DoItIka

No content yet

DoItIka

🚀 The Interest of RWA Coins

The main interest lies in bridging traditional finance (TradFi) and decentralized finance (DeFi), bringing blockchain advantages to assets that were traditionally illiquid or inaccessible.

1. Increased Liquidity and Accessibility

Fractional Ownership (Fractional Ownership): RWAs enable the division of high-value assets (such as real estate, artwork, or bonds) into small digital shares (tokens). This makes investing more accessible to a broader audience, as it is no longer necessary to purchase the entire asset.

Enhanced Liquidity: Traditionally illiquid assets (lik

View OriginalThe main interest lies in bridging traditional finance (TradFi) and decentralized finance (DeFi), bringing blockchain advantages to assets that were traditionally illiquid or inaccessible.

1. Increased Liquidity and Accessibility

Fractional Ownership (Fractional Ownership): RWAs enable the division of high-value assets (such as real estate, artwork, or bonds) into small digital shares (tokens). This makes investing more accessible to a broader audience, as it is no longer necessary to purchase the entire asset.

Enhanced Liquidity: Traditionally illiquid assets (lik

- Reward

- like

- Comment

- Repost

- Share

The scenario to reach $125k: The effect of the Halving is not always immediate, but it is inevitable. If ETF demand explodes (point 1) at the precise moment when miners have less to sell, and long-term holders (the "HODLers") refuse to sell their coins below $100k, a sell-side liquidity crisis (sell-side liquidity crisis) is created. There simply aren't enough Bitcoins left to sell on OTC markets (OTC) and on exchanges, forcing the price to rise vertically to find sellers.#DecemberMarketOutlook $BTC

BTC0,3%

- Reward

- like

- Comment

- Repost

- Share

The scenario to reach $125k: The effect of the Halving is not always immediate, but it is inevitable. If ETF demand explodes (point 1) at the exact moment when miners have less to sell, and long-term holders (the "HODLers") refuse to sell their coins below $100k, it creates a sell-side liquidity crisis (sell-side liquidity crisis). There simply aren’t enough Bitcoins left to sell on over-the-counter markets (OTC) and on exchanges, forcing the price to rise vertically to find sellers.$BTC

BTC0,3%

- Reward

- like

- Comment

- Repost

- Share

MC:$3.64KHolders:1

0.00%

- Reward

- like

- 1

- Repost

- Share

DoItIka :

:

1000x Vibes 🤑Growth Points Lucky Draw

Invite friends to join and win great prizes!

https://www.gate.com/activities/pointprize/?now_period=13&refUid=20263974

Invite friends to join and win great prizes!

https://www.gate.com/activities/pointprize/?now_period=13&refUid=20263974

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Ripple (XRP): After a period of high volatility, XRP has experienced an impressive rally with a growth of 170%. This surge is partly due to regulatory advancements and increasing interest from institutional investors. Furthermore, the launch of an XRP ETF has significantly bolstered confidence in the asset.

Bitcoin (BTC): As a market leader, Bitcoin has continued its ascent with an increase of 110%. Its institutional adoption through ETFs, as well as its status as a "digital safe haven", have solidified its position and fueled its growth.

View OriginalBitcoin (BTC): As a market leader, Bitcoin has continued its ascent with an increase of 110%. Its institutional adoption through ETFs, as well as its status as a "digital safe haven", have solidified its position and fueled its growth.

- Reward

- like

- Comment

- Repost

- Share

Major Events and Conferences (September - November 2025)

These events are crucial for announcements of new projects, updates to "roadmaps" (roadmaps) and partnerships.

Korea Blockchain Week: September 21 - 27, 2025, Seoul.

TOKEN2049 Singapore: September 29 - October 5, 2025, Singapore. One of the largest global events, where many announcements are made.

Future Blockchain Summit: October 11 - 14, 2025, Dubai.

Digital Asset Summit: October 12 - 14, 2025, London.

European Blockchain Convention: October 16 - 17, 2025, Barcelona.

View OriginalThese events are crucial for announcements of new projects, updates to "roadmaps" (roadmaps) and partnerships.

Korea Blockchain Week: September 21 - 27, 2025, Seoul.

TOKEN2049 Singapore: September 29 - October 5, 2025, Singapore. One of the largest global events, where many announcements are made.

Future Blockchain Summit: October 11 - 14, 2025, Dubai.

Digital Asset Summit: October 12 - 14, 2025, London.

European Blockchain Convention: October 16 - 17, 2025, Barcelona.

- Reward

- like

- Comment

- Repost

- Share

To maintain a rational approach, several strategies are recommended:

Take a step back before acting: Assess whether an impulse

corresponds to an objective analysis.

Keep a trading journal: Note your emotions and the lessons learned

each transaction allows one to learn from their mistakes and

develop better self-control.

Define clear entry and exit rules: Establish a

default settings for opening and closing positions help

to avoid impulsive reactions to market movements.

Never trade more than you can afford to lose:

This fundamental rule reduces emotional pressure and allows

to

View Original Take a step back before acting: Assess whether an impulse

corresponds to an objective analysis.

Keep a trading journal: Note your emotions and the lessons learned

each transaction allows one to learn from their mistakes and

develop better self-control.

Define clear entry and exit rules: Establish a

default settings for opening and closing positions help

to avoid impulsive reactions to market movements.

Never trade more than you can afford to lose:

This fundamental rule reduces emotional pressure and allows

to

- Reward

- 2

- Comment

- Repost

- Share

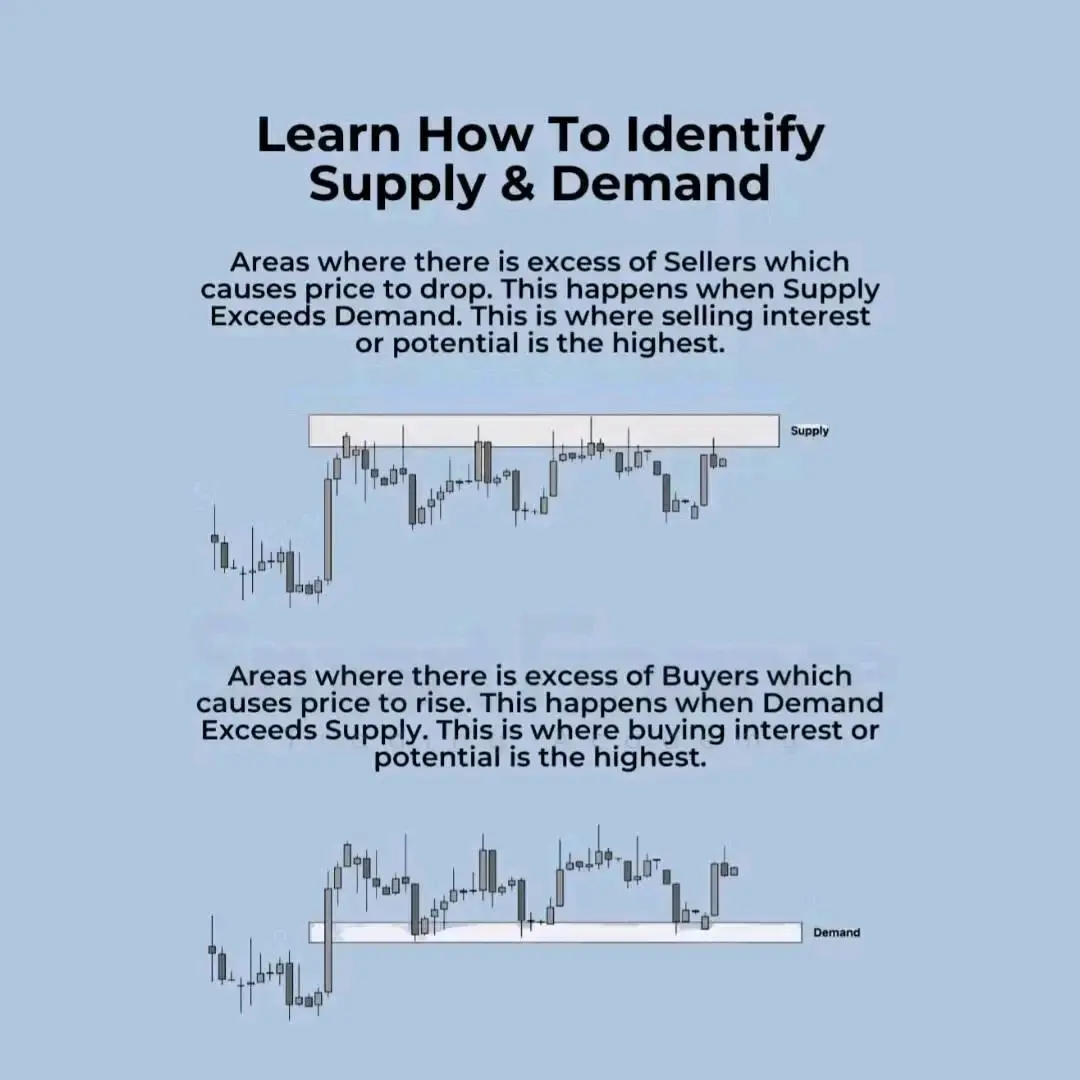

Swing Trading: Capitalize on Medium-Term Fluctuations

Swing trading is a trading technique that aims to profit from price fluctuations over periods ranging from short to medium term, typically from a few days to a few weeks, or even a few months. Traders who adopt this strategy seek to identify the "swing highs" ( in a bullish market ) and the "swing lows" ( in a bearish market ) to enter positions. Swing traders analyze market trends and exploit volatility to their advantage, relying on macro and microeconomic factors, as well as technical analysis. #Rise of Solana Treasury Holders

Swing trading is a trading technique that aims to profit from price fluctuations over periods ranging from short to medium term, typically from a few days to a few weeks, or even a few months. Traders who adopt this strategy seek to identify the "swing highs" ( in a bullish market ) and the "swing lows" ( in a bearish market ) to enter positions. Swing traders analyze market trends and exploit volatility to their advantage, relying on macro and microeconomic factors, as well as technical analysis. #Rise of Solana Treasury Holders

DOLO-11,09%

- Reward

- like

- Comment

- Repost

- Share

Trading on Margin: Amplification of Gains and Losses

Margin trading allows traders to amplify their purchasing power by borrowing funds from a broker or an exchange platform. The goal is to increase the size of positions and, consequently, potential gains. The "Margin" represents the initial capital that the user deposits as collateral to obtain these borrowed funds. For example, with a margin of $1,000, a platform can lend an additional $4,000, thus allowing to open a position worth a total of $5,000.

Margin trading allows traders to amplify their purchasing power by borrowing funds from a broker or an exchange platform. The goal is to increase the size of positions and, consequently, potential gains. The "Margin" represents the initial capital that the user deposits as collateral to obtain these borrowed funds. For example, with a margin of $1,000, a platform can lend an additional $4,000, thus allowing to open a position worth a total of $5,000.

LA-1,6%

- Reward

- like

- Comment

- Repost

- Share

Leveraged Trading: Concepts and Implications

Leverage is a financial mechanism that allows one to control a trading position of a value much greater than the actual initial investment. It is often used interchangeably with the concept of margin in the context of cryptocurrencies, although there is an important nuance: unlike margin trading where the exchange lends money with interest, leverage is not a loan to be repaid with direct interest. However, the two concepts are closely related and refer to the use of borrowed funds to increase market exposure.

The appeal of leverage lies in its poten

View OriginalLeverage is a financial mechanism that allows one to control a trading position of a value much greater than the actual initial investment. It is often used interchangeably with the concept of margin in the context of cryptocurrencies, although there is an important nuance: unlike margin trading where the exchange lends money with interest, leverage is not a loan to be repaid with direct interest. However, the two concepts are closely related and refer to the use of borrowed funds to increase market exposure.

The appeal of leverage lies in its poten

- Reward

- like

- Comment

- Repost

- Share

Fundamental Analysis (FA): Intrinsic Evaluation of Crypto Projects

Fundamental analysis in cryptocurrencies involves examining the underlying factors that determine the intrinsic value of a digital currency. This approach aims to assess the long-term potential of a project based on qualitative and quantitative elements.

Qualitative Factors:

Development Team: The credibility of a project is closely related to the transparency, experience, and past successes of its founders and developers. It is advisable to be wary of anonymous or inexperienced teams, often associated with risky investments or

View OriginalFundamental analysis in cryptocurrencies involves examining the underlying factors that determine the intrinsic value of a digital currency. This approach aims to assess the long-term potential of a project based on qualitative and quantitative elements.

Qualitative Factors:

Development Team: The credibility of a project is closely related to the transparency, experience, and past successes of its founders and developers. It is advisable to be wary of anonymous or inexperienced teams, often associated with risky investments or

- Reward

- like

- Comment

- Repost

- Share

In a market as volatile as cryptocurrencies, short-term price movements often depend more on investor sentiment than on underlying fundamentals, making technical analysis particularly relevant. However, the survival and long-term value of a project depend on its solid fundamentals. The inadequacy of a single analytical approach is evident: the crypto market is unique in that it combines very speculative market dynamics ( where TA is king ) with profound technological innovations ( where FA is essential ). Relying solely on one or the other is an incomplete and risky strategy. A trader who igno

View Original

- Reward

- like

- 2

- Repost

- Share

GateUser-85c4ef36 :

:

HODL Tight 💪View More

Quantitative Factors (Tokenomics and On-Chain Indicators):

Tokenomics: The study of token economics is fundamental. This includes:

Offer: The circulating supply (tokens currently on the market), the maximum supply (total token limit that the project intends to create) and the issuance rate (speed at which new coins are put into circulation). Scarcity, like with Bitcoin with its fixed limit of 21 million coins, can increase long-term value.

Distribution: The methods of distributing tokens (mining, staking, airdrops, ICO) and their concentration are important. A broad distribution reduces the ri

View OriginalTokenomics: The study of token economics is fundamental. This includes:

Offer: The circulating supply (tokens currently on the market), the maximum supply (total token limit that the project intends to create) and the issuance rate (speed at which new coins are put into circulation). Scarcity, like with Bitcoin with its fixed limit of 21 million coins, can increase long-term value.

Distribution: The methods of distributing tokens (mining, staking, airdrops, ICO) and their concentration are important. A broad distribution reduces the ri

- Reward

- like

- Comment

- Repost

- Share

Fundamental Analysis (FA): Intrinsic Evaluation of Crypto Projects

Fundamental analysis in Crypto involves examining the underlying factors that determine the intrinsic value of a digital currency. This approach aims to assess the long-term potential of a project based on qualitative and quantitative elements.

Qualitative Factors:

Development Team: The credibility of a project is closely related to the transparency, experience, and past successes of its founders and developers. It is advisable to be wary of anonymous or inexperienced teams, often associated with risky investments or scams.

Whi

View OriginalFundamental analysis in Crypto involves examining the underlying factors that determine the intrinsic value of a digital currency. This approach aims to assess the long-term potential of a project based on qualitative and quantitative elements.

Qualitative Factors:

Development Team: The credibility of a project is closely related to the transparency, experience, and past successes of its founders and developers. It is advisable to be wary of anonymous or inexperienced teams, often associated with risky investments or scams.

Whi

- Reward

- 1

- Comment

- Repost

- Share

Trending Topics

View More3.09K Popularity

46.47K Popularity

361.17K Popularity

35.72K Popularity

59.51K Popularity

Pin