JunaidDar

No content yet

JunaidDar

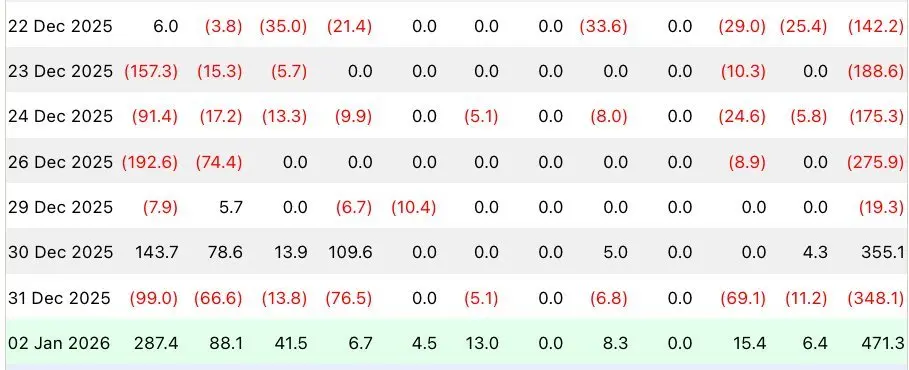

🚨 GLOBAL MARKET BLOODBATH

Over $1.5 TRILLION wiped out as markets spiral into panic.

President Trump’s aggressive stance on Greenland acquisition and potential 10–25% import tariffs has reignited trade war fears, prompting investors to firmly adopt a risk-off approach.

Here’s what just happened 👇

📉 US Stocks~$1.4T erased as Dow & Nasdaq plunge sharply.

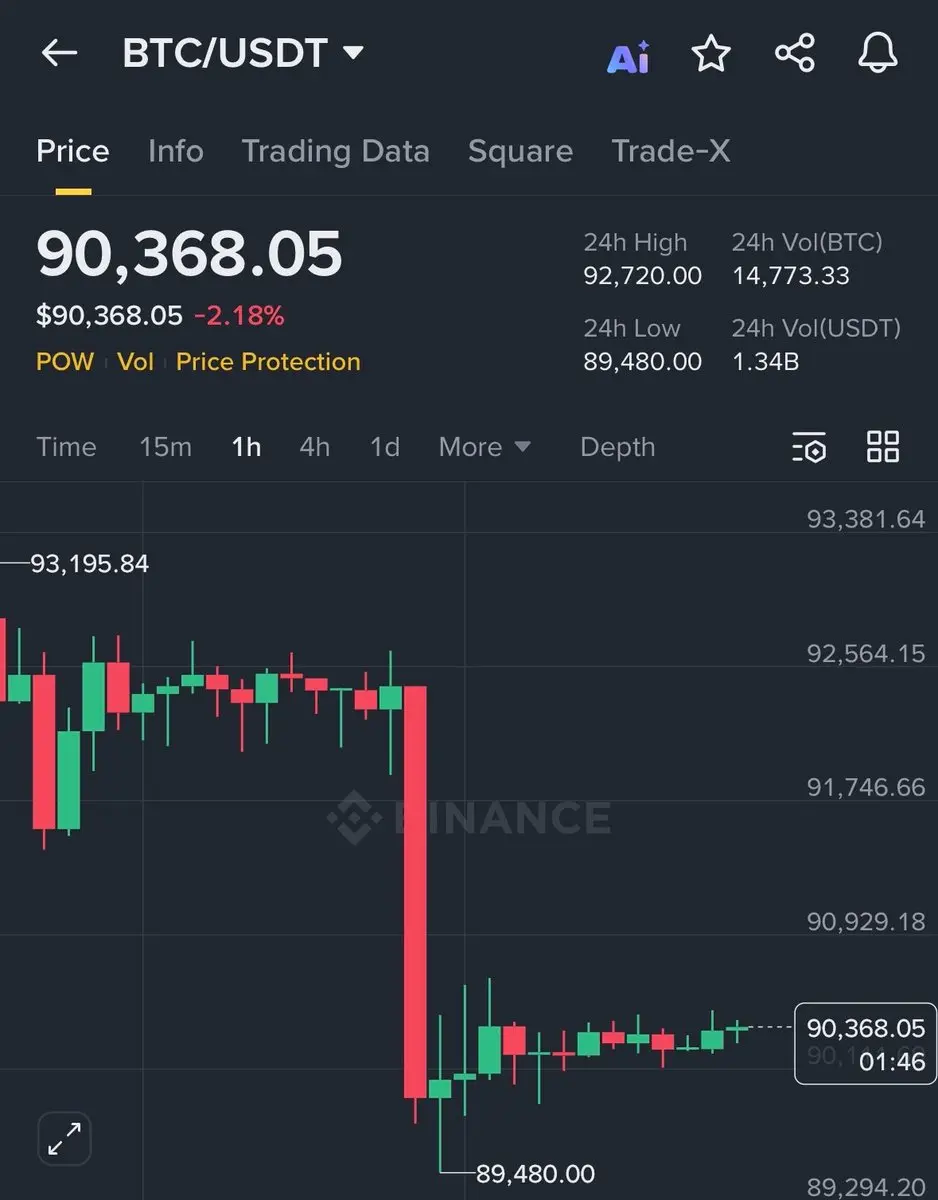

📉 $160 B in crypto wiped out in 24 hours. Bitcoin breaks below $91,000, losing a key psychological level.

🟡 Safe Haven RushGold surges against the chaos, printing a new all-time high at $4,850.

Capital is fleeing risk. Fear is

Over $1.5 TRILLION wiped out as markets spiral into panic.

President Trump’s aggressive stance on Greenland acquisition and potential 10–25% import tariffs has reignited trade war fears, prompting investors to firmly adopt a risk-off approach.

Here’s what just happened 👇

📉 US Stocks~$1.4T erased as Dow & Nasdaq plunge sharply.

📉 $160 B in crypto wiped out in 24 hours. Bitcoin breaks below $91,000, losing a key psychological level.

🟡 Safe Haven RushGold surges against the chaos, printing a new all-time high at $4,850.

Capital is fleeing risk. Fear is

BTC-6,56%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin dumps below $92,000.

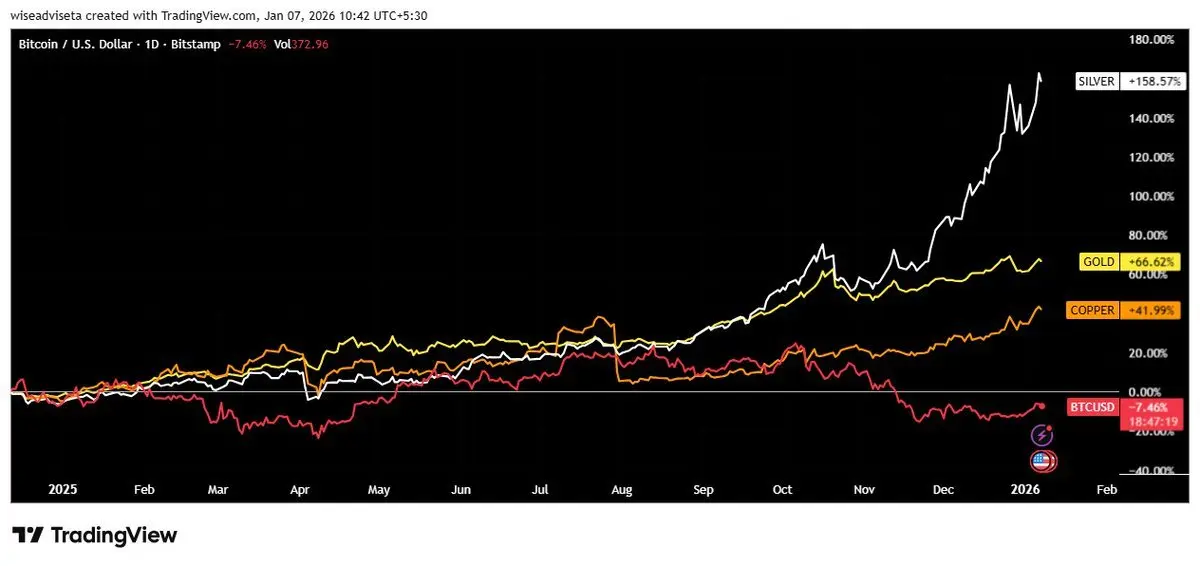

As crypto pulls back, capital is flooding into hard assets.

Gold and Silver have just hit new all-time highs.

Only 20 days into 2026:

Silver is up 30%.

Gold is up 9%.

Since the start of the year, precious metals have absorbed nearly $4 trillion in market value.

Today alone:

Gold added ~$787B.

Silver added ~$160B.

Gold has now printed a record $4,700.

Risk-off is back on the table and the rotation is visible.

As crypto pulls back, capital is flooding into hard assets.

Gold and Silver have just hit new all-time highs.

Only 20 days into 2026:

Silver is up 30%.

Gold is up 9%.

Since the start of the year, precious metals have absorbed nearly $4 trillion in market value.

Today alone:

Gold added ~$787B.

Silver added ~$160B.

Gold has now printed a record $4,700.

Risk-off is back on the table and the rotation is visible.

BTC-6,56%

- Reward

- like

- Comment

- Repost

- Share

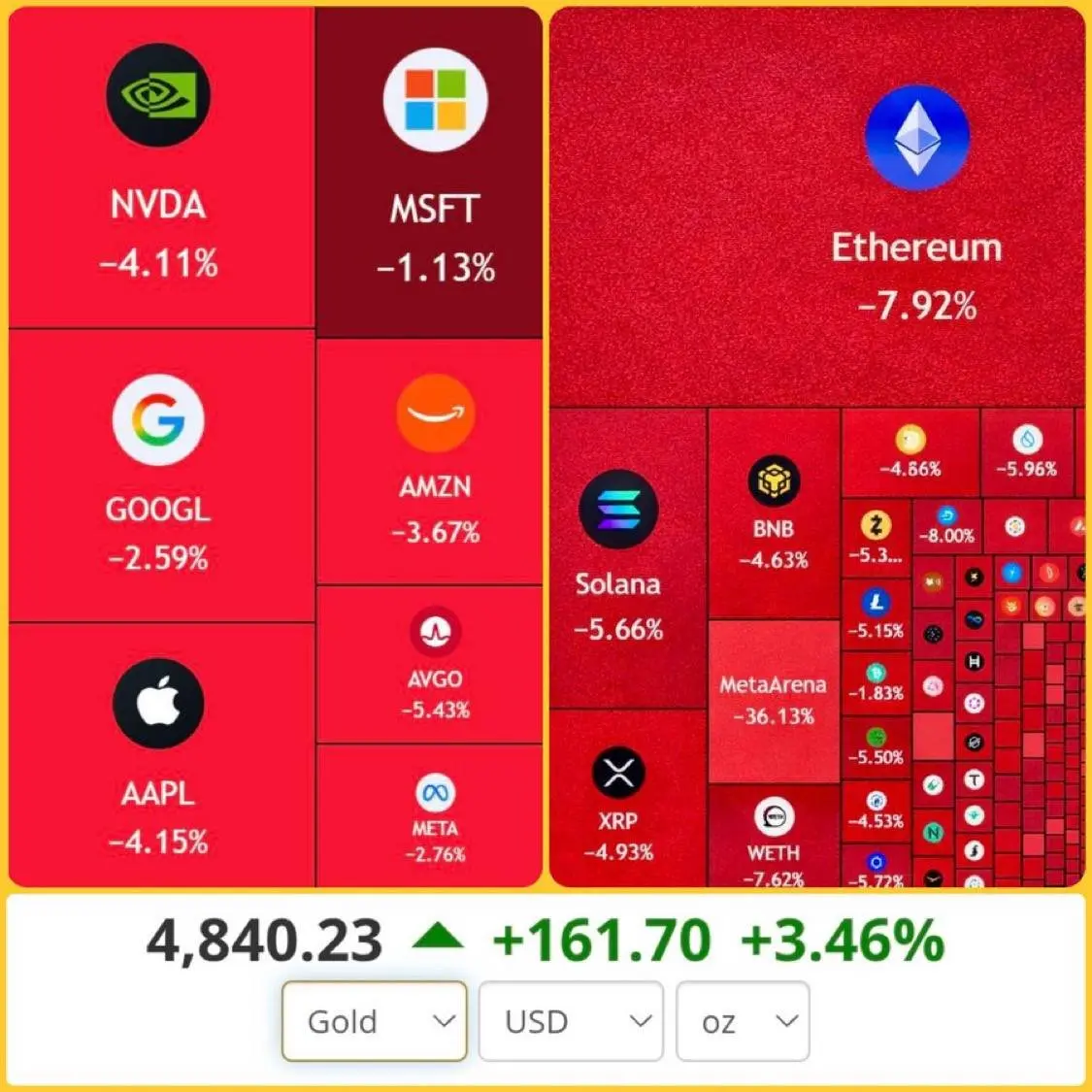

REMINDER

US CPI (December) data drops today, expect volatility 📈📉

⏰ Time:

• 1:30 PM UTC

• 8:30 AM ET

Markets will react fast. Stay alert.

US CPI (December) data drops today, expect volatility 📈📉

⏰ Time:

• 1:30 PM UTC

• 8:30 AM ET

Markets will react fast. Stay alert.

- Reward

- like

- Comment

- Repost

- Share

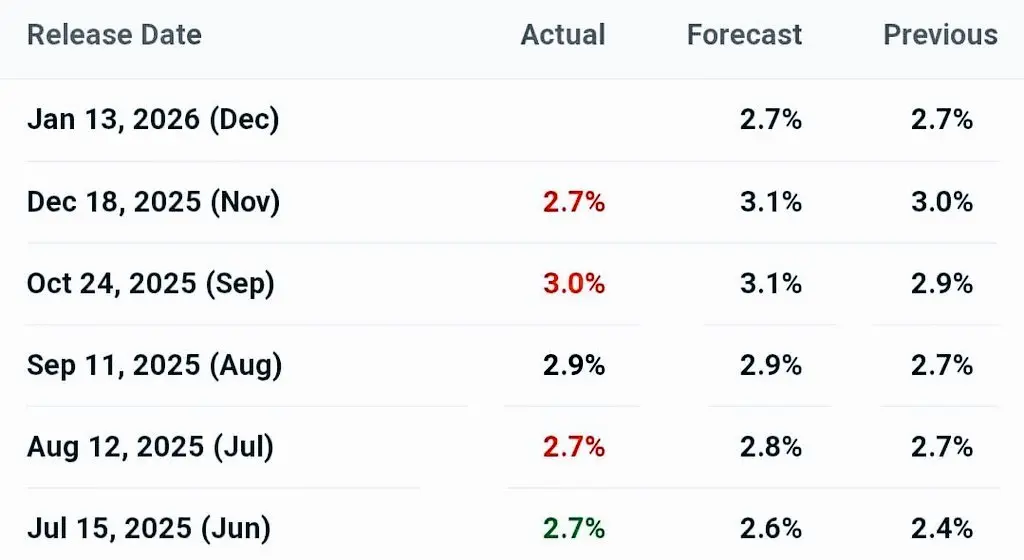

🚨 GEOPOLITICAL RISK IS RISING

Trump just imposed a 25% tariff on any country doing business with Iran.

At the same time, Polymarket shows a 64% probability of a US / Israel strike on Iran by Jan 31.

This combo = rising uncertainty across oil, gold, and risk assets.

Markets may not be fully priced for what’s coming. 👀

Trump just imposed a 25% tariff on any country doing business with Iran.

At the same time, Polymarket shows a 64% probability of a US / Israel strike on Iran by Jan 31.

This combo = rising uncertainty across oil, gold, and risk assets.

Markets may not be fully priced for what’s coming. 👀

- Reward

- like

- 1

- Repost

- Share

GateUser-f16fdcdf :

:

Thank you for the interesting articleSomething important is happening in the market

Gold, silver, and copper are all going up at the same time.

That normally doesn’t happen.

• Copper usually rises when the economy is strong

• Gold usually rises when people are scared

• When both move together, it means something else…

It means big money is quietly moving out of risky assets and into real, safe assets.

Not because a crash is happening tomorrow

but because risk is slowly building in the system.

What this means for traders right now:

• Use smaller position sizes

• Stick more to spot, less to leverage

• Don’t chase breakouts in low

Gold, silver, and copper are all going up at the same time.

That normally doesn’t happen.

• Copper usually rises when the economy is strong

• Gold usually rises when people are scared

• When both move together, it means something else…

It means big money is quietly moving out of risky assets and into real, safe assets.

Not because a crash is happening tomorrow

but because risk is slowly building in the system.

What this means for traders right now:

• Use smaller position sizes

• Stick more to spot, less to leverage

• Don’t chase breakouts in low

- Reward

- like

- Comment

- Repost

- Share

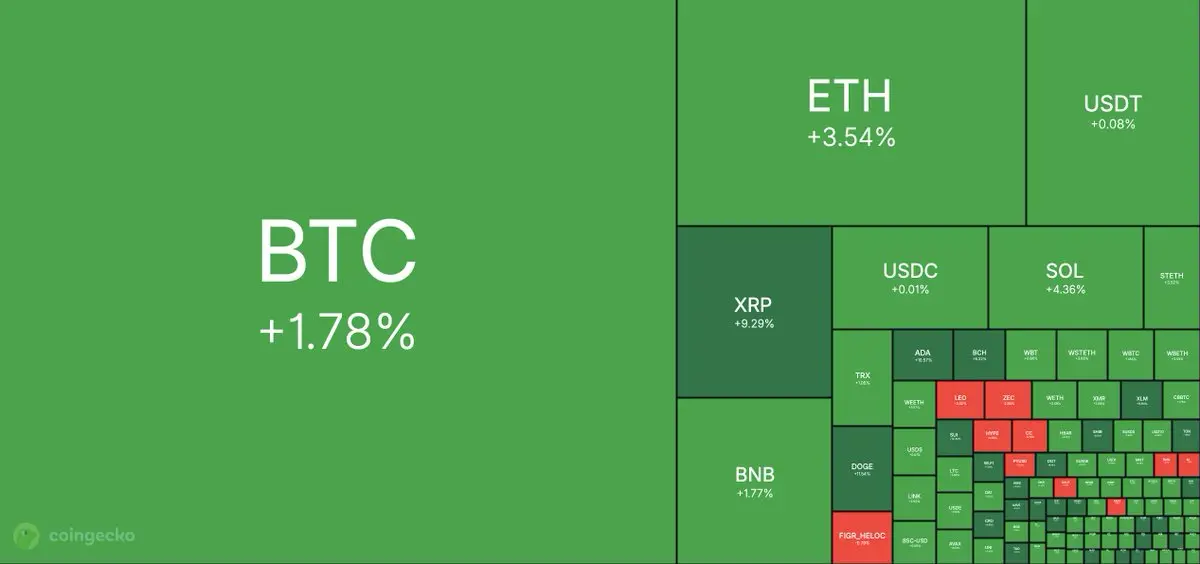

GM to the new week ☀️

Crypto is starting strong:

• Bitcoin: $93,000

• Ethereum: $3,200

• +$99B added to the market in 24 hours

• Total market cap: $3.25T

Momentum is clearly building as liquidity flows back into the market.

Now the big question…

Are you bullish or bearish from here? 📈📉

Crypto is starting strong:

• Bitcoin: $93,000

• Ethereum: $3,200

• +$99B added to the market in 24 hours

• Total market cap: $3.25T

Momentum is clearly building as liquidity flows back into the market.

Now the big question…

Are you bullish or bearish from here? 📈📉

- Reward

- like

- Comment

- Repost

- Share

GM ☀️

Crypto is starting 2026 with a full green sweep 🟢

• $130B added to total market cap in the last 24 hours

• Bitcoin: $90,000

• Ethereum: above $3,000

Momentum is clearly picking up. Now the market is watching closely is this the beginning of a new trend or just a temporary relief bounce?

Either way, volatility is back and so are the opportunities.

Have a great trading day ahead 🚀

Crypto is starting 2026 with a full green sweep 🟢

• $130B added to total market cap in the last 24 hours

• Bitcoin: $90,000

• Ethereum: above $3,000

Momentum is clearly picking up. Now the market is watching closely is this the beginning of a new trend or just a temporary relief bounce?

Either way, volatility is back and so are the opportunities.

Have a great trading day ahead 🚀

- Reward

- like

- Comment

- Repost

- Share

US Economy Just Sent a Big Signal 📈

The U.S. posted 4.3% GDP growth in Q3 2025 the fastest pace in two years. That’s a serious upside surprise and a clear sign the economy still has strong momentum.

Markets loved it. The S&P 500 pushed to a new all-time high, showing investors are willing to take on more risk when growth looks this solid.

With growth this strong, confidence for 2026 is rising. More growth usually means more spending, more profits, and more capital flowing into markets which is why traders are turning more bullish across stocks and crypto alike.

The U.S. posted 4.3% GDP growth in Q3 2025 the fastest pace in two years. That’s a serious upside surprise and a clear sign the economy still has strong momentum.

Markets loved it. The S&P 500 pushed to a new all-time high, showing investors are willing to take on more risk when growth looks this solid.

With growth this strong, confidence for 2026 is rising. More growth usually means more spending, more profits, and more capital flowing into markets which is why traders are turning more bullish across stocks and crypto alike.

- Reward

- like

- Comment

- Repost

- Share

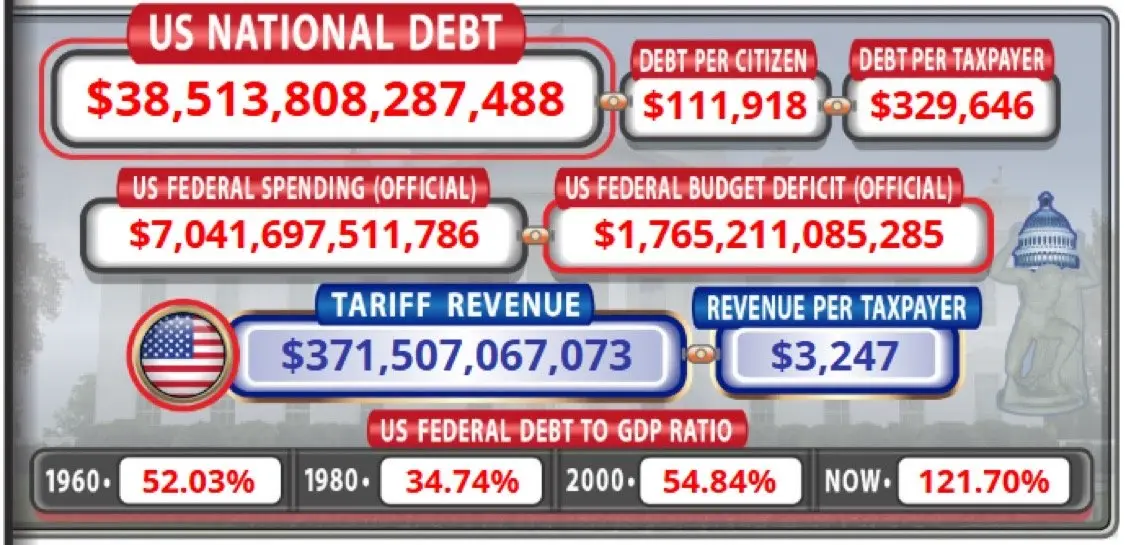

Reality Check for the US Economy 🇺🇸

$38.5 TRILLION in national debt and counting.

Debt is now bigger than the entire economy (125%+ of GDP).

The shocking part?

👉 $1 TRILLION every year goes only to interest.

No new projects.

No growth.

Just paying yesterday’s bills with tomorrow’s money.

At what point does this become unsustainable?

“Too much winning” or just kicking the can down the road? 👀

$38.5 TRILLION in national debt and counting.

Debt is now bigger than the entire economy (125%+ of GDP).

The shocking part?

👉 $1 TRILLION every year goes only to interest.

No new projects.

No growth.

Just paying yesterday’s bills with tomorrow’s money.

At what point does this become unsustainable?

“Too much winning” or just kicking the can down the road? 👀

- Reward

- like

- Comment

- Repost

- Share

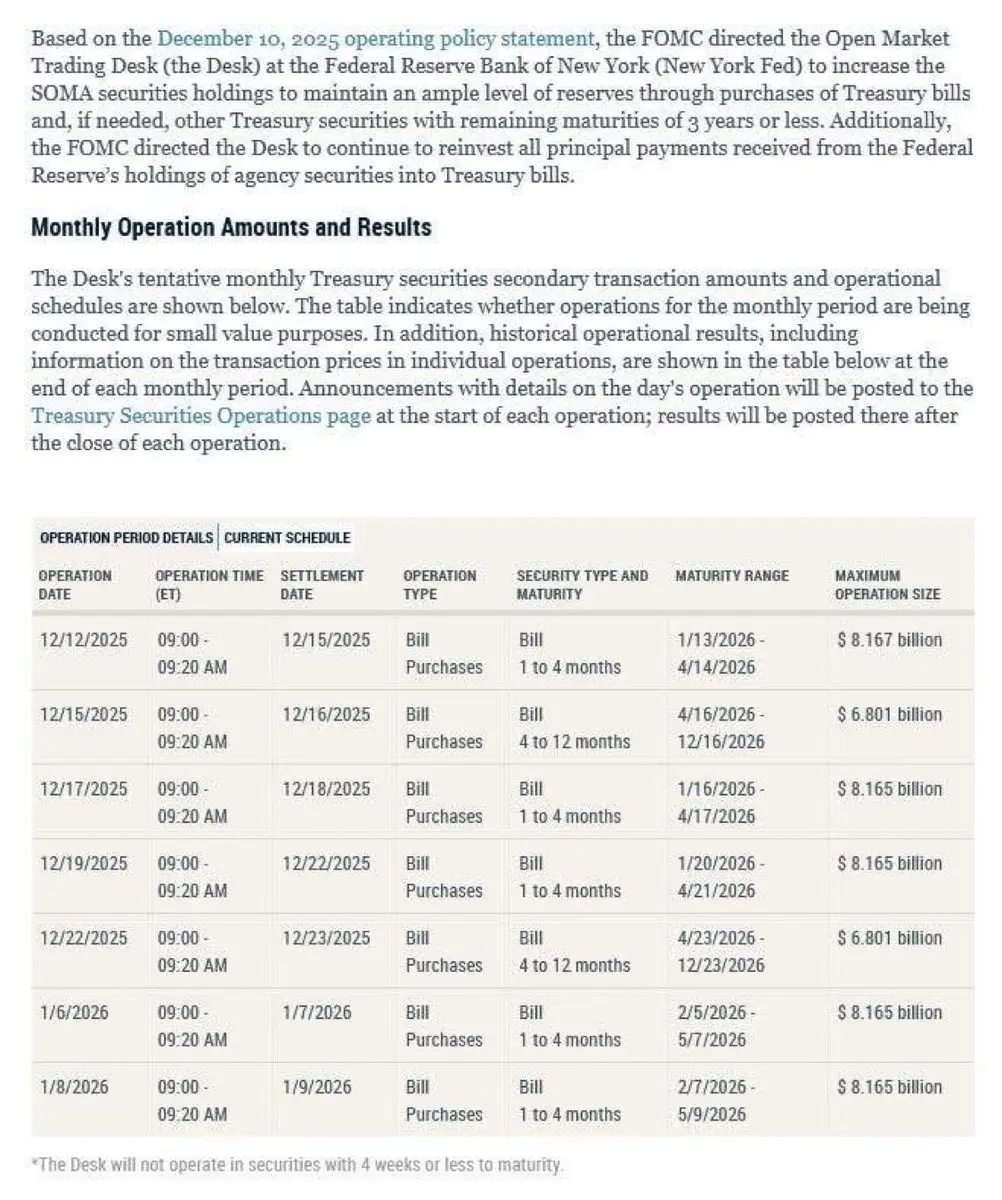

The U.S. Federal Reserve is injecting $6.8 billion into the system today , a short-term liquidity boost markets are watching closely.

🕘 Time:

• 9:00 AM ET

• 13:00 UTC

🕘 Time:

• 9:00 AM ET

• 13:00 UTC

- Reward

- like

- Comment

- Repost

- Share

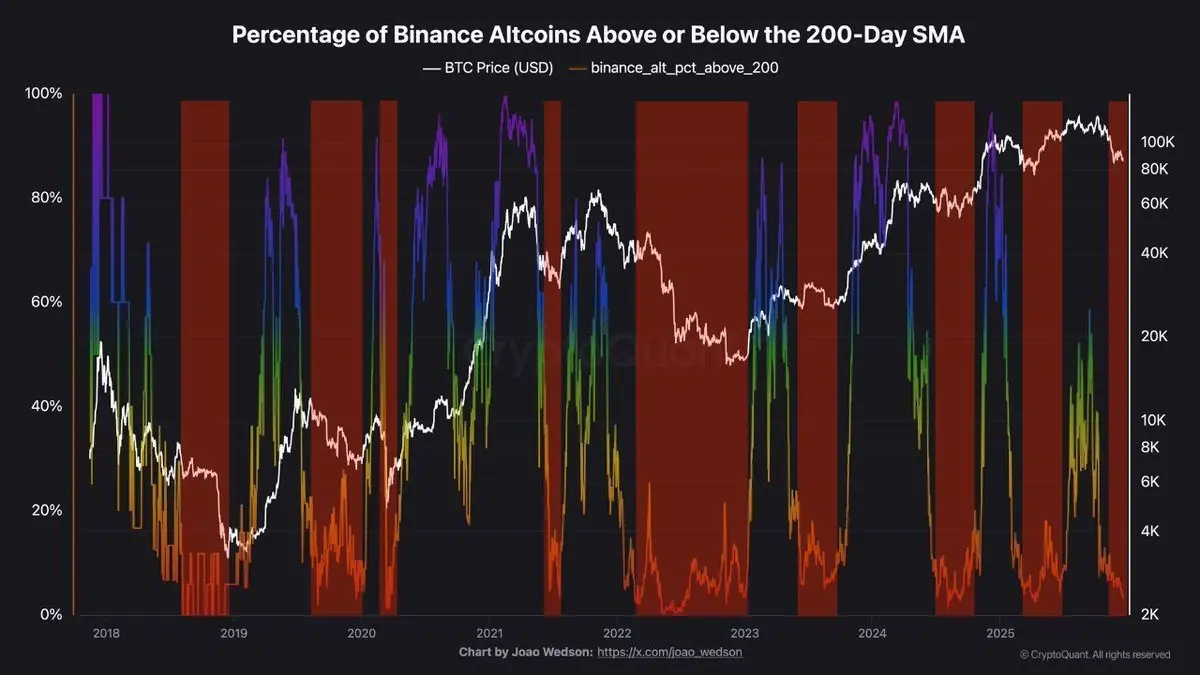

Altcoins are in a really rough spot right now.

If you zoom out, almost everything is beaten down only a tiny number of altcoins are even holding above their long-term averages. That usually happens when people are tired, frustrated, and stepping away.

Since October, a lot of money has left the altcoin market. It didn’t rotate into other alts it just left. People went defensive, reduced risk, or moved to the sidelines.

This doesn’t feel like “we’re late to altseason.”

It feels like capitulation.

That doesn’t mean prices suddenly pump tomorrow. These phases can drag on longer than anyone expect

If you zoom out, almost everything is beaten down only a tiny number of altcoins are even holding above their long-term averages. That usually happens when people are tired, frustrated, and stepping away.

Since October, a lot of money has left the altcoin market. It didn’t rotate into other alts it just left. People went defensive, reduced risk, or moved to the sidelines.

This doesn’t feel like “we’re late to altseason.”

It feels like capitulation.

That doesn’t mean prices suddenly pump tomorrow. These phases can drag on longer than anyone expect

- Reward

- like

- Comment

- Repost

- Share

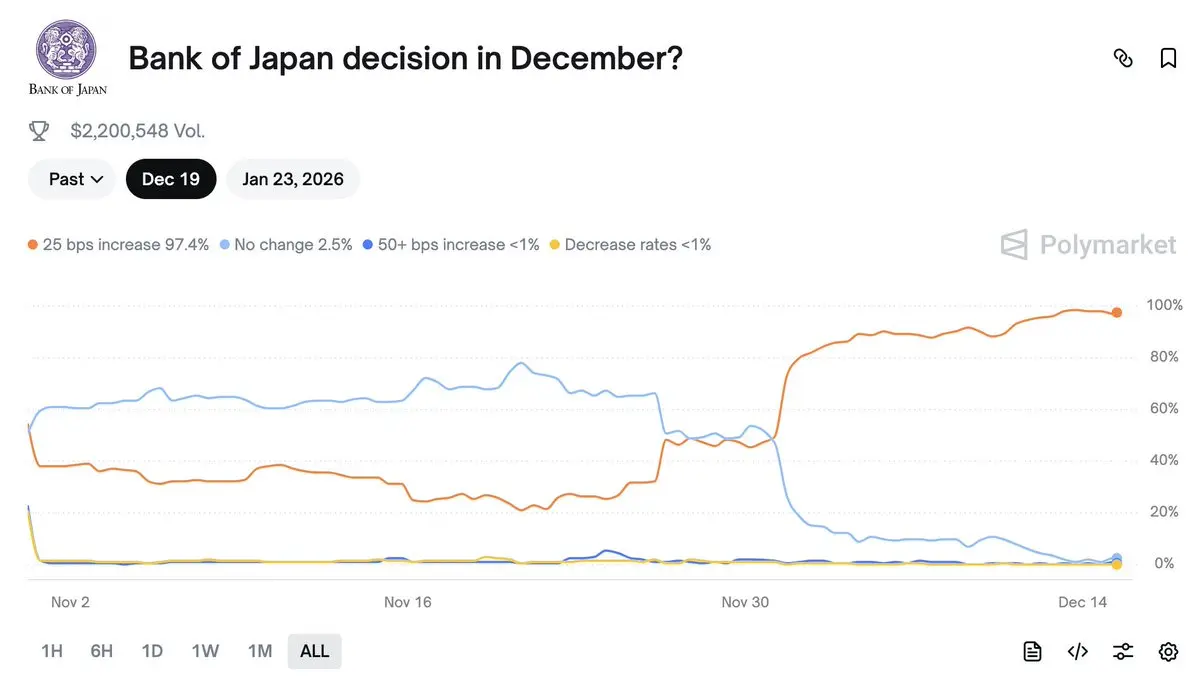

🚨 BREAKING: BOJ RATE HIKE RISK SPIKES

Polymarket now shows a 98.2% chance of the Bank of Japan hiking rates on 19 December

Why this matters 👇

• BOJ rate hike = less global liquidity

• Less liquidity = pressure on risk assets

• Crypto usually feels it first

Markets are starting to price this in.

Short-term bearish signal

#Crypto #Bitcoin #Markets

Polymarket now shows a 98.2% chance of the Bank of Japan hiking rates on 19 December

Why this matters 👇

• BOJ rate hike = less global liquidity

• Less liquidity = pressure on risk assets

• Crypto usually feels it first

Markets are starting to price this in.

Short-term bearish signal

#Crypto #Bitcoin #Markets

BTC-6,56%

- Reward

- like

- Comment

- Repost

- Share

The SEC released a “Crypto Asset Custody Basics” guide for retail investors.

This isn’t about banning crypto.

It’s about teaching people how to hold it safely.

Feels like a shift:

From ignoring crypto → to educating users.

Regulators are adjusting to reality.

This isn’t about banning crypto.

It’s about teaching people how to hold it safely.

Feels like a shift:

From ignoring crypto → to educating users.

Regulators are adjusting to reality.

- Reward

- like

- Comment

- Repost

- Share

GM Community ☀️

Weekend markets = thin volume, easy traps.

Move slow, protect capital, and don’t force trades.

Next week is not normal. Big money is already reducing risk, and two major events are lining up:

1️⃣ Japan could shut off the cheap money tap 🇯🇵

Reports suggest the BOJ may hike rates around Dec 18–19.

Japan has funded global risk markets for years with ultra-low rates.

If rates rise → liquidity dries up → carry trades unwind.

Historically, this hits stocks and crypto hard.

2️⃣ Massive options expiry – Dec 19

Trillions in contracts settle.

That usually means volatility first, clarit

Weekend markets = thin volume, easy traps.

Move slow, protect capital, and don’t force trades.

Next week is not normal. Big money is already reducing risk, and two major events are lining up:

1️⃣ Japan could shut off the cheap money tap 🇯🇵

Reports suggest the BOJ may hike rates around Dec 18–19.

Japan has funded global risk markets for years with ultra-low rates.

If rates rise → liquidity dries up → carry trades unwind.

Historically, this hits stocks and crypto hard.

2️⃣ Massive options expiry – Dec 19

Trillions in contracts settle.

That usually means volatility first, clarit

- Reward

- 1

- Comment

- Repost

- Share

Gold is making moves again ✨

The price is now around $4,314/oz, very close to its all-time high of $4,380/oz.

And here’s the interesting part:

🇨🇳 China bought another 30,000 ounces of gold in November, bringing its reserves to a record $311B.

That’s 25 months in a row of nonstop buying.

When countries keep stacking gold like this, it usually means they’re preparing for big shifts in the global economy.

Gold heating up is never a small signal.

The price is now around $4,314/oz, very close to its all-time high of $4,380/oz.

And here’s the interesting part:

🇨🇳 China bought another 30,000 ounces of gold in November, bringing its reserves to a record $311B.

That’s 25 months in a row of nonstop buying.

When countries keep stacking gold like this, it usually means they’re preparing for big shifts in the global economy.

Gold heating up is never a small signal.

- Reward

- 1

- Comment

- Repost

- Share

🚨 REMINDER

Starting today, the 🇺🇸 Fed will begin buying $40 billion per month in T-bills.

That means more liquidity flowing into the system and that’s usually bullish for markets. 🚀

Starting today, the 🇺🇸 Fed will begin buying $40 billion per month in T-bills.

That means more liquidity flowing into the system and that’s usually bullish for markets. 🚀

- Reward

- 1

- Comment

- Repost

- Share

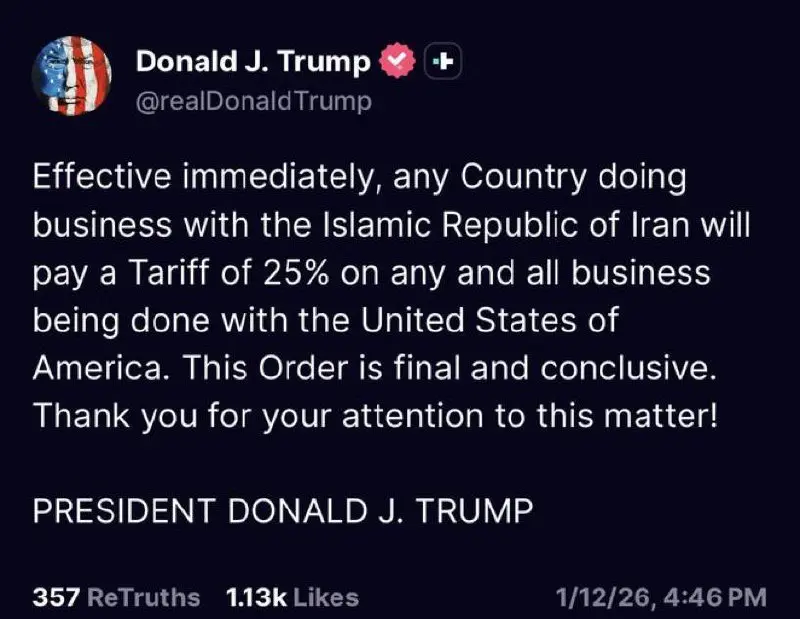

GM ☀️

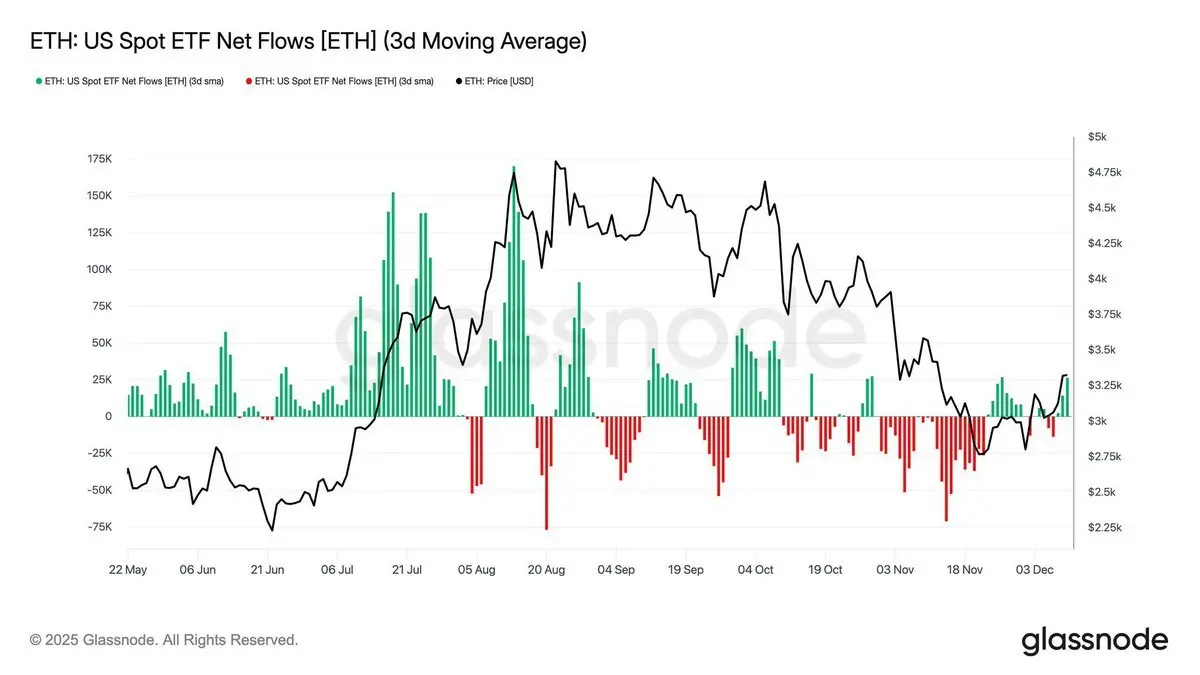

$ETH spot ETF flows are finally turning positive again… quietly, but at the perfect time.

After weeks of outflows and price bleeding, we’re now seeing inflows returning right as ETH is trying to build a base in the $3k–$3.3k range.

What’s interesting?

ETH held its price even when ETFs were in the red and now that flows are flipping green, the chart is already stabilizing. 👀

Something worth watching closely… ETH might be gearing up for its next move. 🫡

$ETH spot ETF flows are finally turning positive again… quietly, but at the perfect time.

After weeks of outflows and price bleeding, we’re now seeing inflows returning right as ETH is trying to build a base in the $3k–$3.3k range.

What’s interesting?

ETH held its price even when ETFs were in the red and now that flows are flipping green, the chart is already stabilizing. 👀

Something worth watching closely… ETH might be gearing up for its next move. 🫡

ETH-7,87%

- Reward

- 1

- Comment

- Repost

- Share