@AltCryptoGems @SeiNetwork @Xiaomi mass scale adoption!

HarisEbrat

No content yet

HarisEbrat

The Yeiliens brethren woke up and chose violence in this market!!!!!

$CLO from @YeiFinance up 100% in 2 days, glad I had my airdrop locked for extra max $CLO.

Unlock is coming on 11th of feb and looking at the current PA, its looking super good. @SeiNetwork eco tokens kickstarting 2026 nicely.

Send it and LFCLO!!!!!!

$CLO from @YeiFinance up 100% in 2 days, glad I had my airdrop locked for extra max $CLO.

Unlock is coming on 11th of feb and looking at the current PA, its looking super good. @SeiNetwork eco tokens kickstarting 2026 nicely.

Send it and LFCLO!!!!!!

- Reward

- like

- Comment

- Repost

- Share

7.4M users on the @Kindred_AI waitlist now!!!!!

And growing by a few hundred thousand per week. Hard not to be curious if this clears +10M before the $KIN TGE.

🔷 Why this matters for @SeiNetwork

➤ If 10m is cleared, that’s potentially 10M new users entering the Sei ecosystem through one dApp

➤ The kind of distribution that can lift everything onchain and add additional liq

➤ If even a slice sticks around post- $KIN, Sei’s consumer base can step-function up fast

IPs/AI/Gaming Moves Faster on Sei🫡

And growing by a few hundred thousand per week. Hard not to be curious if this clears +10M before the $KIN TGE.

🔷 Why this matters for @SeiNetwork

➤ If 10m is cleared, that’s potentially 10M new users entering the Sei ecosystem through one dApp

➤ The kind of distribution that can lift everything onchain and add additional liq

➤ If even a slice sticks around post- $KIN, Sei’s consumer base can step-function up fast

IPs/AI/Gaming Moves Faster on Sei🫡

SEI-4,56%

- Reward

- like

- Comment

- Repost

- Share

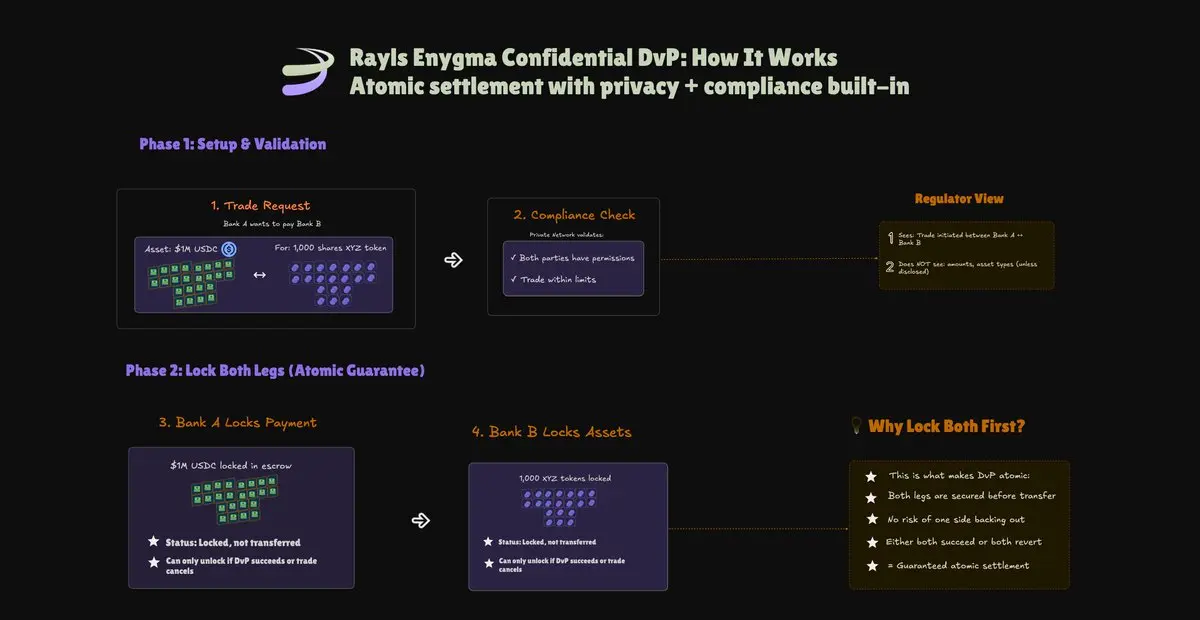

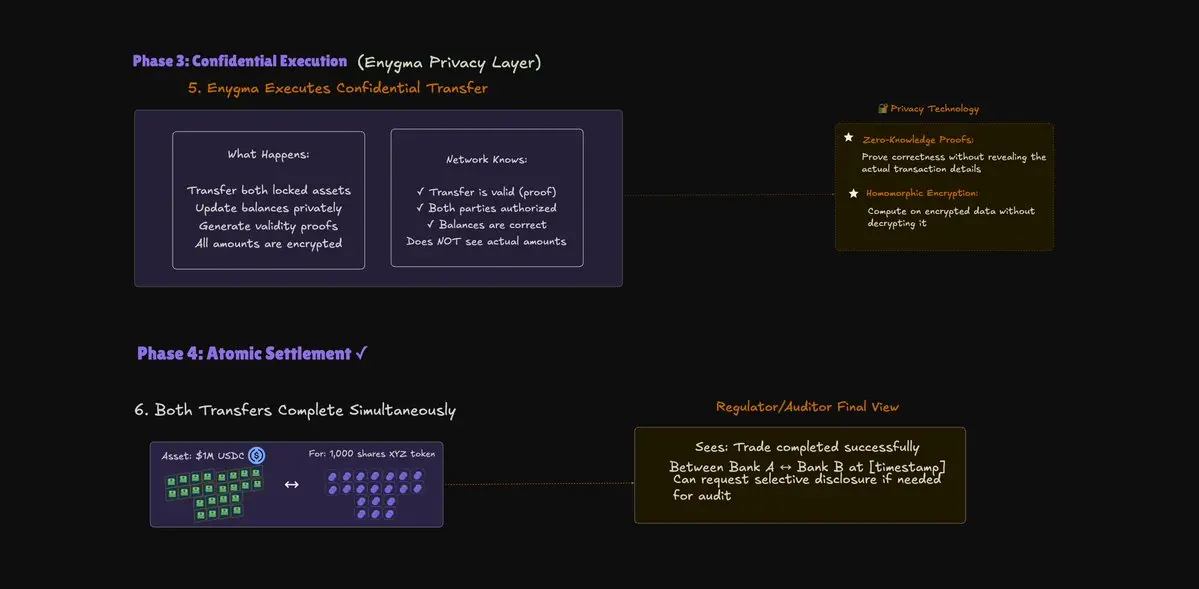

.@RaylsLabs is basically trying to make “bank-grade on-chain settlement” real, private by default, compliance-native, but still programmable.

DvP (delivery vs payment) is the core primitive here, cash and asset have to swap at the same time, or you get counterparty risk.

Here’s how Rayls Enygma does confidential DvP ⤵️

🔷 Phase 1, Setup + validation

➤ Bank A requests a trade with Bank B (ex: USDC for a tokenized security)

➤ Private network runs the compliance gate first

🔸 permissions check

🔸 limits check

➤ Regulator can see “A ↔ B initiated” but not trade details by default

🔷 Phase 2, Lock

DvP (delivery vs payment) is the core primitive here, cash and asset have to swap at the same time, or you get counterparty risk.

Here’s how Rayls Enygma does confidential DvP ⤵️

🔷 Phase 1, Setup + validation

➤ Bank A requests a trade with Bank B (ex: USDC for a tokenized security)

➤ Private network runs the compliance gate first

🔸 permissions check

🔸 limits check

➤ Regulator can see “A ↔ B initiated” but not trade details by default

🔷 Phase 2, Lock

USDC0,04%

- Reward

- like

- Comment

- Repost

- Share

Banks won’t touch public DeFi unless they can keep settlement private and prove compliance. @RaylsLabs is aiming at that exact constraint.

🔷 What Rayls is

➤ An EVM stack with two domains

1⃣ Private, permissioned EVM networks for banks/FIs

2⃣ A public, permissionless EVM L1 for apps + liquidity

🔷 The topology

➤ Banks / FMIs sit on Rayls Private Networks

➤ Those networks can do private interbank settlement directly

➤ A Rayls Privacy Node is the controlled gateway to the public chain

🔷 Private vs public

➤ Private: KYC/ACL, policy rules, confidential tx, settlement

➤ Public: liquidity, comp

🔷 What Rayls is

➤ An EVM stack with two domains

1⃣ Private, permissioned EVM networks for banks/FIs

2⃣ A public, permissionless EVM L1 for apps + liquidity

🔷 The topology

➤ Banks / FMIs sit on Rayls Private Networks

➤ Those networks can do private interbank settlement directly

➤ A Rayls Privacy Node is the controlled gateway to the public chain

🔷 Private vs public

➤ Private: KYC/ACL, policy rules, confidential tx, settlement

➤ Public: liquidity, comp

- Reward

- like

- Comment

- Repost

- Share

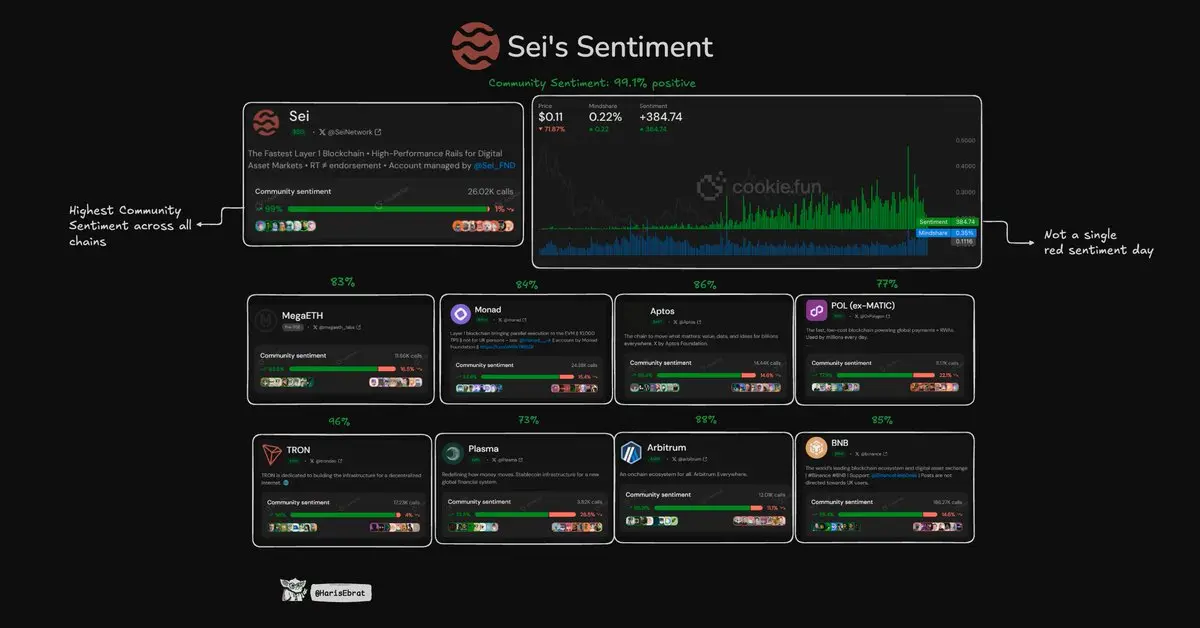

.@SeiNetwork is ranked #1 across all chains with the highest positive community sentiment for the entire year.

🔸 Ranked #1 across all L1-L2s

🔸 99.1% positive sentiment for 2025

🔸 not a single negative sentiment period recorded for 2025

Shoutout to the incredible community of Seiyans and the amazing projects building on Sei.

Community support moves faster on Sei. 🫡

🔸 Ranked #1 across all L1-L2s

🔸 99.1% positive sentiment for 2025

🔸 not a single negative sentiment period recorded for 2025

Shoutout to the incredible community of Seiyans and the amazing projects building on Sei.

Community support moves faster on Sei. 🫡

SEI-4,56%

- Reward

- like

- Comment

- Repost

- Share

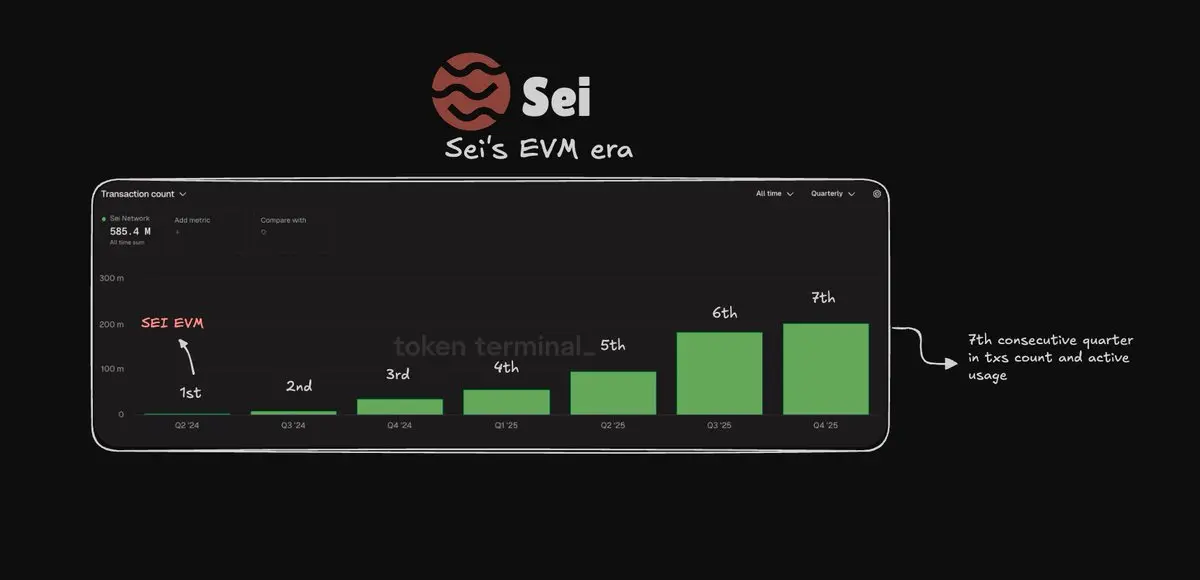

From the first EVM block to now, @SeiNetwork has quietly stacked 7 consecutive growth quarters back to back.

Next year is where we see what that compounding really looks like at scale.

gSei Seiyans🫡

Next year is where we see what that compounding really looks like at scale.

gSei Seiyans🫡

- Reward

- like

- Comment

- Repost

- Share

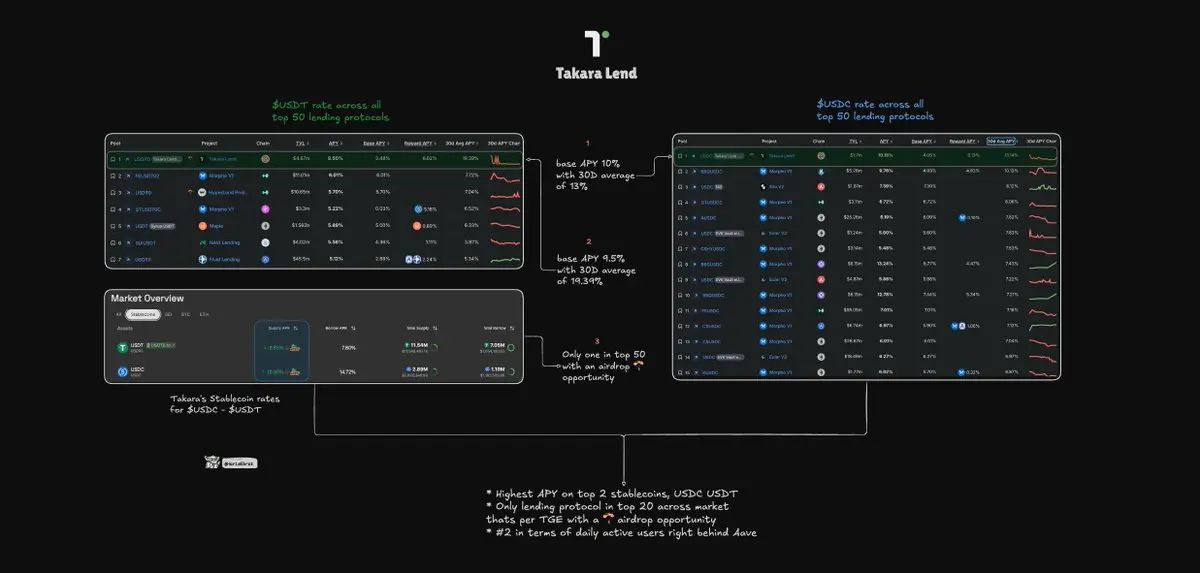

The more you dig into lending stats, the more you'll see that @TakaraLend on @SeiNetwork has turned into one of the leading money markets in all of DeFi, not just “another lending protocol.”

🔷 Takara in one look

➤ 2nd lending protocol by daily usage, sitting right behind @aave

➤ Highest stablecoin yields across top 50 in DeFi:

🔸For $USDC roughly 10% base / ~13% 30d avg

🔸for $USDT ~9.5% base / ~19% 30d avg

➤ Only top-30 lending venue that is still pre TGE with an active 🪂 and all $USDC / $USDT deposits earn max Karate💎 points for the airdrop farming

➤ #1 DeFi app on Sei by TVL and

🔷 Takara in one look

➤ 2nd lending protocol by daily usage, sitting right behind @aave

➤ Highest stablecoin yields across top 50 in DeFi:

🔸For $USDC roughly 10% base / ~13% 30d avg

🔸for $USDT ~9.5% base / ~19% 30d avg

➤ Only top-30 lending venue that is still pre TGE with an active 🪂 and all $USDC / $USDT deposits earn max Karate💎 points for the airdrop farming

➤ #1 DeFi app on Sei by TVL and

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

@gigiz_eth next lev adoption

- Reward

- like

- Comment

- Repost

- Share

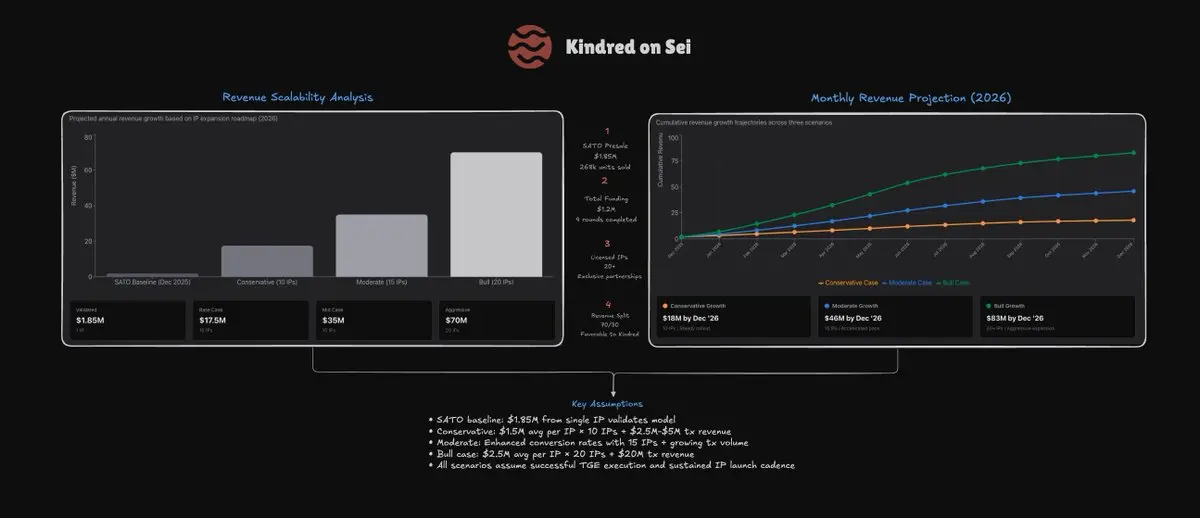

.@Kindred_AI is still pre TGE with launch targeted for Q1 2026, and they have already proven people will pay real money for this before the token even exists. Hard not to be bullish on what this does to @SeiNetwork once it all lands onchain.

🔷 Kindred in one look

➤ IP driven AI companions with 20+ licensed brands instead of another faceless agent app

➤ First chapter SATO already did around $1.85M in presale on its own

➤ Roadmap points to 25+ IP launches through 2026, each with its own presale and in-agent economy

🔷 Why this matters for Sei

➤ Every IP drop, presale and in-agent purchase

🔷 Kindred in one look

➤ IP driven AI companions with 20+ licensed brands instead of another faceless agent app

➤ First chapter SATO already did around $1.85M in presale on its own

➤ Roadmap points to 25+ IP launches through 2026, each with its own presale and in-agent economy

🔷 Why this matters for Sei

➤ Every IP drop, presale and in-agent purchase

SEI-4,56%

- Reward

- like

- Comment

- Repost

- Share