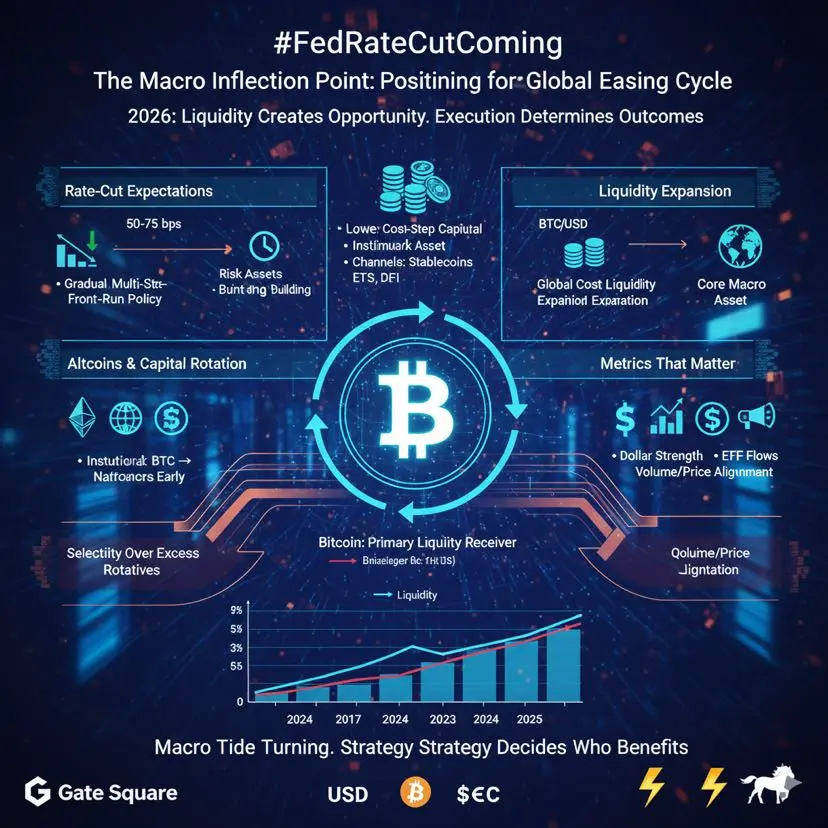

#FedRateCutComing Why Policy Shifts and Market Structure Matter More Than Short-Term Price Action

Watching price charts alone only scratches the surface of what is really happening in crypto markets. While recent price strength has drawn attention, the deeper opportunity lies in structural and policy-level changes that are quietly reshaping the landscape. Markets can rise on momentum, but they only sustain growth when confidence, clarity, and capital alignment follow. As we move toward 2026, these deeper forces are becoming increasingly visible.

The crypto market today is being driven less by

Watching price charts alone only scratches the surface of what is really happening in crypto markets. While recent price strength has drawn attention, the deeper opportunity lies in structural and policy-level changes that are quietly reshaping the landscape. Markets can rise on momentum, but they only sustain growth when confidence, clarity, and capital alignment follow. As we move toward 2026, these deeper forces are becoming increasingly visible.

The crypto market today is being driven less by

DEFI-4,8%