DanielRomero

No content yet

DanielRomero

Samsung will supply more than half of the SOCAMM2 modules that $NVDA will need in 2026, according to Hankyung InsightSamsung has confirmed its supply plans to the publicationSOCAMM is a second-grade HBM solution used in AI data centres

- Reward

- like

- Comment

- Repost

- Share

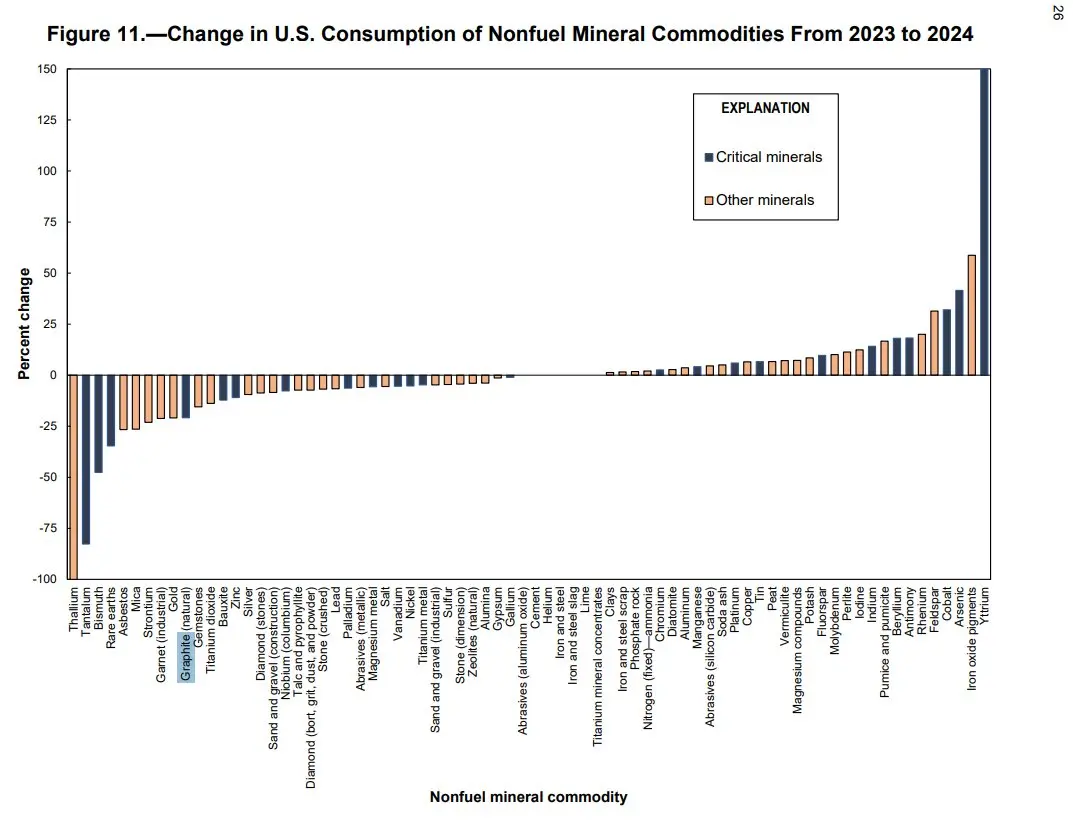

Change in U.S. Consumption of Nonfuel Mineral Commodities From 2023 to 2024

- Reward

- like

- Comment

- Repost

- Share

$MU to invest $24B in Singapore chip plant amid shortagesThe project will span 10 years and involves building a new NAND flash wafer fabrication facility in Singapore, with production expected to begin in the second half of 2028

- Reward

- like

- Comment

- Repost

- Share

$NVDA is competing with $AMD and $INTC directly on CPUs for the first time$NVDA will offer Vera CPUs as a standalone product, marking its first entry as a direct competitor to Intel Xeon and AMD EPYC server-grade CPUs

- Reward

- like

- Comment

- Repost

- Share

Not a bad start to the year

- Reward

- like

- Comment

- Repost

- Share

$SSNLF expects foundry profitability by 2027, driven by chip orders from $TSLA, $AMD, and $QCOMCould 2027 be the final turnaround year for Samsung and Intel Foundries?

- Reward

- like

- Comment

- Repost

- Share

The US has taken equity stakes in the following companies▸ MP Materials | $MP▸ USA Rare Earth | $USAR▸ Lithium Americas | $LAC▸ Intel | $INTC▸ Trilogy Metals | $TMQCompanies that could be next▸ Critical Metals | $CRMLRare earth assets in Greenland. Reuters has reported that US officials discussed converting government support into an equity stake.▸ Graphite One | $GPHOFAlready showing strong US EXIM financing signals across the mine to anode supply chain, making it a natural candidate for an equity-style strategic backstop.▸ United States Antimony | $UAMYDirect defense stockpile priority with

- Reward

- like

- Comment

- Repost

- Share

X throughout the week

- Reward

- like

- Comment

- Repost

- Share

Most people are unaware of the rate of acceleration we’re about to seeThink about it$NVDA\'s new Vera Rubin NVL72 will have 8 times the compute performance of the GB300Our best AI models, already taking on hundreds of thousands of jobs, were trained on computers that will soon look prehistoricNow, the rate of acceleration is such that NVIDIA was able to get that performance improvement in merely a yearImagine what models, applications, and advancements we’ll get once the largest AI labs get this new hardware in their handsNow, competition is accelerating, and that accelerates progress even fur

- Reward

- like

- Comment

- Repost

- Share

$TSMC to impose its steepest price hike ever on $AAPL as $NVDA becomes its top customer\n\nAccording to Culpium, TSMC CEO personally visited Apple’s headquarters in August 2025 to deliver the news\n\nAnalyst Ming-Chi Kuo says Apple could begin receiving chips from $INTC by mid-2027

- Reward

- 1

- Comment

- Repost

- Share

What’s your highest conviction stock for 2026?\n\nLet’s pool ideas

- Reward

- like

- Comment

- Repost

- Share

$INTC has begun mass production of 18A chips\n\nThe first wafers of Panther Lake CPUs and Clearwater Forest server chips are in production\n\nRyuta Makino of Gabelli Funds said: "It’s the most optimistic people have felt about the company in a long time," and he expects a double digit server CPU price increase in 2026

- Reward

- like

- Comment

- Repost

- Share

$AMZN CEO on OpenAI signing deals totaling $1.4 trillion:\n\n"I have a harder time making sense of them all," Jassy told CNBC.

- Reward

- like

- Comment

- Repost

- Share

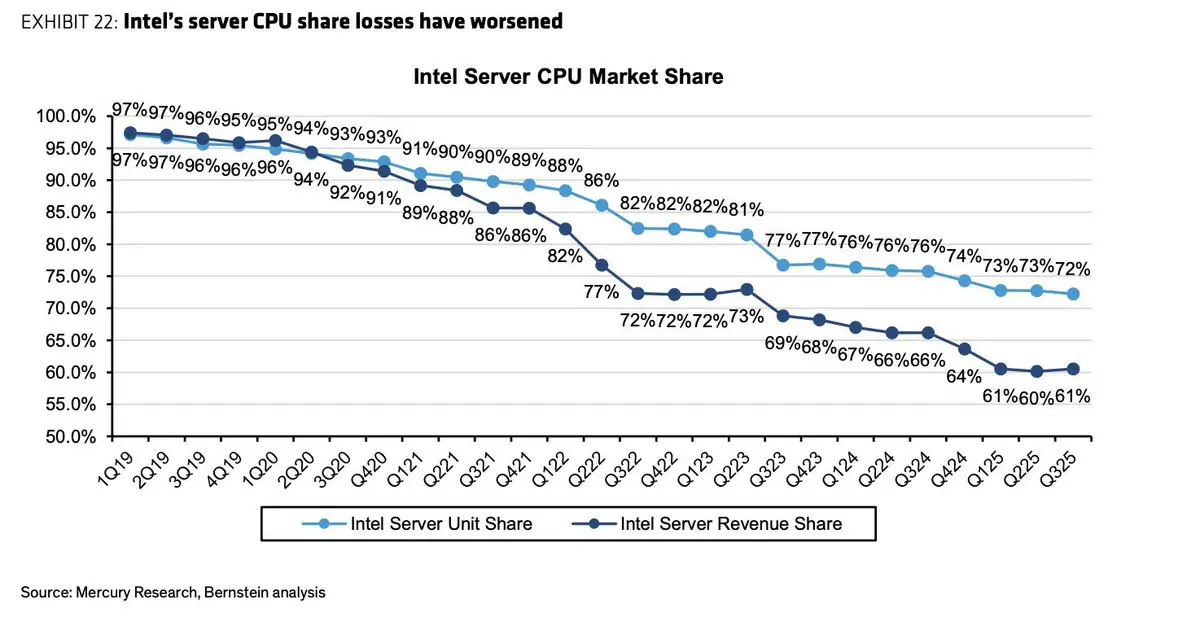

$AMD keeps gaining market share against Intel

- Reward

- like

- Comment

- Repost

- Share

90% of X users fall into 3 categories:

> Talk about trendy names that already pumped 500% to farm engagement

> Talk about 100 different companies. The more you cover, the more promotional multibaggers you can point to

> Talk about the same 3 companies over and over

> Talk about trendy names that already pumped 500% to farm engagement

> Talk about 100 different companies. The more you cover, the more promotional multibaggers you can point to

> Talk about the same 3 companies over and over

- Reward

- like

- Comment

- Repost

- Share

$NBIS

Vineland will host a DataOne town hall on Jan. 21 to present details on the Nebius DC campus

It will cover project scope, community impacts, infrastructure considerations, and next steps, with a Q&A included

The path toward a 600 MW expansion starts today

Vineland will host a DataOne town hall on Jan. 21 to present details on the Nebius DC campus

It will cover project scope, community impacts, infrastructure considerations, and next steps, with a Q&A included

The path toward a 600 MW expansion starts today

- Reward

- like

- Comment

- Repost

- Share

$META is considering buying $AMD GPUs instead of Google TPUs

According to GF Securities analyst Jeff Pu

According to GF Securities analyst Jeff Pu

- Reward

- like

- Comment

- Repost

- Share

2025: $NVDA announces memory bandwidth in Rubin of 13 TB/s

$AMD announces MI455X with 19.6 TB/s

2026: $NVDA increases Rubin to 22.2 TB/s

One year ago, I was told $AMD was no competition at all to $NVDA

Turns out there’s competition after all

$AMD announces MI455X with 19.6 TB/s

2026: $NVDA increases Rubin to 22.2 TB/s

One year ago, I was told $AMD was no competition at all to $NVDA

Turns out there’s competition after all

- Reward

- like

- 1

- Repost

- Share

YingYue :

:

2026 GOGOGO 👊If the memory and chip shortage is bad now,

imagine when humanoid robots enter mass production.

You could park your money in semis for 20 years and beat the market

imagine when humanoid robots enter mass production.

You could park your money in semis for 20 years and beat the market

- Reward

- 1

- Comment

- Repost

- Share

Semis are a gold mine at the moment 🚨

> $MSFT and $SONY are debating whether to delay next-generation consoles from their intended 2027–2028 window

> $NVDA and $AMD are likely to increase GPU prices

> Prices are unlikely to normalize until 2028

> $MSFT and $SONY are debating whether to delay next-generation consoles from their intended 2027–2028 window

> $NVDA and $AMD are likely to increase GPU prices

> Prices are unlikely to normalize until 2028

- Reward

- like

- Comment

- Repost

- Share