accompanied my idol to the North Fifth Ring and happened to visit a high-end villa.

The sales team talked about the changes in buyers over the years: years ago, most were from the internet and finance circles; now, many of those receiving keys come from the new energy industry.

This development has been on sale since 2015, and even now, nearly half of it remains undeveloped.

The market is changing, and the flow of wealth is quietly shifting.

Currently, China's IPO enthusiasm remains high, but the true wealt

View OriginalOn the weekend, I accompanied my idol to the North Fifth Ring and happened to visit a high-end villa.

The sales team talked about the changes in buyers over the years: years ago, most were from the internet and finance circles; now, many of those receiving keys come from the new energy industry.

This development has been on sale since 2015, and even now, nearly half of it remains undeveloped.

The market is changing, and the flow of wealth is quietly shifting.

Currently, China's IPO enthusiasm remains high, but the true wealt

- Reward

- like

- Comment

- Repost

- Share

On December 24, 2025, Multicoin Capital's wallet address transferred 30 million USDC to the Worldcoin (World) team wallet.

On December 25, 2025, Multicoin Capital's wallet address received 60 million $WLD from the World team wallet.

The average purchase price of WLD by Multicoin Capital is $0.5.

In May 2025, Worldcoin (World) affiliate subsidiary World Assets sold WLD to Andreessen Horowitz (a16z), Bain Capital Crypto, Mirana Ventures, and others at an average price of around $1, raising $135 million.

As of the end of December 2025, the WLD price is approximately $0.5, with a circulating mark

View OriginalOn December 25, 2025, Multicoin Capital's wallet address received 60 million $WLD from the World team wallet.

The average purchase price of WLD by Multicoin Capital is $0.5.

In May 2025, Worldcoin (World) affiliate subsidiary World Assets sold WLD to Andreessen Horowitz (a16z), Bain Capital Crypto, Mirana Ventures, and others at an average price of around $1, raising $135 million.

As of the end of December 2025, the WLD price is approximately $0.5, with a circulating mark

- Reward

- like

- Comment

- Repost

- Share

Ten-year veteran TCM doctor Xiao Huihui observes celestial phenomena at night.

A new round of crypto bull market has officially begun.

The increase may not be very high, but the odds should be good.

Stable player First choice configuration $BTC Players looking to achieve high returns can also configure $ETH

Next, we still have a positive outlook on Perps DEX, prediction markets, and the related upstream and downstream sectors of everything on-chain.

View OriginalA new round of crypto bull market has officially begun.

The increase may not be very high, but the odds should be good.

Stable player First choice configuration $BTC Players looking to achieve high returns can also configure $ETH

Next, we still have a positive outlook on Perps DEX, prediction markets, and the related upstream and downstream sectors of everything on-chain.

- Reward

- like

- Comment

- Repost

- Share

The average holding cost of US spot Bitcoin ETFs is around $83,000, with approximately 1.33 million coins currently held, accounting for about 6% of $BTC 's total supply.

The three main players: BlackRock $IBIT , Fidelity $FBTC, Grayscale $GBTC .

The US-listed company with the largest holdings, Strategy $MSTR , has a holding cost of around $74,000, currently holding about 660,000 coins, which accounts for approximately 3% of the total BTC supply.

The three main players: BlackRock $IBIT , Fidelity $FBTC, Grayscale $GBTC .

The US-listed company with the largest holdings, Strategy $MSTR , has a holding cost of around $74,000, currently holding about 660,000 coins, which accounts for approximately 3% of the total BTC supply.

BTC-5,35%

- Reward

- like

- Comment

- Repost

- Share

In this round of the Crypto cycle, institutions are getting on board, and the gameplay has changed.

JPMorgan's latest report: Crypto has entered the "post-retail era"

Core viewpoint:

Cryptocurrency is bidding farewell to the "venture capital" model and evolving into a formal macro trading asset dominated by institutional liquidity.

Early projects were driven by private financing, with retail investors always taking over at high valuation points. Now, institutions are becoming the main force in the market.

Institutional funds get on board, stabilizing liquidity + reducing volatility, to "an

View OriginalJPMorgan's latest report: Crypto has entered the "post-retail era"

Core viewpoint:

Cryptocurrency is bidding farewell to the "venture capital" model and evolving into a formal macro trading asset dominated by institutional liquidity.

Early projects were driven by private financing, with retail investors always taking over at high valuation points. Now, institutions are becoming the main force in the market.

Institutional funds get on board, stabilizing liquidity + reducing volatility, to "an

- Reward

- like

- Comment

- Repost

- Share

As of November 24, the Nasdaq-listed company BitMine $BMNR holds 3.6297 million $ETH , which is equivalent to 3% of the total supply of Ether.

This means that BitMine has officially surpassed BlackRock's Ethereum ETF $ETHA holdings of approximately 3.5 million coins, becoming the largest single holder of ETH in the world.

This means that BitMine has officially surpassed BlackRock's Ethereum ETF $ETHA holdings of approximately 3.5 million coins, becoming the largest single holder of ETH in the world.

ETH-5,8%

- Reward

- like

- Comment

- Repost

- Share

Institutions and listed companies are just large suckers, as the market falls.

Holding 649,870 bitcoins $BTC with a Strategy $MSTR , the average purchase price is $74,433, with a return of +12%.

Bitmine holds 3,559,879 Ethereum $ETH , with an average purchase price of $4010 and a yield of -31.67%.

Holding 6,834,506 shares of Forward $BMNR , with an average purchase price of 232 USD, the yield is -44.85%.

View OriginalHolding 649,870 bitcoins $BTC with a Strategy $MSTR , the average purchase price is $74,433, with a return of +12%.

Bitmine holds 3,559,879 Ethereum $ETH , with an average purchase price of $4010 and a yield of -31.67%.

Holding 6,834,506 shares of Forward $BMNR , with an average purchase price of 232 USD, the yield is -44.85%.

- Reward

- like

- Comment

- Repost

- Share

Recently, the pullback in Ethereum has been largely driven by macro factors, primarily the Fed's expectations for interest rate cuts in December 2025 being lowered repeatedly.

I remember buying the dip around 3300 in early November, the logic at that time was very simple:

US government shutdown crisis averted → Market sentiment improves → ETH rebounds

Indeed, there is more than a 10% return.

But recently the situation has changed, and the market's expectations for a rate cut in December have weakened, $ETH once falling below the 2900 mark.

The latest data also confirms this point:

The

I remember buying the dip around 3300 in early November, the logic at that time was very simple:

US government shutdown crisis averted → Market sentiment improves → ETH rebounds

Indeed, there is more than a 10% return.

But recently the situation has changed, and the market's expectations for a rate cut in December have weakened, $ETH once falling below the 2900 mark.

The latest data also confirms this point:

The

ETH-5,8%

- Reward

- like

- Comment

- Repost

- Share

The Nasdaq-listed company, the world's only $WLD strategic reserve Eightco $ORBS announced that as of November 17, it holds 272 million WLD, calculated at 0.67 dollars, approximately 182 million dollars, accounting for 10% of the circulating supply and 2.722% of the total supply.

In addition, Eightco also holds 11,068 tokens of $ETH , which amounts to approximately $34 million based on a calculation of 3100.

View OriginalIn addition, Eightco also holds 11,068 tokens of $ETH , which amounts to approximately $34 million based on a calculation of 3100.

- Reward

- like

- Comment

- Repost

- Share

BTC falls below 90,000, ETH falls below 3,000, SOL falls to 130.

The returns of these three major assets have all fallen below water by 2025:

$BTC has fallen 5% since 2025.

$ETH has fallen 11% from 2025 to now.

$SOL has fallen 30% since 2025

And the other two:

$BNB fall below 900, but still rise 26% in 2025

$HYPE fell below 38, but still rose 51% in 2025.

By the time we reach 2025, we will find a very realistic thing:

This year, it's actually very difficult to achieve positive returns in Crypto.

This is not a market where "everyone makes money in a bull market."

Is everyone really mak

View OriginalThe returns of these three major assets have all fallen below water by 2025:

$BTC has fallen 5% since 2025.

$ETH has fallen 11% from 2025 to now.

$SOL has fallen 30% since 2025

And the other two:

$BNB fall below 900, but still rise 26% in 2025

$HYPE fell below 38, but still rose 51% in 2025.

By the time we reach 2025, we will find a very realistic thing:

This year, it's actually very difficult to achieve positive returns in Crypto.

This is not a market where "everyone makes money in a bull market."

Is everyone really mak

- Reward

- like

- Comment

- Repost

- Share