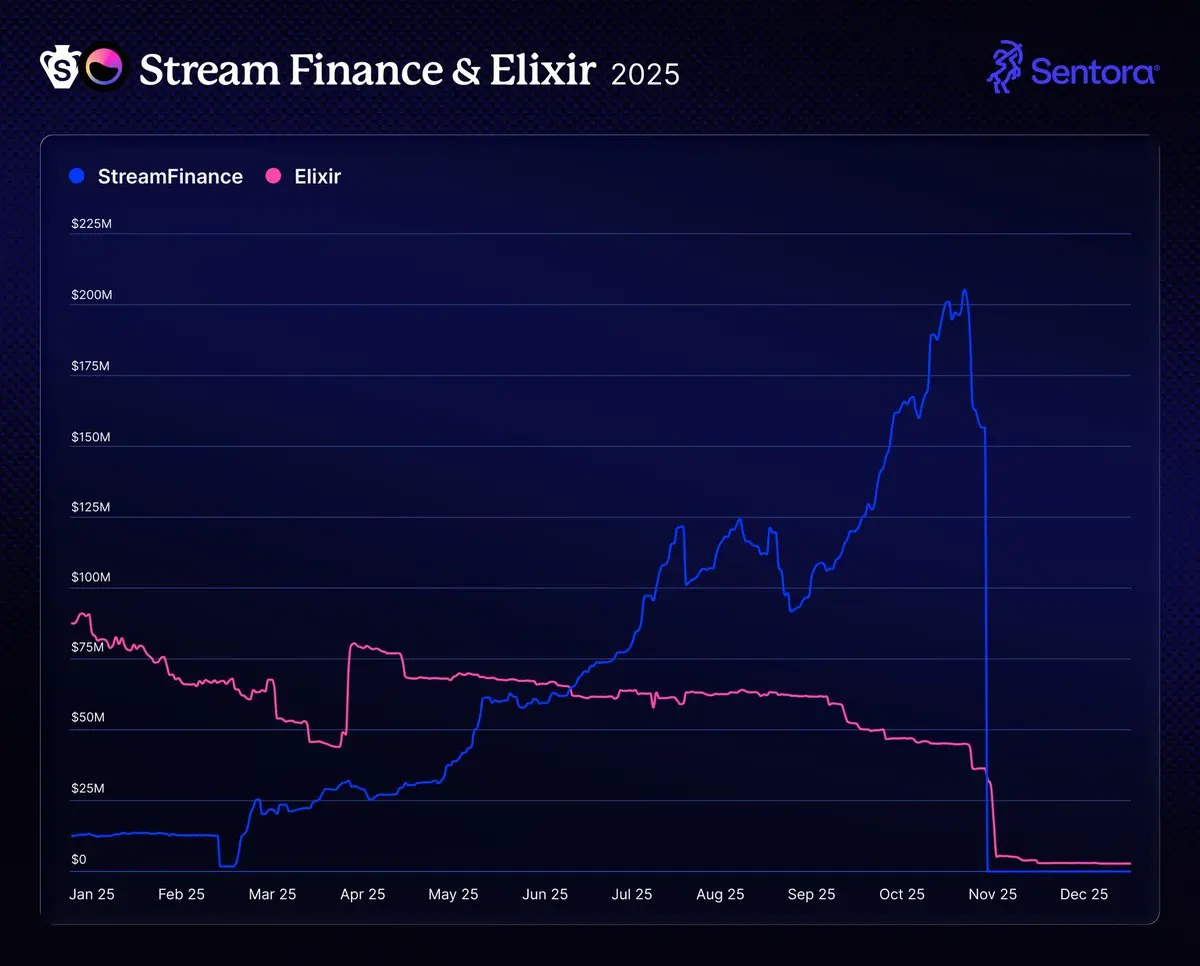

We can't look back on 2025 without mentioning the Stream Finance & Elixir losses.

Stream Finance suffered a $93 million loss due to external fund manager failure, triggering a catastrophic default for their xUSD token. As the markets scrambled to identify what curators and protocols were exposed, Elixir announced that they had significant allocation in Stream Finance and would not be able to cover the gap to repeg their stablecoin.

The entire event highlighted the need for further transparency in DeFi vaults and asset curation as many curators and strategists were exposed to losses as they so