CryptoHODL

No content yet

CryptoHODL

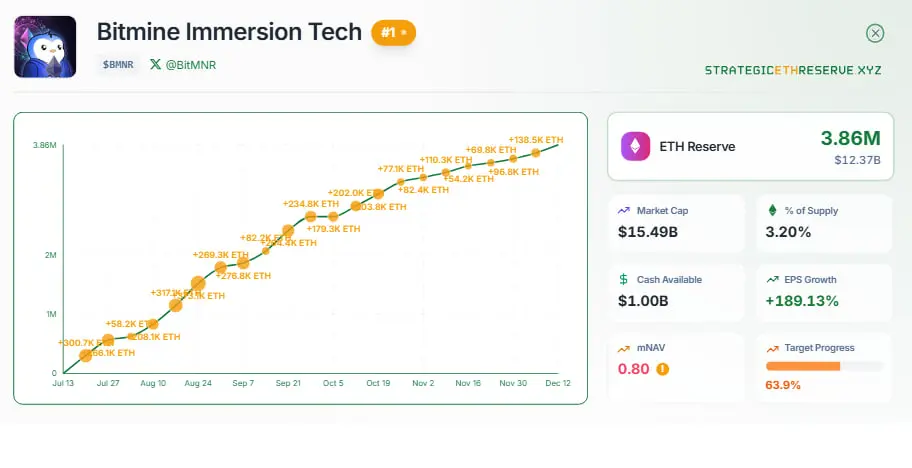

BitMine continues to increase its $ETH reserves.

Amid expectations of a key rate cut, the company decided to purchase an additional 33,504 ETH for a total of $112 million.

Currently, it holds 3,864,951 $ETH , along with 193 $BTC

The CEO of BitMine is optimistic and is betting on market growth early next year.

Overall, my position is similar. I also expect a positive start to the year, so I recommend you consider buying Ethereum ecosystem coins, although I've already mentioned them. Perhaps some haven't yet decided to add to their positions, but now is the time.

Amid expectations of a key rate cut, the company decided to purchase an additional 33,504 ETH for a total of $112 million.

Currently, it holds 3,864,951 $ETH , along with 193 $BTC

The CEO of BitMine is optimistic and is betting on market growth early next year.

Overall, my position is similar. I also expect a positive start to the year, so I recommend you consider buying Ethereum ecosystem coins, although I've already mentioned them. Perhaps some haven't yet decided to add to their positions, but now is the time.

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

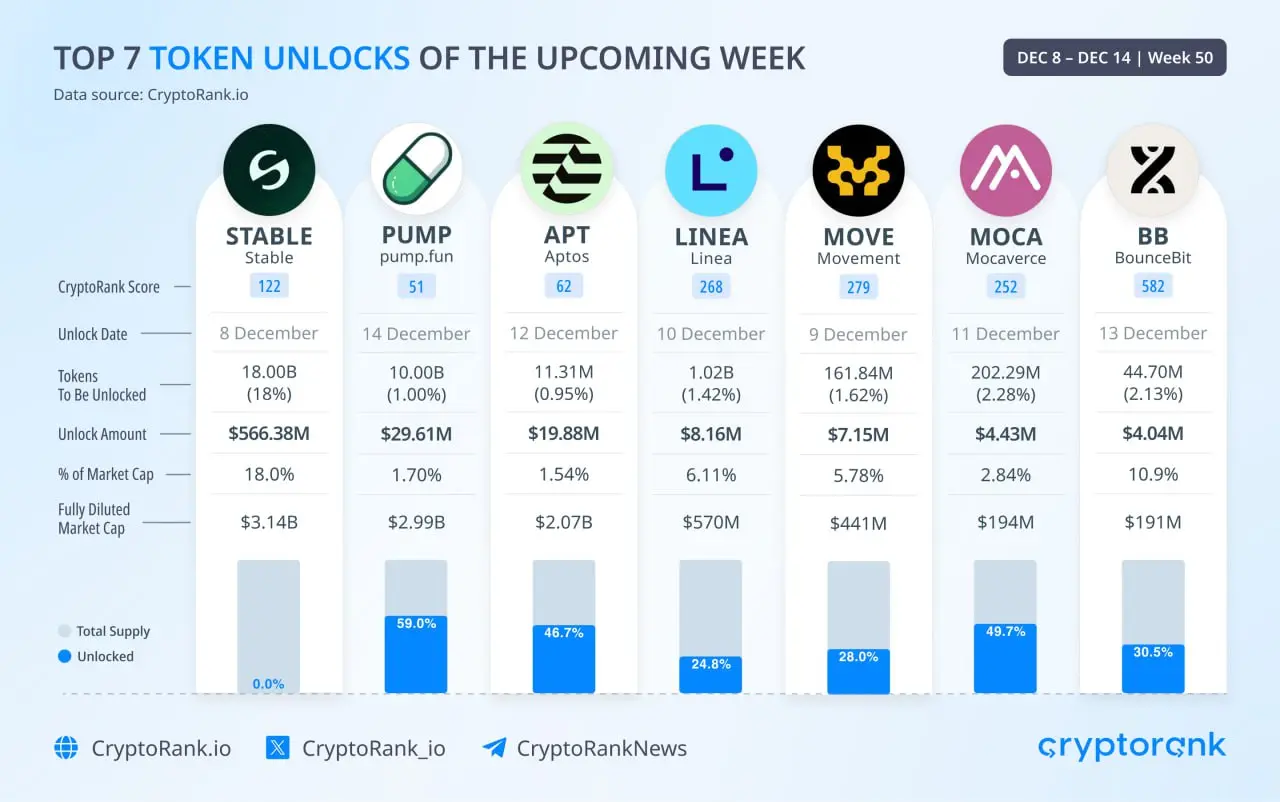

📊 Bitwise values $BTC at $1.3 millions by 2035

Bitwise's chief investment officer, Matt Hougan, presented their model for valuing $BTC. Their target is $1.3 millions in 10 years. This theory is based on the potential growth of $BTC share of gold's market capitalization from 9 to 25 percent.

This is essentially a guess—who will even remember all these conferences and big talk in 10 years? If BTC doesn't even come close to this target, the company will simply remain silent. If it does, headlines like "We warned you" will appear.

This is a viable idea for buying BTC for 10 years, but this str

Bitwise's chief investment officer, Matt Hougan, presented their model for valuing $BTC. Their target is $1.3 millions in 10 years. This theory is based on the potential growth of $BTC share of gold's market capitalization from 9 to 25 percent.

This is essentially a guess—who will even remember all these conferences and big talk in 10 years? If BTC doesn't even come close to this target, the company will simply remain silent. If it does, headlines like "We warned you" will appear.

This is a viable idea for buying BTC for 10 years, but this str

BTC-2.41%

- Reward

- 1

- Comment

- Repost

- Share

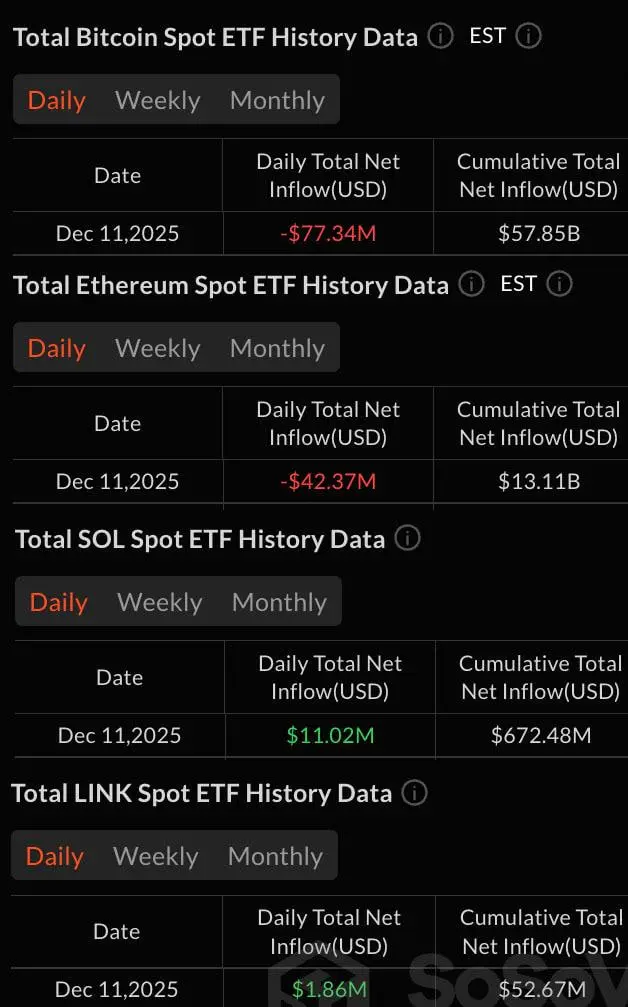

📈 The market is recovering

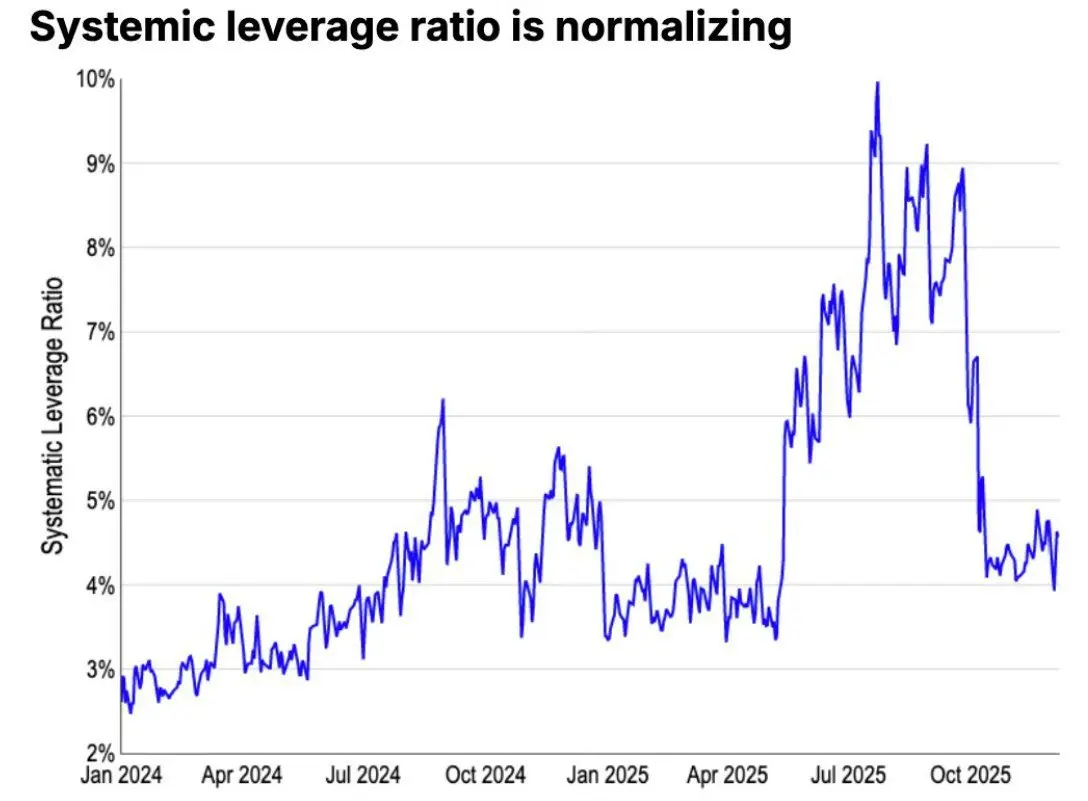

All indications are that the market is recovering – leverage has decreased, speculative interest has declined, and some risky positions have been eliminated.

The market is improving, but now is the most important moment that will determine the subsequent trend.

The Fed has cut rates for the third time in a row. Overall, as everyone expected, we saw a key rate cut. However, as I told you, with a 25-basis cut, we expect only a slight increase, given that this was already priced into the market.

📊 There was some volatility based on expectations, with $BTC hitting the

All indications are that the market is recovering – leverage has decreased, speculative interest has declined, and some risky positions have been eliminated.

The market is improving, but now is the most important moment that will determine the subsequent trend.

The Fed has cut rates for the third time in a row. Overall, as everyone expected, we saw a key rate cut. However, as I told you, with a 25-basis cut, we expect only a slight increase, given that this was already priced into the market.

📊 There was some volatility based on expectations, with $BTC hitting the

BTC-2.41%

- Reward

- like

- Comment

- Repost

- Share

🦈 Sharks and whales are actively buying up $ETH

🐋 Whales and sharks are showing a tendency to accumulate Ether, having accumulated approximately 930,000 ETH over the past three weeks.

Retail investors, however, are leaning toward selling the asset; they have sold 1,040 coins over the past week, but compared to whales' purchases, this is a small amount and has no impact on the altcoin's price.

$ETH has shown a net gain of +9% over the past 24 hours, which is, of course, largely due to its strong correlation with $BTC . But the trend is clearly positive, and we could still see significant gro

🐋 Whales and sharks are showing a tendency to accumulate Ether, having accumulated approximately 930,000 ETH over the past three weeks.

Retail investors, however, are leaning toward selling the asset; they have sold 1,040 coins over the past week, but compared to whales' purchases, this is a small amount and has no impact on the altcoin's price.

$ETH has shown a net gain of +9% over the past 24 hours, which is, of course, largely due to its strong correlation with $BTC . But the trend is clearly positive, and we could still see significant gro

- Reward

- like

- Comment

- Repost

- Share

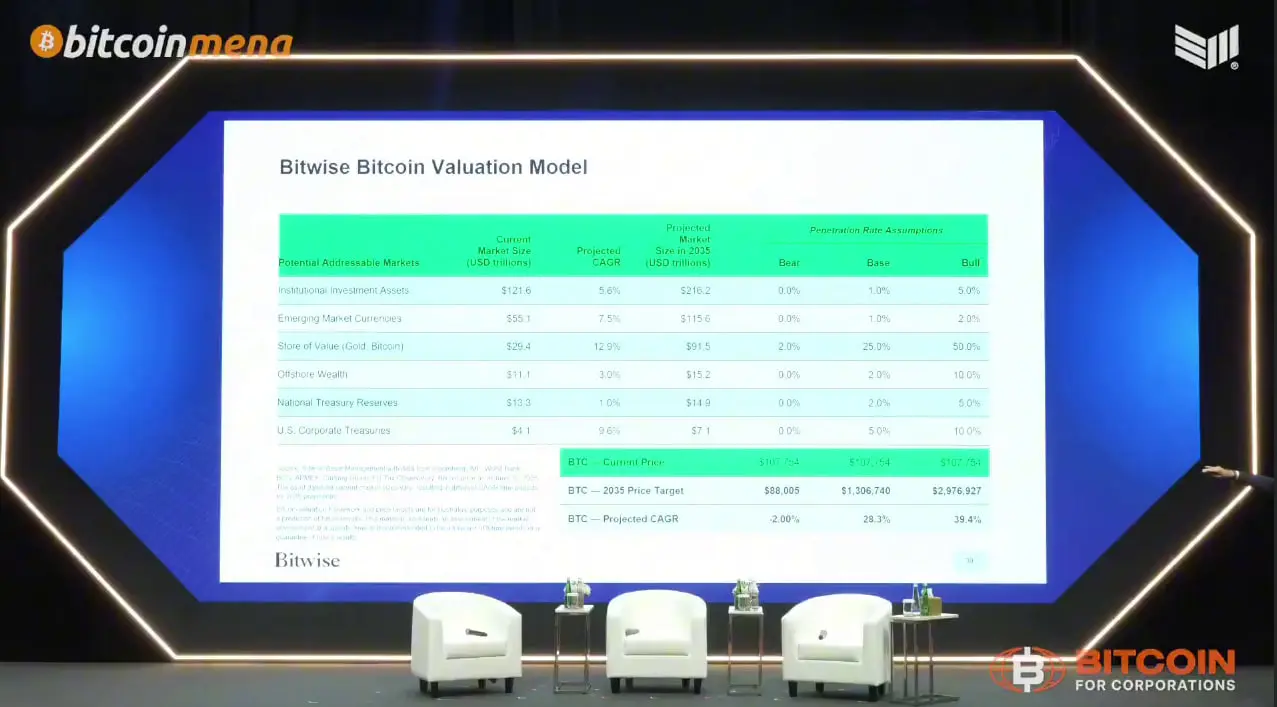

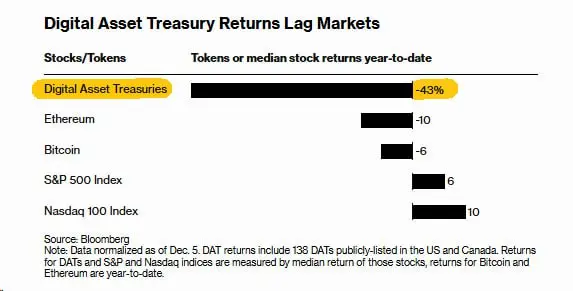

📉 Investors began to realize the collapse of companies.

As soon as the $BTC spot ETF launched, many companies began buying $BTC and $ETH onto their balance sheets, and their shares skyrocketed. I think you remember all that news, and even then I told you that I didn't understand the logic, as the companies themselves were greatly overvalued.

But it was just hype, and companies, realizing this, began buying BTC en masse. As time went on and the market correction intensified, investors realized that buying BTC wasn't helping companies develop. The hype died down.

Now we see a picture of compa

As soon as the $BTC spot ETF launched, many companies began buying $BTC and $ETH onto their balance sheets, and their shares skyrocketed. I think you remember all that news, and even then I told you that I didn't understand the logic, as the companies themselves were greatly overvalued.

But it was just hype, and companies, realizing this, began buying BTC en masse. As time went on and the market correction intensified, investors realized that buying BTC wasn't helping companies develop. The hype died down.

Now we see a picture of compa

- Reward

- like

- Comment

- Repost

- Share

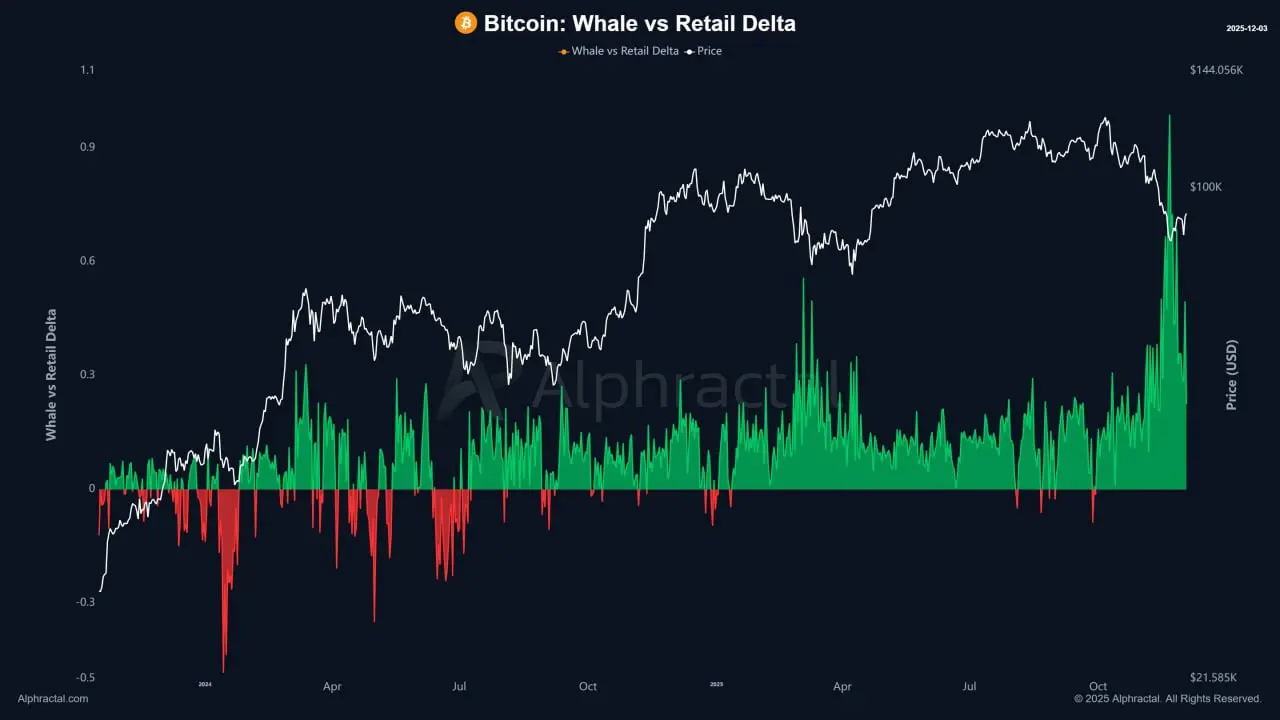

🐋 Whales have bought up a huge amount of $BTC

In just the first eight days of December, large wallets bought an additional 47,000 $BTC. The market is in an active accumulation phase, which is not typical for the potential bearish trend that many are raising. While we don't have a certain stability in the sideways movement and the potential for a correction remains, in percentage terms, we are heavily biased toward a normalization of the situation.

💰 Strategy also made another purchase of $BTC.

Despite the fact that the pace of this company's purchases has significantly slowed this year, it

In just the first eight days of December, large wallets bought an additional 47,000 $BTC. The market is in an active accumulation phase, which is not typical for the potential bearish trend that many are raising. While we don't have a certain stability in the sideways movement and the potential for a correction remains, in percentage terms, we are heavily biased toward a normalization of the situation.

💰 Strategy also made another purchase of $BTC.

Despite the fact that the pace of this company's purchases has significantly slowed this year, it

BTC-2.41%

- Reward

- like

- Comment

- Repost

- Share

💰The supply of $ETH on exchanges is gradually declining.

Currently, there is a trend of ETH being withdrawn from exchanges and moved into long-term storage through staking or restaking.

The volume of coins held on exchanges has fallen to 8.7% of the total supply, a record low since the network's launch.

This trend will significantly reduce selling pressure, and we will not see any significant correction in the current cycle.

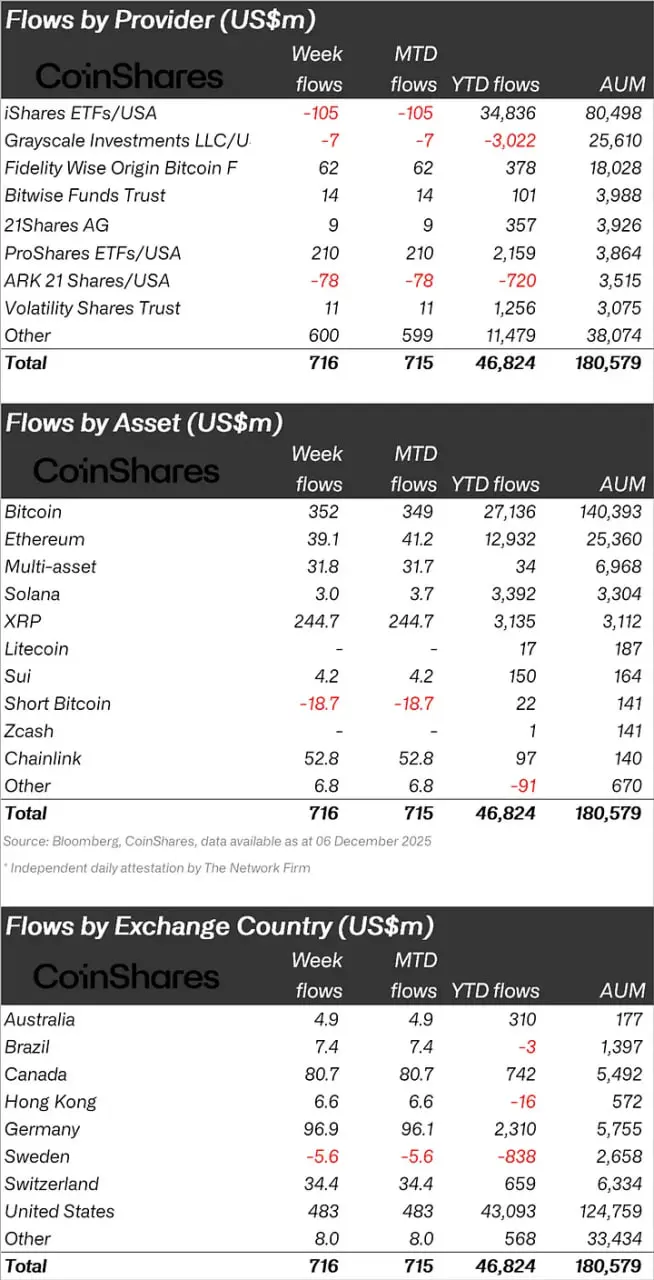

Also, CoinShares' weekly report on attractive inflows.

This week turned out to be profitable, with $716M in inflows to the community. $BTC, of course, had the largest

Currently, there is a trend of ETH being withdrawn from exchanges and moved into long-term storage through staking or restaking.

The volume of coins held on exchanges has fallen to 8.7% of the total supply, a record low since the network's launch.

This trend will significantly reduce selling pressure, and we will not see any significant correction in the current cycle.

Also, CoinShares' weekly report on attractive inflows.

This week turned out to be profitable, with $716M in inflows to the community. $BTC, of course, had the largest

- Reward

- like

- Comment

- Repost

- Share

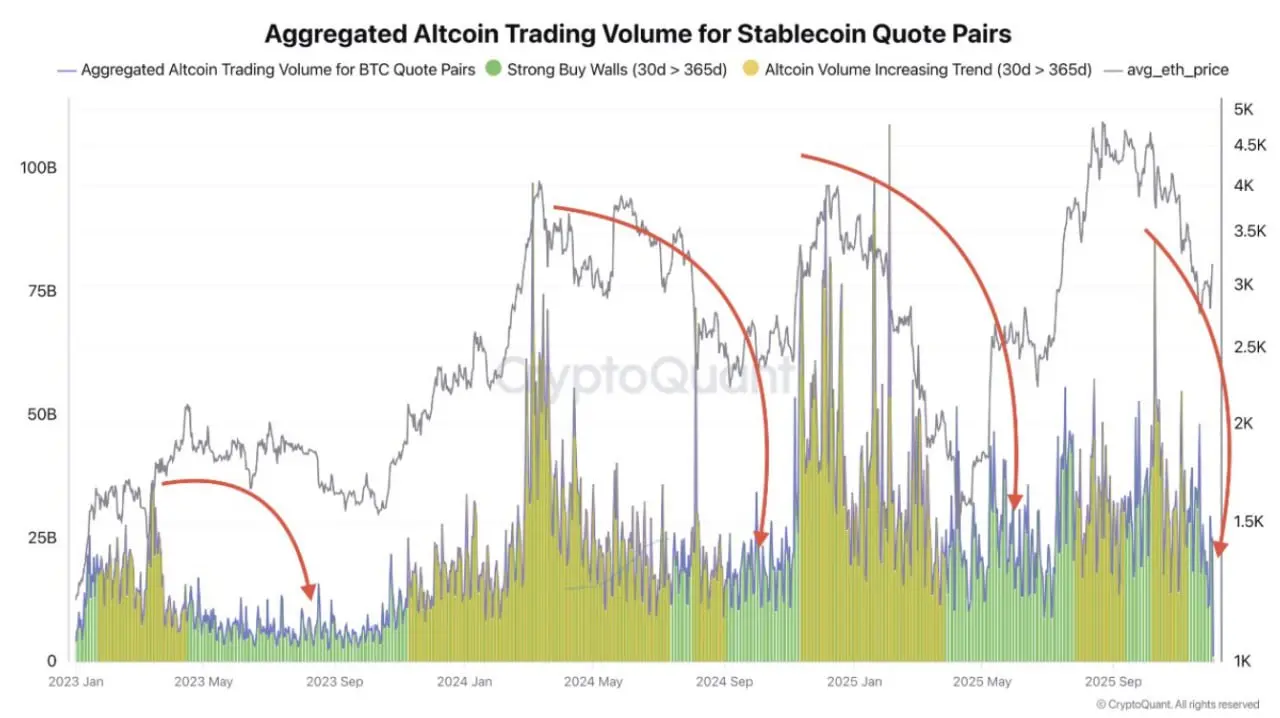

📊 A strong sign that altos are preparing for a rally.

Altcoin trading volumes have dropped sharply, which often happens during periods of accumulation and peaks of market fear. We're back in the buying zone: 30-day volumes have fallen below the annual average.

Altos still have potential to fall by around 20% to 30% overall, but all indications are that this will be the final round of correction, which will largely offset the squeezes in altos.

🐋 Also, one of the whales has been actively buying.

He recently bought 10 assets worth approximately $13.9 million, taking advantage of the market cra

Altcoin trading volumes have dropped sharply, which often happens during periods of accumulation and peaks of market fear. We're back in the buying zone: 30-day volumes have fallen below the annual average.

Altos still have potential to fall by around 20% to 30% overall, but all indications are that this will be the final round of correction, which will largely offset the squeezes in altos.

🐋 Also, one of the whales has been actively buying.

He recently bought 10 assets worth approximately $13.9 million, taking advantage of the market cra

- Reward

- like

- Comment

- Repost

- Share

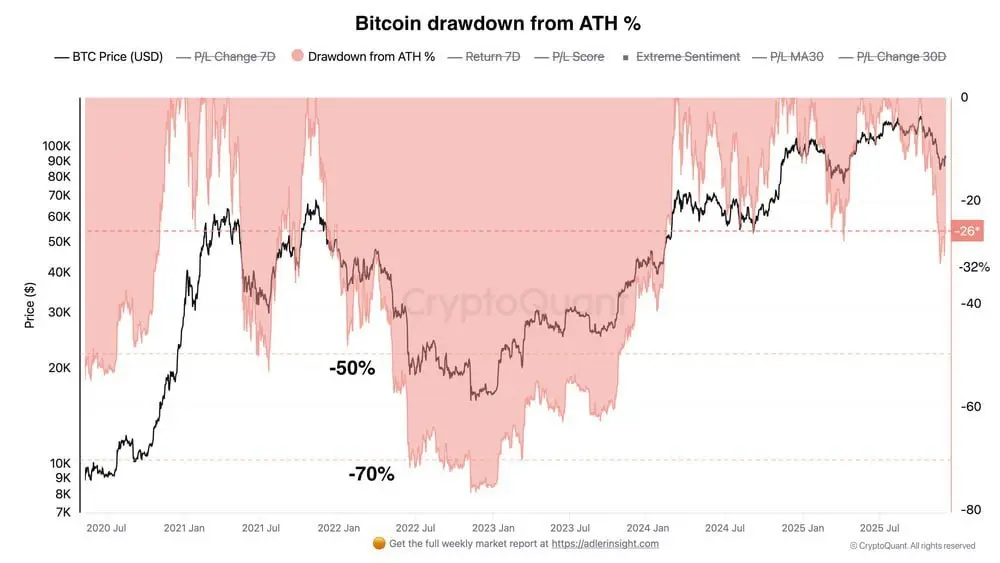

📊 A Сrossroads in the Road for $BTC

We've now reached a difficult market area where all we can do is guess and try to flip a coin in our favor. The current correction has reached 32%—a level that could prove to be either a local bottom, like in 2021, or a harbinger of a new bear cycle, like at the very beginning of 2022.

And no one can give you a definitive answer right now, no analytics will help. The pattern resembles the 2021 corona-dump, but it also resembles the start of a bear cycle, albeit not metrically.

Now more than ever, you need qualities such as patience, faith, and composure. E

We've now reached a difficult market area where all we can do is guess and try to flip a coin in our favor. The current correction has reached 32%—a level that could prove to be either a local bottom, like in 2021, or a harbinger of a new bear cycle, like at the very beginning of 2022.

And no one can give you a definitive answer right now, no analytics will help. The pattern resembles the 2021 corona-dump, but it also resembles the start of a bear cycle, albeit not metrically.

Now more than ever, you need qualities such as patience, faith, and composure. E

BTC-2.41%

- Reward

- like

- Comment

- Repost

- Share

🐋 Major $BTC whales are gradually switching from selling to accumulation.

The trend has begun to gradually reverse, and the aggressive selling we observed in November is gradually subsiding. Systematic buying is now occurring among virtually all whale groups. If this trend continues, we could soon return to the $100,000 range for Bitcoin.

There's also an interest rate forecast. The probability of a rate cut is over 90%. With only four days left until the key market day, we've fully factored in our expectations, namely a 25 basis point reduction.

The market is still sluggish; trading volumes

The trend has begun to gradually reverse, and the aggressive selling we observed in November is gradually subsiding. Systematic buying is now occurring among virtually all whale groups. If this trend continues, we could soon return to the $100,000 range for Bitcoin.

There's also an interest rate forecast. The probability of a rate cut is over 90%. With only four days left until the key market day, we've fully factored in our expectations, namely a 25 basis point reduction.

The market is still sluggish; trading volumes

BTC-2.41%

- Reward

- like

- Comment

- Repost

- Share

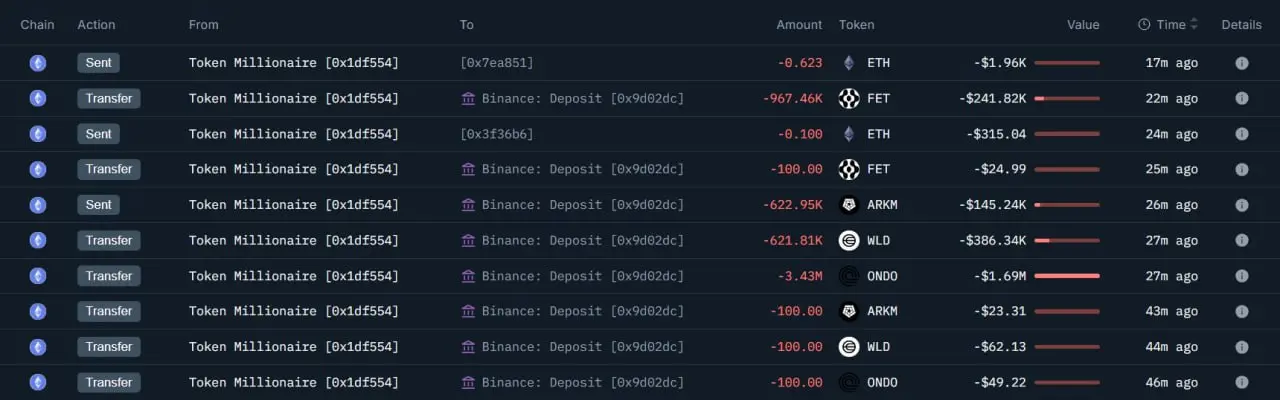

🐋 One of the whales began transferring his coins to Binance while other whales were launching stablecoins.

This investor held his assets for over a year, but his investment is now in the red, with an unrealized loss of $4 million.

Here is the list of coins:

- 3.43 million $ONDO ($1.69 million), loss of $1.03 millions

- 621,914 $WLD ($387,000), loss of $1.11 millions

- 967,558 $FET ($243,000), loss of $1.07 millions

- 623,055 $ARKM ($146,000), loss of $1 millions

Most likely, he is wary of a further market correction and decided to lock in the losses on his positions.

🐳 At the same time, seve

This investor held his assets for over a year, but his investment is now in the red, with an unrealized loss of $4 million.

Here is the list of coins:

- 3.43 million $ONDO ($1.69 million), loss of $1.03 millions

- 621,914 $WLD ($387,000), loss of $1.11 millions

- 967,558 $FET ($243,000), loss of $1.07 millions

- 623,055 $ARKM ($146,000), loss of $1 millions

Most likely, he is wary of a further market correction and decided to lock in the losses on his positions.

🐳 At the same time, seve

- Reward

- like

- Comment

- Repost

- Share

📈 Bitcoin is preparing to reach $100,000.

A CoinDesk analyst has identified bullish factors that point to continued growth.

▪️ $BTC (BVIV) volatility fell to 48, breaking the bullish trend. Panic is easing, and the market is stabilizing.

The downtrend in the dollar is an additional plus.

🕯 Technical factors:

BTC has consolidated above $93,104 and the Ichimoku cloud.

▪️ Next target: $98,000 - $100,000.

However, there is a risk that a break below the Ichimoku cloud will weaken the momentum.

Key targets for other coins:

🔹 $ETH - $3,500.

🔹 $SOL - $165.

🔹 $XRP - $2.30.

A CoinDesk analyst has identified bullish factors that point to continued growth.

▪️ $BTC (BVIV) volatility fell to 48, breaking the bullish trend. Panic is easing, and the market is stabilizing.

The downtrend in the dollar is an additional plus.

🕯 Technical factors:

BTC has consolidated above $93,104 and the Ichimoku cloud.

▪️ Next target: $98,000 - $100,000.

However, there is a risk that a break below the Ichimoku cloud will weaken the momentum.

Key targets for other coins:

🔹 $ETH - $3,500.

🔹 $SOL - $165.

🔹 $XRP - $2.30.

- Reward

- like

- Comment

- Repost

- Share

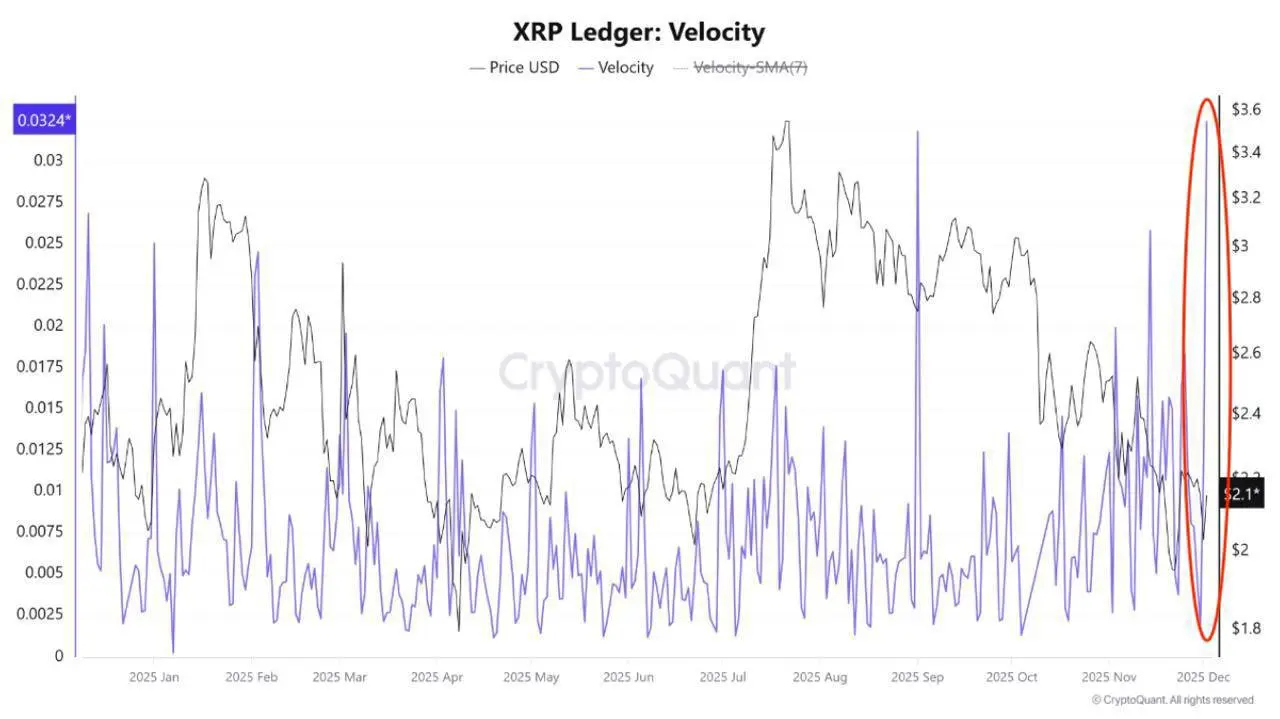

🐋 Activity is being observed among $XRP whales.

Whales have begun to show activity and gradually buy back this asset.

The coin has reached a favorable $2 level, which likely prompted these investors to add to their positions.

I believe their activity will be sufficient to maintain this price level, and we won't see any significant declines in the near future.

Whales have begun to show activity and gradually buy back this asset.

The coin has reached a favorable $2 level, which likely prompted these investors to add to their positions.

I believe their activity will be sufficient to maintain this price level, and we won't see any significant declines in the near future.

XRP-1.32%

- Reward

- like

- Comment

- Repost

- Share

💠The $ETH network has undergone the Fusaka update.

Developers have deployed an update that has reduced network fees. The main update is PeerDAS. Instead of each node downloading the entire network, they now check only random fragments. This reduces the load and saves computing resources, thereby increasing throughput. The update schedule has also changed; they will now be performed twice a year.

Ethereum is actively developing, making it one of the most promising assets on the market. I've repeatedly told you that Ether should be in your portfolio. I hope you've listened and are gradually ac

Developers have deployed an update that has reduced network fees. The main update is PeerDAS. Instead of each node downloading the entire network, they now check only random fragments. This reduces the load and saves computing resources, thereby increasing throughput. The update schedule has also changed; they will now be performed twice a year.

Ethereum is actively developing, making it one of the most promising assets on the market. I've repeatedly told you that Ether should be in your portfolio. I hope you've listened and are gradually ac

ETH-4.72%

- Reward

- like

- Comment

- Repost

- Share

💸 Funds are buying Bitcoin

Larry Fink said that sovereign wealth funds have bought a large amount of $BTC , around $80,000. This isn't speculation, but genuine accumulation.

🐂 Fink also said that the Bitcoin market will soar much faster than expected.

The main driver of this growth will be the tokenization of assets.

BlackRock is confident that this will become the foundation of a new financial system in the coming years.

Larry Fink said that sovereign wealth funds have bought a large amount of $BTC , around $80,000. This isn't speculation, but genuine accumulation.

🐂 Fink also said that the Bitcoin market will soar much faster than expected.

The main driver of this growth will be the tokenization of assets.

BlackRock is confident that this will become the foundation of a new financial system in the coming years.

BTC-2.41%

- Reward

- like

- Comment

- Repost

- Share

🐋 Whales are gradually closing their long positions.

Whales are gradually closing long positions and a small increase in short positions, which could indicate another market correction. If short positions gain the upper hand, we expect another decline to $81,000. While the market is still uncertain, buying activity has noticeably decreased, and we've entered a consolidation phase, the outcome of which will determine the future price movement of $BTC .

However, momentum remains weak, volumes have dropped, and it looks like we're unlikely to be able to hold the $93,000 BTC area.

🏦 This year, t

Whales are gradually closing long positions and a small increase in short positions, which could indicate another market correction. If short positions gain the upper hand, we expect another decline to $81,000. While the market is still uncertain, buying activity has noticeably decreased, and we've entered a consolidation phase, the outcome of which will determine the future price movement of $BTC .

However, momentum remains weak, volumes have dropped, and it looks like we're unlikely to be able to hold the $93,000 BTC area.

🏦 This year, t

BTC-2.41%

- Reward

- like

- Comment

- Repost

- Share

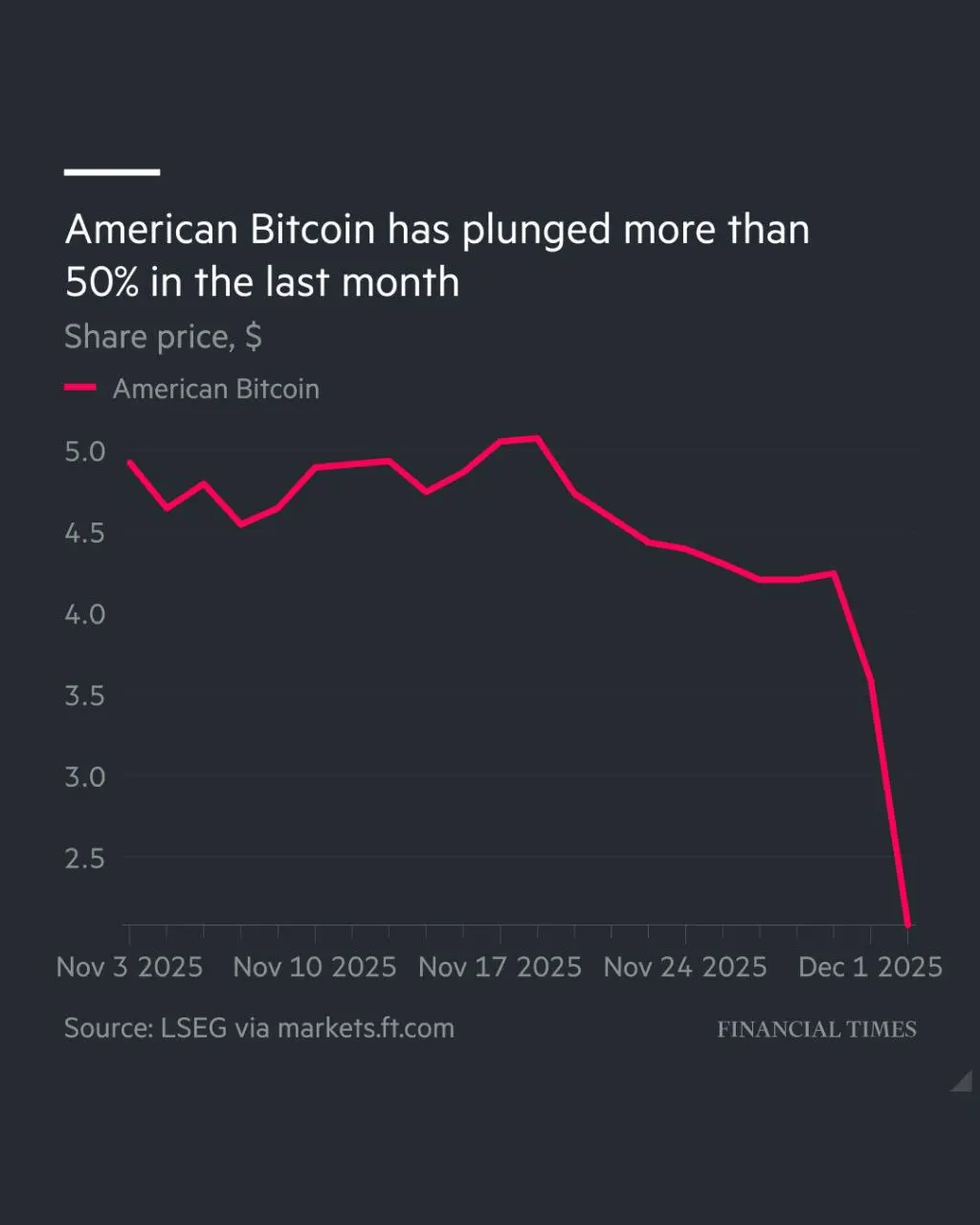

🐋📊 A whale's perfect $ETH trade, American Bitcoin shares are falling, and Michael Saylor isn't doing so well.

The whale sold 1,900 ETH at $4,500 for $9 millions, and has now bought the coin back – 2,017 ETH ($6.17 millions) at $3,061.

Meanwhile, American Bitcoin shares have lost more than 50% of their value in a month, as investors are exiting the project en masse. Strategy (MSTR) Chairman Michael Saylor stated that the company is in discussions with MSCI regarding a possible exclusion from its indices. If MSCI decides to exclude Strategy from the index on January 15, it will lead to an out

The whale sold 1,900 ETH at $4,500 for $9 millions, and has now bought the coin back – 2,017 ETH ($6.17 millions) at $3,061.

Meanwhile, American Bitcoin shares have lost more than 50% of their value in a month, as investors are exiting the project en masse. Strategy (MSTR) Chairman Michael Saylor stated that the company is in discussions with MSCI regarding a possible exclusion from its indices. If MSCI decides to exclude Strategy from the index on January 15, it will lead to an out

- Reward

- like

- Comment

- Repost

- Share

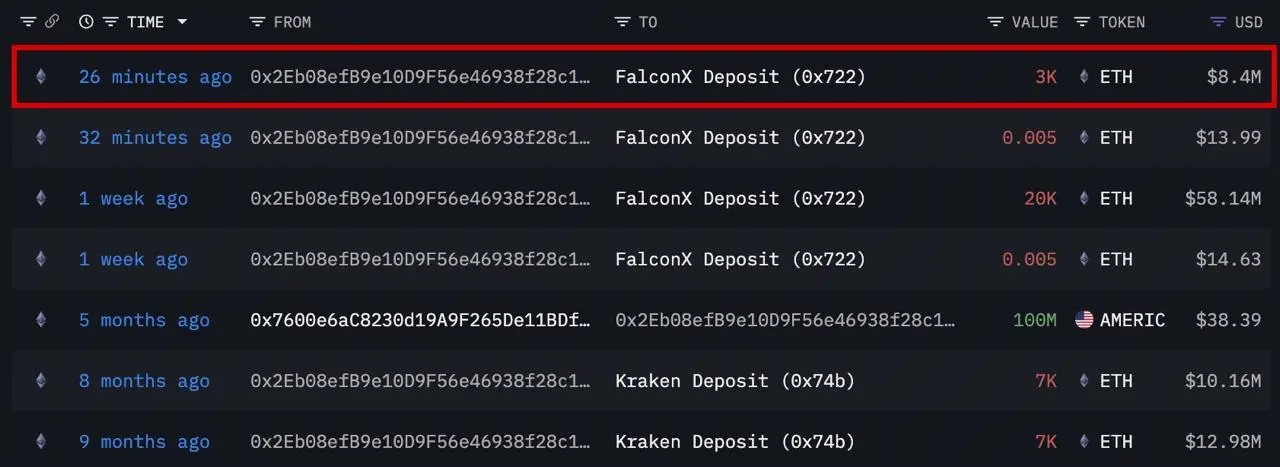

🐋 One of the whales is actively selling $ETH

This investor acquired his coins during the ICO, buying 254,908 $ETH for just $79.3k. Over the past week, he has been gradually selling his holdings, having already sold approximately 23,000 $ETH ($66.53 millions). He deposited another 3,000 ETH ($8.4 millions) on FalconX, likely for a similar purpose, and these coins will be sold soon.

Even though Ethereum isn't near its all-time high, this whale will still be making a significant profit. However, he still has a significant amount of coins in his wallet, which he may hold onto for a resurgence.

This investor acquired his coins during the ICO, buying 254,908 $ETH for just $79.3k. Over the past week, he has been gradually selling his holdings, having already sold approximately 23,000 $ETH ($66.53 millions). He deposited another 3,000 ETH ($8.4 millions) on FalconX, likely for a similar purpose, and these coins will be sold soon.

Even though Ethereum isn't near its all-time high, this whale will still be making a significant profit. However, he still has a significant amount of coins in his wallet, which he may hold onto for a resurgence.

ETH-4.72%

- Reward

- like

- Comment

- Repost

- Share