#PostToWinLaunchpadKDK.

As Berachain matures into a top-tier Layer 1, Kodiak ($KDK) has emerged not merely as a decentralized exchange but as the definitive vertical liquidity hub for the entire ecosystem. While standard DEXs often struggle with fragmented capital, Kodiak’s integration with Berachain’s Proof-of-Liquidity (PoL) consensus allows it to capture and recycle value far beyond traditional DeFi protocols. Serving as both a spot and perpetual trading engine, Kodiak ensures that every dollar of liquidity on-chain works harder, generating higher fees and deeper market stability.

🏛️ Protocol Architecture: The “Three Pillars”

Kodiak’s competitive advantage lies in its three-pronged infrastructure, designed to solve the "Liquidity Dilemma":

Kodiak Islands – Advanced liquidity vaults that manage concentrated liquidity. Algorithmic strategies keep liquidity “in-range,” maximizing fee generation and reducing impermanent loss risk.

Sweetened Islands – Incentive engine leveraging Berachain’s native $BGT rewards. High-multiplier pools provide LPs with dual yield: trading fees plus network emissions.

Panda Factory – Permissionless, no-code token deployment tool, enabling every new project on Berachain to immediately access Kodiak’s liquidity pools.

This architecture positions Kodiak as the backbone of liquidity innovation on Berachain

.

📄 Whitepaper Highlights

The Kodiak Whitepaper outlines the protocol’s core design and economic model, emphasizing sustainability and long-term value capture:

Liquidity Optimization: Automated concentrated liquidity management in Kodiak Islands

Revenue Model: 90% of protocol revenue redistributed; 60% directed to $KDK buybacks

Dual Yield Mechanics: LPs earn trading fees + $BGT rewards via Sweetened Islands

Governance & xKDK: Escrowed KDK locks tokens for fee participation and voting power

Token Economics: 100M fixed supply, deflationary buyback system

Security Focus: Audited smart contracts and algorithmic safeguards

The whitepaper emphasizes sustainable growth, strong tokenomics, and governance alignment, making Kodiak not just a trading platform but a full liquidity ecosystem.

📊 KDK Launchpad & Market Overview

Launchpad Highlights:

Launch price: $0.35

Fully Diluted Valuation (FDV): $35M

Total supply: 100M $KDK (fixed, deflationary)

Gate.io Launchpad exposure ensures high liquidity, fair distribution, and credibility

KYC verification and anti-bot measures protect early investors

The 90% Revenue Redistribution model ensures $KDK sustainability:

60% of all protocol fees are used for public market buybacks

Creates a perpetual buy-wall that scales with trading volume

If $KDK captures even 50% of ecosystem volume, mid-term price projections suggest $1.20 – $1.75, supported by scarcity and buyback mechanics.

⚖️ Investment Balance: Bull vs. Bear

Bull Case:

Monopoly position as the only DEX incubated by the “Build-a-Bera” accelerator

Aggressive buyback mechanism and PoL synergy prevent token inflation

Sustainable, long-term liquidity flywheel

Bear Case:

Entirely dependent on Berachain adoption

Potential competition from “vampire” protocols targeting short-term yields

Smart contract complexity carries standard DeFi risks

🛡️ Governance & xKDK Mechanism

Transition to $xKDK (Escrowed KDK) locks tokens to:

Earn protocol fees

Gain voting power over $BGT boosts for pools

Reduce circulating supply, strengthening long-term support

This creates a governance moat and aligns token holders with protocol growth.

📈 Roadmap & Future Outlook

Key milestones through 2026:

Kodiak Perps: High-performance futures exchange sharing the liquidity layer

Institutional Integrations: Tokenized BTC/ETH in Kodiak Islands

200ms transaction confirmations for high-frequency trading

Expanded LP incentive programs via $xKDK

Enhanced Gate.io Launchpad rewards and broader distribution

Ongoing ecosystem integrations and governance upgrades

Kodiak is prepared to handle retail and institutional demand, positioning $KDK as Berachain’s cornerstone liquidity asset.

💡 Strategic Takeaways

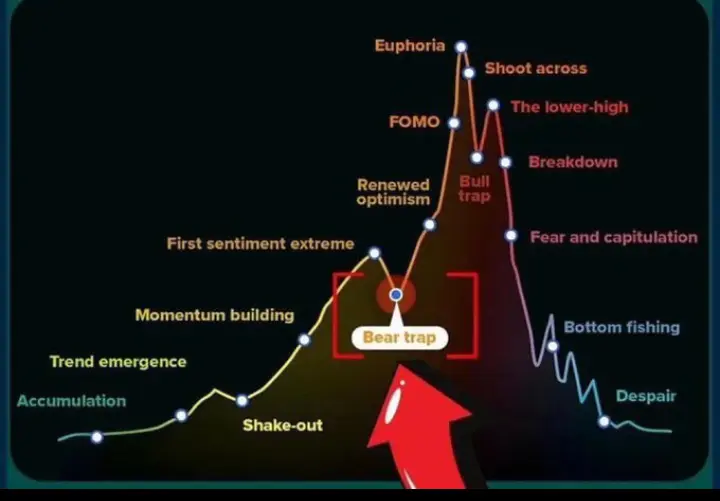

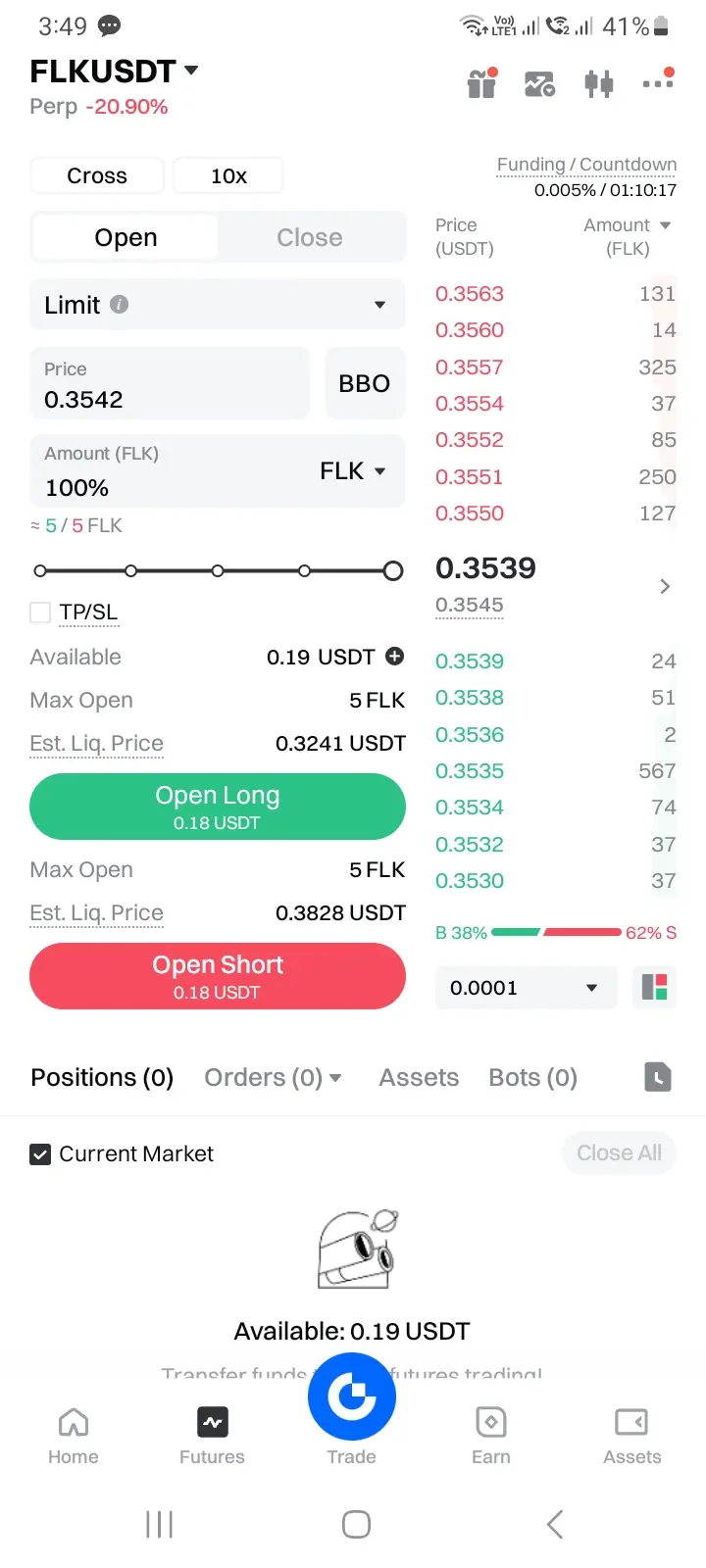

Current Price: $0.36 — early entry, high-risk/high-reward

Volume: ~$280K–$300K USD, moderate for early-stage launch

Support Zones: $0.30–$0.32 | Resistance: $0.40–$0.45 (short-term), $0.60+ (mid-term)

Trading Strategy: Short-term: trade volatility | Swing: accumulate near support | Long-term: hold core position for infrastructure growth

Gate.io Launchpad has provided KDK with the ideal launch environment, ensuring credibility, liquidity, and exposure to a global audience of sophisticated investors. Their fair distribution, KYC protocols, and community support make early participation more secure and rewarding.

Final Verdict:

At $0.36, $KDK offers an early-stage DeFi opportunity with strong fundamentals, sustainable tokenomics, governance alignment, and launchpad support — a high-potential asset for strategic participants.

🚀 #KDK #Kodiak

As Berachain matures into a top-tier Layer 1, Kodiak ($KDK) has emerged not merely as a decentralized exchange but as the definitive vertical liquidity hub for the entire ecosystem. While standard DEXs often struggle with fragmented capital, Kodiak’s integration with Berachain’s Proof-of-Liquidity (PoL) consensus allows it to capture and recycle value far beyond traditional DeFi protocols. Serving as both a spot and perpetual trading engine, Kodiak ensures that every dollar of liquidity on-chain works harder, generating higher fees and deeper market stability.

🏛️ Protocol Architecture: The “Three Pillars”

Kodiak’s competitive advantage lies in its three-pronged infrastructure, designed to solve the "Liquidity Dilemma":

Kodiak Islands – Advanced liquidity vaults that manage concentrated liquidity. Algorithmic strategies keep liquidity “in-range,” maximizing fee generation and reducing impermanent loss risk.

Sweetened Islands – Incentive engine leveraging Berachain’s native $BGT rewards. High-multiplier pools provide LPs with dual yield: trading fees plus network emissions.

Panda Factory – Permissionless, no-code token deployment tool, enabling every new project on Berachain to immediately access Kodiak’s liquidity pools.

This architecture positions Kodiak as the backbone of liquidity innovation on Berachain

.

📄 Whitepaper Highlights

The Kodiak Whitepaper outlines the protocol’s core design and economic model, emphasizing sustainability and long-term value capture:

Liquidity Optimization: Automated concentrated liquidity management in Kodiak Islands

Revenue Model: 90% of protocol revenue redistributed; 60% directed to $KDK buybacks

Dual Yield Mechanics: LPs earn trading fees + $BGT rewards via Sweetened Islands

Governance & xKDK: Escrowed KDK locks tokens for fee participation and voting power

Token Economics: 100M fixed supply, deflationary buyback system

Security Focus: Audited smart contracts and algorithmic safeguards

The whitepaper emphasizes sustainable growth, strong tokenomics, and governance alignment, making Kodiak not just a trading platform but a full liquidity ecosystem.

📊 KDK Launchpad & Market Overview

Launchpad Highlights:

Launch price: $0.35

Fully Diluted Valuation (FDV): $35M

Total supply: 100M $KDK (fixed, deflationary)

Gate.io Launchpad exposure ensures high liquidity, fair distribution, and credibility

KYC verification and anti-bot measures protect early investors

The 90% Revenue Redistribution model ensures $KDK sustainability:

60% of all protocol fees are used for public market buybacks

Creates a perpetual buy-wall that scales with trading volume

If $KDK captures even 50% of ecosystem volume, mid-term price projections suggest $1.20 – $1.75, supported by scarcity and buyback mechanics.

⚖️ Investment Balance: Bull vs. Bear

Bull Case:

Monopoly position as the only DEX incubated by the “Build-a-Bera” accelerator

Aggressive buyback mechanism and PoL synergy prevent token inflation

Sustainable, long-term liquidity flywheel

Bear Case:

Entirely dependent on Berachain adoption

Potential competition from “vampire” protocols targeting short-term yields

Smart contract complexity carries standard DeFi risks

🛡️ Governance & xKDK Mechanism

Transition to $xKDK (Escrowed KDK) locks tokens to:

Earn protocol fees

Gain voting power over $BGT boosts for pools

Reduce circulating supply, strengthening long-term support

This creates a governance moat and aligns token holders with protocol growth.

📈 Roadmap & Future Outlook

Key milestones through 2026:

Kodiak Perps: High-performance futures exchange sharing the liquidity layer

Institutional Integrations: Tokenized BTC/ETH in Kodiak Islands

200ms transaction confirmations for high-frequency trading

Expanded LP incentive programs via $xKDK

Enhanced Gate.io Launchpad rewards and broader distribution

Ongoing ecosystem integrations and governance upgrades

Kodiak is prepared to handle retail and institutional demand, positioning $KDK as Berachain’s cornerstone liquidity asset.

💡 Strategic Takeaways

Current Price: $0.36 — early entry, high-risk/high-reward

Volume: ~$280K–$300K USD, moderate for early-stage launch

Support Zones: $0.30–$0.32 | Resistance: $0.40–$0.45 (short-term), $0.60+ (mid-term)

Trading Strategy: Short-term: trade volatility | Swing: accumulate near support | Long-term: hold core position for infrastructure growth

Gate.io Launchpad has provided KDK with the ideal launch environment, ensuring credibility, liquidity, and exposure to a global audience of sophisticated investors. Their fair distribution, KYC protocols, and community support make early participation more secure and rewarding.

Final Verdict:

At $0.36, $KDK offers an early-stage DeFi opportunity with strong fundamentals, sustainable tokenomics, governance alignment, and launchpad support — a high-potential asset for strategic participants.

🚀 #KDK #Kodiak