Alexá

No content yet

Alexá

- Reward

- 2

- 1

- Repost

- Share

Noaa_Grace :

:

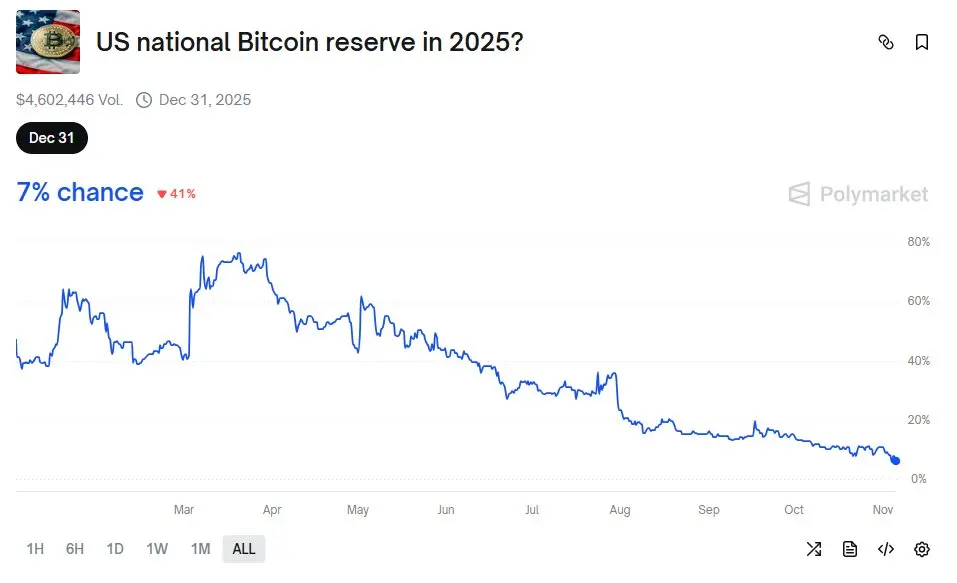

eyes on itPolymarket odds for the U.S. to implement a Strategic #Bitcoin Reserve in 2025 have dropped to just 7%, marking the lowest point so far.

Market confidence may be fading but with Trump back in the spotlight, it’s never safe to assume anything. His stance on crypto has shifted before, and one unexpected policy move could flip this narrative overnight.

Sometimes, the best trades are built on what everyone else thinks won’t happen.

Market confidence may be fading but with Trump back in the spotlight, it’s never safe to assume anything. His stance on crypto has shifted before, and one unexpected policy move could flip this narrative overnight.

Sometimes, the best trades are built on what everyone else thinks won’t happen.

BTC-0,34%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

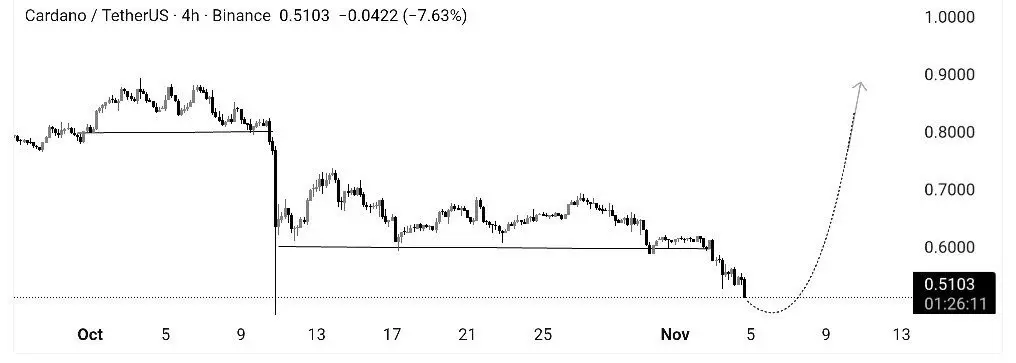

#ADA is showing signs of a potential reversal after a prolonged decline. The price is stabilizing around $0.50, a key support level that could form the base of a rounded bottom pattern.

If buying pressure strengthens and the level holds, $ADA could aim for a recovery toward the $0.80–$0.90 range.

A breakout with solid volume would confirm the move, making this an important setup to watch as market sentiment begins to shift.

#ADA #Cardano

If buying pressure strengthens and the level holds, $ADA could aim for a recovery toward the $0.80–$0.90 range.

A breakout with solid volume would confirm the move, making this an important setup to watch as market sentiment begins to shift.

#ADA #Cardano

ADA-2,09%

- Reward

- like

- Comment

- Repost

- Share

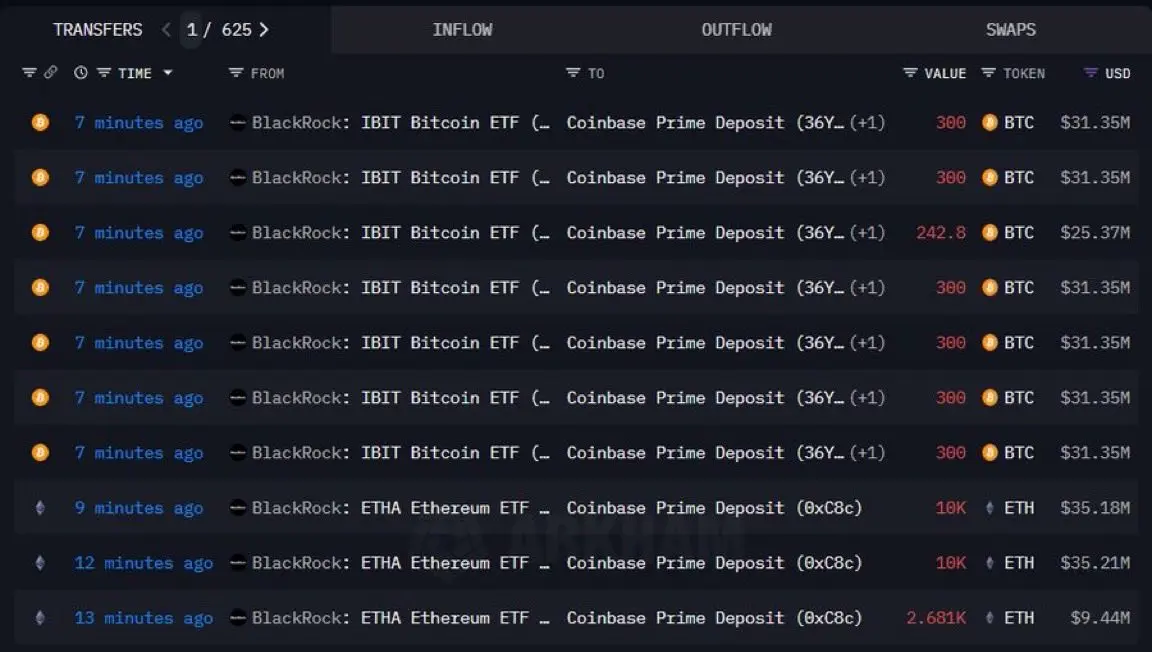

BREAKING:

BlackRock just moved 2,042.8 BTC ($213.49M) and 22,681 ETH ($79.83M) into Coinbase.

That’s nearly $293 million in crypto heading to an exchange and whenever giants like BlackRock make a move this big, the market pays attention.

Something’s definitely brewing.

BlackRock just moved 2,042.8 BTC ($213.49M) and 22,681 ETH ($79.83M) into Coinbase.

That’s nearly $293 million in crypto heading to an exchange and whenever giants like BlackRock make a move this big, the market pays attention.

Something’s definitely brewing.

- Reward

- 1

- Comment

- Repost

- Share

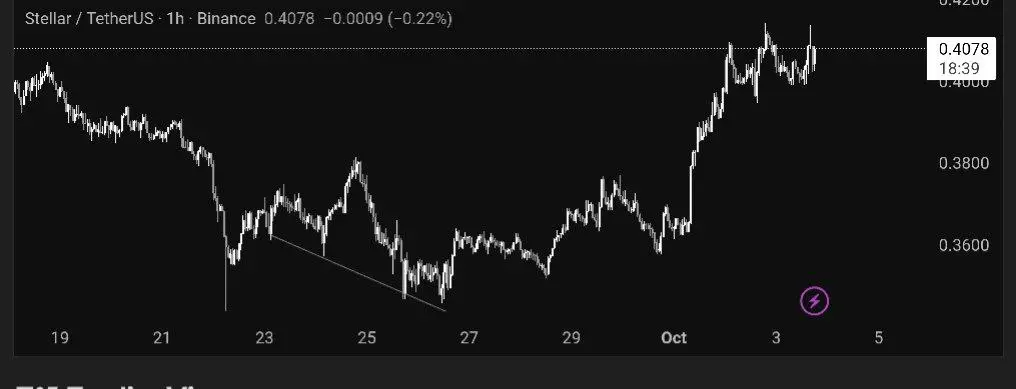

#XLM has been slowly bleeding for weeks, but it’s now sitting right on a major support level that’s been tested multiple times before.

Every time price touched this zone in the past, it triggered a strong bounce and this setup looks no different.

If momentum kicks in, a move of around 40% from here is on the table. The chart shows signs of quiet accumulation, suggesting some buyers might already be positioning early.

#XLM has been quiet for a while, but this could be one of those calm-before-the-move moments. Watching closely for that next leg up.

Every time price touched this zone in the past, it triggered a strong bounce and this setup looks no different.

If momentum kicks in, a move of around 40% from here is on the table. The chart shows signs of quiet accumulation, suggesting some buyers might already be positioning early.

#XLM has been quiet for a while, but this could be one of those calm-before-the-move moments. Watching closely for that next leg up.

XLM0,35%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Global liquidity is going vertical. 🌍💸

The world’s M2 money supply is exploding, more liquidity, more fuel flowing into risk assets.

And when global money expands, #Bitcoin doesn’t just follow, it leads.

Every cycle starts the same way: liquidity up, Bitcoin goes parabolic.

The question isn’t if, it’s when.

The world’s M2 money supply is exploding, more liquidity, more fuel flowing into risk assets.

And when global money expands, #Bitcoin doesn’t just follow, it leads.

Every cycle starts the same way: liquidity up, Bitcoin goes parabolic.

The question isn’t if, it’s when.

BTC-0,34%

- Reward

- 1

- 1

- Repost

- Share

RiseFromTheAshes! :

:

Steadfast HODL💎$XLM had a clean breakout. 🚀

After weeks of chopping between $0.36–$0.38, Stellar finally broke the downtrend and pushed above $0.40.

This move shows clear strength — the market flipped from lower lows to higher highs, a classic trend reversal sign.

As long as $0.40 holds, momentum looks strong for continuation.

Are you watching $XLM for the next leg up? 👀

After weeks of chopping between $0.36–$0.38, Stellar finally broke the downtrend and pushed above $0.40.

This move shows clear strength — the market flipped from lower lows to higher highs, a classic trend reversal sign.

As long as $0.40 holds, momentum looks strong for continuation.

Are you watching $XLM for the next leg up? 👀

XLM0,35%

- Reward

- like

- Comment

- Repost

- Share

ApeX Goes All-In with $12M Buyback – APEX Token Jumps 13%

The DEX space is getting fiercely competitive, and ApeX is making a bold statement. The protocol has committed $12 million to buy back its own tokens, with plans to use 50–90% of daily revenue for future buybacks. The market reacted immediately, sending APEX up nearly 13%.

What makes this move noteworthy is the backing of zkLink X, which solves the challenge of fragmented multi-chain liquidity. With a robust infrastructure driving revenue, ApeX can confidently execute large-scale buybacks. All repurchased tokens are locked in a public o

The DEX space is getting fiercely competitive, and ApeX is making a bold statement. The protocol has committed $12 million to buy back its own tokens, with plans to use 50–90% of daily revenue for future buybacks. The market reacted immediately, sending APEX up nearly 13%.

What makes this move noteworthy is the backing of zkLink X, which solves the challenge of fragmented multi-chain liquidity. With a robust infrastructure driving revenue, ApeX can confidently execute large-scale buybacks. All repurchased tokens are locked in a public o

ZKL-3,49%

- Reward

- like

- Comment

- Repost

- Share

Singapore and UAE Lead Global Crypto Adoption

A recent study by Apex Protocol highlights Singapore and the UAE as the world’s most “crypto-obsessed” countries.

Singapore scored a perfect 100, with 24.4% of its population owning crypto.

UAE followed closely with a score of 99.7, and 25.3% ownership.

These figures show that crypto adoption is rapidly growing in regions with strong infrastructure and awareness. As more people integrate digital assets into their daily lives, these markets are likely to play a key role in shaping global trends.

This is a clear reminder that cryptocurrency is no lon

A recent study by Apex Protocol highlights Singapore and the UAE as the world’s most “crypto-obsessed” countries.

Singapore scored a perfect 100, with 24.4% of its population owning crypto.

UAE followed closely with a score of 99.7, and 25.3% ownership.

These figures show that crypto adoption is rapidly growing in regions with strong infrastructure and awareness. As more people integrate digital assets into their daily lives, these markets are likely to play a key role in shaping global trends.

This is a clear reminder that cryptocurrency is no lon

- Reward

- like

- Comment

- Repost

- Share

Q4 is About to Begin – Market Poised for Movement

As we enter the final quarter of the year, market conditions suggest significant momentum could be on the horizon. Indicators point toward potential new highs, signaling opportunities for those prepared to act strategically.

Historical trends show Q4 often brings heightened activity and notable price movements. Market participants should remain attentive, as volatility may increase and key opportunities could arise rapidly. Staying informed and positioned can make the difference between capturing gains and missing critical market shifts.

The ne

As we enter the final quarter of the year, market conditions suggest significant momentum could be on the horizon. Indicators point toward potential new highs, signaling opportunities for those prepared to act strategically.

Historical trends show Q4 often brings heightened activity and notable price movements. Market participants should remain attentive, as volatility may increase and key opportunities could arise rapidly. Staying informed and positioned can make the difference between capturing gains and missing critical market shifts.

The ne

- Reward

- like

- Comment

- Repost

- Share

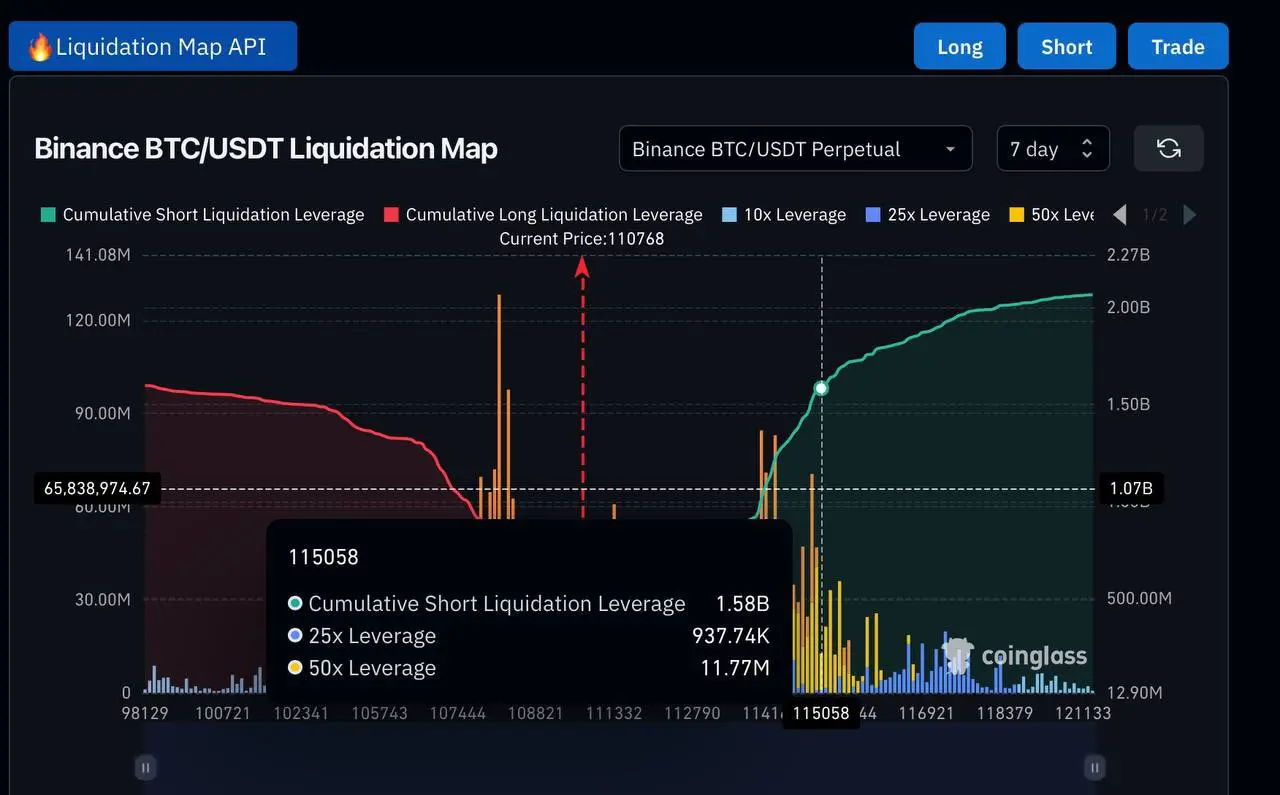

💥 $1.58 Billion in Shorts Could Be Wiped Out at $115K

Bitcoin is on the move, and the numbers are eye-popping. If BTC reaches $115,000, more than $1.58 billion in short positions are at risk of being liquidated. For context, short positions are bets that the price will go down. When the market moves against them, these positions get automatically closed, often fueling rapid price spikes.

A liquidation of this size could trigger a short squeeze, where traders rushing to cover their positions push Bitcoin even higher. Historically, these events can cause sudden bursts of volatility and momentum

Bitcoin is on the move, and the numbers are eye-popping. If BTC reaches $115,000, more than $1.58 billion in short positions are at risk of being liquidated. For context, short positions are bets that the price will go down. When the market moves against them, these positions get automatically closed, often fueling rapid price spikes.

A liquidation of this size could trigger a short squeeze, where traders rushing to cover their positions push Bitcoin even higher. Historically, these events can cause sudden bursts of volatility and momentum

BTC-0,34%

- Reward

- like

- Comment

- Repost

- Share

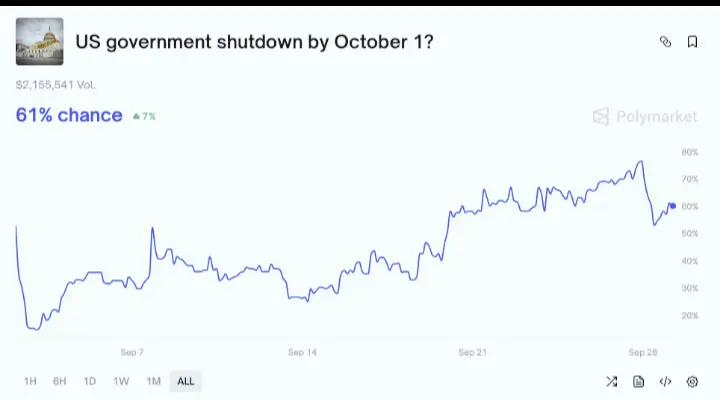

BREAKING: There’s a 61% chance of a U.S. government shutdown by October 1.

Markets could feel the impact as federal services pause and investor sentiment shifts. Stay alert and watch for updates—this could ripple across stocks, crypto, and global markets.

Markets could feel the impact as federal services pause and investor sentiment shifts. Stay alert and watch for updates—this could ripple across stocks, crypto, and global markets.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Ethereum spot ETFs recorded $795.56M in net outflows this week their largest weekly outflow since inception.

After several months of steady inflows and growing institutional demand, this sharp reversal signals a notable change in sentiment. Such a large weekly outflow can indicate:

• Profit-taking from investors after ETH’s strong price run.

• Portfolio rotation into other assets or risk-off positioning.

• A potential short-term pause in the aggressive accumulation seen earlier this year.

Despite the outflow, total net assets across these ETFs remain substantial at $26B, and ETH is still hol

After several months of steady inflows and growing institutional demand, this sharp reversal signals a notable change in sentiment. Such a large weekly outflow can indicate:

• Profit-taking from investors after ETH’s strong price run.

• Portfolio rotation into other assets or risk-off positioning.

• A potential short-term pause in the aggressive accumulation seen earlier this year.

Despite the outflow, total net assets across these ETFs remain substantial at $26B, and ETH is still hol

ETH-0,64%

- Reward

- like

- Comment

- Repost

- Share

Institutions Are Quietly Stacking Crypto

Fresh data shows a clear, long-term shift:

• BTC treasury holdings climbed from 2.1% of total supply in January to nearly 3.7% today.

• ETH treasuries have surged since July, now near 2.9%.

• SOL holdings are steadily approaching 0.6%.

Why it matters: every coin locked in a treasury is one less in active circulation tightening supply while long-term demand keeps building.

The takeaway for investors? Institutions are treating crypto like a strategic reserve asset, and that can be a powerful driver for future price dynamics.

#Bitcoin #Ethereum #Solana

Fresh data shows a clear, long-term shift:

• BTC treasury holdings climbed from 2.1% of total supply in January to nearly 3.7% today.

• ETH treasuries have surged since July, now near 2.9%.

• SOL holdings are steadily approaching 0.6%.

Why it matters: every coin locked in a treasury is one less in active circulation tightening supply while long-term demand keeps building.

The takeaway for investors? Institutions are treating crypto like a strategic reserve asset, and that can be a powerful driver for future price dynamics.

#Bitcoin #Ethereum #Solana

- Reward

- like

- Comment

- Repost

- Share

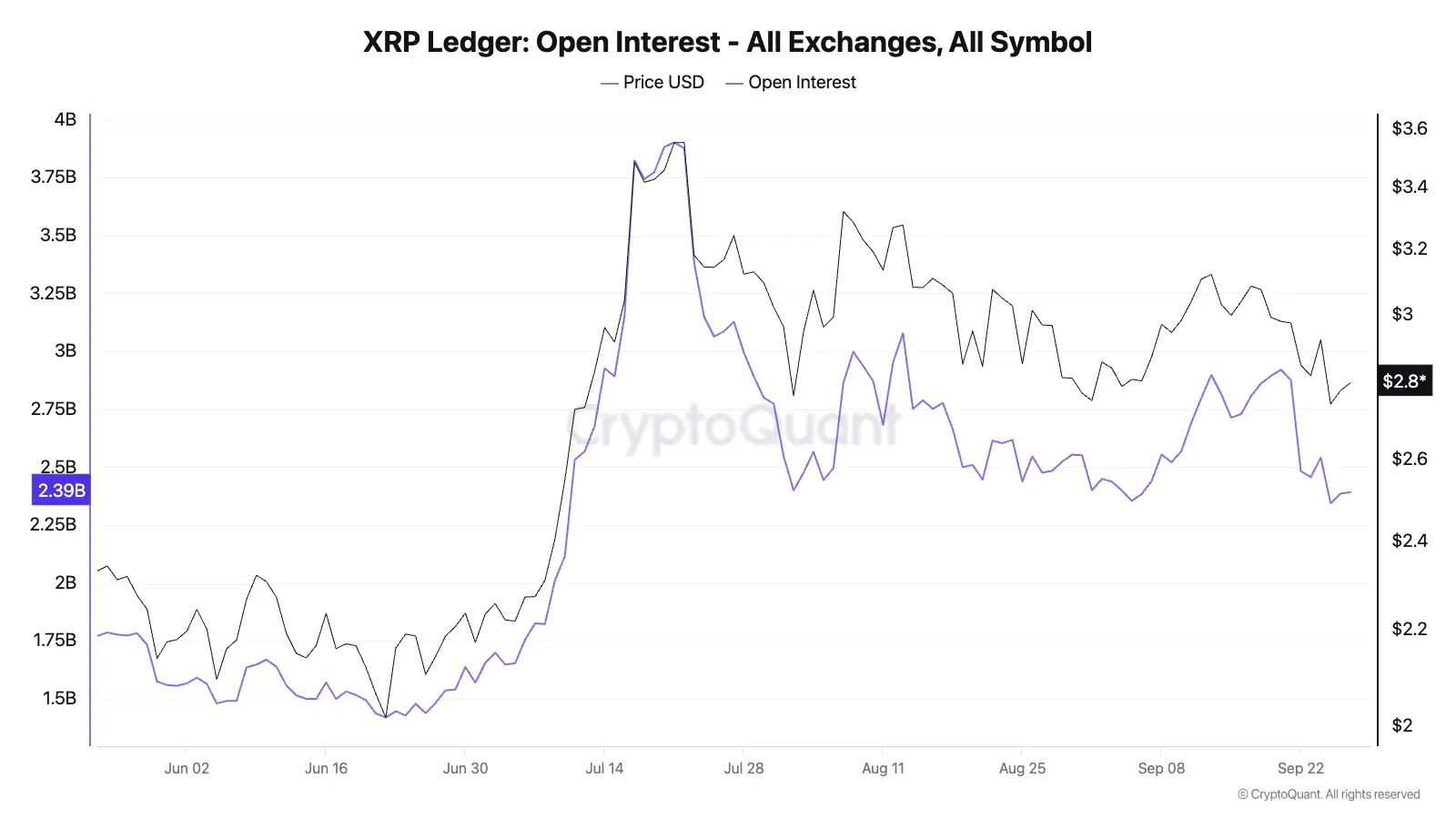

#XRP Ledger – Market Update

Open Interest across all exchanges has retraced to $2.39B while XRP price consolidates around $2.8.

This comes after July’s sharp rally that briefly pushed price near $3.6, followed by a steady reduction in both price and open interest.

This cooling phase typically signals:

🔹 Leverage has been flushed out.

🔹 Market participants are repositioning after profit-taking.

If open interest holds near these levels and price continues to defend the $2.7–$2.8 range, it could lay the groundwork for the next sustained move.

Open Interest across all exchanges has retraced to $2.39B while XRP price consolidates around $2.8.

This comes after July’s sharp rally that briefly pushed price near $3.6, followed by a steady reduction in both price and open interest.

This cooling phase typically signals:

🔹 Leverage has been flushed out.

🔹 Market participants are repositioning after profit-taking.

If open interest holds near these levels and price continues to defend the $2.7–$2.8 range, it could lay the groundwork for the next sustained move.

XRP-0,69%

- Reward

- like

- Comment

- Repost

- Share