PARON

No content yet

Pin

PARON

0

0

Result of investing $1000 in #الذهب over #البيتكوين for 8 years ( starting from 2017 until now )

Investing $1,000 in Bitcoin has become approximately $88,000

Investing $1,000 in gold has become approximately $3,800

#CryptoMarketMildlyRebounds #Gate2025AnnualReportComing

View OriginalInvesting $1,000 in Bitcoin has become approximately $88,000

Investing $1,000 in gold has become approximately $3,800

#CryptoMarketMildlyRebounds #Gate2025AnnualReportComing

MC:$3.54KHolders:1

0.00%

- Reward

- like

- Comment

- Repost

- Share

⚡ The genius who profited from the 2008 crisis issues a new warning!

Michael Burry says 2026 = a collapse worse than the dot-com bubble 📉

AI bubble + weakness of Passive funds = an upcoming disaster?

But beware... 🔍

His predictions since 2017: Almost complete failure (0-29% accuracy )

Question: Is this time different? Or the same old story?

View OriginalMichael Burry says 2026 = a collapse worse than the dot-com bubble 📉

AI bubble + weakness of Passive funds = an upcoming disaster?

But beware... 🔍

His predictions since 2017: Almost complete failure (0-29% accuracy )

Question: Is this time different? Or the same old story?

- Reward

- like

- Comment

- Repost

- Share

Germany's second-largest bank, DZ Bank, has just approved Bitcoin and cryptocurrency trading.

Bitcoin adoption worldwide is accelerating.

View OriginalBitcoin adoption worldwide is accelerating.

- Reward

- like

- Comment

- Repost

- Share

$BTC Vanguard Makes a Strong Entry into Bitcoin

The company @Vanguard_Group, which manages assets exceeding $12 trillion, revealed it holds a stake worth $505 million in Bitcoin treasury company Strategy ($MSTR) 💰

Most importantly:

• By late 2025 / early 2026, Vanguard will become one of the largest institutional holders of MSTR shares

• Total exposure across its various funds has surpassed $3 billion

• This reflects increasing institutional confidence in Bitcoin as a long-term strategic asset

Summary:

Massive capital is beginning to enter strongly…

And the available market share is becomin

The company @Vanguard_Group, which manages assets exceeding $12 trillion, revealed it holds a stake worth $505 million in Bitcoin treasury company Strategy ($MSTR) 💰

Most importantly:

• By late 2025 / early 2026, Vanguard will become one of the largest institutional holders of MSTR shares

• Total exposure across its various funds has surpassed $3 billion

• This reflects increasing institutional confidence in Bitcoin as a long-term strategic asset

Summary:

Massive capital is beginning to enter strongly…

And the available market share is becomin

BTC-2,34%

- Reward

- 2

- 1

- Repost

- Share

Plastikkid :

:

Hold tight 💪When algorithms speak.. skeptics fall silent.

-

Everyone was scared when I tested Bitcoin at the $90,000 levels,

but the chart was cooking something else in the background.

What you see in front of you is the (8/21 EMA Cross) strategy,

and it is one of the most reliable momentum (Momentum) signals that "bots" and smart wallets rely on.

-

1. What does this crossover mean?

The crossover of the 8 (Fast Line) exponential moving average above the 21 (Slow Line) is like a "race start signal."

This means buyers have taken control of the short-term trend, and the nerve-wracking correction has offic

-

Everyone was scared when I tested Bitcoin at the $90,000 levels,

but the chart was cooking something else in the background.

What you see in front of you is the (8/21 EMA Cross) strategy,

and it is one of the most reliable momentum (Momentum) signals that "bots" and smart wallets rely on.

-

1. What does this crossover mean?

The crossover of the 8 (Fast Line) exponential moving average above the 21 (Slow Line) is like a "race start signal."

This means buyers have taken control of the short-term trend, and the nerve-wracking correction has offic

BTC-2,34%

- Reward

- 1

- 1

- 1

- Share

Before00zero :

:

Bullish market at its peak 🐂Crypto companies crush traditional companies in numbers

The revenue for the past 12 months says it all:

Solana: $5.7 billion

Snapchat: $4.1 billion

Lululemon: $3.2 billion

Coinbase: $6.2 billion

Cloudflare: $3 billion

Dropbox: $1.9 billion

GoPro: $1.3 billion

Robinhood: $5.1 billion

EA Sports: $3 billion

Ethereum: $3.8 billion

Blockchain companies are not just "tech projects," they are real businesses with figures competing with the biggest traditional names

$BTC

The revenue for the past 12 months says it all:

Solana: $5.7 billion

Snapchat: $4.1 billion

Lululemon: $3.2 billion

Coinbase: $6.2 billion

Cloudflare: $3 billion

Dropbox: $1.9 billion

GoPro: $1.3 billion

Robinhood: $5.1 billion

EA Sports: $3 billion

Ethereum: $3.8 billion

Blockchain companies are not just "tech projects," they are real businesses with figures competing with the biggest traditional names

$BTC

BTC-2,34%

- Reward

- like

- Comment

- Repost

- Share

Liquidity does not lie.. and Micron redefines the "ceiling" of artificial intelligence.

While some were wondering if the AI bubble had started to burst, Micron's ($MU) response was harsh and eloquent: the biggest financial quarter, the highest historical peak, and most importantly.. institutional liquidity we haven't seen since April.

What happened with Micron is not just "good profits," but a confirmation of one technical and economic truth: there is no artificial intelligence without "superior" memory.

Processors (like those made by Nvidia) are the brain, but HBM (memory made by Micron is t

While some were wondering if the AI bubble had started to burst, Micron's ($MU) response was harsh and eloquent: the biggest financial quarter, the highest historical peak, and most importantly.. institutional liquidity we haven't seen since April.

What happened with Micron is not just "good profits," but a confirmation of one technical and economic truth: there is no artificial intelligence without "superior" memory.

Processors (like those made by Nvidia) are the brain, but HBM (memory made by Micron is t

BTC-2,34%

- Reward

- 1

- Comment

- Repost

- Share

$100 billion in the snow..

Is it just a factory or the beginning of a new era?

-

"Made in America" is no longer just a political slogan,

but has become a technological survival strategy.

Today, Micron ($MU) is laying the foundation for what can be described as the largest chip manufacturing project in U.S. history.

The image you see is not just officials holding shovels in New York's snow, but an official announcement of a major geopolitical shift.

-

What happened?

Micron has officially begun constructing its giant complex in New York with investments reaching $100 billion.

The goal?

Build 4 (

Is it just a factory or the beginning of a new era?

-

"Made in America" is no longer just a political slogan,

but has become a technological survival strategy.

Today, Micron ($MU) is laying the foundation for what can be described as the largest chip manufacturing project in U.S. history.

The image you see is not just officials holding shovels in New York's snow, but an official announcement of a major geopolitical shift.

-

What happened?

Micron has officially begun constructing its giant complex in New York with investments reaching $100 billion.

The goal?

Build 4 (

BTC-2,34%

MC:$17.12KHolders:325

45.71%

- Reward

- like

- Comment

- Repost

- Share

The truth that banks hide about "Stablecoins"

(A serious topic, read until the end)

-

I have spoken many times before about the GENIUS Act

And how the Trump administration is thinking of making this law the lifeline that restores the dollar to its throne

It seems that it will not pass quietly in the corridors of Wall Street, because it simply threatens the thrones of traditional banks, which will undoubtedly resist fiercely against anything that threatens their profits.

In the latest "Bank of America" earnings meeting (January 2026), the real reason behind the fierce banking war against stable

(A serious topic, read until the end)

-

I have spoken many times before about the GENIUS Act

And how the Trump administration is thinking of making this law the lifeline that restores the dollar to its throne

It seems that it will not pass quietly in the corridors of Wall Street, because it simply threatens the thrones of traditional banks, which will undoubtedly resist fiercely against anything that threatens their profits.

In the latest "Bank of America" earnings meeting (January 2026), the real reason behind the fierce banking war against stable

BTC-2,34%

- Reward

- like

- Comment

- Repost

- Share

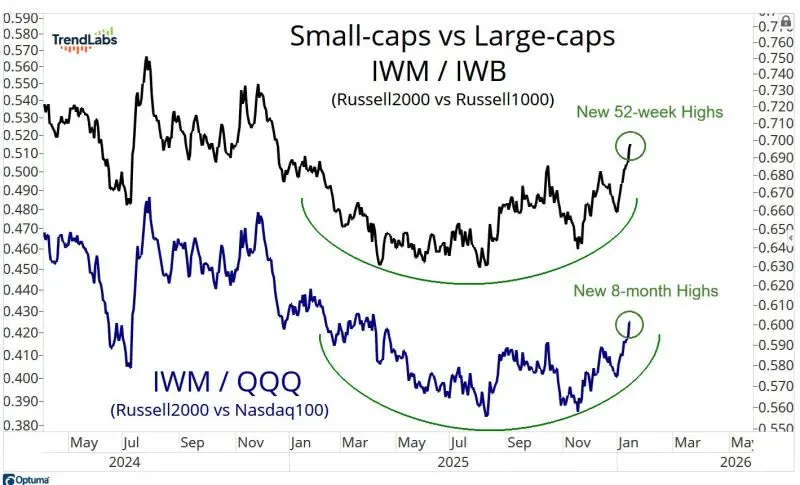

Giants are resting... and the small ones are starting to run.

Everyone is watching the prices of trillion-dollar companies, but the "real story" of the market is happening now in the shadows.

The attached chart shows a fundamental shift in investor behavior at the beginning of 2026: small companies are beginning to outperform tech giants and major corporations, reaching new highs in relative strength.

What does this mean in financial terms?

This is what we call "Market Breadth Expansion" (Market Breadth).

A market that relies on only seven companies to rise is a "fragile" market, but a market

Everyone is watching the prices of trillion-dollar companies, but the "real story" of the market is happening now in the shadows.

The attached chart shows a fundamental shift in investor behavior at the beginning of 2026: small companies are beginning to outperform tech giants and major corporations, reaching new highs in relative strength.

What does this mean in financial terms?

This is what we call "Market Breadth Expansion" (Market Breadth).

A market that relies on only seven companies to rise is a "fragile" market, but a market

BTC-2,34%

MC:$3.56KHolders:3

0.00%

- Reward

- like

- Comment

- Repost

- Share

Does attacking the independence of the Federal Reserve lead to inflation?

This is what Jamie Dimon, CEO of JPMorgan, recently said.

But the most important question is not political… but structural:

Is inflation in the modern monetary system a mistake? Or a necessity?

In fact, to understand the issue, we must go back to the very foundation of the financial system itself.

In the current monetary system, money is not created out of thin air, nor does the state print it directly.

Money is primarily created by commercial banks when they extend loans.

Each loan = new money

And each money = a d

This is what Jamie Dimon, CEO of JPMorgan, recently said.

But the most important question is not political… but structural:

Is inflation in the modern monetary system a mistake? Or a necessity?

In fact, to understand the issue, we must go back to the very foundation of the financial system itself.

In the current monetary system, money is not created out of thin air, nor does the state print it directly.

Money is primarily created by commercial banks when they extend loans.

Each loan = new money

And each money = a d

BTC-2,34%

MC:$3.56KHolders:3

0.00%

- Reward

- like

- Comment

- Repost

- Share

When the chart speaks, we must listen.

Gravity is a law that does not exclude anyone... even the most expensive "apple" in the world.

Do you remember our previous article about $AAPL and inflated valuations?

Today, the chart in front of you tells the second chapter of the story.

Technically, we are at a pivotal moment:

A break of the (Trendline) that has supported the price for months.

The shaded area that was a "solid ground" of support now appears fragile, and the red candles have begun to dominate.

In financial language, we say:

The price has started to seek its new reality, away from i

Gravity is a law that does not exclude anyone... even the most expensive "apple" in the world.

Do you remember our previous article about $AAPL and inflated valuations?

Today, the chart in front of you tells the second chapter of the story.

Technically, we are at a pivotal moment:

A break of the (Trendline) that has supported the price for months.

The shaded area that was a "solid ground" of support now appears fragile, and the red candles have begun to dominate.

In financial language, we say:

The price has started to seek its new reality, away from i

BTC-2,34%

MC:$17.12KHolders:325

45.71%

- Reward

- like

- Comment

- Repost

- Share

All markets turned red yesterday in a strange collective decline across financial markets.

-

Markets don't like surprises, but they hate "disappointment" even more.

-

What happened with the simultaneous collapse of (Bitcoin, gold, silver, and Nasdaq) was not random selling, but a harsh and rapid "re-pricing" of reality.

-

What's the story?

Markets had high hopes for "Kevin Hasset" as a potential candidate to lead the Federal Reserve.

-

The man is known in financial circles as a friend of liquidity and an advocate for interest rate cuts.

-

In short: he is the man markets love.

-

But, as soon as

-

Markets don't like surprises, but they hate "disappointment" even more.

-

What happened with the simultaneous collapse of (Bitcoin, gold, silver, and Nasdaq) was not random selling, but a harsh and rapid "re-pricing" of reality.

-

What's the story?

Markets had high hopes for "Kevin Hasset" as a potential candidate to lead the Federal Reserve.

-

The man is known in financial circles as a friend of liquidity and an advocate for interest rate cuts.

-

In short: he is the man markets love.

-

But, as soon as

BTC-2,34%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

"Five Narratives About Bitcoin Monitored by Analysts, Beyond Just the Price"

By Bradley Peck from CoinTelegraph

Key Points:

- ETF fund flows reveal genuine institutional demand that goes beyond short-term price movements.

- Bitcoin treasury shares can shift exposure to Bitcoin into stock risk shaped by index rules.

- Low fees revive questions about how Bitcoin funds its security long-term.

- Expansion now means choosing between Lightning, Layer 2 designs, and protocol upgrades.

- Everyone watches the Bitcoin price, but in 2026, that often isn't a very useful indicator.

That's why it's helpful

View OriginalBy Bradley Peck from CoinTelegraph

Key Points:

- ETF fund flows reveal genuine institutional demand that goes beyond short-term price movements.

- Bitcoin treasury shares can shift exposure to Bitcoin into stock risk shaped by index rules.

- Low fees revive questions about how Bitcoin funds its security long-term.

- Expansion now means choosing between Lightning, Layer 2 designs, and protocol upgrades.

- Everyone watches the Bitcoin price, but in 2026, that often isn't a very useful indicator.

That's why it's helpful

MC:$3.61KHolders:2

0.04%

- Reward

- 1

- Comment

- Repost

- Share

The market does not rise in a straight line... but rather in "steps."

-

In technical analysis, there is a golden rule:

"Resistance that is broken should turn into support."

Today, Bitcoin at levels of $95,000 is making the most important healthy move in any upward direction:

Re-testing the $94,000 zone (Breakout Retest).

-

Why is this important?

Because rapid upward movement tempts traders,

But "re-testing" is what reassures institutions.

The market is trying to confirm:

Has the $94K become a solid floor to build upon?

If this test succeeds,

The path is technically open toward the 200-day movi

View Original-

In technical analysis, there is a golden rule:

"Resistance that is broken should turn into support."

Today, Bitcoin at levels of $95,000 is making the most important healthy move in any upward direction:

Re-testing the $94,000 zone (Breakout Retest).

-

Why is this important?

Because rapid upward movement tempts traders,

But "re-testing" is what reassures institutions.

The market is trying to confirm:

Has the $94K become a solid floor to build upon?

If this test succeeds,

The path is technically open toward the 200-day movi

- Reward

- like

- Comment

- Repost

- Share

Top 3 Stocks by Sector:

Healthcare

- $HIMS

- $NVO

- $UNH

Robotics

- $XPEV

- $KRKNF | $PNG

- $PATH

Insurtech

- $PLMR

- $OSCR

- $LMND

AI Infrastructure

- $NBIS

- $IREN

- $CRWV

Fintech

- $SOFI

- $DLO

- $PGY

Programming

- $SNOW

- $ZETA

- $META

Energy

- $FLNC

- $EOSE

- $BE

Devices

- $AMD

- $TSM

- $NVDA

Quantum Computing

- $QBTS

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

View OriginalHealthcare

- $HIMS

- $NVO

- $UNH

Robotics

- $XPEV

- $KRKNF | $PNG

- $PATH

Insurtech

- $PLMR

- $OSCR

- $LMND

AI Infrastructure

- $NBIS

- $IREN

- $CRWV

Fintech

- $SOFI

- $DLO

- $PGY

Programming

- $SNOW

- $ZETA

- $META

Energy

- $FLNC

- $EOSE

- $BE

Devices

- $AMD

- $TSM

- $NVDA

Quantum Computing

- $QBTS

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- Reward

- like

- Comment

- Repost

- Share

Do you believe that markets have a "memory" that cannot be forgotten?

The Microsoft chart $MSFT tells us today a harsh lesson in gravity.

We are looking at an ideal "Double Top" (Double Top) pattern, completed by a break of the neckline, shifting the trend from upward to searching for a new bottom.

But the story isn't here...

The story is in the "gap."

Look at the shaded area below, "Earnings Gap."

This area was previously crossed by the price at a crazy speed,

And now?

It's as if the market feels a technical "guilt," slowly but steadily returning to fill this void.

-

In market

View OriginalThe Microsoft chart $MSFT tells us today a harsh lesson in gravity.

We are looking at an ideal "Double Top" (Double Top) pattern, completed by a break of the neckline, shifting the trend from upward to searching for a new bottom.

But the story isn't here...

The story is in the "gap."

Look at the shaded area below, "Earnings Gap."

This area was previously crossed by the price at a crazy speed,

And now?

It's as if the market feels a technical "guilt," slowly but steadily returning to fill this void.

-

In market

- Reward

- like

- Comment

- Repost

- Share