MAB350

No content yet

MAB350

Consistency is the key

- Reward

- like

- Comment

- Repost

- Share

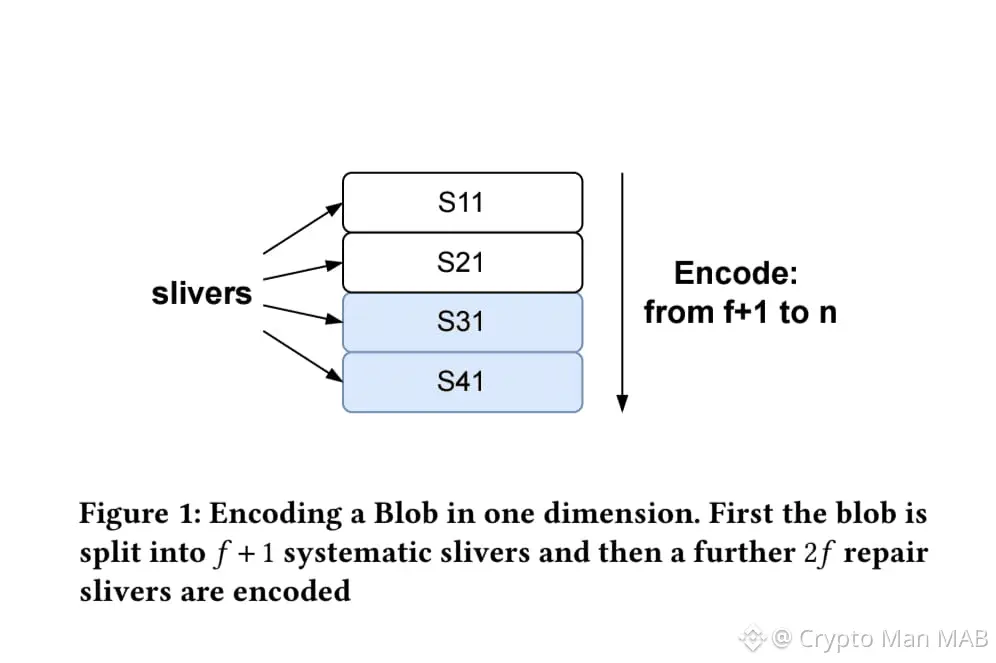

Decentralized storage isn\'t just about saving files it\'s infrastructure for AI data provenance, censorship-resistant social media, rollup DA, and programmable data markets. Walrus\'s willingness to publicly roast its own strawman designs shows serious engineering maturity. By fixing recovery and asynchrony pain points that have haunted the space for years, Walrus positions itself as a leader in making large-scale, reliable blob storage actually usable and affordable.If you\'re building on Sui, exploring DePIN, or just tired of centralized cloud bills, Walrus is worth watching closely. The st

- Reward

- like

- Comment

- Repost

- Share

BREAKING: Silver reaches $100 for the first time in history.

- Reward

- like

- Comment

- Repost

- Share

One of the standout protocol customizations in Vanar Chain is its transaction ordering mechanism, which prioritizes simplicity, predictability,

- Reward

- like

- Comment

- Repost

- Share

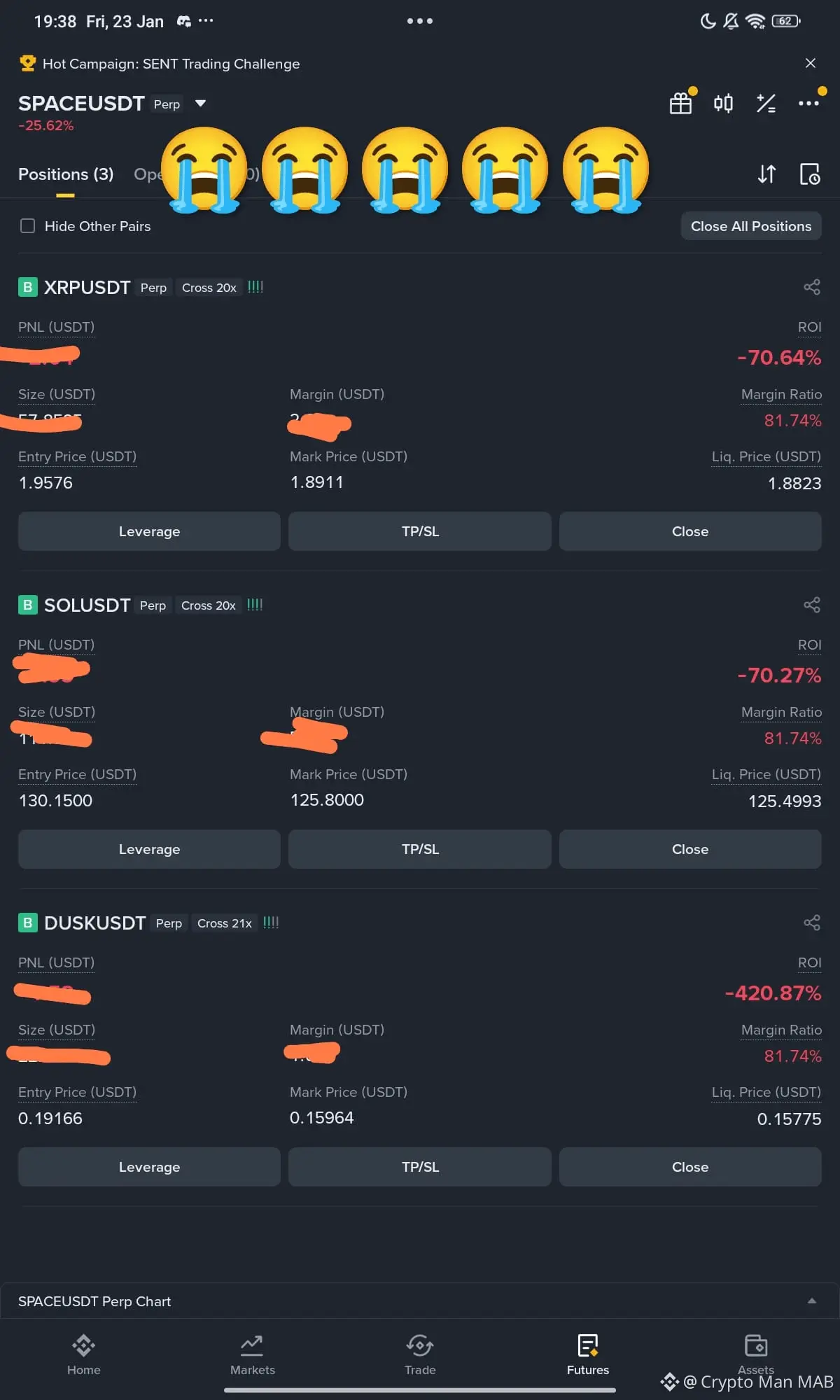

My All Positions got liquidated 😭😭😭😭😭 I can Feel the pain of you guys just checkout my PNL

- Reward

- 1

- Comment

- Repost

- Share

Jummah Mubarak

- Reward

- like

- Comment

- Repost

- Share

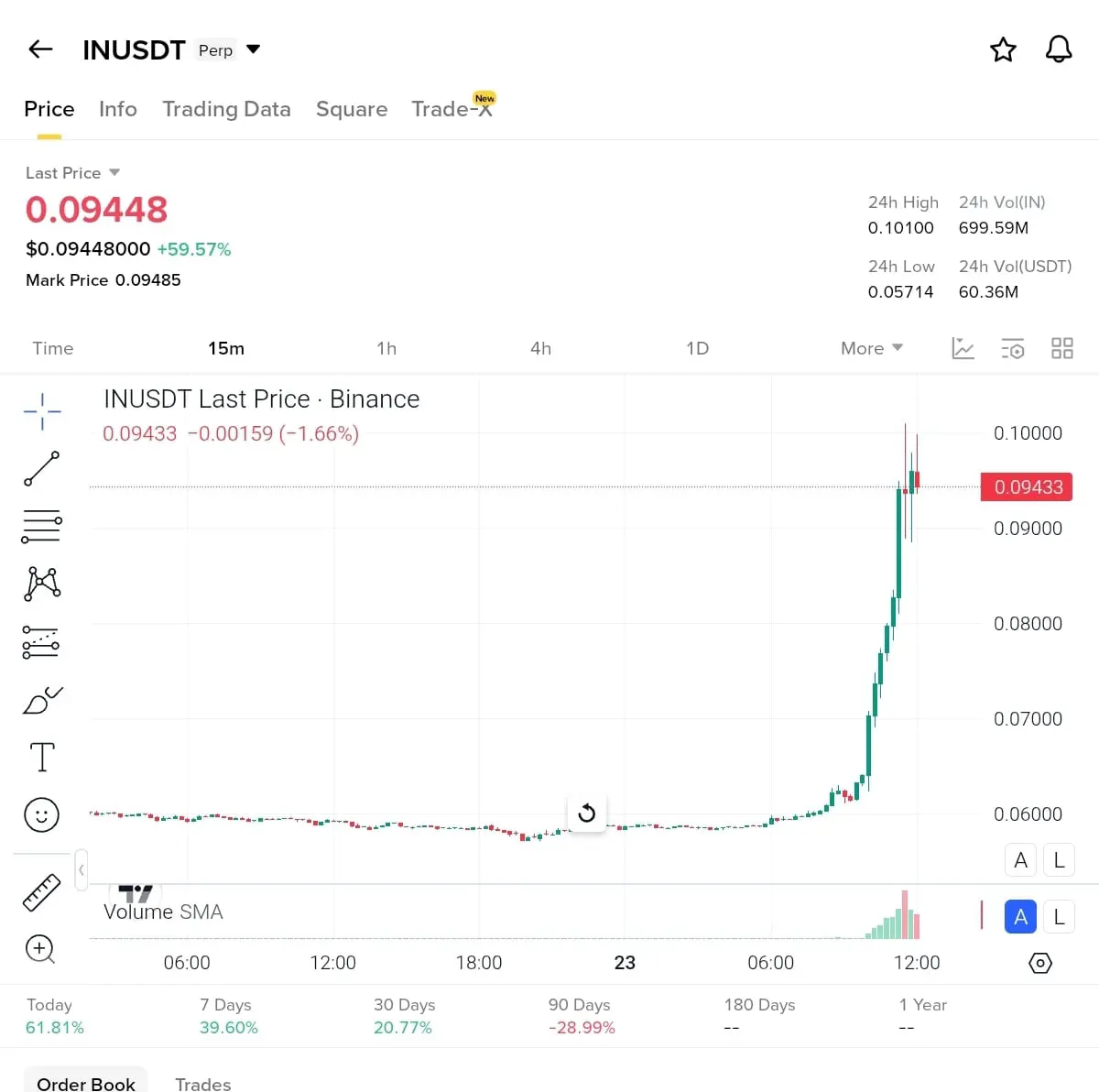

$IN IS LIT RIGHT NOW Explosive breakout from the bottom loading massive volume – this one\'s ripping! Long $IN immediately – don\'t fade the momentum! \n\n Entry zone: 0.092 – 0.100\n\nTargets:\n\nTP1: 0.112 \n\nTP2: 0.135 \n\nTP3: 0.160 \n\n\n\n Who\'s riding this wave? \n\n DYOR | NFA | High risk, high reward vibes only

IN2,42%

- Reward

- like

- Comment

- Repost

- Share

In the rapidly evolving landscape of blockchain and decentralized technologies, secure and efficient data storage remains a critical challenge. Traditional centralized storage solutions are prone to single points of failure, censorship, and data breaches, while early decentralized alternatives often struggle with scalability, high costs, and reliability. Enter Walrus, a cutting-edge decentralized storage network developed by Mysten Labs and integrated with the Sui blockchain. Walrus addresses th

SUI-1,71%

- Reward

- like

- Comment

- Repost

- Share

CZ at Davos: has higher volume than Shanghai and NY stock exchange last year. 🔥

- Reward

- like

- Comment

- Repost

- Share

Vanar addresses this challenge head-on. Our blockchain is engineered to deliver\nexceptional speed, boasting block time that is capped at a maximum of 3 seconds. This impressive turnaround time ensures that transactions areconfirmed swiftly, facilitating near-instantaneous interactions and responses touser actions.\n\nVanar\'s commitment to high-speed block finality is driven by the understanding that rapid transaction processing is fundamental to fostering a user-friendly environment. By drastically reducing the time it takes for transactions to be finalized, Vanar sets the stage for applicat

VANRY-6,17%

- Reward

- like

- Comment

- Repost

- Share

In a decentralized storage network handling massive blobs for AI, dApps, and Web3, poor node performance can cascade into higher recovery costs and degraded availability. By letting WAL-staked nodes the ones directly impacted govern these penalties, Walrus creates a self-correcting economic layer. It\'s democracy for incentives: operators vote their stake to protect their own uptime and profitability.\n\nThe result? A more robust, adaptive network where penalties evolve with real-world conditions all without risky protocol overhauls.\n

WAL1,17%

- Reward

- like

- Comment

- Repost

- Share

Imagine a world where storage isn\'t a boring utility bill it\'s a dynamic marketplace where thousands of nodes battle it out to give you the cheapest, most reliable space for your data. Welcome to Walrus, the decentralized blob storage protocol built on Sui, where economics meets cutthroat competition to deliver rock-bottom prices without sacrificing security or availability.\n\nAt the heart of Walrus is a clever twist: storage isn\'t just "space" it\'s traded as storage resources on the Sui blockcha

SUI-1,71%

- Reward

- like

- Comment

- Repost

- Share

In a world where your financial data is often broadcast louder than a stadium roar, Dusk Network emerges as the whisper in the shadows a blockchain built for secrecy, security, and seamless transactions. But what truly sets this privacy powerhouse apart? Enter the Genesis Contracts: the foundational pillars deployed right from the network\'s launch, ensuring everything runs smoothly, securely, and with a cloak of anonymity. Launched on mainnet in early 2025, these contracts aren\'t just code; they

DUSK-15,54%

- Reward

- like

- Comment

- Repost

- Share