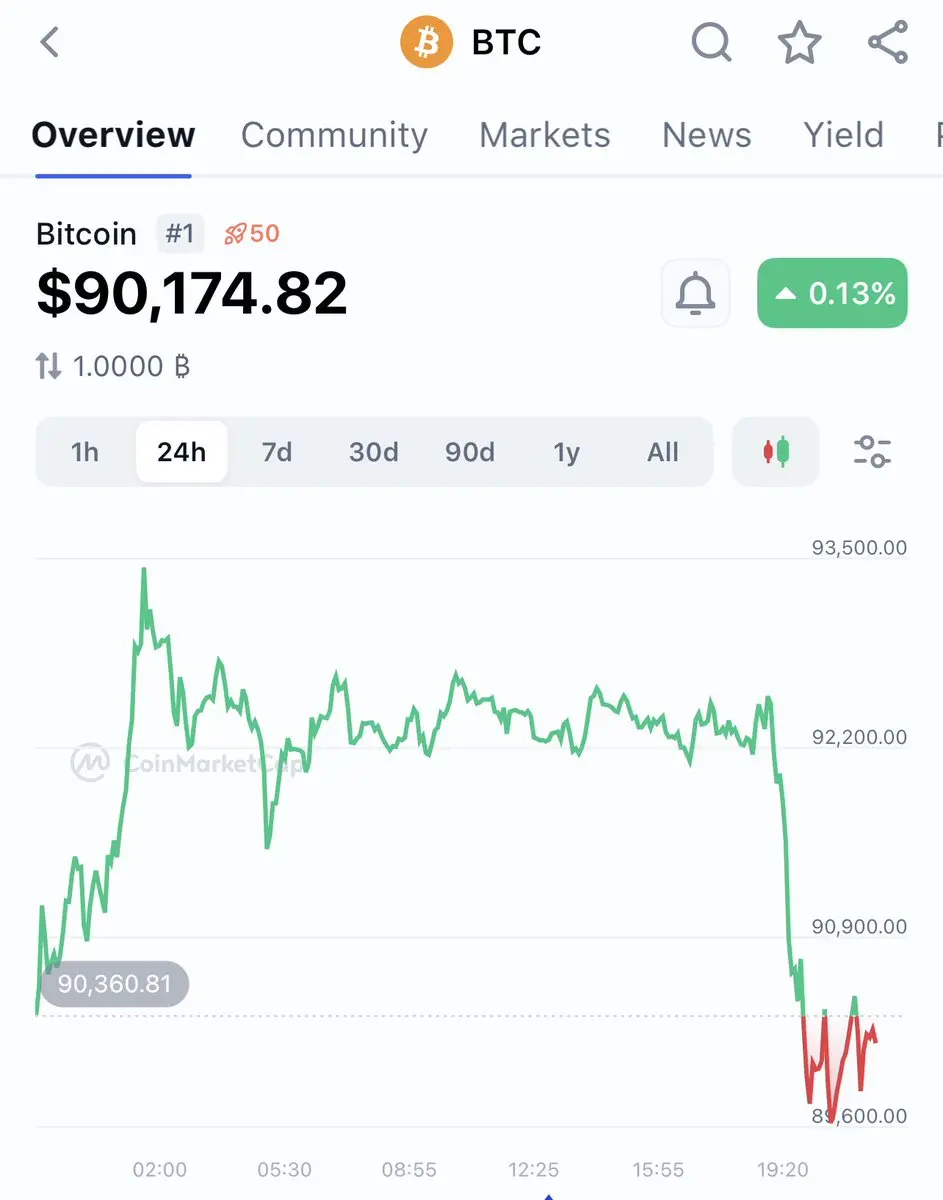

Why might #BTC & #Crypto enjoy a Santa rally?

Quite why this phenomenon should occur is unclear, and in truth there are probably several factors behind each individual rally. But a few of the major theories on why markets rally in December include:

Seasonal goodwill among investors, who are more willing to buy around Christmas

Markets rising on lower volumes over the holiday period

Fund managers rebalancing their portfolios before the end of the year

People investing their Christmas bonuses

Bargain hunting before prices rise in January (known as the January effect)

However, the biggest cause

Quite why this phenomenon should occur is unclear, and in truth there are probably several factors behind each individual rally. But a few of the major theories on why markets rally in December include:

Seasonal goodwill among investors, who are more willing to buy around Christmas

Markets rising on lower volumes over the holiday period

Fund managers rebalancing their portfolios before the end of the year

People investing their Christmas bonuses

Bargain hunting before prices rise in January (known as the January effect)

However, the biggest cause

BTC-1.09%