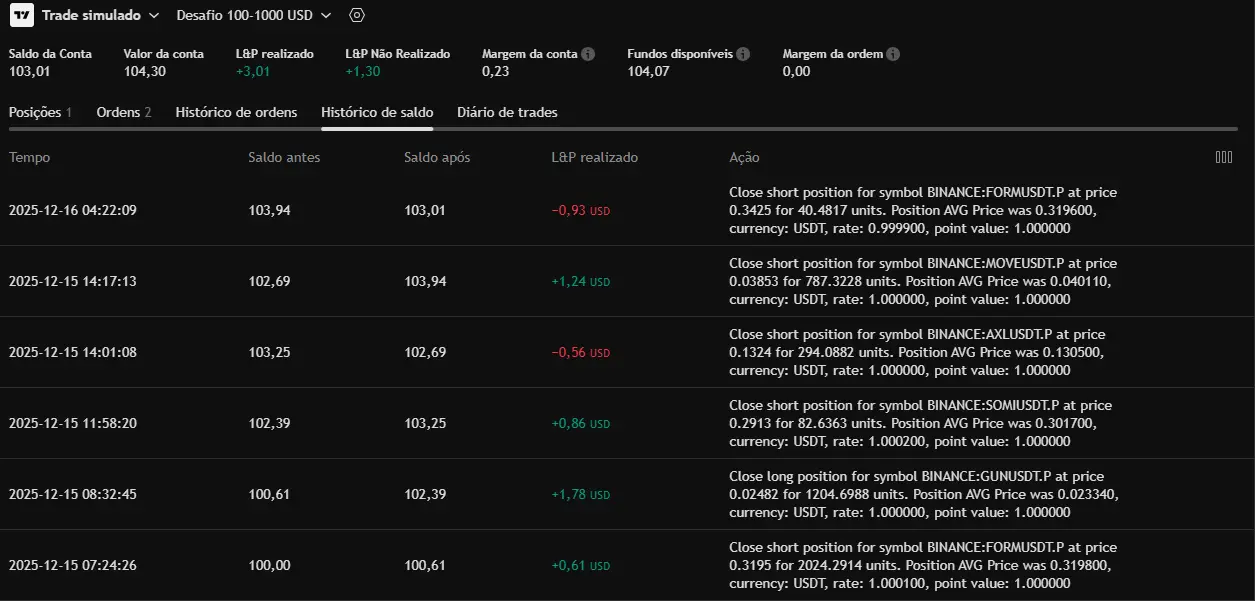

Challenge 100 → 1000 | Day 1 - 📅 12/15/2025

🔹Capital

Initial bankroll: US$ 100.00

Current bankroll: US$ 102.39

🔹 Period operations:

Total trades: 6

Winning trades: 3

Losing trades: 2

Win rate: 60%

🔹 Net result

Period result: +2.39%

Cumulative result: +2.39%

🧠 Day observations

This first day of the challenge had significant events, especially in

#AXL and one open position. An important change I will make to the project is to close all trades at 22:00, regardless of the outcome.

👉 This rule will take effect once the last currently open position is closed.

⚠️ Important notes

Note ¹: I open