PARON

No content yet

Pin

PARON

0

0

Result of investing $1000 in #الذهب over #البيتكوين for 8 years ( starting from 2017 until now )

Investing $1,000 in Bitcoin has become approximately $88,000

Investing $1,000 in gold has become approximately $3,800

#CryptoMarketMildlyRebounds #Gate2025AnnualReportComing

View OriginalInvesting $1,000 in Bitcoin has become approximately $88,000

Investing $1,000 in gold has become approximately $3,800

#CryptoMarketMildlyRebounds #Gate2025AnnualReportComing

MC:$3.54KHolders:1

0.00%

- Reward

- like

- Comment

- Repost

- Share

Sometimes, a rapid rise is just a "bait" to lure the legs before the drop.

And this is exactly what the Bitcoin chart is telling us today.

What we see is a classic model of a "Failed Breakout" (Failed Breakout).

An attempt to rise that was not completed,

And the result?

A harsh return to reality.

-

We are now standing on the edge of $90,000.

This number is not random;

It is the (Point of Control),

the "center of gravity" where most liquidity has recently gathered.

The equation now is simple but dangerous:

Maintaining the $90k means that buyers are still defending their positions.

But br

And this is exactly what the Bitcoin chart is telling us today.

What we see is a classic model of a "Failed Breakout" (Failed Breakout).

An attempt to rise that was not completed,

And the result?

A harsh return to reality.

-

We are now standing on the edge of $90,000.

This number is not random;

It is the (Point of Control),

the "center of gravity" where most liquidity has recently gathered.

The equation now is simple but dangerous:

Maintaining the $90k means that buyers are still defending their positions.

But br

BTC-3,12%

- Reward

- like

- Comment

- Repost

- Share

Sometimes, a rapid rise is just a "bait" to lure the legs before the drop.

And this is exactly what the Bitcoin chart is telling us today.

What we see is a classic model of a "Failed Breakout" (Failed Breakout).

An attempt to rise that was not completed,

And the result?

A harsh return to reality.

-

We are now standing on the edge of $90,000.

This number is not random;

It is the (Point of Control),

the "center of gravity" where most liquidity has recently gathered.

The equation now is simple but dangerous:

Maintaining the $90k means that buyers are still defending their positions.

But br

And this is exactly what the Bitcoin chart is telling us today.

What we see is a classic model of a "Failed Breakout" (Failed Breakout).

An attempt to rise that was not completed,

And the result?

A harsh return to reality.

-

We are now standing on the edge of $90,000.

This number is not random;

It is the (Point of Control),

the "center of gravity" where most liquidity has recently gathered.

The equation now is simple but dangerous:

Maintaining the $90k means that buyers are still defending their positions.

But br

BTC-3,12%

- Reward

- like

- Comment

- Repost

- Share

Sometimes, a rapid rise is just a "bait" to lure the legs before the drop.

And this is exactly what the Bitcoin chart is telling us today.

What we see is a classic model of a "Failed Breakout" (Failed Breakout).

An attempt to rise that was not completed,

And the result?

A harsh return to reality.

-

We are now standing on the edge of $90,000.

This number is not random;

It is the (Point of Control),

the "center of gravity" where most liquidity has recently gathered.

The equation now is simple but dangerous:

Maintaining the $90k means that buyers are still defending their positions.

But br

And this is exactly what the Bitcoin chart is telling us today.

What we see is a classic model of a "Failed Breakout" (Failed Breakout).

An attempt to rise that was not completed,

And the result?

A harsh return to reality.

-

We are now standing on the edge of $90,000.

This number is not random;

It is the (Point of Control),

the "center of gravity" where most liquidity has recently gathered.

The equation now is simple but dangerous:

Maintaining the $90k means that buyers are still defending their positions.

But br

BTC-3,12%

- Reward

- like

- Comment

- Repost

- Share

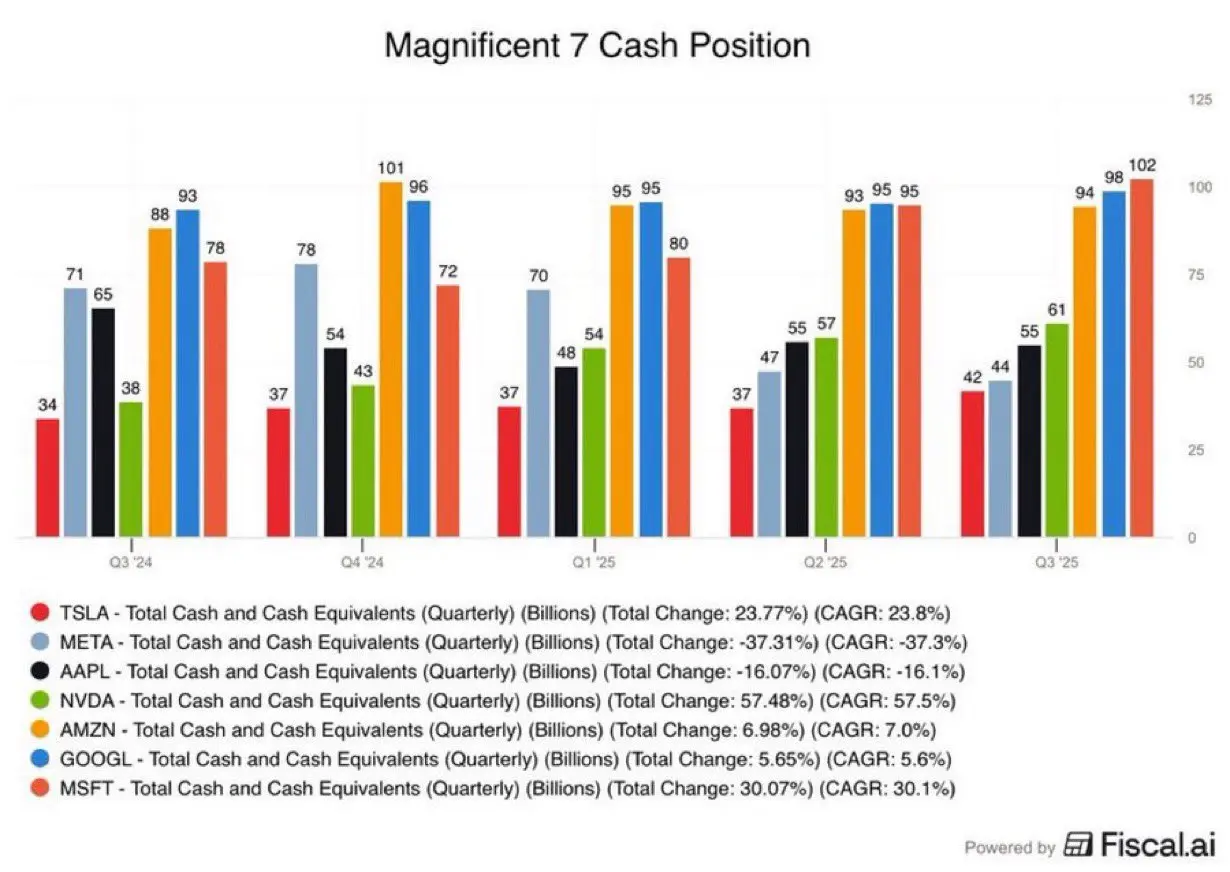

In the race of artificial intelligence, "cash" is the real ammunition.

This report confirms once again that we are far from a "bubble."

Because a bubble simply = promising a trip to the beach, while I don’t have a car or even a horse.

What we see from the amount of free cash with AI giants is a guarantee of continued investment for years to come, even assuming profitability halts.

Microsoft today ranks at the top of global cash liquidity, surpassing all tech giants.

These $102 billion are not just financial security, but a huge strategic flexibility; allowing it to inject massive investments i

This report confirms once again that we are far from a "bubble."

Because a bubble simply = promising a trip to the beach, while I don’t have a car or even a horse.

What we see from the amount of free cash with AI giants is a guarantee of continued investment for years to come, even assuming profitability halts.

Microsoft today ranks at the top of global cash liquidity, surpassing all tech giants.

These $102 billion are not just financial security, but a huge strategic flexibility; allowing it to inject massive investments i

BTC-3,12%

- Reward

- like

- Comment

- Repost

- Share

Gold is heading towards new all-time highs: Are we on the verge of a major re-pricing phase?

Goldman Sachs' forecasts indicated that gold would reach $4,900 per ounce by the end of 2026.

But recent developments in the geopolitical and economic landscape make this level much closer than previously expected.

In fact, some indicators suggest that reaching these levels could happen sooner, perhaps before the end of the year, amid rising global uncertainty.

Recent statements by U.S. President Donald Trump, and his continued confrontational approach to trade and geopolitical issues, bring back scena

Goldman Sachs' forecasts indicated that gold would reach $4,900 per ounce by the end of 2026.

But recent developments in the geopolitical and economic landscape make this level much closer than previously expected.

In fact, some indicators suggest that reaching these levels could happen sooner, perhaps before the end of the year, amid rising global uncertainty.

Recent statements by U.S. President Donald Trump, and his continued confrontational approach to trade and geopolitical issues, bring back scena

BTC-3,12%

- Reward

- like

- Comment

- Repost

- Share

Is the moment of "handover" in the global markets approaching?

-

Smart liquidity does not move randomly, nor does it stay in one place forever..

It is always looking for the "next opportunity" not the "old story."

Since last July, I have been talking about the danger of excessive geographic concentration in the investment portfolio, and the necessity of looking outside the dollar, and beyond "Wall Street" boundaries.

Today, the chart language confirms what the language of logic and fundamentals has been saying.

Look at this chart that shows the performance of emerging markets (EEM) versus the

View Original-

Smart liquidity does not move randomly, nor does it stay in one place forever..

It is always looking for the "next opportunity" not the "old story."

Since last July, I have been talking about the danger of excessive geographic concentration in the investment portfolio, and the necessity of looking outside the dollar, and beyond "Wall Street" boundaries.

Today, the chart language confirms what the language of logic and fundamentals has been saying.

Look at this chart that shows the performance of emerging markets (EEM) versus the

- Reward

- like

- Comment

- Repost

- Share

What is happening in the market 🔻🔻🔻

The current market bleeding is caused by the return of the trade war, but this time not between America and China, but between America and the European Union.

After America decided to impose a new 10% customs duty starting February 1st, increasing to 25% on a large group of European countries to pressure them into ceding Greenland, it seems that the European Union may decide to take countermeasures, including imposing new customs duties of 93 billion euros on American products.

Possibly preventing American companies from operating within EU countries.

The

The current market bleeding is caused by the return of the trade war, but this time not between America and China, but between America and the European Union.

After America decided to impose a new 10% customs duty starting February 1st, increasing to 25% on a large group of European countries to pressure them into ceding Greenland, it seems that the European Union may decide to take countermeasures, including imposing new customs duties of 93 billion euros on American products.

Possibly preventing American companies from operating within EU countries.

The

LONG-10,08%

- Reward

- like

- Comment

- Repost

- Share

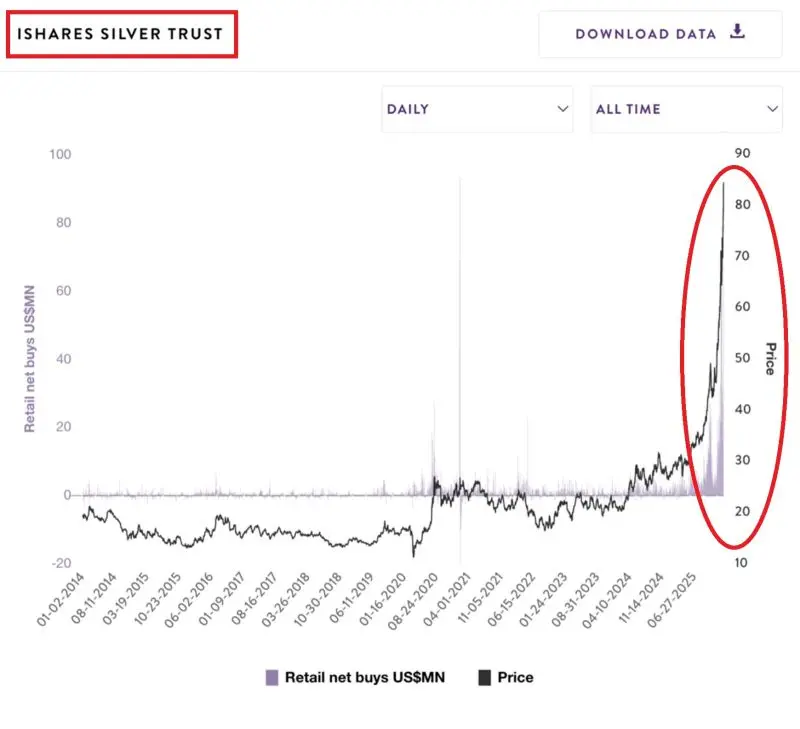

Has the "Poor Man's Gold" awakened? 🥈

-

What is happening in the silver market now is not just a "trend"...

It is a historic event we have never seen before.

For the first time, and for 169 consecutive days, retail investors (Retail) are pouring their money into silver funds ( $SLV ) nonstop.

We are talking about the longest buying streak in history, with inflows exceeding all expectations.

-

📊 The language of numbers does not lie:

In just the last 30 days, more than $921 million has entered silver funds.

Current buying activity is 2.1 times higher than the normal rate.

And most important

View Original-

What is happening in the silver market now is not just a "trend"...

It is a historic event we have never seen before.

For the first time, and for 169 consecutive days, retail investors (Retail) are pouring their money into silver funds ( $SLV ) nonstop.

We are talking about the longest buying streak in history, with inflows exceeding all expectations.

-

📊 The language of numbers does not lie:

In just the last 30 days, more than $921 million has entered silver funds.

Current buying activity is 2.1 times higher than the normal rate.

And most important

- Reward

- like

- Comment

- Repost

- Share

⚡ The genius who profited from the 2008 crisis issues a new warning!

Michael Burry says 2026 = a collapse worse than the dot-com bubble 📉

AI bubble + weakness of Passive funds = an upcoming disaster?

But beware... 🔍

His predictions since 2017: Almost complete failure (0-29% accuracy )

Question: Is this time different? Or the same old story?

View OriginalMichael Burry says 2026 = a collapse worse than the dot-com bubble 📉

AI bubble + weakness of Passive funds = an upcoming disaster?

But beware... 🔍

His predictions since 2017: Almost complete failure (0-29% accuracy )

Question: Is this time different? Or the same old story?

- Reward

- 1

- Comment

- Repost

- Share

Germany's second-largest bank, DZ Bank, has just approved Bitcoin and cryptocurrency trading.

Bitcoin adoption worldwide is accelerating.

View OriginalBitcoin adoption worldwide is accelerating.

- Reward

- 1

- Comment

- Repost

- Share

$BTC Vanguard Makes a Strong Entry into Bitcoin

The company @Vanguard_Group, which manages assets exceeding $12 trillion, revealed it holds a stake worth $505 million in Bitcoin treasury company Strategy ($MSTR) 💰

Most importantly:

• By late 2025 / early 2026, Vanguard will become one of the largest institutional holders of MSTR shares

• Total exposure across its various funds has surpassed $3 billion

• This reflects increasing institutional confidence in Bitcoin as a long-term strategic asset

Summary:

Massive capital is beginning to enter strongly…

And the available market share is becomin

The company @Vanguard_Group, which manages assets exceeding $12 trillion, revealed it holds a stake worth $505 million in Bitcoin treasury company Strategy ($MSTR) 💰

Most importantly:

• By late 2025 / early 2026, Vanguard will become one of the largest institutional holders of MSTR shares

• Total exposure across its various funds has surpassed $3 billion

• This reflects increasing institutional confidence in Bitcoin as a long-term strategic asset

Summary:

Massive capital is beginning to enter strongly…

And the available market share is becomin

BTC-3,12%

- Reward

- 2

- 1

- Repost

- Share

Plastikkid :

:

Hold tight 💪When algorithms speak.. skeptics fall silent.

-

Everyone was scared when I tested Bitcoin at the $90,000 levels,

but the chart was cooking something else in the background.

What you see in front of you is the (8/21 EMA Cross) strategy,

and it is one of the most reliable momentum (Momentum) signals that "bots" and smart wallets rely on.

-

1. What does this crossover mean?

The crossover of the 8 (Fast Line) exponential moving average above the 21 (Slow Line) is like a "race start signal."

This means buyers have taken control of the short-term trend, and the nerve-wracking correction has offic

-

Everyone was scared when I tested Bitcoin at the $90,000 levels,

but the chart was cooking something else in the background.

What you see in front of you is the (8/21 EMA Cross) strategy,

and it is one of the most reliable momentum (Momentum) signals that "bots" and smart wallets rely on.

-

1. What does this crossover mean?

The crossover of the 8 (Fast Line) exponential moving average above the 21 (Slow Line) is like a "race start signal."

This means buyers have taken control of the short-term trend, and the nerve-wracking correction has offic

BTC-3,12%

- Reward

- 1

- 1

- 1

- Share

Before00zero :

:

Bullish market at its peak 🐂Crypto companies crush traditional companies in numbers

The revenue for the past 12 months says it all:

Solana: $5.7 billion

Snapchat: $4.1 billion

Lululemon: $3.2 billion

Coinbase: $6.2 billion

Cloudflare: $3 billion

Dropbox: $1.9 billion

GoPro: $1.3 billion

Robinhood: $5.1 billion

EA Sports: $3 billion

Ethereum: $3.8 billion

Blockchain companies are not just "tech projects," they are real businesses with figures competing with the biggest traditional names

$BTC

The revenue for the past 12 months says it all:

Solana: $5.7 billion

Snapchat: $4.1 billion

Lululemon: $3.2 billion

Coinbase: $6.2 billion

Cloudflare: $3 billion

Dropbox: $1.9 billion

GoPro: $1.3 billion

Robinhood: $5.1 billion

EA Sports: $3 billion

Ethereum: $3.8 billion

Blockchain companies are not just "tech projects," they are real businesses with figures competing with the biggest traditional names

$BTC

BTC-3,12%

- Reward

- like

- Comment

- Repost

- Share

Liquidity does not lie.. and Micron redefines the "ceiling" of artificial intelligence.

While some were wondering if the AI bubble had started to burst, Micron's ($MU) response was harsh and eloquent: the biggest financial quarter, the highest historical peak, and most importantly.. institutional liquidity we haven't seen since April.

What happened with Micron is not just "good profits," but a confirmation of one technical and economic truth: there is no artificial intelligence without "superior" memory.

Processors (like those made by Nvidia) are the brain, but HBM (memory made by Micron is t

While some were wondering if the AI bubble had started to burst, Micron's ($MU) response was harsh and eloquent: the biggest financial quarter, the highest historical peak, and most importantly.. institutional liquidity we haven't seen since April.

What happened with Micron is not just "good profits," but a confirmation of one technical and economic truth: there is no artificial intelligence without "superior" memory.

Processors (like those made by Nvidia) are the brain, but HBM (memory made by Micron is t

BTC-3,12%

- Reward

- 1

- Comment

- Repost

- Share

$100 billion in the snow..

Is it just a factory or the beginning of a new era?

-

"Made in America" is no longer just a political slogan,

but has become a technological survival strategy.

Today, Micron ($MU) is laying the foundation for what can be described as the largest chip manufacturing project in U.S. history.

The image you see is not just officials holding shovels in New York's snow, but an official announcement of a major geopolitical shift.

-

What happened?

Micron has officially begun constructing its giant complex in New York with investments reaching $100 billion.

The goal?

Build 4 (

Is it just a factory or the beginning of a new era?

-

"Made in America" is no longer just a political slogan,

but has become a technological survival strategy.

Today, Micron ($MU) is laying the foundation for what can be described as the largest chip manufacturing project in U.S. history.

The image you see is not just officials holding shovels in New York's snow, but an official announcement of a major geopolitical shift.

-

What happened?

Micron has officially begun constructing its giant complex in New York with investments reaching $100 billion.

The goal?

Build 4 (

BTC-3,12%

MC:$5.65KHolders:325

11.06%

- Reward

- like

- Comment

- Repost

- Share

The truth that banks hide about "Stablecoins"

(A serious topic, read until the end)

-

I have spoken many times before about the GENIUS Act

And how the Trump administration is thinking of making this law the lifeline that restores the dollar to its throne

It seems that it will not pass quietly in the corridors of Wall Street, because it simply threatens the thrones of traditional banks, which will undoubtedly resist fiercely against anything that threatens their profits.

In the latest "Bank of America" earnings meeting (January 2026), the real reason behind the fierce banking war against stable

(A serious topic, read until the end)

-

I have spoken many times before about the GENIUS Act

And how the Trump administration is thinking of making this law the lifeline that restores the dollar to its throne

It seems that it will not pass quietly in the corridors of Wall Street, because it simply threatens the thrones of traditional banks, which will undoubtedly resist fiercely against anything that threatens their profits.

In the latest "Bank of America" earnings meeting (January 2026), the real reason behind the fierce banking war against stable

BTC-3,12%

- Reward

- like

- Comment

- Repost

- Share