Arnau4Bet

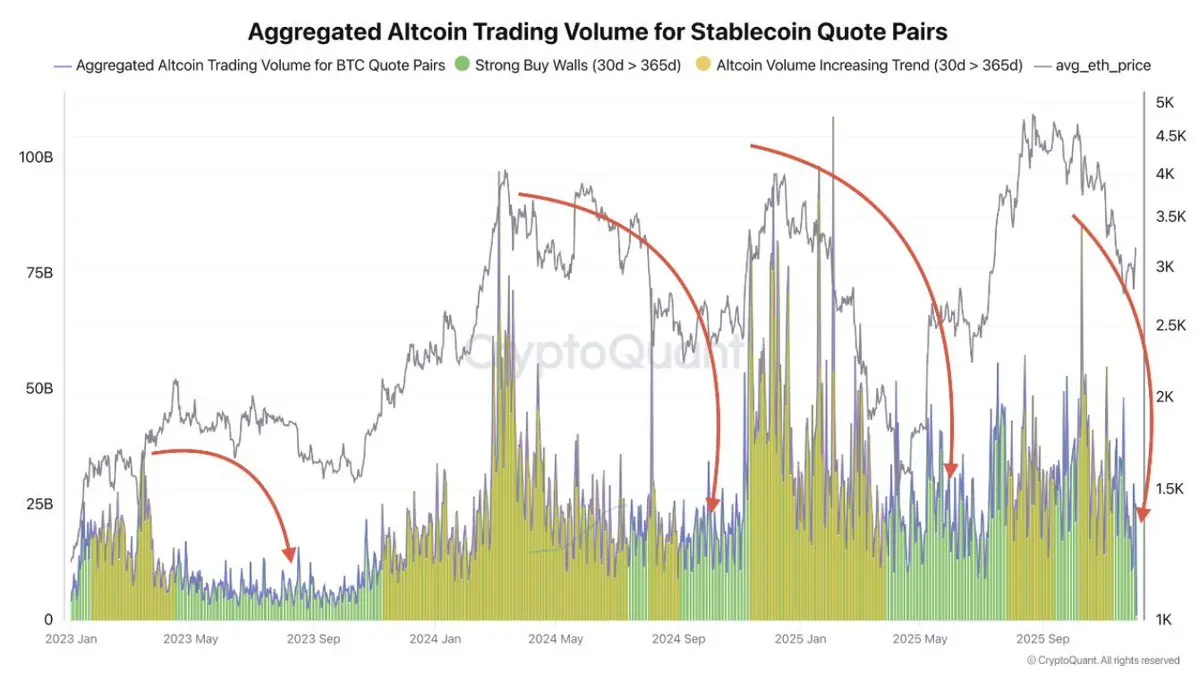

Altcoins at historical oversold levels.

Historically, when this indicator reaches these extremes, they have been support areas for altcoins.

I'm going to be direct: I think we'll see a bounce from this area. Good days will come for altcoins.

View OriginalHistorically, when this indicator reaches these extremes, they have been support areas for altcoins.

I'm going to be direct: I think we'll see a bounce from this area. Good days will come for altcoins.