People are mad that Crypto isn’t following their schedule. Comical.

History doesn't move on retail’s watch: Gold consolidated 10+ years. Silver consolidated 10+ years. Copper consolidated 20+ years.

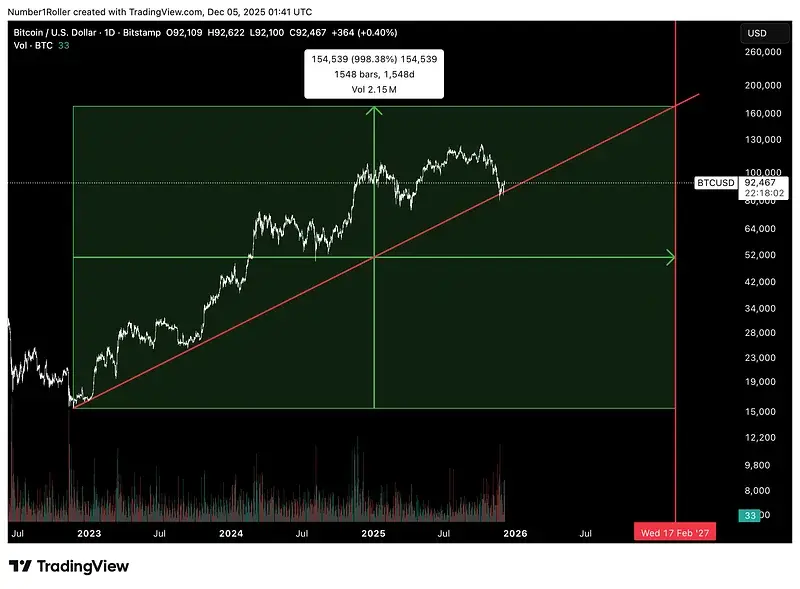

Crypto has been methodically building structure for 5 years, hitting every major time factor with precision.

It’s not "broken." You just don’t understand the clock. Everything moves when the time is right and that shift will manifest in the markets sooner than most expect

History doesn't move on retail’s watch: Gold consolidated 10+ years. Silver consolidated 10+ years. Copper consolidated 20+ years.

Crypto has been methodically building structure for 5 years, hitting every major time factor with precision.

It’s not "broken." You just don’t understand the clock. Everything moves when the time is right and that shift will manifest in the markets sooner than most expect